Document 268687

RE PO RT This is a Company Profile Report, with The Dun & Bradstreet Corporation shown as a sample. These $99 reports are available for large private or public companies, and include the company overview, officers and employees, executive biographies, competitors, and industry information, plus income statements and financials. Hoover's Custom Report Builder The Dun & Bradstreet Corporation SA M PL E 103 JFK Pkwy. Short Hills, NJ 07078 United States (Map) Phone: 973−921−5500 Toll Free: 800−234−3867 Fax: 973−921−6056 http://www.dnb.com Table of Contents The Basics................................................................................................................................................................................1 Key Information..........................................................................................................................................................1 Key Numbers..............................................................................................................................................................1 Rankings/Stock Indexes..............................................................................................................................................1 RE PO RT Officers and Employees.........................................................................................................................................................2 Corporate Officers.......................................................................................................................................................2 Board...........................................................................................................................................................................2 SA M PL E Biographies.............................................................................................................................................................................4 Steven W. (Steve) Alesio, Age 52..............................................................................................................................4 Sara S. Mathew, Age 51..............................................................................................................................................4 James P. (Jim) Burke, Age 41.....................................................................................................................................5 Stacy Cashman............................................................................................................................................................5 James (Jim) Delaney...................................................................................................................................................6 Patricia A. Clifford, Age 42........................................................................................................................................6 David J. Emery............................................................................................................................................................7 Anastasios G. (Tasos) Konidaris, Age 40...................................................................................................................7 Charles E. Gottdiener, Age 40....................................................................................................................................8 David J. Lewinter, Age 45..........................................................................................................................................8 Tim McChristian.........................................................................................................................................................9 David Palmieri............................................................................................................................................................9 James M. (Jim) Howland, Age 46.............................................................................................................................10 Lee A. Spirer.............................................................................................................................................................10 Byron C. Vielehr, Age 43.........................................................................................................................................10 Ronald L. Kuehn, Age 71.........................................................................................................................................11 Austin A. Adams, Age 63.........................................................................................................................................11 Anthony Pietrontone, Age 48....................................................................................................................................12 Dan Phelan................................................................................................................................................................12 Michael J. Winkler, Age 61......................................................................................................................................12 Christopher J. Coughlin, Age 54...............................................................................................................................13 Sandra E. Peterson, Age 48.......................................................................................................................................13 Naomi O. Seligman, Age 68.....................................................................................................................................14 John W. Alden, Age 65.............................................................................................................................................14 Michael R. Quinlan, Age 62.....................................................................................................................................14 Jeffrey S. (Jeff) Hurwitz, Age 46..............................................................................................................................15 David Kieselstein......................................................................................................................................................15 Significant Developments....................................................................................................................................................17 Overview...............................................................................................................................................................................18 History...................................................................................................................................................................................19 i Table of Contents Industry Information...........................................................................................................................................................20 RE PO RT Competitors...........................................................................................................................................................................21 Top Competitors........................................................................................................................................................21 All Competitors.........................................................................................................................................................21 Products and Operations.....................................................................................................................................................22 Other Resources Available On Hoover's Online...............................................................................................................23 Additional Reports....................................................................................................................................................23 SA M PL E Company Financials.............................................................................................................................................................24 Financial