Sample Quote Transcript Page |

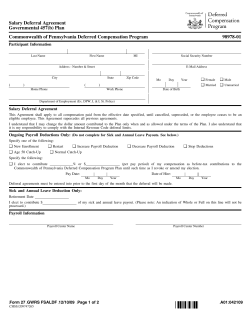

Page | 1 Sample Quote Transcript Hello this is Ronnie O'Dell with Alternative Risk Marketing. In this training segment we are going to review a sample quotation from Southeast personnel leasing. Perhaps you have been released a quote and you do not understand completely what you are reviewing. This audio training resource should help clear up most if not all any confusion related to the employer service aspects of the pricing sheet. First, I want to start by conveying that this is a nonbinding rate quote valid for 30 days and it is exclusive to the broker for those 30 days and or up to the day before the policy effective date. This is a PEO policy and is not a policy of Alternative Risk Marketing. A second quote may be released to another broker after the exclusive period if they remit a complete submission for the same account. The first broker to remit a signed quote and client services agreement is considered to have “won” the account. Second, I want to encourage you to contact your marketing specialist so that he or she may assist you in presenting this quotation and the services to your client. Their contact information was provided within the context of the email when the quote was released. And third, it is important that you inform your marketing specialist immediately in the event your client wants to move forward with this program. This way we can expedite final approval of this quote and start the process as soon as possible. Let's begin. The top left section of the quote displays the date the quote was released for example June 19, 2013. As we move down you will notice the following: The insured’s name The producer’s agency name The insured’s estimated number of employees and Estimated number of pay periods The Ex-mod used to price the program, based on the WCIRB. The discount factor also known as the underwriting credits applied. The composite factor (which is the adjusted factor after debits or credits applied) And the number of days before the quote expires based on the date highlighted at the top quote. As we shift to the right we see the premium calculations. You will notice that based on the Acord 130 information that the base premium adjusted for the ex-mod is $153,890. When you apply the group discount also known as credits of 30% shown on the left that results in a risk adjustments of $46,167. Therefore when you subtract the risk adjustment from the standard premium for the modified premium the adjusted annual premiums are $107,723. The estimated taxes for the year based on $107,723 are approximately $5,203. The total projected premium taxes for the year based on the Acord 130 information are $112,926. As we move down you will see the employer services fee of 3%. The employer services fee is a charge by the professional employer organization for the inclusive services such as payroll processing, tax services, loss control, and human resources and legal support. The 3% is charged on the gross estimated annual payroll wages shown for the two class codes. For example when you add the wages for class code 3372 electroplating in the amount of $710,000 plus the wages of class code 8810 clerical in the amount of $116,244 for a total annual payroll of $826,244 and then multiply that by the employer services be 3% we arrive at the $24,787 in employer services fees shown on the quote. This program also includes mandatory EPLI. This charge is mandatory even if the client has their own EPLI coverage. The charge is $65 per year per active employee. It is build a rate of $1.25 per pay period based on a weekly pay cycle. Page | Delivery is another charge included under the service fees category. This charge is for the delivery of payroll reports, and 2 payroll checks. The charge is $26 per pay period and per location. So based on the proposal you can see that the E PLI charge based on 26 employees is $1690 and the delivery charge based on 52 pay periods is $1,352. The total service fees estimated for this particular client is $27,829. When you add the total premium which includes the modified premiums and the taxes they total $112,926; and when you apply those costs to the total service fees of $27,829; the total premium and service for this program is $140,755. There are also two one-time fees. First is the program broker fee. The program broker fee is typically equal to 3% of the estimated annual premiums not including taxes. And shown on this proposal that amount is $3,232. This amount is payable to AmericaOne also known as Alternative Risk