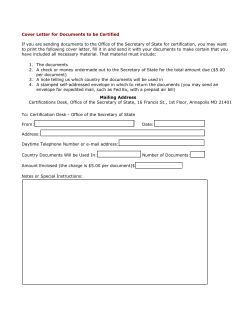

Document 262883