Overview...................................................................................................................................................24 Annual Income Statement.........................................................................................................................................25 Quarterly Income Statement.....................................................................................................................................25 Annual Balance Sheet...............................................................................................................................................27 Quarterly Balance Sheet............................................................................................................................................27 Annual Cash Flow.....................................................................................................................................................29 Quarterly Cash Flow.................................................................................................................................................29 Historical Financials..................................................................................................................................................30 Historical Auditors....................................................................................................................................................30 Market Data...............................................................................................................................................................32 Comparison Data.......................................................................................................................................................33 Competitive Landscape.............................................................................................................................................35 ii The Basics 103 JFK Pkwy. Short Hills, NJ 07078 United States (Map) Phone: 973−921−5500 Toll Free: 800−234−3867 Fax: 973−921−6056 http://www.dnb.com Key Information D−U−N−S Number Doing Business As Company Type Location Type Year Of Founding or Change In Control State of Incorporation Key Numbers Sales (mil.) SA M PL E Fiscal Year−End 1−Year Sales Growth Net Income (mil.) 1−Year Net Income Growth 2006 Employees Employees At This Location Rankings/Stock Indexes • S&P 400 1 RE PO RT For The Dun & Bradstreet Corporation, there's no business like "know" business. The company, known as D&B, is one of the world's leading suppliers of business information, services, and research. Its database contains statistics on more than 100 million companies in more than 200 countries, including the largest volume of business−credit information in the world. D&B sells that information and integrates it into software products and Web−based applications. D&B also offers marketing information and purchasing−support services. D&B made a major commitment to provide information via the Internet with its acquisition of Hoover's, the publisher of this profile. 884114609 "D&B" Public − NYSE: DNB Headquarters 1841 DE December $1,531.3 6.1% $240.7 8.8% 4,400 450 Officers and Employees Corporate Officers Title Name Age Mr. Steven W. (Steve) Alesio 52 President and COO Ms. Sara S. Mathew 51 SVP Global Solutions and Chief Marketing Officer Mr. James P. (Jim) Burke 41 SVP, Middle Market Customer Group Ms. Stacy Cashman SVP, Global Sales & Marketing Solutions Mr. James (Jim) Delaney RE PO RT Chairman and CEO SVP Human Resources, Winning Culture, and Team Member Communications Ms. Patricia A. Clifford SVP, International Partnerships and Asia Pacific Mr. David J. Emery SVP and CFO Mr. Anastasios G. (Tasos) Konidaris 40 Mr. Charles E. Gottdiener 40 Mr. David J. Lewinter 45 SVP, Small Business Marketing SVP Global Reengineering SVP, Enterprise Customer Group Mr. Tim McChristian SVP and Leader, Strategy and Innovation President, D&B International 42 Mr. David Palmieri Mr. James M. (Jim) Howland SVP, Strategy, Business Development, and Reengineering Mr. Lee A. Spirer Leader, Global Analytics Mr. Frederick A. (Rick) Teague 46 Mr. Byron C. Vielehr Leader, External Communications Mr. Joseph Jones SVP, General Counsel, and Secretary Mr. Jeffrey S. (Jeff) Hurwitz 46 Principal Accounting Officer Mr. Anthony Pietrontone 48 SVP, Small Business Group Credit Mr. David Kieselstein Leader, Channel Management Board Mr. Dan Phelan SA M PL E SVP Technology and CIO Title Name Age Chairman and CEO Mr. Steven W. (Steve) Alesio 52 Director Mr. John W. Alden 65 Mr. Christopher J. Coughlin 54 Mr. James N. Fernandez 51 Mr. Ronald L. Kuehn Jr. 71 Director Director Director 2 43 Mr. Victor A. (Vic) Pelson 69 Director Ms. Sandra E. Peterson 48 Director Mr. Michael R. Quinlan 62 Director Ms. Naomi O. Seligman 68 Director Mr. Michael J. Winkler 61 Director Mr. Austin A. Adams 63 SA M PL E RE PO RT Director 3 Biographies Steven W. (Steve) Alesio, Age 52 Title held since 2006: Chairman and CEO Recent Work Highlights Biography RE PO RT • The Dun & Bradstreet Corporation ♦ 2005: Chairman and CEO, $750,000 salary, $1,200,000 bonus ♦ 2004 − 2005, Chairman and CEO ♦ 2003 − 2004, President, COO, and Director ♦ 2002: SVP, Global Marketing, Strategy Implementation, eBusiness Solutions, Asia Pacific/Latin America and Data and Operations, $500,000 salary, $850,000 bonus ♦ 2001 − 2002, SVP, Global Marketing, Strategy Implementation, eBusiness Solutions, Asia Pacific/Latin America and Data and Operations SA M PL E Steven W. Alesio is Chairman of the Board and CEO of D&B (Dun & Bradstreet Corporation). After joining D&B in January 2001 as senior vice president, Mr. Alesio served in various senior leadership positions. In May, 2002, Mr. Alesio was named President and Chief Operating Officer, and was elected to the Board of Directors. In January, 2005, Mr. Alesio was chosen to be the CEO, and in May of that year, he became Chairman of the Board.Under Mr. Alesio's leadership and the direction of the company's Blueprint for Growth strategy, D&B's performance has had very strong returns for shareholders and has become a model culture for employees. Prior to joining D&B, Mr. Alesio spent 19 years with the American Express Company, where he was groomed in marketing and then general management. His last responsibility at American Express was as president and general manager of the Business Services Group−a unit that served small businesses in the US with financial products. In that role, Mr. Alesio was also a member of the company's Policy and Planning Committee. Mr. Alesio is the founding sponsor and Senior Advisor for the non−profit, All Stars Project of New Jersey, which provides outside−of−school leadership development and performance−based education programming to thousands of inner−city young people in Newark and its surrounding communities. Mr. Alesio received a bachelor's degree from St. Francis College in 1976 and master's degree in business administration from the University of Pennsylvania's Wharton School in 1981. Source: Company Web Site, 2007 Sara S. Mathew, Age 51 Title held since 2007: President and COO Other Company Affiliations Company Campbell Soup Company Recent Work Highlights • The Dun & Bradstreet Corporation ♦ 2006 − 2006, CFO 4 Director Title −− Salary −− Bonus ♦ 2006 − 2006, CFO and President, D&B International ♦ 2006 − 2007, CFO; President, D&B US ♦ 2005: Leader, Strategy and CFO, $450,000 salary, $486,000 bonus (prior to promotion) ♦ 2004: Leader, Strategy and CFO, $400,000 salary, $530,075 bonus ♦ 2003: Leader, Strategy and CFO, $375,000 salary, $315,000 bonus ♦ 2002: Leader, Strategy and CFO, $375,000 salary, $451,000 bonus ♦ 2001 − 2002, Leader, Strategy and CFO Biography RE PO RT Sara joined D&B in August 2001 as Chief Financial Officer. Since then, she has assumed additional executive assignments, while retaining her CFO role. Sara has been instrumental in helping lead the Company to consistently deliver on its strong financial commitments to shareholders. In January 2006, she added responsibility as President − International and in September 2006, she relinquished that role and then became President − U.S. Prior to joining D&B, Sara had an 18−year career with Procter & Gamble, where she served in a number of executive positions in finance and general management, both domestically and overseas. Source: Company