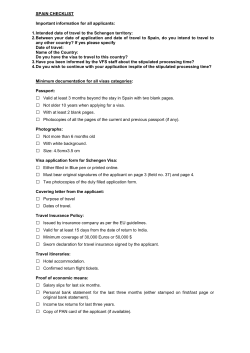

Page 1 of 1 CBD/Trade Operations Dept. 550 S. Western Ave., 1

Page 1 of 1

CBD/Trade Operations Dept.

550 S. Western Ave., 1st Floor, Los Angeles, CA 90020

Tel:(213)387-3200 Fax:(213)389-8255 SWIFT:BWILUS66

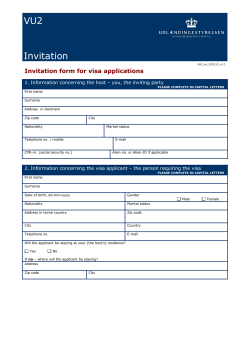

APPLICATION FOR STANDBY LETTER OF CREDIT

We request that you establish an irrevocable Standby Letter of Credit on the

following terms and conditions :

Date:

MM/dd/yyyy

FOR BANK USE ONLY

L/C No.

1

ADVISING BANK (Name and Address) If blank, any Correspondent at your

option:

APPLICANT (Name and Address):

BENEFICIARY/IN FAVOR OF (Name and Address):

AMOUNT:

$

EXPIRY DATE- FOR PAYMENT AT THE COUNTERS OF THE DRAWEE BANK

Beneficiary’s draft must be accompanied by :

A Certified Statement Containing the Following Wording:

Additional Documents Required:

Partial draws on the letter of credit:

The letter of credit should be :

Permitted

Nonrenewable

Not Permitted

Renewed automatically unless notice of nonrenewal is given

I/we acknowledge and agree that acceptance of this Application by the Bank does not constitute a commitment or agreement by the Bank to issue or open

the letter of credit described in this Application and that the opening of the letter of credit is subject to approval by the Bank and receipt by me/us of such

approval. I/we further acknowledge and agree that, if this Application is approved by Bank, the final form of the letter of credit issued hereunder may be

subject to such revision and changes as are deemed necessary or appropriate by Bank, and Applicant consents to such revisions and changes. By

signing below, Applicant agrees that, if this Application is approved by Bank, the issuance of the letter of credit described in this Application, or as

amended by agreement between the parties hereto, and Applicant’s obligation to reimburse Bank for any draws paid under the letter of credit, will be

governed by the terms and conditions set forth in that certain Master Standby Letter of Credit Agreement dated as of _____________, 20___, and

executed by Applicant in favor of Bank (“Master Agreement”), which terms and conditions are hereby incorporated herein by this reference and which

shall supersede the terms and conditions of this Application to the extent that the terms of the Master Agreement are inconsistent herewith. The terms of

this Application, together with the terms of the Master Agreement, shall constitute the entire agreement between the parties hereto and shall not be

subject to change or modification except by written agreement signed by the parties hereto. Execution and delivery of the Master Agreement by me/us is

a condition precedent to any opening of the letter of credit described herein.

FOR BANK USE ONLY

(BRANCH- LOAN DEPT/ CBD- TFD DEPT)

FOR BANK USE ONLY

(TRADE OPERATIONS DEPT.)

Prepaid L/C

OR

Line of Credit

Limit/Collateral/Past due/Line Expired

Within/In Order OR

Exceeding/Out of Order

Checked by:__________ Name: ________________

Approved by: _________ Name: ________________

OFAC Checked by: ___________

Signature Verified by :_________

Prepared by: ________________

Approved by:________________

FOR THE CUSTOMER SECTION

Applicant’s Name:__________________________

TF-106 (REV. 03-10-2014)

Authorized Signature: _______________________

Title & Name:______________________________

STANDBY LETTER OF CREDIT AGREEMENT

IN CONSIDERATION OF WILSHIRE BANK ("Bank") from time

to time issuing its irrevocable standby letter of credit (each a "Credit"

and collectively, “Credits”) for the account of the undersigned

("Applicant") in the amount and on terms set forth in a Standby Letter

of Credit Application that refers to, and incorporates by reference, this

Agreement (each an "Application" and collectively, “Applications”),

and in favor of the party named as beneficiary in the Application

("Beneficiary), Applicant hereby agrees as follows:

1.

ISSUANCE OF LETTERS OF CREDIT.

