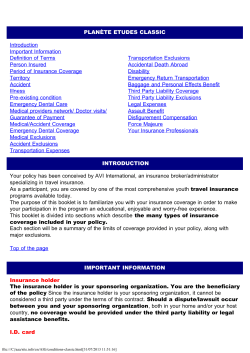

Understanding the Personal Accident Disability Insurance and Cash Hospital Contract: