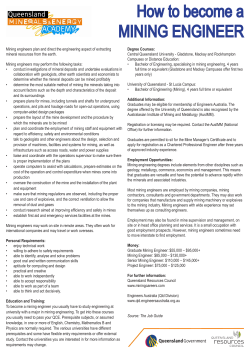

COVER SHEET