Marketing. There is also a policy be payable to South East Personnel Leasing. The policy fee may range from $500-$1000. In this proposal the amount is $500. In order to calculate the all in cost of the program for the policy year you must be total premium and services of $140,755 with the program broker fee of $3,232 and the policy fee of $500. The grand total or what I call the “ALL IN” annual cost of this program is $144,487. This ($144,487) is the number that you want to compare all other competitive nonstandard and standard workers comp quotes against. You want to make sure that you add up all of the taxes premiums and fees in order to derive at the all in cost for each individual program. This way you are comparing apples to apples. In this particular scenario the competition was State Compensation Insurance Fund. They’re “All In” was $191,706. Hence our program was able to save the client $47,219. This represented a 25% savings. That did not include the additional savings we did not discuss related to the termination of their ADP payroll services estimated at $7,000 per year. Moreover the client was thrilled with the dramatic and reduced out-of-pocket renewal expense when compared to the standard market. For example, their total renewal expense to renew in the standard market was $26,205 which included the 10% premium deposit and taxes. Compare that to the Southeast personnel leasing renewal expense consisting of the $3,232 broker fee and a one-time $500 policy fee for a grand total of $3,732. This enabled the client to retain an additional $22,473 in their bank account at renewal time. As we scroll down you will see the net rate for the two class codes illustrated in this proposal. As you scroll down further you will notice definitions and correlating financial data. For example workers compensation minimum there is a per week minimum workers comp charge of $1,975. This minimum charge is the minimum premium that the PEO will accept order to cover this risk. There is also a workers comp deductible per claim. Typically the workers comp claim deductible is $1000 per claim. There are no limits on the number of claim fees charged within a policy period. In some circumstances workers comp claim deductible's may be higher (i.e. $2,500, $5,000, $10,000 etc.). (* Claim fee – If the claim is only $300, and the program max deductible for an individual claim is $1,000 then the client is only responsible for paying $300. If the claim is $5,000 and the individual claim fee is $1,000 then the client is responsible up to the $1,000 limit for the individual claim. There are no limits on the number of claims and deductibles per policy period). For example industry-specific claim fees such as: Trucking ($2,500) or Staffing ($10,000, $25,000 etc.). And for high premium accounts where a high deductible is requested in order to reduce premiums. And finally a higher workers comp claim deductible may be applied on accounts with high claims severity. Such claims fees may range from $2500-$5000. While in extreme situations those fees may range from $7,500 to as high Page | as $25,000 or higher ($50,000). 3 The term collateral is in reference to an amount required by the PEO at the service inception. The collateral is used to fund workers comp claim deductibles. Collateral amounts range from as little as five thousand dollars to as much as fifty thousand dollars. Typically most quotes do not display a requirement for collateral. Collateral is a requirement for accounts with higher than normal claim fees. The remaining definitions are related to various taxes for workers compensation and or employment taxes. These are taxes that the employer currently pays. Payments for services are due 3 to 4 days before the companies paid date. Acceptable payment is made only by bank transfer or wire transfer. Preferred bank relationships are through Bank of America and Wells Fargo. As we scroll down to page 2 of the quote you will see a grid with the title estimated liability to be invoiced per pay period. This grid provides a snapshot of the estimated total payroll and tax and administrative services along with Worker's Compensation premium liability required on a per pay period basis. This is the amount the insurer must have available to wire or bank transfer to the PEO 3 to 4 days in advance of the paid date. The grid shows the liability owed before the tax cut offs for unemployment and the liability owed after the tax cut offs. This page of the proposal provides a brief overview of the service provider South East personnel and the services that it provides to its