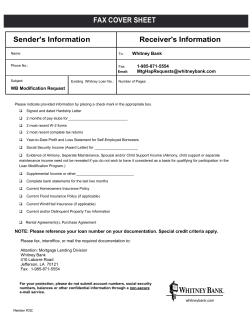

Uniform Residential Loan Application