(a) Payment. Applicant shall pay to Bank the principal

amount of each Advance, together with interest thereon:

□

□

□

1.1 Credits. Upon request of Applicant, as evidenced by the

submission of an Application, made from time to time during the

term of this Agreement, and subject to the full satisfaction of each

and all of the conditions set forth in Sections 1.3 (including

without limitation the review and approval of an Application by

Bank), Bank shall issue Credits containing terms substantially in

accordance with the terms of the related Application; provided,

however, that in no event shall Bank be obligated to issue a Credit

whenever the amount of the requested Credit, when combined

with the aggregate amount of the outstanding Credits issued

hereunder exceeds at any one time, the sum of

Dollars ($

).

1.2 Termination Date. Notwithstanding anything contained

herein to the contrary, Bank's obligation to issue Credits shall

, 20

,

automatically terminate without notice on

unless expressly renewed by Bank by written agreement at least

thirty (30) days prior to termination. Notwithstanding the

foregoing, upon the occurrence and during the continuation of any

“Event of Default” (as defined below), Bank may terminate

without notice its obligation to issue Credits hereunder. Applicant

acknowledges and agrees that notwithstanding the termination of

any of Bank's obligations hereunder, Applicant's obligations

hereunder shall continue until all outstanding Credits have expired

and all of Applicant’s obligations hereunder, contingent or

otherwise, have been fully and indefeasibly repaid and performed.

1.3 Conditions Precedent. Bank's obligation to issue Credits

hereunder is subject to the full satisfaction of each and all of the

following conditions:

(a) Applicant shall have executed and delivered to Bank an

original counterpart of this Agreement together with such

other documents, instruments and agreements required by

Bank.

(b) Applicant shall have submitted to Bank an original

Application containing the general terms and conditions of the

requested letter of credit and executed by an authorized officer

of Applicant, and Bank, in its sole discretion and in

accordance with the internal standards and procedures

established by Bank from time to time for transactions of this

nature, shall have approved such Application. Applicant

acknowledges and agrees that the execution and delivery by

Applicant and the acceptance by Bank of an Application shall

not be construed as a commitment or obligation by Bank to

issue a Credit.

(c) Bank shall have reviewed and approved the form and

content, along with any special requirements by Beneficiary,

of the Credit.

(d) Applicant shall have paid to Bank, and Bank shall have

received, the applicable Letter of Credit Fee in accordance

with Section 2.2.

(e) No Event of Default shall have occurred and remain

uncured, and no event shall have occurred which with the

giving of notice or the passage of time shall constitute an

Event of Default.

2.

OBLIGATIONS OF APPLICANT TO BANK

2.1 Repayment of Advances. Applicant promises to pay to

Bank or order the principal amount of each disbursement of funds

of any kind or character made by Bank or Bank's correspondents

under or in respect to a Credit (each an "Advance" and

collectively, “Advances”) together with interest thereon from the

date of the Advance until the date such amount is repaid in full, in

accordance with the following terms:

□

Immediately upon demand by Bank;

On or before the date which is

days after

Bank has given written notice that it has paid an

Advance.

From an advance under that certain line of credit or

other credit facility extended to Applicant by Bank

pursuant to that certain agreement dated

, 20

, between Applicant and Bank,

and evidenced by that certain promissory note dated

, 20

, in the original

principal amount of

Dollars

). Applicant hereby expressly

($

and irrevocably authorizes Bank to advance funds

under the line of credit or other credit facility without

further notice or demand for the purpose of

reimbursing Bank the principal amount of any

Advance. Applicant acknowledges and agrees that

notwithstanding anything contained in this Agreement

to the contrary, the advance by Bank of proceeds

under the line of credit or other credit facility referred

to in the preceding sentence shall be made only in

accordance with the terms and conditions of

documents evidencing such line of credit or other

credit facility.

By debiting that certain deposit account maintained by

Applicant with Bank which is referred to by Bank as

account numbered

("Reimbursement Account").

Applicant hereby

expressly and irrevocably authorizes Bank to debit the

Reimbursement Account without notice to or demand

on Applicant for the principal amount of any Advance

made by Bank under the Letter of Credit.

(b) Interest. Applicant shall pay to Bank interest on the

amount of each Advance from the date of the Advance until

such Advance is repaid in full. Interest payable by Applicant

on any Advance shall accrue at a rate, expressed as an annual

percentage rate, equal to:

□

□

percent (

%);

The sum of (i) the "Base Rate," plus (ii)

%), provided that such interest

percent (

rate shall change from time to time as the Base Rate

changes. As used herein, the term "Base Rate" shall

mean the rate of interest used as the reference or base

rate to establish the actual rates charged on

commercial loans and which is publicly announced or

reported from time to time by

.