Press Release, February 28, 2007 James P. (Jim) Burke, Age 41 Title held since 2006: SVP Global Solutions and Chief Marketing Officer Recent Work Highlights • The Dun & Bradstreet Corporation ♦ 2005 − 2006, SVP Global Solutions and Chief Marketing Officer ♦ 2004 − 2005, Leader, US Risk Management Solutions ♦ 2003 − 2004, VP, RMS Traditional Products SA M PL E Biography James P. Burke is senior vice president of Global Solutions and the chief marketing office of D&B, positions he has held since January 2006. Mr. Burke is also a member of the company's Global Leadership Team. Mr. Burke joined D&B in 2001 as vice president for Small Business Solutions. He subsequently held several leadership roles for Risk Management Solutions (RMS) − D&B's largest solution set − including vice president for Traditional Products, vice president for Products and Marketing, and most recently as leader, U.S. Under his leadership, RMS has become the company's leading growth driver. Mr. Burke most recently led the development and launch of DNBi, the company's new web−based subscription service, which uses innovation to bring greater value to customers. Prior to joining D&B, Mr. Burke was chief development officer at Prudential's E−Business Group and head of Internet Marketing at First USA Bank. He also held various marketing leadership roles at MCI and served as a captain in the U.S. Marine Corps. Mr. Burke received a bachelor's degree from Villanova and a master's in business administration from Katz Graduate School of Business at the University of Pittsburgh. Source: Company Web Site, 2007 Stacy Cashman Title held since 2006: SVP, Middle Market Customer Group 5 Biography Source: Company Web Site, 2007 James (Jim) Delaney SVP, Global Sales & Marketing Solutions Biography RE PO RT Stacy Cashman is the senior vice president of the Middle Market Customer Group for D&B, a position she has held since January 2006. Ms. Cashman is also a member of the company's Global Leadership Team. A strong leader and innovator with a broad background in business management and driving sales results, Ms. Cashman's focus is on the company's Middle Market customer segment. Ms. Cashman has been with D&B for over 20 years and previously served in a variety of sales leadership roles. From March 2003 to December 2005, she served as leader, Regional Business Units and as regional vice president, Great Lakes Region from 1998 to 2002. In addition to her sales experience, Ms. Cashman has held a number of positions in operations and business development throughout her D&B tenure. Ms. Cashman holds a bachelor's degree from Drake University. SA M PL E Jim Delaney is senior vice president, Global Sales & Marketing Solutions. In this role, Mr. Delaney is responsible for driving sustained revenue growth in our Sales & Marketing Solutions business by transforming our products to better meet customer needs. Sales & Marketing Solutions (S&MS) is our second largest segment, accounting for more than $300 million of annual revenue. Growth in this business is critical to delivering on our commitments. Mr. Delaney is also a member of the Global Leadership team. Mr. Delaney has held a number of leadership positions in senior management and marketing in the financial services industry. Most recently, he was senior vice president of Card Services at JP Morgan Chase, where he led his product portfolio to unprecedented growth and acquired 500,000 new customers in a single year−− the most in the program's history. At Colonial Penn Insurance, he led a team that developed a sales and marketing plan that allowed his company to penetrate their market, and at FirstUSA, he worked closely with internal business partners to better service military customers, generating additional revenue for his business. He's also held leadership roles at several other respected financial institutions. Mr. Delaney is a graduate of the U.S. Naval Academy and holds an MBA from the Wharton School at the University of Pennsylvania. Source: Company Web Site, 2007 Patricia A. Clifford, Age 42 Title held since 2002: SVP Human Resources, Winning Culture, and Team Member Communications Biography Patricia A. Clifford is senior vice president of Human Resources for D&B, a position she has held since June 2002. In 2004, Ms. Clifford took on the additional responsibility for Team Member Communications. Ms. Clifford is a member of the company's Global Leadership Team. Ms. Clifford also leads a key component of D&B's Blueprint for Growth strategy − Winning Culture − for which she has driven significant change across the business that has resulted in improved overall performance. She led the implementation of the Company's leadership model and developed strategy and processes for goal setting, performance review, talent assessment, recruiting and formal feedback. These Winning Culture initiatives have contributed to the achievement of the highest employee satisfaction scores and participation rate in the Company's history. Previously as assistant corporate secretary for D&B, Ms. Clifford played a key role in both the 1998 spin−off of R.H. Donnelley Corporation and 2000 spin−off of Moody's Corporation. She was instrumental in the development of the company's first set of Corporate Governance practices, as well as the restructuring of the Board committees, including 6 increasing the rigor around the functions and accountability of the Audit Committee. Ms. Clifford joined D&B in 1990 as a member of the president's office of the Dun & Bradstreet Business Credit Services group. Since then, she has held leadership roles of increasing responsibility at D&B including assistant vice president for recognition and events. Ms. Clifford holds a bachelor's degree in management from the University of Scranton. Source: Company Web Site, 2007 David J. Emery Biography RE PO RT Title held since 2005: SVP, International Partnerships and Asia Pacific David Emery is senior vice president of International Partnerships & Asia Pacific of D&B, a position he has held since 2005. He has served D&B in several international positions since joining the company in 1995 as managing director, D&B Switzerland. He is also a member of the company's Global Leadership Team. Mr. Emery's additional international assignments for D&B include his appointment in 1998 as leader, South East Asia and India, where he was responsible for streamlining the business and expanding D&B's coverage in the region through alliances and partnerships. His responsibilities expanded in 2001 to include the whole of D&B Asia Pacific, and subsequently the Middle East, where he replicated the company's successful partnership business model. Mr. Emery continued to lead the business model change through 2004 in Scandinavia, Central Europe, Iberia and France. Before joining D&B, Mr. Emery began his career with Xerox in Switzerland and ultimately became the regional general manager of Xerox Engineering Systems, Switzerland, Austria and Italy. He holds a Swiss Federal bachelor's degree in Commerce and General Management and is also an Alumni of IMD International, Switzerland, where he specialized in Marketing. Source: Company Web Site, 2007 Anastasios G. (Tasos) Konidaris, Age 40 SA M PL E Title held since 2007: SVP and CFO Recent Work Highlights • The Dun & Bradstreet Corporation ♦ 2005 − 2007, SVP, Finance Operations Biography Tasos joined D&B in March 2005 to lead the Company's global finance operations and began serving as Principal Accounting Officer in May 2005. In his two years with D&B, Tasos has taken on increased financial leadership responsibility. He has had accountability for the financial operations supporting the Company's U.S. and International businesses. He has also had corporate finance responsibility, including accounting, financial reporting, audit and controls. Tasos joined D&B with more than 15 years of experience in general management and global finance operations, including a role as Group Vice President of a division at Schering−Plough. Tasos previously served as Vice President of Finance, North America at Pharmacia Corporation and held senior leadership roles in finance, operations and marketing at Bristol−Myers Squibb, Sandoz Corporation and Rhone−Poulenc Rorer. Source: Company Press Release, February 28, 2007 7 Charles E. Gottdiener, Age 40 Title held since 2006: SVP, Small Business Marketing Recent Work Highlights • The Dun & Bradstreet Corporation ♦ 