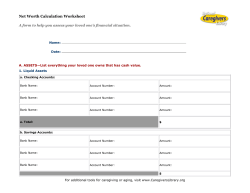

Document 254489