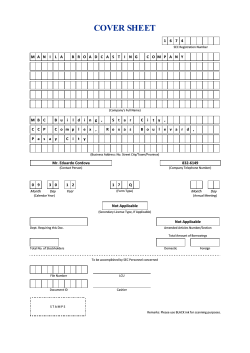

Identification Full Name : UZDAROJI AKCINE BENDROVE "SAMPLE" IGK-number

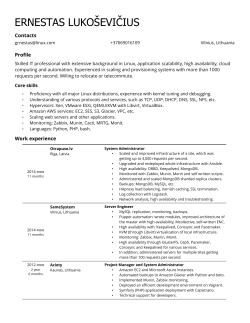

Identification Full Name :UZDAROJI AKCINE BENDROVE "SAMPLE" IGK-number :111-111-111 Full Name in :UŽDAROJI AKCINĖ BENDROVĖ "SAMPLE" national language Trading : Sample, SAMPLE, Sample company Names, Brands Company has about 40 registered trademarks in total Office address :Sample str. XX, Vilnius, Vilnius region, Vilnius city municipality, Lithuania Legal Address :Sample str. XX, Vilnius, Vilnius region, Vilnius city municipality, Lithuania Contacts :- E-mail : [email protected] - Fax : (+370 5) xxxxxxx - Phone : (+370 5) xxxxxxx - WWW : www.xxxxxxx.lt SUMMARY Legal Form : UAB (Private Joint-Stock Co. by Lithuanian law) Incorporation : 1993 Sales : Staff : 72 Litigation events : n/a Remarks on payments : none 14 022 782.00 LTL ( for 12 months, ended 31.12.2008 ) 12 102 668.00 LTL ( for 12 months, ended 31.12.2007 ) CREDIT OPINION IGK Credit Rating Credit Limit Range Incorporation Registration Data Date of registration Registration number Registr. authority Date of registration VAT number Registr. authority Legal Form Share Capital Shareholders Board / Executives :[B] Normal risk. :60 000 EUR Credit line at value over the Credit Limit is advised to be secured with proper guarantees. :R5 :1993 :01.01.1993 :123456789 :State Register (Vilnius, Vilnius region, Vilnius city municipality, Lithuania) :11.11.1994 :LT123456789 :Tax Office (Vilnius, Vilnius region, Vilnius city municipality, Lithuania) :UAB (Private Joint-Stock Co. by Lithuanian law) since n/a :1 000 000 LTL (registered) since n/a :No official information is available by law, the company refused to disclose us this information. Executives General director Authorised signature Activities :Mr. Xxxxxxxx, Yxxxxxx Zxxxxxxxx (Lithuania) pers. code: xxxxxxxxxxxxxx :Mr. Xxxxxxxx, Yxxxxxx Zxxxxxxxx :- 5154 Coffee & Tea (NACE 5137: Wholesale of coffee, tea, cocoa and spices) Wholesale HoReCa system Operation of tea & coffee boutique shops Office supply system (for hot beverages) Vending Tea & coffee export Company's partners: Lithuanian association of hotels and restaurants; Lithuanian association of restaurant chefs and confectioners; Vilnius city municipal government; The gourmet food magazine "Sample"; :72 [E] Staff employed Staff History :- 72 [E] ( the data as of 01.01.2008 ) - 72 [E] ( the data as of 01.01.2007 ) - 72 [E] ( the data as of 01.01.2006 ) - 72 [E] ( the data as of 01.01.2005 ) - 60 [E] ( the data as of 01.01.2004 ) - 64 [E] ( the data as of 01.01.2003 ) :Belarus, Ukraine, Latvia Export :Germany, Finland Import :-Branch (Kaunas, Kaunas region, Kaunas city municipality, Lithuania) Branches name:Office in Kaunas address:Xxxxx av. XX, Kaunas, Kaunas region, Kaunas city municipality, Lithuania Phone: +370 37 111111111 E-mail: [email protected] -Branch (Klaipeda, Klaipeda region, Klaipeda city municipality, Lithuania) name:Office in Klaipeda address:Sxxxxxxx XXX, Klaipeda, Klaipeda region, Klaipeda city municipality, Lithuania Phone: +370 37 111111111 E-mail: [email protected] -Branch (Panevezys, Panevezys region, Pasvalys city municipality, Lithuania) name:Office in Panevezys address:Rxxxxxxxxx st. XX, Panevezys, Panevezys region, Pasvalys city municipality, Lithuania Phone: +370 37 111111111 E-mail: [email protected] Company has specialized tea and coffee shops in Vilnius, Kaunas, Klaipeda and Panevezys and delivers some Sample's products, as well as Sample tea and Sample coffee for almost all Lithuanian supermarkets. :n/a Subsidiaries and Participation :- AB DnB XXXX bankas (Lithuania) Bankers bank code: XXXXX : XXXXXXX (Germany) Suppliers - XXXXXX Ltd (Finland) :Case number: XX-XXX Litigation Court: 111 Instance: First instance Date: 11.11.2008 Subject: Re: defending of property rights, cancelation of