2002 − 2006, Leader, Strategy and Business Development Biography SA M PL E RE PO RT Charles E. Gottdiener is senior vice president, Small Business Marketing at D&B with responsibility for the unified Hoover's and Market Data Retrieval (MDR) businesses. He is also responsible for the development and implementation of D&B's Internet Strategy. Mr. Gottdiener is a member of the Global Leadership Team. Most recently, Mr. Gottdiener served as vice president, corporate strategy & development at Unisys Corporation. In addition to his corporate strategy and development responsibilities, Mr. Gottdiener had revenue responsibility for the company's high−growth solution areas −− Outsourcing, Security, Microsoft, Open Source and Real Time Infrastructure. Prior to joining Unisys, Mr. Gottdiener spent four years with D&B as Leader, Strategy & Business Development. In this role, Mr. Gottdiener leveraged his broad experience in consulting and transforming businesses to successfully lead D&B's strategic planning process as well as several acquisitions and divestitures. During this time he was a member of the company's Global Leadership Team. Prior to joining D&B, Mr. Gottdiener was a vice president with Cap Gemini Ernst & Young (CGE&Y), one of the largest management and information technology consulting organizations in the world, where he was leader of the strategy and transformation service line for the Americas. He developed and implemented the turnaround and growth strategy for the service line, returning it to profitability by launching several unique product offerings. Prior to joining CGE&Y, Mr. Gottdiener was chief operating officer and chief financial officer for Stockback LLC, a financial services and loyalty company that pioneered the use of mutual fund shares as reward for making everyday purchases. He led the negotiation of revenue−producing partnerships with several retailers and financial institutions to enable the growth of this unique business. Mr. Gottdiener's background also includes leadership positions at Ernst & Young LLP, CSC Index, and the Boston Consulting Group. Mr. Gottdiener earned a bachelor's degree from Grinnell College in Iowa and an MBA from the Wharton School at the University of Pennsylvania. Source: Company Web Site, 2007 David J. Lewinter, Age 45 Title held since 2007: SVP Global Reengineering Recent Work Highlights • The Dun & Bradstreet Corporation ♦ 2006 − 2007, SVP, General Counsel, Corporate Secretary, and Leader Global Reengineering ♦ 2005: SVP, General Counsel, and Corporate Secretary, $330,000 salary, $240,900 bonus ♦ 2004: SVP, General Counsel, and Corporate Secretary, $300,000 salary, $333,190 bonus ♦ 2003 − 2004, SVP, General Counsel, and Corporate Secretary ♦ 2001 − 2002, VP and Leader, European Legal Affairs ♦ 2000 − 2001, VP and Corporate Secretary ♦ 1999 − 2000, Corporate Secretary 8 Biography Mr. Lewinter, Senior Vice President, has served as our Leader, Global Reengineering since April 2006, in addition to serving as our General Counsel and Corporate Secretary from May 2002 until February 2007. Prior to that, Mr. Lewinter served as our Vice President and Leader, European Legal Affairs from September 2001 to April 2002, as a Vice President of our domestic legal department from April 2000 to August 2001 and as Corporate Secretary from November 1999 to August 2001. Source: Proxy, March 26, 2007 RE PO RT Tim McChristian Title held since 2006: SVP, Enterprise Customer Group Biography SA M PL E Tim McChristian is senior vice president of the Enterprise Customer Group at D&B, a position he has held since January 2006. In this role, Mr. McChristian is responsible for leading the company's customer and product specialist sales teams to deliver revenue and customer satisfaction with D&B's largest customers across three segments −− Strategic, Global Major and Government. He is also a member of the company's Global Leadership Team. Mr. McChristian joined D&B in April 2005 after nearly 26 years with the IBM Corporation in various senior leadership positions. His most recent assignment at IBM was as the general manager for the Computer Services Industry. In that role, he was responsible for over $7 billion of IBM revenue delivered by building relationships with the major, global consulting and integration firms such as Accenture, CapGemini and EDS, among others. He previously held IBM positions as the general manager for Distribution Channels in Asia Pacific and as the vice president of Sales and Marketing for the Networking Hardware Division. He is active in leadership positions with several major non−profit organizations including serving as vice chairman of the Board of Directors of the A Better Chance Program and serving on the Corporate Advisory Board at the Marshall School of Business at the University of Southern California. In addition, Mr. McChristian was elected to the Executive Leadership Council, America's most prestigious association of African−American corporate executives. Mr. McChristian received a bachelor's of science degree in organizational behavior from Yale University and a master's in business administration with a concentration in finance from the Marshall School of Business at the University of Southern California. Source: Company Web Site, 2007 David Palmieri Title held since 2006: SVP and Leader, Strategy and Innovation Recent Work Highlights • The Dun & Bradstreet Corporation ♦ Title held until 2006: SVP, Global Risk Management Solutions Biography Prior to joining D&B in 2003, Mr. Palmieri was the vice president of Product Development for Register.com, a leading provider of domain name registration services based in New York City. He also served as director of Product Development for Barnes & Noble.com, the e−commerce division of Barnes & Noble, Inc., as product manager for Broadband Services for Bell Atlantic (now Verizon), and as a consultant with Andersen Consulting (now Accenture). Mr. Palmieri holds a bachelor of arts degree from Franklin & Marshall College and received a master¿s degree in business 9 administration from Harvard University. Source: Company Web Site, 2006 James M. (Jim) Howland, Age 46 Title held since 2006: President, D&B International Biography Source: Company Web Site, 2007 Lee A. Spirer RE PO RT James M. Howland is president, International for D&B, a position he was named to in September 2006. Mr. Howland is also a member of the company's Global Leadership Team. Mr. Howland is a seasoned general manager with a strong record of driving growth and business transformation. Prior to joining D&B, he held CEO positions at Edison Schools Educational Services Group and Regus Business Centers − Americas. Earlier in his career, Mr. Howland spent ten years with American Express in a number of senior leadership roles, including his last role as president of their Merchant Services International business. In that capacity, he was responsible for the 4 million merchants that accepted the American Express Card in Europe, Asia Pacific, Latin America, and Canada. Mr. Howland spent the first six years of his career in management consulting with McKinsey & Co. Mr. Howland is a graduate of Bucknell University with a BA in economics and has an MBA from the Stanford Graduate School of Business. Title held since 2005: SVP, Strategy, Business Development, and Reengineering Biography SA M PL E Lee A. Spirer is senior vice president of Strategy, Business Development,since September 2005 to lead strategy and business development and soon after assumed leadership for reengineering. Mr. Spirer is also a member of the company's Global Leadership Team. Mr. Spirer brings tremendous experience to D&B in leading transformational change in organizations, driving innovation and executing growth and acquisition strategies. He also has deep expertise in the financial services industry across a wide range of businesses. Prior to joining D&B, Mr. Spirer was with IBM where he held a variety of strategy and line management roles, most recently as the global leader of the $600M Financial Markets Business Consulting Services unit. Mr. Spirer played a significant role in IBM's transformation to a business services company as leader of the Financial Services strategy consulting practice and in the acquisition and integration of PriceWaterhouseCoopers' consulting business. Mr. Spirer joined IBM through the acquisition of Mainspring Inc., a boutique strategy consulting