2.2 Letter of Credit Fee.

(a) Payment of Initial Fee. Concurrently upon receipt by

Applicant of notice of Bank’s approval of an Application,

Applicant shall pay to Bank a letter of credit fee in an amount

equal to

percent (

%) of the face

amount of the Credit described in the approved Application

(each, a "Letter of Credit Fee"). Applicant acknowledges and

agrees that a Letter of Credit Fee shall be deemed fully earned

by Bank upon payment of such Letter of Credit Fee to Bank

and Applicant shall not be entitled to a refund of all or any

portion of such Letter of Credit Fee should Bank's obligations

under the related Credit terminate for any reason prior to the

expiration date indicated thereon.

(b) Annual Fee. So long as Bank is liable to a Beneficiary

for all or any portion of the amount of the related Credit, then

on the anniversary of the issuance date of such Credit,

Applicant shall pay to Bank in advance an annual fee in an

amount equal to

percent (

%) of that

portion of the Credit amount for which Bank remains liable to

Beneficiary (each, an "Annual Fee"). Applicant acknowledges

and agrees that an Annual Fee shall be deemed fully earned by

Bank upon payment of such Annual Fee to Bank and

Applicant shall not be entitled to a refund of all or any portion

of such Annual Fee should Bank's obligations under the

related Credit terminate for any reason prior to the expiration

date indicated thereon (or as may be extended or modified).

2.3 Commissions and Fees. Applicant shall pay Bank, on

demand, all commissions, fees and other charges (including,

where applicable, interest or discount) arising out of or in

connection with the Credit. If such amounts are not paid within

ten (10) calendar days after demand is made by Bank, Applicant

shall pay interest on such amount at the rate of interest set forth in

Section 2.1(b).

the Credit; (v) the failure of any draft presented under the Credit to

bear any reference or adequate reference to the related Credit, or

the failure to note the amount of any draft on the reverse side of

the Credit; (vi) the presentation of a draft by an assignee,

transferee or successor-in-interest of Beneficiary; (vii) any errors,

omissions, neglect or default by any correspondent bank of Bank

or any advising bank in connection with a Credit; (viii) the

occurrence or existence of any dispute or disagreement of any

kind between Applicant and Beneficiary.

2.4 Bank Expenses.

Applicant shall reimburse Bank

immediately upon demand for all expenses which Bank or Bank's

correspondents may incur under or in respect of the Credit. If

such amounts are not paid within ten (10) calendar days after

demand is made by Bank, Applicant shall pay interest on such

amount at the rate of interest set forth in Section 2.1(b).

3.

GRANT OF SECURITY INTEREST. As security for the

performance by Applicant of all of Applicant's obligations under

this Agreement and all other agreements, documents and

instruments executed by Applicant in connection with the Credit

(collectively, "Letter of Credit Documents"), whether now owing

or hereafter incurred or created, whether due or to become due and

whether absolute or contingent, Applicant hereby assigns, conveys

and grants to Bank a security interest in all of applicants now

existing and hereinafter acquired (together will all proceeds

thereof):

5.

5.3 Notice, Presentation, Demand and Protest.

Applicant hereby waives any right to notice, presentation, demand

of payment or protest.

6.

DEFAULTS AND REMEDIES.

6.1 Events of Default. Any one or more of the following shall

constitute an "Event of Default" by Applicant under this

Agreement: (i) Applicant defaults in the due and punctual

payment of any amount due in connection with any Advance or

other amount payable hereunder; (ii) any representation or

warranty made by Applicant, whether made in this Agreement,

any other document, certificate, report or other statement

heretofore or hereafter furnished by Applicant to Bank in

deposit accounts, including, without limitation, the

connection with the Credit, shall prove to be false or misleading in

Reimbursement Account and that certain deposit

any material respect, or if any such representation or warranty is

account maintained by Applicant with Bank and

withdrawn by Applicant; (iii) Applicant has committed any act or

referred to as account no.

