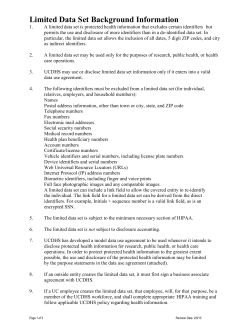

ENTITY BUY DIRECTION LETTER COVER SHEET

ENTITY BUY DIRECTION LETTER

COVER SHEET

On May 21, 2014, the United States District Court for the District of Utah entered an

Order Clarifying Order Appointing Receiver, Freezing Assets, and Other Relief ("Clarifying Order")

in Case No. 2014-cv-00309. Pursuant to the Clarifying Order, I am making a formal request that

the Court-Appointed Receiver authorize certain transactions as evidenced by the attached

Buy Direction Letter and related documents.

By submitting this Buy Direction Letter and signing below, I hereby acknowledge that my request

may not be approved unless I provide sufficient proof that the entity will purchase hard assets

such as real estate with the funds provided to it and that any funds transferred to the entity or

assets acquired as a result of the requested transaction shall continue to remain subject to the

terms of the Court’s Order Appointing Receiver, Freezing Assets, and Other Relief (“Receivership

Order”). I also understand that the requested transaction may not be approved unless I maintain

or reach a ratio of 20% cash to asset value following any reinvestments. I further acknowledge

and agree that I may be required to liquidate this investment and/or some of my other selfdirected investments to generate cash in the future when a Court approved Plan of Liquidation is

implemented.

Signed this ____ day of ___________, 2014.

Account Name(s):

____________________________________________

Account Number(s): ____________________________________________

Signature:

____________________________________________

Address:

____________________________________________

____________________________________________

Phone Number(s):

____________________________________________

E-mail(s):

____________________________________________

Please send this cover sheet, the attached Buy Direction Letter, and all other required documents

to Diane Thompson, the Court-Appointed Receiver for American Pension Services, Inc., either via

email at [email protected], via facsimile at (801) 208-7303, or via postal mail at

4168 W. 12600 S., Suite 300, Riverton, Utah 84096.

Rev. 6.2.2014

ENTITY

BUY DIRECTION

LETTER

INSTRUCTIONS:

USE THIS FORM FOR:

To initiate the process of purchasing assets for your retirement account a

Buy Direction Letter is required.

Submit this two page Direction Letter with all Supporting

Documentation as listed below. Keep American Pension Services

current with any future documentation or amendments.

•

•

•

•

•

•

C-Corporation

Land Trust

Limited Partnership

Limited Liability Company

Private Stock

Private Placement Memorandum

REQUIRED SUPPORTING DOCUMENT(S):

*Supporting documentation MUST accompany your completed Buy Direction Letter

*Any existing entity MUST provide a Certificate of Good Standing with Buy Direction Letter Documents

NOTE: Pursuant to the Court’s Clarifying Order dated May 21, 2014, you MUST provide documentation showing

that the entity will be investing in hard assets such as real estate.

C-CORPORATION /

PRIVATE STOCK

Copy of the C Corporation’s Articles of Incorporation.

Copy of the Private Placement Memorandum or Operating Agreement.

Copy of the Subscription Agreement.

If the corporation issues stock certificates, these must be physically held by American

Pension Services, Inc.

Current Balance Sheet.

LAND TRUST

Income Statement for the last two years.

Copies of federal income tax returns for the last two years.

List of all shareholders, officers, and directors.

Identification of what % of C Corp is owned by APS.

Indicate if C Corp owns real property and if so the fair market value.

Identify and provide documentation showing all hard assets (such as real estate) that the

entity plans to purchase.

Copy of the Land Trust Agreement signed by Retirement Account Owner as Beneficial

Owner.

Identify the real property owned by the Land Trust and the Fair Market Value, and

documentation showing same.

Rev. 6.2.2014

REQUIRED SUPPORTING DOCUMENT(S):

*Supporting documentation MUST accompany your completed Buy Direction Letter

*Any existing entity MUST provide a Certificate of Good Standing with Buy Direction Letter Documents

LIMITED

PARTNERSHIP

Copy of Certificate of Limited Partnership filed with the state.

Copy of Limited Partnership Agreement, signed by Retirement Account Owner.

Attorney Comfort Letter stating the LP addresses the unique laws and rules governing plans

regulated by ERISA, DOL, and the IRS.

Current balance sheet.

Income Statement for the last two years.