business. As General Manager of Financial Services and a member of the management team, he led the rapid growth of the firm's largest sector and played a key role in the relationships with private equity investors, the initial public offering, and eventual sale to IBM. Mr. Spirer's background also includes leadership positions at Booz Allen & Hamilton and First Manhattan Consulting Group. Mr. Spirer holds a BA from Brandeis University where he graduated Phi Beta Kappa, and an MBA from The Wharton School at the University of Pennsylvania. Source: Company Web Site, 2007 Byron C. Vielehr, Age 43 Title held since 2006: SVP Technology and CIO 10 Recent Work Highlights • The Dun & Bradstreet Corporation ♦ 2005 − 2006, SVP, Technology and CIO Biography Source: Company Web Site, 2007 Ronald L. Kuehn, Age 71 Title held since 1996: Director Other Company Affiliations Company El Paso Corporation Praxair, Inc. Chairman Director Title −− −− SA M PL E Biography RE PO RT Byron C. Vielehr is chief information officer and senior vice president of Technology for D&B, positions he has held since joining the company in 2005. He is also a member of the company's Global Leadership Team. Mr. Vielehr brings 17 years of strategic technology planning experience to D&B, with a proven track record of enabling business growth and process reengineering. Mr. Vielehr joined D&B from NorthStar Systems International, Inc., an enterprise wealth management and asset management technology solutions provider, where he served as president and chief operating officer. Prior to NorthStar, Mr. Vielehr served as chief technology officer of the Private Client Group at Merrill Lynch, and earlier as chief technology officer and Global Head of eBusiness with Merrill Lynch Investment Managers. Mr. Vielehr received a bachelor of science degree from Drexel University and holds a master's degree in business administration from the University of Pennsylvania's Wharton School. Salary −− −− Bonus Ronald L. Kuehn, Jr. has served as a director of D&B since 1996, and is chairman of the Compensation & Benefits Committee and a member of the Audit Committee. Mr. Kuehn was appointed as chairman of the board of El Paso Corporation, a diversified energy company, in March 2003, and also served as El Paso¿s chief executive officer from March 2003 to September 2003. He previously served as chairman of the board of directors of El Paso from the time of its merger with Sonat Inc. in October 1999 until December 2000. Prior to that, Mr. Kuehn was chairman, president and chief executive officer of Sonat Inc. Source: Proxy, March 23, 2006 Austin A. Adams, Age 63 Title held since 2007: Director Other Company Affiliations Company Spectra Energy Corp 11 Director Title −− Salary −− Bonus Biography Adams was most recently, executive vice president and corporate chief information officer of JPMorgan Chase, the third largest bank holding company in the world. Prior to this role, Adams served as executive vice president and chief information officer of Bank One from 2001 to 2004. Most of Adams' 35−year banking career was in leading technology and operations during dramatic consolidation in the industry. Adams is also a director of Spectra Energy, Inc., a public company, and NCO Corporation, which is owned by JPMorgan private equity. Source: Company Press Release, April 2, 2007 Principal Accounting Officer Biography RE PO RT Anthony Pietrontone, Age 48 Mr. Pietrontone will assume the role of Principal Accounting Officer of the Company, reporting to the Chief Financial Officer. Mr. Pietrontone has been with the Company since 1985 and during his tenure has served in various roles of increasing responsibility over D&B's financial reporting. Most recently, Mr. Pietrontone has served as the Company's Assistant Corporate Controller since December 2002. Source: 8K, Februar 28, 2007 Dan Phelan Leader, Channel Management Biography SA M PL E Dan has over 25 years of sales experience and a proven track record of building, developing, and leading teams to drive significant growth within large organizations. Dan joined D&B in 2004 as Regional Vice President, Western Region for the RBU channel and most recently held the role of Leader, GMC Sales reporting into Tim McChristian. Prior to joining D&B, Dan held numerous senior leadership positions with both Xerox Corporation and Gartner. Source: Other: Publication, March 6, 2007 Michael J. Winkler, Age 61 Title held since 2005: Director Biography Michael J. Winkler has served as a director of D&B since March 2005, and is a member of the Board Affairs Committee. Mr. Winkler served at Hewlett−Packard Company, a technology solutions provider to consumers, businesses and institutions globally, from May 2002 to July 2005, most recently as executive vice president and chief marketing officer of Hewlett−Packard. Prior to that, Mr. Winkler was executive vice president for HP Worldwide Operations from May 2002 to November 2003, and served as executive vice president, Global Business Units for Compaq Computer Corporation from June 2000 to May 2002. He also served as senior vice president and general manager of Compaq¿s Commercial Personal Computing Group from February 1998 to June 2000. Mr. Winkler is also a director of the following public company: Banta Corporation. 12 Source: Proxy, March 23, 2006 Christopher J. Coughlin, Age 54 Title held since 2004: Director Other Company Affiliations Biography Title Director EVP and CFO Salary −− $750,000.00 RE PO RT Company Covidien Ltd. Tyco International Ltd. Bonus −− $950,000.00 Christopher J. Coughlin has served as a director of D&B since December 2004, and is a member of the Audit Committee. Mr. Coughlin has served as executive vice president and chief financial officer of Tyco International Ltd., a global, diversified company that provides vital products and services in five business segments (Fire & Security, Electronics, Healthcare, Engineered Products & Services and Plastics & Adhesives) since March 2005. Previously, he served at The Interpublic Group of Companies, Inc. as executive vice president and chief operating officer from June 2003 to December 2004, as chief financial officer from August 2003 to June 2004, and as a director from July 2003 to July 2004. Prior to that, Mr. Coughlin served as executive vice president and chief financial officer of Pharmacia Corporation from 1998 to 2003. Mr. Coughlin does not serve on the board of any public companies other than D&B. Source: Proxy, March 23, 2006 Sandra E. Peterson, Age 48 Title held since 2002: Director SA M PL E Other Company Affiliations Company Bayer Corporation Bayer HealthCare AG Bayer HealthCare Diabetes Care Division Title President, Diabetes Care Division, Bayer HealthCare LLC Member, Executive Committee; President, Diabetes Care Division President Salary Bonus −− −− −− −− −− −− Biography Sandra E. Peterson has served as a director of D&B since September 2002, and is a member of the Board Affairs and Compensation & Benefits Committees. Ms. Peterson has served as executive vice president and president, Diabetes Care of Bayer HealthCare LLC, a researcher, developer, manufacturer and marketer of products for diabetes disease prevention, diagnosis and treatment, since May 2005. Ms. Peterson previously served as group president of government for Medco Health Solutions, Inc. (formerly Merck−Medco) from September 2003 until February 2004, senior vice president of Medco¿s health businesses from April 2001 through August 2003 and senior vice president of marketing for Merck−Medco Managed Care LLC from January 1999 to March 2001. Ms. Peterson does not serve on the board of any public companies other than D&B. Source: Proxy, March 23, 2006 13 Naomi O. Seligman, Age 68 Title held since 1999: Director Other Company Affiliations Biography Director Director Director Director Title −− −− −− −− Salary RE PO RT Company Akamai Technologies, Inc. Oracle Corporation Sun Microsystems, Inc. Tellme Networks, Inc. −− −− −− −− Bonus Naomi O. Seligman has served as a director of D&B since June 1999, and is a member of the Audit and Board Affairs Committees. Since June 1999, Ms. Seligman has been a senior partner at Ostriker von Simson, Inc. and co−partner of the CIO Strategy Exchange, a private forum for discussion and research which facilitates a dialogue between the chief information officers of large multinational corporations, premier venture capitalists, and computer