has engaged

in anyconduct

accounts

inventory;

equipment;

chattel which now or in the future may

expose any asset of Applicant to a claim by the federal or state

paper;

farm prod

ucts;

general intangibles;

government under asset forfeiture laws or Applicant has received

instruments;

investment property

any notice of seizure or the government has amended forfeiture

proceedings against Applicant or any guarantor or any of their

REPRESENTATIONS

AND

WARRANTIES

OF

assets including, but not limited to, any collateral securing the

APPLICANT. Applicant hereby represents and warrants to Bank

performance of Applicant’s obligations hereunder; (iv) Applicant

as follows:

defaults in the due performance or observance of any term,

4.1 Authority. Applicant has all requisite power and authority to

provision, condition, covenant, warranty or representation

enter into this Agreement and, if applicable, to grant to Bank a

contained in this Agreement or any other document executed by

security interest in the collateral that secures Applicant's

Applicant in connection with the Credit, and such default shall not

obligations hereunder.

have been cured within 5 business days after notice thereof is

given to Applicant by Bank; (v) a petition in bankruptcy or for

4.2 Compliance With Laws. The transaction(s) contemplated

reorganization or for an arrangement or any composition,

by each Credit comply in all respects with all applicable domestic

readjustment, liquidation, dissolution or similar relief pursuant to

and foreign laws, rules and regulations.

the federal bankruptcy law or under similar present or future

federal or state bankruptcy or insolvency law, is filed by or against

4.3 Binding Obligation. This Agreement constitutes a legally

Applicant, and such petition is not dismissed within 60 days

valid and binding obligation of Applicant, enforceable against

thereafter; and (vi) Applicant ceases to exist, or any guarantor of

Applicant in accordance with its terms, except as limited by

Applicant's obligations under this Agreement or any other

applicable bankruptcy, insolvency, or reorganization or similar

document related to the Credit, revokes his/her/its guaranty, dies

laws affecting the enforcement of creditors' rights generally.

or is declared incompetent by a court of appropriate jurisdiction.

4.4 No Action or Proceeding. There is no action or proceeding

6.2 Remedies. Upon the occurrence of an Event of Default,

pending by or against Applicant or any guarantor of Applicant

Bank shall have all rights available to Bank under this Agreement,

before any court or administrative agency, and Applicant has no

any other documents related to the Credit, at law and in equity,

knowledge of any pending, threatened or imminent litigation,

including without limitation the right to file an action to enforce

governmental investigation or claim, complaint, action or

this Agreement or the right to exercise any rights under any

prosecution involving Applicant, or any guarantor of Applicant, in

documents securing Applicant's obligations hereunder. If at the

which the amount in controversy exceeds Twenty Five Thousand

time any Event of Default shall have occurred, Bank remains

Dollars ($25,000.00), except as heretofore disclosed in writing to

liable under the Credit, whether because the Credit has not yet

Bank. If any of the foregoing arise during the term of this

expired and amounts remain available to be drawn thereunder,

Agreement, Applicant shall immediately notify Bank in writing.

because drafts which have been accepted thereunder, or deferred

WAIVERS

payment obligations which have been incurred thereunder, have

not yet matured, or otherwise, then Applicant shall provide Bank,

5.1 Defenses. Applicant acknowledges and understands that

on demand, sufficient funds from which to pay all amounts for

Applicant may have the right to assert certain defenses to the

which Bank may become liable as if the Credit is thereafter fully

enforcement of Applicant's obligations hereunder that may arise

drawn and all amounts for which Bank will become liable under

by reason of certain actions of a party to the Credit transaction or

drafts and deferred payment obligations which have there before

by reason of the occurrence of certain events. Applicant hereby

been accepted or incurred but have not yet matured. All amounts

knowingly and voluntarily waives any defense to enforcement of

which Applicant is required to provide Bank pursuant to this

Applicant's obligations hereunder that may arise or be created by

Section shall be deposited in an account to be maintained with

reason of any of the following and agrees to pay all monies due

Bank as additional Collateral for Applicant's obligations hereunder

hereunder notwithstanding the occurrence of any of the following

and the unused portion thereof, if any, shall be returned, without

events: (i) the existence of any claim, setoff, defense or other

interest, to the persons legally entitled thereto when it is finally

rights which Applicant may have at any time against the Bank, the

determined by Bank that Applicant has fully discharged its

Beneficiary or any other person, whether in connection with the

obligations under this Agreement.