Copies of federal income tax returns for the last two years.

List of all partners in the Limited Liability Partnership.

Indication of what percentage is owned by APS.

Identify and provide documentation showing all hard assets (such as real estate) that the

entity plans to purchase.

LIMITED

LIABILITY

COMPANY

Copy of Private Placement Memorandum or LLC Operating Agreement.

Subscription Agreement.

Attorney Comfort Letter stating LLC addresses the unique laws and rules governing plans

regulated by ERISA, DOL, and IRS.

Current balance sheet.

Income Statement for the last two years.

Copies of federal income tax returns for the last two years.

List of all officers and members of the LLC.

Indication of what percentage of the LLC is owned by APS.

Indicate whether LLC owns real property and if so the fair market value.

Indication of what percentage is owned by APS.

Identify and provide documentation showing all hard assets (such as real estate) that the

entity plans to purchase.

~ SUBMISSION OPTIONS ~

Overnight and Regular Mail:

American Pension Services, Inc.

4168 West 12600 South, Suite 300

Riverton, UT 84096

Rev. 6.2.2014

Fax:

Email:

(801) 208-7303

[email protected]

ENTITY

BUY DIRECTION

LETTER

1. Account Owner Information :

Account Owner Name:

Account Number:

(4 or 5 Digit)

Primary Daytime Phone Number

(required):

Email Address (required):

Fax Number:

2. Investment Information :

Type of Entity:

LLC

C-Corporation

Land Trust

Limited Partnership

Name of Entity:

Other__________________

TID:

Address:

City:

State:

Zip Code:

Retirement Accounts are prohibited from investing in Subchapter (S) Corporations

Entity Management

Managing Member Title:

General Partner Managing Director Officer Other

Managing Member Name:

Phone Number:

Address:

City:

State:

Zip Code:

Unrelated Business Income Tax (UBIT): you may be subject to UBIT when an entity is classified as a flow through entity. Contact your tax advisor and visit

www.irs.gov see publication 598.

3. Ownership Percentage:

Number of Units/Shares:

Price per Unit/Share: $

Retirement Plan Entity Ownership Percentage:

% Total Purchase $

4. Funding the Investment:

Funds must be cleared and available to make an investment. Funds are further subject to requirements below. Funds are clear and available to invest 7 business days

after deposit of a personal or business check. Funds from deposit of cashier’s checks are available after 3 business days. Bank wire funds are available immediately.

Please Send $

on Date:

By Check: (provide information below)

OR

By Wire $20: (Complete attached Wire Request Form)

Check Payable To:

Mail Check To:

Address:

City:

State:

Select Check Type:

Regular Check

Cashier’s Check ($15)

I have read and approved the information provided above:

Select Mailing Option:

(regular mail will be selected if left empty)

Regular US mail

Certified Mail ($15)

Overnight (FedEx charge)

X _____________________

Account Owners Initials

Rev. 6.2.2014

Zip Code:

Continue to Page 2

5. Document Signatures:

Does this investment have documents requiring signatures? Please list below:

1.

3.

2.

4.

Account Number:

(4 or 5 digit)

Where To Return Signed Documents:

Mail to:

Address:

City:

State:

Fax to:

Send Overnight Send by Mail

Send by email

Zip

Attention:

6. Title of Investment:

When Purchasing Assets in a Self-Directed Retirement Plan, You MUST Title the Investment Properly.

My Retirement Plan will be 100% owner and will be titled: “American Pension Services, Inc. Administrator For Account Owner’s Name,

Account type #.”

My Retirement Plan will be less than 100% owner and will be titled: “American Pension Services, Inc. Administrator For

Account Owner’s Name, Account Type #, Percentage of Ownership %, Tenants In Common.”

7. Hard Assets (such as real estate) the Entity Will Purchase:

The entity to be funded will invest in the following hard assets:

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

I have provided all documentation showing that the entity will purchase the hard assets identified above.

I have read and approved all documents, and I agree with the terms. I understand that my account is self-directed and that American Pension

Services, Inc., or any of its licensees, affiliates, or employees (collectively, “Administrator) and/or trustee or custodian does not review the

merits, appropriateness and/or suitability of any investment in general, or in connection with my account in particular. I acknowledge that I have

not requested the Administrator provide, and that the Administrator has not provided, any advice with respect to the investment directive set

forth in this Buy Direction Letter, nor has the Administrator made any representations or recommendations or other statements regarding the

parties with whom I now or in the future may be dealing. I understand that neither the Administrator nor trustee or custodian determine whether

this investment is acceptable under the Employee Retirement Income Securities Act of 1974, as amended (“ERISA”), the Internal Revenue

Code of 1986, as amended (the “Code”), or any other applicable federal, state, or local laws, including but not limited to securities laws. I

understand that it is my responsibility to review any investments to ensure compliance with these requirements.