industry establishment chief executive officers. Previously, Ms. Seligman was a senior partner of the Research Board, Inc., which she co−founded in 1977 and led until June 1999. Ms. Seligman is also a director of the following public companies: Akamai Technologies, Inc., Oracle Corporation and Sun Microsystems, Inc. Source: Proxy, March 23, 2006 John W. Alden, Age 65 Title held since 2002: Director SA M PL E Other Company Affiliations Company Arkansas Best Corporation Barnes Group Inc. Silgan Holdings Inc. Biography Director Director Director Title −− −− −− Salary −− −− −− Bonus John W. Alden has served as a director of D&B since December 2002, and is a member of the Board Affairs and Compensation & Benefits Committees. Mr. Alden served with United Parcel Service, Inc. (UPS), the largest express package carrier in the world, for 35 years, serving on UPS¿s board of directors from 1988 to 2000. His most recent role was as vice chairman of the board of UPS from 1996 until his retirement in 2000. Mr. Alden is also a director of the following public companies: Arkansas Best Corporation, Barnes Group, Inc. and Silgan Holdings, Inc. Source: Proxy, March 23, 2006 Michael R. Quinlan, Age 62 Title held since 1989: Director 14 Other Company Affiliations Company Loyola University Chicago Loyola University Health System Warren Resources, Inc. Biography Chairman Director Director Title −− −− −− Salary −− −− −− Bonus Source: Proxy, March 23, 2006 Jeffrey S. (Jeff) Hurwitz, Age 46 RE PO RT Michael R. Quinlan has served as a director of D&B since 1989, and is chairman of the Board Affairs Committee and a member of the Compensation & Benefits Committee. Mr. Quinlan is also the presiding director for the regularly scheduled executive sessions of non−management directors. Mr. Quinlan served as a director of McDonald¿s Corporation, a global food service retailer, from 1979 until his retirement in 2002. He was the chairman of the board of directors of McDonald¿s from March 1990 to May 1999 and chief executive officer from March 1987 through July 1998. Mr. Quinlan is also a director of the following public company: Warren Resources, Inc. Title held since 2007: SVP, General Counsel, and Secretary Biography SA M PL E Jeff joined D&B in September 2003 as Deputy General Counsel and assumed responsibility as lead counsel on the Company's M&A and international partnership initiatives. Since joining D&B, Jeff has taken on increasing responsibility for running the day−to−day operations of the Company's Legal Department. Jeff joined D&B with extensive experience in M&A, corporate governance and compliance and litigation management. He served as Corporate Senior Vice President, General Counsel and Secretary for Covance, Inc. − a global drug development company, which he helped take public as part of the spin−off from Corning, Incorporated. Jeff was also Of Counsel at Hale and Dorr LLP. Source: Company Press Release, February 28, 2007 David Kieselstein SVP, Small Business Group Credit Biography David Kieselstein is senior vice president, Small Business Group Credit at D&B. The business consists of two divisions: Small Business Credit Solutions (formerly Credit Teleweb), which sells sophisticated small business solutions, and Small Business Credit, which sells entry−level products. Mr. Kieselstein is a member of the Global Leadership Team. Prior to joining D&B, Mr. Kieselstein spent 17 years at Time Warner, where he transformed many of its brands, progressed through several senior leadership positions and led a number of complex organizations. As president of The Parenting Group, he managed a portfolio of media assets reaching over 20 million customers each month, including Parenting, Babytalk and Healthy Pregnancy magazines, a product sampling company and Parenting.com. During his tenure, the group's revenues exceeded $250 million, and profits grew by 75%. Previously, Mr. Kieselstein was president of The Personal Finance Media Group, which included flagship Money magazine and Money.com. Prior to joining Time Warner, Mr. Kieselstein worked in brand management at Nabisco. Mr. Kieselstein received his MBA from Northwestern University's Kellogg School, where he currently serves on the Executive Committee of the Alumni Board. He received his 15 undergraduate degree in economics from Binghamton University. SA M PL E RE PO RT Source: Company Web Site, 2007 16 Significant Developments SA M PL E RE PO RT Date Event Details 1/03/2005 Top Executive Change Steven W. Alesio succeeded Allan Z. Loren, who retired as CEO. 17 Overview For The Dun & Bradstreet Corporation, there's no business like "know" business. The company, known as D&B, is one of the world's leading suppliers of business information, services, and research. Its database contains statistics on more than 100 million companies in more than 200 countries, including the largest volume of business−credit information in the world. D&B sells that information and integrates it into software products and Web−based applications. D&B also offers marketing information and purchasing−support services. D&B made a major commitment to provide information via the Internet with its acquisition of Hoover's, the publisher of this profile. RE PO RT D&B strengthened its Internet presence in 2007 with the purchase of First Research, a Web−based provider of editorial−based industry reports aimed at sales people. (After the acquisition, First Research became a wholly owned subsidiary of Hoover's which D&B bought in 2003.) This division, E−business Solutions, is a key company focus because it is the fastest growing of D&B's four business segments. The company is also making technology investments designed to expand its core businesses. D&B is improving the data capabilities of Risk Management Solutions (accounting for two−thirds of sales) and delivering more predictive indicators about credit risks to its customers. The company is also focused on making investments in and improvements to its Sales and Marketing Solutions division, which supplies lists and related data to direct mail and marketing customers. Although it will continue to support its operations, D&B's Supply Management Solutions segment is not expected to experience any significant growth. D&B has also instituted a financial flexibility program designed to simplify management as well as consolidate its technology infrastructure. D&B continues to focus its international operations on a market−by−market basis, conducting business through wholly−owned subsidiaries, independent correspondents, strategic partner relationships through its D&B Worldwide Network. As a result, D&B is offering more international company records to its customers around the world. SA M PL E Davis Selected Advisors owns about 15% of D&B. 18 History D&B originated as Lewis Tappan's Mercantile Agency, established in 1841 in New York City. One of the first commercial credit−reporting agencies, the Mercantile supplied wholesalers and importers with reports on their customers' credit histories. The company's credit reporters included four future US presidents (Lincoln, Grant, Cleveland, and McKinley). In the 1840s it opened offices in Boston, Philadelphia, and Baltimore, and in 1857 it established operations in Montreal and London. RE PO RT In 1859 Robert Dun took over the agency and renamed it R.G. Dun & Co. The first edition of the Dun's Book (1859) contained information on 20,268 businesses; by 1886 that number had risen to over a million. During this time Dun's was competing fiercely with the John M. Bradstreet Company, founded in 1849 by its namesake in Cincinnati. The rivalry continued until the Depression, when Dun's CEO Arthur Whiteside negotiated a merger of the two firms in 1933; the new company adopted the Dun & Bradstreet name in 1939. In 1961 Dun & Bradstreet bought Reuben H. Donnelley Corp., a direct−mail advertiser and publisher of the Yellow Pages (first published 1886) and 10 trade magazines. In 1962 Moody's Investors Service (founded 1900) became part of Dun & Bradstreet. The company began computerizing its records in the 1960s and eventually developed the largest private business database in the world. Repackaging that information, the company began creating new products such as Dun's Financial Profiles, first published in 1979. Dun & Bradstreet continued buying information and publishing companies during the 1970s and 1980s, including Technical Publishing (trade and professional publications, 1978), National CSS (computer services, 1979), and McCormack & Dodge (software, 1983). Later came ACNielsen (1984) and IMS International (pharmaceutical sales data, 1988). SA M PL E Finding that not all information was equally profitable, Dun & Bradstreet sold its specialty industry and consumer database companies in the early 1990s. Still hoping to cash in on medical and technology information, the company formed D&B HealthCare Information and bought a majority interest in consulting firm Gartner Group. In 1993 the company consolidated its 27 worldwide data centers into four locations. The following year it settled a class−action suit involving overcharging customers for credit reports. After its second earnings decline in three years, management revamped the company in 1996, selling off ACNielsen and Cognizant (consisting of IMS Health and Nielsen Media Research). Volney Taylor was appointed chairman and CEO of Dun &Bradstreet. In 1998 it spun off R. H. Donnelley (formerly Reuben H. Donnelley). Under pressure from unhappy shareholders, Taylor resigned in late 1999. With director Clifford Alexander Jr. acting as interim CEO, Dun &Bradstreet announced plans to spin off its Moody's unit. After completing the spinoff the following year, Allan Loren took over as chairman and CEO of Dun & Bradstreet. Loren retired from the company in mid−2005 and president Steven Alesio became chairman, president, and CEO. The company boosted its risk management business with a $16 million acquisition of online credit management software maker LiveCapital in 2005. 19 Industry Information Hoover's Industries • Business Services ♦ Advertising &Marketing ◊ Market Research Services • Insurance ♦ Risk Management RE PO RT • Media ♦ Information Collection & Delivery ♦ Internet Content Providers • Financial Services ♦ Transaction, Credit & Collections ◊ Credit Reporting (primary) Primary SIC Code • 7323: Credit reporting services Primary NAICS Code SA M PL E • 561450: Credit Bureaus 20 Competitors Top Competitors • Acxiom • Equifax • infoUSA SA M PL E • ACNielsen • Acxiom • Capgemini • Deloitte Consulting • Equifax • Experian Americas • Fair Isaac • GfK NOP • Harte−Hanks • Information Resources • Jewelers Board of Trade • Kreller Business Information • OneSource • S&P • Thomson Corporation • infoUSA RE PO RT All Competitors 21 Products and Operations The Dun & Bradstreet Corporation has offices in about 30 countries and correspondents in another 140 countries. % of total 64 27 6 3 100 SA M PL E 2006 Sales $ mil. Risk management solutions 985.5 Sales & marketing solutions 412.2 E−business solutions 88.7 Supply management solutions 44.9 Total 1,531.3 RE PO RT 2006 Sales $ mil. % of total US 1,164.2 76 International 367.1 24 Total 1,531.3 100 22 Other Resources Available On Hoover's Online • Industry Watch Additional Reports RE PO RT ♦ Call of the Day: Toro (2:21) 07/11/07 4:15PM ET −− Janney Montgomery Scott Managing Director/Infrastructure Jim Lucas discusses his outlook on Toro • News and Press Releases for D&B (last 90 days) • SEC Filings ♦ 10−K Filings • Stock Quote • Stock Chart • Earnings Estimates • ValuEngine Analysis • Annual Report • Investor Relations • Financial Data Definitions • Market Data Definitions • Comparison Data Definitions • Historical Financials & Employees Definitions These reports are available for purchase from our Trusted Partners. To see more reports, try our specialized report search. SA M PL E Title Publisher Pages Price Date of Report Dun & Bradstreet Corporation, The: Company Profile Datamonitor N/A $125.00 May 18, 2007 Additional 3rd Party Libraries The Rich Register Featuring information on 4,700 individuals with a net worth greater than $25 million, The Rich Register is available in both hardcover and CD−ROM format. Learn More Build Lead Lists Use Hoover's Lead Finder to create prospect and contact lists. 23 Company Financials Financial Overview SA M PL E Fiscal Year−End Financial Filings 2006 Sales (mil.) 1−Year Sales Growth 2006 Net Income (mil.) 1−Year Net Income Growth Annual Report Investor Relations 24 Public − NYSE: DNB Headquarters December SEC $1,531.3 6.1% $240.7 8.8% Company Web Site Company Web Site RE PO RT Company Type Annual Income Statement All amounts in millions of US Dollars unless otherwise noted. Dec 05 1,443.6 412.0 1,031.6 71.5% 619.2 48.4 364.0 25.2% 11.2 21.1 354.1 133.6 220.5 Dec 04 1,414.0 403.9 1,010.1 71.4% 644.0 47.3 318.8 22.5% 41.1 18.9 340.8 129.2 211.6 Dec 03 1,386.4 433.3 953.1 68.7% 597.3 64.0 291.8 21.0% 7.2 18.6 280.4 106.2 174.2 Dec 02 1,275.6 392.1 883.5 69.3% 543.4 84.2 255.9 20.1% 2.8 19.5 239.2 94.1 145.1 240.7 −− 240.7 240.7 15.7% 220.5 −− 220.5 221.2 15.3% 211.8 −− 211.8 211.8 15.0% 174.2 −− 174.2 174.5 12.6% 145.1 −− 145.1 143.4 11.2% −− −− −− 3.19 −− −− −− −− 2.90 −− −− −− −− 2.30 −− −− −− −− 1.87 −− RE PO RT Revenue Cost of Goods Sold Gross Profit Gross Profit Margin SG&A Expense Depreciation & Amortization Operating Income Operating Margin Nonoperating Income Nonoperating Expenses Income Before Taxes Income Taxes Net Income After Taxes Dec 06 1,531.3 451.1 1,080.2 70.5% 644.5 33.3 402.4 26.3% 6.8 20.3 388.9 146.8 242.1 Continuing Operations Discontinued Operations Total Operations Total Net Income Net Profit Margin SA M PL E Diluted EPS from Continuing Operations ($) Diluted EPS from Discontinued Operations ($) Diluted EPS from Total Operations ($) Diluted EPS from Total Net Income ($) Dividends per Share −− −− −− 3.70 −− Quarterly Income Statement All amounts in millions of US Dollars unless otherwise noted. Quarter Ending Quarter Ending Quarter Ending Quarter Ending Mar 07 Dec 06 Sep 06 Jun 06 Revenue Cost of Goods Sold Gross Profit Gross Profit Margin 25 392.3 117.4 274.9 70.1% 437.5 109.5 328.0 75.0% 359.2 114.5 244.7 68.1% 367.4 117.7 249.7 68.0% Quarter Ending Mar 06 367.2 109.4 257.8 70.2% 172.4 17.1 85.4 21.8% 7.4 6.4 86.4 33.8 52.6 Continuing Operations Discontinued Operations Total Operations Total Net Income Net Profit Margin 52.7 −− 52.7 52.7 13.4% −− −− −− 0.87 0.25 26 160.0 8.2 76.5 21.3% 0.9 5.1 72.1 26.4 45.7 165.1 (1.0) 85.6 23.3% 2.0 4.2 83.3 31.2 52.1 156.8 15.0 86.0 23.4% 2.2 5.4 82.7 31.3 51.4 91.2 −− 91.2 91.2 20.8% 45.8 −− 45.8 45.8 12.8% 52.2 −− 52.2 52.2 14.2% 51.5 −− 51.5 51.5 14.0% −− −− −− −− −− −− −− −− −− −− −− −− 1.43 0.73 0.79 0.75 −− −− −− −− SA M PL E Diluted EPS from Continuing Operations ($) Diluted EPS from Discontinued Operations ($) Diluted EPS from Total Operations ($) Diluted EPS from Total Net Income ($) Dividends per Share 162.6 11.1 154.3 35.3% 1.7 5.6 150.8 57.9 92.9 RE PO RT SG&A Expense Depreciation & Amortization Operating Income Operating Margin Nonoperating Income Nonoperating Expenses Income Before Taxes Income Taxes Net Income After Taxes Annual Balance Sheet All amounts in millions of US Dollars unless otherwise noted. Assets Dec 06 Dec 04 Dec 03 Dec 02 304.7 438.6 −− 16.0 759.3 44.2 809.9 1,613.4 Dec 05 335.5 414.8 −− 11.8 762.1 51.2 822.2 1,635.5 Dec 04 239.0 397.3 52.6 41.9 730.8 55.1 838.8 1,624.7 Dec 03 191.9 334.9 −− 87.4 614.2 149.7 763.8 1,527.7 Dec 02 314.6 300.8 413.7 1,029.1 0.1 506.6 1,535.8 244.7 −− 468.9 713.6 300.0 567.7 1,581.3 330.7 −− 405.2 735.9 299.9 540.5 1,576.3 351.0 −− 367.1 718.1 299.9 528.5 1,546.5 −− 77.6 77.6 67.1 −− 54.2 54.2 68.6 −− 48.4 48.4 72.3 −− (18.8) (18.8) 74.4 RE PO RT Current Assets Cash 138.4 Net Receivables 436.7 Inventories −− Other Current Assets 69.9 Total Current Assets 645.0 Net Fixed Assets 50.7 Other Noncurrent Assets 664.4 Total Assets 1,360.1 Liabilities and Shareholder's Equity Dec 06 Current Liabilities Accounts Payable 237.7 Short−Term Debt 0.1 Other Current Liabilities 567.7 Total Current Liabilities 805.5 Long−Term Debt 458.9 Other Noncurrent Liabilities 494.8 Total Liabilities 1,759.2 Dec 05 SA M PL E Preferred Stock Equity Common Stock Equity Total Equity Shares Outstanding (mil.) Shareholder's Equity −− (399.1) (399.1) 60.1 Quarterly Balance Sheet All amounts in millions of US Dollars unless otherwise noted. Assets Current Assets Cash Net Receivables Inventories Other Current Assets Total Current Assets 27 Quarter Ending Quarter Ending Quarter Ending Quarter Ending Quarter Ending Mar 07 Dec 06 Sep 06 Jun 06 Mar 06 139.6 426.9 −− 21.9 588.4 138.4 436.7 −− 69.9 645.0 138.9 366.4 −− 21.2 526.5 117.1 397.5 −− 19.8 534.4 229.3 428.7 −− 15.4 673.4 Accounts Payable Short−Term Debt Other Current Liabilities