Credit, this Agreement or any other document or agreement

between the Beneficiary and Applicant executed in connection

7. GENERAL PROVISIONS

with the Credit; (ii) any demand, statement or any other document

7.1 Time of the Essence. Time is hereby declared to be of the

presented under the Credit proving to be forged, fraudulent,

essence of this Agreement and of every part hereof.

invalid, or insufficient in any respect or any statement therein

proving to be untrue or inaccurate in any respect whatsoever; (iii)

7.2 Transferable Credit. If the Credit is transferable, Applicant

any claim by Applicant or a third party that the presentation by the

acknowledges that Bank may take such actions as Bank deems

Beneficiary is deficient; (iv) the solvency of any party issuing any

necessary or desirable to assure itself that neither the Credit nor

documents that may be presented in connection with a draw under

any portion thereof is transferred in violation of applicable laws,

□

4.

5.2 Notice of Acceptance. Applicant hereby waives any notice

of acceptance by Bank of this Agreement.

rules or regulations and, in connection therewith (but not by way

of limitation), Applicant authorizes Bank to include as a condition

of the Credit a requirement that the identity of any proposed

transferee (whether of all or any portion of the Credit) be disclosed

to Bank, and that Bank's consent to such transfer to such transferee

be obtained before the Credit or any portion thereof is transferred.

Bank's consent to any such transfer shall not, however, constitute a

representation or warranty by Bank to Applicant or any other

person that such transfer is, in fact, legally permissible.

7.7 Severability. Each provision of this Agreement shall be

severable from every other provision of this Agreement for the

purpose of determining the legal enforceability of any specific

provision.

7.3 Notices. Except as otherwise provided herein, any notice or

other communication required or permitted to be given in writing

under this Agreement shall be personally served by messenger, or

sent by a commercial overnight delivery service (such as Federal

Express), or by certified mail, return receipt requested, and shall

be deemed given on the date actually received if served by

messenger, or on the next business day after deposit with an

overnight delivery service, or on the date of receipt as shown on

the return receipt if sent by certified mail. Applicant or Bank may

change its address for giving notices or demands hereunder by

written notice of such change to the other party in accordance with

the provisions hereof. Applicant shall promptly notify Bank of

any change of its principal place of business or mailing address in

the manner prescribed by this paragraph.

7.9 Successors and Assigns. This Agreement shall bind and

inure to the benefit of the respective successors and assigns of

each of the parties.

7.4 Entire Agreement; Amendment. This Agreement and any

agreements, instruments or documents referred to herein constitute

the entire agreement between Bank and Applicant regarding the

subject matter hereof, and all prior and/or contemporaneous

communications, verbal or written, between Bank and Applicant

regarding the subject matter hereof shall be of no further effect or

evidentiary value. No course of prior dealing between the parties

hereto, no usage of trade, and no parole or extrinsic evidence of

any nature shall be used to supplement or modify any term or

condition of this Agreement. This Agreement can be amended

only by a written agreement executed by duly authorized

representatives of Bank and Applicant.

7.5 Definitions. Terms used in this Agreement, if not defined

herein, shall have the meaning given or defined in the provisions

of the California Uniform Commercial Code, as it may be

amended, modified or replaced from time to time (“UCC”). If a

term is not defined herein or by the UCC, then such term shall be

construed in a manner that is consistent with the general intent of

this Agreement and with the general practices of the banking

industry in California.

7.6 Construction of Agreement. Neither this Agreement nor

any uncertainty or ambiguity herein shall be construed or resolved

against Bank or Applicant, whether under any rule of construction

or otherwise. On the contrary, this Agreement has been reviewed

by all parties and shall be construed and interpreted according to

the ordinary meaning of the words used so as to fairly accomplish

the purposes and intentions of the parties hereto.

7.8 Headings. All section headings and section numbers have

been set forth herein for convenience of reference only, and shall

not limit or affect the meaning or interpretation of any section

hereof.

7.10 Governing Law. This Agreement and all other agreements

and instruments required by Bank in connection herewith shall be

governed by and construed in accordance with the laws of the

State of California. Notwithstanding the foregoing to the contrary,

Applicant acknowledges and agrees that the terms of the Credit

and the rights and duties of the parties thereto shall be governed

by the International Standby Practices 1998.

7.11 Attorneys' Fees. In the event any party to this Agreement

shall be required to commence any action or proceeding against

any other party by reason of any breach or claimed breach of any

provision of this Agreement, to commence any action in any way

connected with this Agreement, or to seek a judicial declaration of

rights under this Agreement, the party prevailing in such action or

proceeding shall be entitled to recover from the other party, or

parties, the prevailing party's reasonable attorneys' fees and costs

including, without limitation, all witness fees and associated

expenses, including matters on appeal whether or not the

proceeding or action proceeds to judgment.

Date:

APPLICANT:

a

By

Name

Title

© Copyright 2026