I understand that no one at the Administrator has authority to agree to anything different than the above policy.

I understand that neither the Administrator nor trustee or custodian is a “fiduciary” for my account as such term is defined in the Code, ERISA,

or any applicable federal, state or local laws. I agree to release, indemnify, defend and hold the Administrator and trustee or custodian harmless

from any claims arising out of this investment, including, but not limited to claims, demands, or causes of actions that an investment is not

prudent, proper, diversified or otherwise in compliance with ERISA, the Code or any other applicable federal, state or local laws.

I also understand and agree that the Administrator and/or trustee or custodian will not investigate, analyze, monitor, verify title to or otherwise

evaluate any investment contemplated herein, or to obtain or maintain insurance coverage (whether liability, property or otherwise) with respect

to any assets or investments purchased by me. The Administrator shall not be responsible to take any action should there be any default with

regard to this investment. Such obligation to release, indemnify, defend and hold the Administrator and trustee and/or custodian harmless shall

include but not be limited to necessary court costs, attorneys’ fees, or other expenses incurred to Administrator. I alone am responsible for the

selection, due diligence, management, review and retention of all investments in my account.

Rev. 6.2.2014

I am directing you as Administrator, in a passive capacity, to complete this transaction as specified above. I confirm that the decision to buy this

asset is in accordance with the rules of my account and applicable law and I agree to hold harmless and without liability the Administrator

and/or the trustee or custodian of my account. I have reviewed this transaction with my tax and legal advisors, and it does not constitute a

Prohibited Transaction (as defined in section 4975 of the Code).

IMPORTANT: PURSUANT TO THE COURT’S ORDER CLARIFYING ORDER APPOINTING RECEIVER, FREEZING ASSETS, AND OTHER RELIEF DATED

MAY 21, 2014, BY SUBMITTING THIS BUY DIRECTION LETTER AND SIGNING BELOW, I HEREBY ACKNOWLEDGE THAT THE REQUESTED

TRANSACTION MAY NOT BE APPROVED UNLESS I MAINTAIN OR REACH A RATIO OF 20% CASH TO ASSET VALUE FOLLOWING ANY

REINVESTMENTS. I FURTHER ACKNOWLEDGE AND AGREE THAT I MAY BE REQUIRED TO LIQUIDATE THIS INVESTMENT AND/OR SOME OF MY

OTHER INVESTMENTS TO GENERATE CASH IN THE FUTURE WHEN A COURT APPROVED PLAN OF LIQUIDATION IS IMPLEMENTED.

I declare that I have examined this document, including accompanying information, and to the best of my knowledge and belief, it is true,

correct, and complete.

X Account Owner’s Signature: _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Date:_ _ _ _ _ _ _ _ _ _ _

By signing above I certify that I have read the above disclosures.

REMEMBER TO SEND REQUIRED SUPPORTING DOCUMENT(S):

Documents MUST accompany your completed Buy Direction Letter to avoid delays

(Refer to cover page for specific documents relating to your Entity type)

Rev. 6.2.2014

Type Required Information(*), Print, Sign & Date,

Send to APS With the Applicable Direction Letter

WIRE REQUEST FORM

Daily Outgoing Wire Cut-off is 4pm EST

Date:

*Amount (Numeric): $

*Amount (Alpha):

TO:

*Receiving Bank:

*Bank Address:

*ABA #: (9 digit number)

BENEFICIARY INFORMATION:

*Credit to:

(Name on Bank Account)

*Receiving Bank Account #

*SSN or EIN of Payee:

Further Credit To:

Additional Reference:

*Client Signature: X

Date:

*Print Name:

APS Account #

Authorized Personnel Complete Below Portion

Please wire funds as requested above from American Pension Services, Inc.

AUTHORIZED SIGNATURE:

Diane A. Thompson, Receiver, APS

Account:

From:

American Pension Services, Inc.

Address:

4168 W. 12600 S. Suite 300 Riverton, UT 84096

Rev. 6.2.2014

© Copyright 2026