Total Current Liabilities Long−Term Debt Other Noncurrent Liabilities Total Liabilities 543.8 1,854.6 −− (462.4) (462.4) 59.4 43.3 872.2 1,449.9 Quarter Ending Jun 06 43.3 859.6 1,576.3 Quarter Ending Mar 06 270.9 0.4 449.3 720.6 354.3 236.9 1.1 476.2 714.2 299.3 494.8 509.0 509.4 504.9 1,759.2 1,638.6 1,584.3 1,518.4 Shareholder's Equity −− −− (399.1) (187.9) (399.1) (187.9) 60.1 61.4 −− (134.4) (134.4) 62.8 −− 57.9 57.9 66.3 SA M PL E Preferred Stock Equity Common Stock Equity Total Equity Shares Outstanding (mil.) 299.8 0.1 526.8 826.7 484.1 50.7 45.4 664.4 878.8 1,360.1 1,450.7 Quarter Ending Quarter Ending Dec 06 Sep 06 Current Liabilities 237.7 298.3 0.1 0.1 567.7 430.8 805.5 729.2 458.9 400.4 RE PO RT Net Fixed Assets 49.7 Other Noncurrent Assets 754.1 Total Assets 1,392.2 Liabilities and Quarter Ending Shareholder's Equity Mar 07 28 Annual Cash Flow All amounts in millions of US Dollars unless otherwise noted. Quarterly Cash Flow Dec 05 261.5 (54.1) (241.2) (57.6) 48.4 (5.7) −− Dec 04 267.6 (39.2) (233.5) 13.9 47.3 (12.1) −− Dec 03 235.7 (65.3) (132.8) 47.1 64.0 (11.0) −− RE PO RT Net Operating Cash Flow Net Investing Cash Flow Net Financing Cash Flow Net Change in Cash Depreciation & Amortization Capital Expenditures Cash Dividends Paid Dec 06 304.9 47.3 (431.5) (56.9) 33.3 (11.6) −− Dec 02 213.1 (67.1) (104.7) 46.6 84.2 (15.8) −− All amounts in millions of US Dollars unless otherwise noted. Quarter Ending Mar 07 119.6 (45.2) (74.8) 1.2 29 Quarter Ending Sep 06 Quarter Ending Jun 06 Quarter Ending Mar 06 69.8 97.2 101.7 36.2 (11.0) (21.2) 87.3 (7.8) (63.2) (58.3) (207.5) (102.5) (0.5) 21.8 (9.0) (69.2) SA M PL E Net Operating Cash Flow Net Investing Cash Flow Net Financing Cash Flow Net Change in Cash Depreciation & Amortization Capital Expenditures Cash Dividends Paid Quarter Ending Dec 06 17.1 11.1 8.2 (1.0) 15.0 (6.5) (14.9) (2.4) −− (5.0) −− (2.6) −− (1.6) −− Historical Financials Dec Dec Dec Dec Dec Dec Dec Dec 2006 2005 2004 2003 2002 2001 2000 1999 Revenue ($ mil.) 1,531.3 1,443.6 1,414.0 1,386.4 1,275.6 1,304.6 1,417.6 1,407.7 Net Profit Margin 15.7% 15.3% 15.0% 12.6% 11.2% 11.5% 14.6% 18.2% RE PO RT Year Income Statement Net Income ($ mil.) 240.7 221.2 211.8 174.5 143.4 149.9 206.6 256.0 SA M PL E 2006 Year−End Financials Debt Ratio (115.0%) Return on Equity (60.3%) Cash ($ mil.) 138.4 Current Ratio 0.80 Long−Term Debt ($ mil.) 458.9 Shares Outstanding (mil.) 60.1 Dividend Yield −− Dividend Payout −− Market Cap ($ mil.) 4,975.7 Stock History Stock Price ($) P/E Year FY FY FY High Low High Low Close Dec 2006 84.98 65.03 82.79 23 18 Dec 2005 68.00 54.90 66.96 21 17 Dec 2004 60.80 47.85 59.65 21 16 Dec 2003 50.81 32.31 50.71 22 14 Dec 2002 43.40 28.26 34.49 23 15 Dec 2001 36.90 25.72 35.30 20 14 Earns. 3.70 3.19 2.90 2.30 1.87 1.84 Employees 4,400 4,350 4,700 6,100 6,600 7,800 10,100 10,700 Per Share ($) Book Div. Value −− 0.00 −− 1.16 −− 0.79 −− 0.67 −− 0.00 −− 0.00 Historical Auditors Auditor Name PricewaterhouseCoopers LLP PricewaterhouseCoopers LLP PricewaterhouseCoopers LLP 30 Year 2005 2004 2003 PricewaterhouseCoopers LLP 2002 SA M PL E RE PO RT Data Definitions 31 Market Data Current Information Last Close (13−Jul−2007) $105.78 Price/Sales Ratio 4.04 52−Week High $105.78 Price/Book Ratio −− 60−Month Beta Market Cap (mil.) Shares Outstanding (mil.) Dividend Rate Dividend Yield # of Institutional Holders Latest Short Interest Ratio Growth Rates Revenue Growth EPS Growth Dividend Growth 32 26.92 0.5 Price/Cash Flow Ratio 16.18 $6,283.8 Return on Assets 16.3% 59.4 Return on Equity (119.6%) 0.50 Current Ratio 0.71 50.0% Long−Term Debt/Equity −− 340 % Owned by Institutions 86.0% 2.72 Latest Net Insider Transactions (770.00) 12 Month 36 Month 60 Month 5.9% 10.0% 23.4% 18.4% 53.5% 100.5% 0.0% 0.0% 0.0% SA M PL E Data Definitions $65.03 Price/Earnings Ratio RE PO RT 52−Week Low Comparison Data Company Industry1 Market2 Gross Profit Margin 70.50% 53.20% 51.80% Pre−Tax Profit Margin 25.20% (2.80%) 6.40% Net Profit Margin 15.50% (1.90%) 5.10% Return on Equity (119.6%) 8.0% 9.5% Return on Assets 16.3% (2.6%) 1.6% Return on Invested Capital 33.9% 3.6% 4.2% Valuation RE PO RT Profitability 1 Market2 4.04 2.72 2.25 26.92 26.92 19.96 −− 3.49 2.24 16.18 18.68 13.56 Company Price/Sales Ratio Price/Earnings Ratio Price/Book Ratio Price/Cash Flow Ratio Operations Days of Sales Outstanding Inventory Turnover Days Cost of Goods Sold in Inventory Asset Turnover Net Receivables Turnover Flow SA M PL E Effective Tax Rate Industry Company Industry1 Market2 100.12 70.34 57.15 −− 13.4 5.7 −− 27 63 1.1 0.9 0.6 3.6 5.6 6.5 38.0% 13.1% 29.1% Company Industry1 Market2 0.71 1.47 1.73 −− 1.4 1.3 0.35 0.21 0.24 Total Debt/Equity −− 0.30 0.63 Interest Coverage 19.43 11.45 5.27 Financial Current Ratio Quick Ratio Leverage Ratio 1 Market2 26.20 1.97 5.45 −− −− −− Dividends Per Share 0.50 0.35 0.65 Cash Flow Per Share 6.54 0.01 0.45 (4.01) 0.13 0.57 8.15 0.10 2.47 Per Share Data ($) Revenue Per Share Fully Diluted Earnings Per Share from Total Operations Working Capital Per Share Long−Term Debt Per Share 33 Company Industry Book Value Per Share (7.78) 0.57 4.96 Total Assets Per Share 23.44 1.72 10.13 Growth Company Industry 1 Market2 12−Month Revenue Growth 5.9% 13.5% 11.9% 12−Month Net Income Growth 9.7% 16.8% 14.5% 18.4% 15.6% 10.4% 12−Month Dividend Growth 0.0% 0.0% 0.0% 36−Month Revenue Growth 10.0% 46.3% 36.8% 36−Month Net Income Growth 29.2% 82.0% 43.1% 53.5% 63.9% 39.6% 0.0% 0.0% 0.0% 36−Month EPS Growth 36−Month Dividend Growth 2 RE PO RT 12−Month EPS Growth Public companies trading on the New York Stock Exchange, the American Stock Exchange, and the NASDAQ National Market. SA M PL E Data Definitions 34 Competitive Landscape KEY: Best of Group. Companies listed are Top Competitors. Key Numbers D&B Acxiom Equifax infoUSA 1,531.3 1,395.1 1,546.3 434.9 −− −− 4,400 7,100 4,960 −− −− −− 6,283.8 2,088.1 5,750.0 583.2 −− −− D&B Acxiom Equifax infoUSA Gross Profit Margin 70.50% 27.30% 59.10% Pre−Tax Profit Margin 25.20% 8.50% Net Profit Margin 15.50% Return on Equity Return on Assets Annual Sales ($ mil.) Employees Market Cap ($ mil.) Market3 68.70% 53.20% 51.80% 26.80% 10.40% (2.80%) 6.40% 5.10% 17.80% 6.50% (1.90%) 5.10% (119.6%) 11.5% 31.4% 14.7% 8.0% 9.5% 16.3% 4.4% 15.1% 5.1% (2.6%) 1.6% 33.9% 5.4% 17.4% 7.0% 3.6% 4.2% D&B Acxiom Equifax infoUSA 4.04 1.53 3.65 26.92 30.93 −− Industry Operations RE PO RT Profitability 2 D&B Acxiom Equifax infoUSA Industry2 Market3 Days of Sales Outstanding 100.12 82.63 58.36 108.07 70.34 57.15 Inventory Turnover −− −− −− −− 13.4 5.7 Days Cost of Goods Sold in Inventory −− −− −− −− 27 63 Asset Turnover 1.1 0.9 0.8 0.8 0.9 0.6 Net Receivables Turnover Flow 3.6 4.6 6.6 4.3 5.6 6.5 38.0% 40.1% 33.8% 37.7% 13.1% D&B Acxiom Equifax infoUSA Industry2 29.1% Market3 0.71 1.06 0.66 0.82 1.47 1.73 −− −− −− −− 1.4 1.3 0.35 0.45 0.25 0.38 0.21 0.24 Total Debt/Equity −− 1.42 0.49 1.23 0.30 0.63 Interest Coverage 19.43 3.53 14.46 4.68 11.45 5.27 Per Share Data ($) D&B Acxiom Equifax infoUSA Revenue Per Share 26.20 17.37 12.61 8.81 Return on Invested Capital Valuation Price/Sales Ratio Price/Earnings Ratio Price/Book Ratio Effective Tax Rate Financial Current Ratio Quick Ratio Leverage Ratio 35 Market3 1.19 2.72 2.25 20.72 18.42 26.92 19.96 4.10 6.20 2.63 3.49 2.24 16.18 8.22 15.40 10.60 18.68 13.56 SA M PL E Price/Cash Flow Ratio 2 Industry 2 Market3 1.97 5.45 Industry Fully Diluted Earnings Per Share from Total Operations −− −− −− −− −− Dividends Per Share 0.50 0.17 0.20 0.35 0.35 0.65 Cash Flow Per Share 6.54 3.24 2.99 0.99 0.01 0.45 (4.01) 0.31 (1.55) (0.63) 0.13 0.57 8.15 7.86 1.19 4.80 0.10 2.47 Book Value Per Share (7.78) 6.49 7.41 3.99 0.57 4.96 Total Assets Per Share 23.44 20.62 14.64 13.04 1.72 Growth D&B Acxiom Equifax infoUSA Industry2 10.13 Market3 5.9% 4.7% 7.0% 25.2% 13.5% 11.9% 9.7% 10.3% 11.9% 4.2% 16.8% 14.5% 18.4% 17.8% 14.4% 0.0% 15.6% 10.4% 0.0% (15.0%) 25.0% 52.2% 0.0% 0.0% 10.0% 38.0% 27.5% 54.9% 46.3% 36.8% 29.2% 21.2% 63.2% 84.1% 82.0% 43.1% 53.5% 26.5% 70.8% 72.7% 63.9% 39.6% 0.0% 112.5% 122.2% 0.0% 0.0% 0.0% Working Capital Per Share Long−Term Debt Per Share 12−Month Revenue Growth 12−Month Net Income Growth 12−Month EPS Growth 12−Month Dividend Growth 36−Month Revenue Growth 36−Month Net Income Growth 36−Month EPS Growth 36−Month Dividend Growth 1 Data unavailable. SA M PL E Data Definitions RE PO RT −− 36

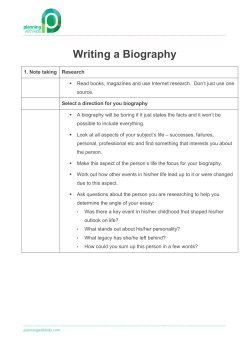

© Copyright 2026