clients. As you scroll down even further you will see the payment and address information for the broker and policy fee. You will also notice the information and instructions for requesting a bind for coverage. In order to seek an underwriting approval your client must accept the terms and conditions listed above of this nonbinding rate indication. They must sign an initial this proposal. You as the broker must return this sign an initial proposal back to your marketing specialist. Now we find ourselves on the final page of the proposal. This is a copy of the traditional PEO quote. This is a breakdown of the workers comp rate and taxes and admin rate. If you view the extreme right of the grid you will see the rate and cut off rate. This is the accumulation of all of the sections to the left. This is the labor burden based on the class code both before the SUTA rate cut off and after the SUTA rate cut off. As you scroll even further you will see a recap of the information and terms previously reviewed on page one of the quote. This concludes the review of our sample proposal. If you have additional questions please do not hesitate to contact us. EMPLOYER SERVICES AND WORKERS' COMPENSATION QUOTE PROPOSAL PREMIUM CALCULATIONS Proposed $105,755.00 $79,316.00 $153,890.00 $185,071.00 $46,167.00 $0.00 EST. ANNUAL PREMIUMS $107,723.00 $185,071.00 Taxes & Fees (If Applicable) TOTAL PREMIUMS $5,203.00 $8,939.00 $112,926.00 $194,010.00 1.75 Risk Adjustment DATE INSURED: PRODUCER: TOTAL NO EMPLOYEES PAY PERIODS X-MODIFIER GROUP PREM DISCOUNT COMPOSITE FACTOR QUOTE EXPIRES QUOTE STATUS 6/19/2013 Company AmericaOne dba (AltRisk) 26 52 1.75 30% $24,787.00 $1,690.00 $1,352.00 EMPLOYER SRVC 3.00 % EPLI DELIVERY TOTAL SERVICE FEES 1.23 30 Days Market $87,937.00 $65,953.00 Base Premium X-Mod Adjustment Standard Premium $81,084.00 Estimated Savings $27,829.00 TOTAL PREM & SERVICES $140,755.00 PROGRAM BROKER FEE $3,232.00 AmericaOne dba (AltRisk) Payable to POLICY FEE $500.00 Payable to SouthEast Personnel CLASS CODE #EE DESCRIPTION ESTIMATED ANNUAL PAYROLL NET RATE BASE RATE EST. ANNUAL PREMIUM PER EE/Min WK EST. PREMIUM MINIMUM CA3372 - Electroplating; Detinning; Buf 24 $710,000.00 14.98 12.23 $106,370.00 $75.00 CA8810 - Clerical Office Employees; Dra 2 $116,244.00 1.16 0.95 $1,353.00 $6.00 Workers' Compensation Workers' Compensation Minimum There is a Per Week Minimum WC Charge: $1,975.00 WC Deductible per Claim Per Workers Comp per claim deductible $1,000.00 Premium Rates CLIENT IS AWARE THAT SHOULD THE VOLUME OF PAYROLL FALL BELOW THE ORIGINAL AMOUNT, OR THERE IS A NOTABLE SHIFT IN LABOR FROM ONE CODE TO ANOTHER, AN INCREASE IN THE RATES MAY BE ASSESSED OR WORKERS COMPENSATION MINIMUMS APPLIED. CLIENTS WILL BE NOTIFIED IF THIS WILL OCCUR. Approval TICF Assesment Proposal is based on approval by the workers' compensation carrier Applies to clients with a work comp EX MOD over 1.25. Assesments based on TICF calculations. and a Collateral of $0.00 Taxes FICA Rate FUTA Rate State Unemployment Rate(s) Other Notes Payment Terms 7.65 (Social Security & Medicare) - Using the PEO's Tax ID up to Applicable Thresholds Applicable State Rate on first per employee - Using the PEO's Tax ID (e.g. 1.20%) $ 7,000 Dependent on State (See Exhibit A for Rates) Bank Transfer, Wire, 3 Days Prior to Paydate with no direct deposit or 4 Days Prior with Direct Deposit W/C MINIMUM OF 1,975.00 PER WEEK OR PER EMPLOYEE PER WEEK MINIMUMS LISTED ABOVE. WHICHEVER IS GREATER WILL BE CHARGED. Initials Estimated Liability to Be Invoiced Per Pay Period 52 Pay periods: Description of Liability Gross Payroll Liability Workers' Comp Taxes on WC Premium FICA Taxes SUTA Taxes FUTA Taxes Admin Fee EPLI Delivery Total Liability Owed Annual Payroll: $826,244.00 Before Cut Offs After Cut Offs Est. Per Pay Period Est. Per Pay Period $15,889.31 $2,071.60 $100.06 $1,215.53 $858.02 $238.34 $476.68 $32.50 $26.00 $20,908.04 Workers' Compensation Limits of Liability Bodily Injury by Accident $1 million Per Accident Bodily Injury by Disease $1 million Policy Limit Bodily Injury by Disease $1 million Per Employee Note: Limits Vary by State, Example for California $15,889.31 $2,071.60 $100.06 $1,215.53 . . $476.68 $32.50 $26.00 $19,811.67 * Estimate based on payroll estimates on the Acord 130. Service Provider Overview Services Provided Build a Successful Business Southeast Personnel, Inc. began offering PEO Services to clients in 1995, while Southeast Personnel Leasing, Inc. has become one of the largest privately owned companies in Florida as published by Florida Trend Magazine. Payroll Administration