registration, acknowledgement of the deal as invalid. Participants: Defendant: "XXXXXX" Plaintiff: ,,XXXXXXXX" Third person: AB bankas ,,XXXXXXXX", ,, XXXXXXXX" Remarks on payment Case number: XX-XXX Court: Vilnius district court Instance: Appeal Date: 11.11.2008 Subject: Re: joint property Participants: Defendant: JSC „XXXXXXX“ Plaintiff: JSC „XXXXXXXXX“ :none No current records are reported by the local debt collection companies. Financial Elements Period, months Ended Currency Non-current assets incl: - Fixed assets - Financial assets Current assets incl: - Stock - Debtors - Cash ASSETS TOTAL Equity incl: - Share capital Liabilities Total incl: - Long-term liabilities - Short-term liabilities EQUITY AND LIABILITIES TOTAL Net sales Cost of goods sold Operating profit Profit before taxation Net profit - - - - - - - KEY RATIOS - - - - - - Return on sales, % Profit before taxation / Net sales Operating margin of profit, % 3 2 5 2 2 8 1 1 6 3 3 8 14 8 12 12 31.12.2008 31.12.2007 LTL LTL 003 916.00 3 213 506.00 796 057.00 2 959 576.00 96 034.00 120 654.00 564 013.00 4 835 484.00 428 728.00 2 089 137.00 854 869.00 2 580 059.00 280 507.00 166 288.00 567 929.00 8 048 990.00 855 453.00 1 653 633.00 000 000.00 1 000 000.00 708 822.00 6 390 750.00 394 306.00 3 340 298.00 314 516.00 3 050 452.00 567 929.00 8 048 990.00 022 782.00 12 102 668.00 419 135.00 7 384 593.00 448 172.00 229 317.00 315 267.00 7 904.00 201 820.00 -59 201.00 2.25 0.07 3.20 1.89 Operating profit / Net sales Return on investment, % Profit before taxation / Equity Current assets turnover Net sales / Current assets Working capital Current assets - Short-term liabilities Leverage Equity / Total assets Current ratio Current assets / Short-term liabilities Quick ratio (Current assets - Stock) / Short-term liabilities Debt-to-equity ratio Total liabilities / Equity 16.99 0.48 2.52 2.50 2 249 497.00 1 785 032.00 0.22 0.21 1.68 1.59 0.95 0.90 3.62 3.86 Publications - 11.11.2008 :Subject :http://www.xxxxxxxxxxxxx.lt/index.php?content=page&Id=167&lng=en The company was established in 1993; In 1997 SAMPLE became an official exclusive distributor of XXX products in Lithuania; In 1998 SAMPLE became an official exclusive distributor of XXX products in Lithuania; In 1999 the company introduced stands for loose tea and coffee for the supermarkets. Today, you can find those stands in almost all Lithuanian supermarkets. In 2000 the company became an operator in XXX. In 2000 the company started its vending business line too. SAMPLE was also an official operator of XXX vending machines between the period of 20022005. In 2002 the company created its own brand name XXX’s and opened its first tea & coffee shop XXX’s. FINAL COMMENTS Information was received from all the sources available, some information was confirmed by administrator of the company Mrs. Xxxxxxxx. We've send our questionnaire and if we receive any additional information, we'll supplement the report. THE COMPANY MANAGEMENT'S OPINION REGARDING CURRENT STATE OF BUSINESS IN THE SECTOR: Business section: Wholesale of coffee, tea, cocoa and spices; 1. General view to the situation in the Sector: - Company has expressed some fears about slowdown of sales 2. Changes in payment behavior of clients. Average true payment terms: - Payment terms are prolonged till 60-70 days. 3. What percentage of companies in the sector have factually become insolvent (by opinion of interviewed person): - appr. 5% /Date:08.10.2008, phone: (+370 5) xxxxxxxxx THE RESULT OF THE OPINION POLL: 1. - 37% of polled companies evaluate common state of business in the sector as remaining stable. - 63% of polled companies confirm some fears about slowdown of sales in the future but at the time they feel no negative effects. . 2. - 25 % of polled companies confirm that they do not see any sensible change in payment behaviour of their clients. - 75 % of polled companies fix slowdown in client's payments. Average delay in payment has reached 60-75 days after shipping. 