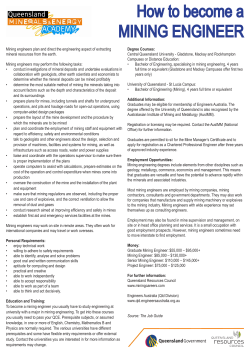

COVER SHEET 1 1 2 9 4 2