Payroll Taxes Government Reporting Management Reporting Cost Analysis Record Keeping Salary History Payroll Processing Vacation, Holiday and Sick Pay Paperwork Reduction Many businesses, particularly those with a limited number of employees, find personnel administration requirements to be extremely complex and time consuming. Outsourcing these managerial burdens to SouthEast Personnel has enabled small to medium sized clients to devote their limited time and resources back to their business. We pride ourselves on serving the "blue and gray" collar marketplace with a genuine understanding of how the economy affects all of our clients throughout the States of California, Florida and eleven other States. Risk Management Workers' Compensation Claims Management Safety Services Drug Testing* Record Keeping Unemployment Insurance Controls Employer Protection Policies and Services Post Accident & Reasonable Suspicion Background Checks * Focus on your Business When you enter into a PEO services arrangement with SouthEast Personnel the client becomes the "Worksite" co-employer of their company's existing and future workforce. As the Administrative Co-Employer SouthEast Personnel assumes responsibility for the majority of the Human Resource functions, including payroll and taxes, employee benefit administration, workers' compensation coverage, workplace safety programs, compliance with federal, state and local laws, labor and workplace regulatory requirements and related administrative responsibilities. * May Have Additional Costs Human Resources Human Resource Advice Legal Support Services Our clients remain responsible for day to day assignments, supervision, recruiting and training. Each new hire is processed by SouthEast Personnel to ensure that you are in compliance with all Federal, State and Local laws. PEO Provider: Undewritten by: Carrier: SouthEast Personnel Leasing ($1.5B Revenue, 3,500 Client Members) - www.southeastpersonnel.com Risk Tranfer Programs, LLC Tower Insurance A Rated Carrier (Rated AM BEST A-) | Reports Annually to the WCIRB Policy Fee Payable to: SouthEast Personnel SouthEast Personnel Leasing, Inc. 2739 Rquired to Bind Coverage Broker Fee Payable to: AmericaOne dba (AltRisk) Please Provide the Following $3,232.00 19360 Rinaldi St #180 Porter Ranch, CA 91326 Signed Client Services Agreement Signed System Generated Rate Quote | "Schedule A" US Highway 19 N Holiday, FL 34691 Att. Stacy Bouris $500.00 Signed Acord 130 Form Completed Employee Applications Please note that your Workers Compensation Coverage is not Bound until all of the above paperwork has been received, and accpeted, by SPLI. All Paperwork needs to be submitted and payroll needs to be processed By signing I accept the terms and conditions listed above. ` in order to provide Certificates of Insurance. ____________________________________________ Signature EXHIBIT "A" SOUTHEAST PERSONNEL LEASING, INC. 6/19/2013 Spectrum P Bob Smith QUOTATION VALID FOR 30 DAYS OR POLICY EXPIRTATION WHICHEVER COMES FIRST Total Estimated Payroll: $826,244.00 Total Number of Employees: 26 State & Class # EE Est Payroll W/C FICA SUTA FUTA ADMIN Rate * Cutoff Rate ** CA3372 - Electroplating; Detinning; Buf 24 $710,000.00 14.98 7.65 5.40 1.50 3.00 32.53 25.63 CA8810 - Clerical Office Employees; Dra 2 $116,244.00 1.16 7.65 5.40 1.50 3.00 18.71 11.81 ** Rate after arriving at SUTA / FUTA cut off amounts in Payroll/Employee W/C Minimum THERE IS A PER WEEK W/C MINIMUM THAT WILL BE CHARGED: $1,975.00 W/C Deductible per Claim PER WORKERS COMPENSATION PER CLAIM DEDUCTIBLE: $1,000.00 Premium and Rates CLIENT IS AWARE THAT SHOULD THE VOLUME OF PAYROLL FALL BELOW THE ORIGINAL AMOUNT, OR THERE IS A and a Collateral of $0.00 NOTABLE SHIFT IN LABOR FROM ONE CODE TO ANOTHER, AN INCREASE IN THE RATES MAY BE ASSESSED OR WORKERS COMPENSATION MINIMUMS APPLIED. CLIENTS WILL BE NOTIFIED IF THIS WILL OCCUR. Approval Proposal is based on approval by the workers' compensation carrier FUTA Rate 1.50 State Unemployment Rate(s) Dependent on State (See Exhibit A for Rates) (2011 Federal Tax Schedule) on first $ 7,000 per employee - Using the PEO's Tax ID FICA Rate 7.65 Payment Terms Bank Transfer, Wire, 3 Days Prior to Paydate with no direct deposit or 4 Days Prior with Direct Deposit TICF Assesment Applies to 1.25. Assesments basedbased on TICF to clients clientswith withaawork workcomp compEX EXMOD MODover over 1.25. Assesments on calculations. TICF calculations. Powered By: PEO Professionals (Federal Social Security, Medicare and Income Tax) - Using the PEO's Tax ID Initials

© Copyright 2026