3. - Most respondents are of opinion that from 5% to 10% of companies operating in the sector have become insolvent. COUNTRY REVIEW Financial ratios of enterprises total: 2007, IVQ Number of enterprises A profitable share out of the total number of enterp. (%) A non profitable share out of the total number of enterp. (%) Ratio of gross profit to sales Current assets to current liabilities Liabilities to assets 38450 Ratio of gross profit to sales Current assets to current liabilities Liabilities to assets 40369 2008, IIQ 41050 65,1 58,9 62,8 34,9 41,1 37,2 20,5 1,51 0,44 20,1 1,47 0,44 20,6 1,42 0,47 Financial ratios/ manufacturing (Nace section: D): 2007, IVQ Number of enterprises A profitable share out of the total number of enterp. (%) A non profitable share out of the total number of enterp. (%) 2008, IQ 5502 2008, IQ 2008, IIQ 5433 5505 60,5 60 59,9 39,5 40 40,1 18,0 1,39 0,52 14,4 1,34 0,52 17 1,39 0,53 Financial ratios /Manufacture of food products and beverages (Nace code: 15: 2007, IVQ 2008, IQ 2008, IIQ Number of enterprises A profitable share out of the total number of enterp. (%) A non profitable share out of the total number of enterp. (%) Ratio of gross profit to sales Current assets to current liabilities Liabilities to assets 612 562 569 58,7 61 54,5 41,3 39 45,5 24,8 1,33 0,52 18,5 1,28 0,51 19 1,20 0,56 Financial ratios / Manufacture of textiles (Nace code: 17): 2007, IVQ 2008, IQ Number of enterprises A profitable share out of the total number of enterp. (%) A non profitable share out of the total number of enterp. (%) Ratio of gross profit to sales Current assets to current liabilities Liabilities to assets 212 201 2008, IIQ 202 54,9 48,6 59,5 45,1 51,4 40,5 13,7 1,66 0,51 13,6 1,74 0,46 15,8 1,73 0,50 Financial ratios/ manufacture of wood and wood products (except furniture)/ Nace co de: 20: 2007, IVQ 2008, IQ 2008, IIQ Number of enterprises 947 918 925 A profitable share out of the total number of enterp. (%) 53,8 48,5 50,8 A non profitable share out of the total number of enterp. (%) 46,2 51,5 49,2 Ratio of gross profit to sales Current assets to current liabilities Liabilities to assets 14,4 1,09 0,67 Financial ratios /Construction / Nace section F: 2007, IVQ Number of enterprises A profitable share out of the total number of enterp. (%) A non profitable share out of the total number of enterp. (%) Ratio of gross profit to sales Current assets to current liabilities Liabilities to assets 3704 14,1 1,06 0,69 14,7 1,12 0,70 2008, IQ 2008, IIQ 4459 4554 74,5 55,5 66,9 25,5 44,5 33,1 20,7 1,57 0,57 17,9 1,43 0,60 19,9 1,42 0,62 Financial ratios / Wholesale trade, except motor vehicles and … NACE: 51): 2007, IVQ 2008, IQ 2008, IIQ Number of enterprises 5965 5941 6033 A profitable share out of the total number of enterp. (%) 74,4 69,1 72,7 A non profitable share out of the total number of enterp. (%) 25,6 30,9 27,3 Ratio of gross profit to sales Current assets to current liabilities Liabilities to assets 15,8 1,43 0,63 17,5 1,43 0,63 17,2 1,41 0,65 Financial ratios / Retail trade, except motor vehicles and motorcycles 2007, IVQ 2008, IQ 2008, IIQ Number of enterprises 4486 4487 4560 A profitable share out of the total number of enterp. (%) 69,1 55,2 64,2 A non profitable share out of the total number of enterp. (%) 30,9 44,8 35,8 Ratio of gross profit to sales Current assets to current liabilities Liabilities to assets 25,5 1,55 0,53 24,1 1,53 0,54 Financial ratios / Transport and storage (Nace code: 60-63): 2007, IVQ 2008, IQ Number of enterprises A profitable share out of the total number of enterp. (%) A non profitable share out of the total number of enterp. (%) Ratio of gross profit to sales Current assets to current liabilities Liabilities to assets 3444 3676 25,4 0,90 0,76 2008, IIQ 3733 59,1 52,3 55 40,9 47,7 45 18,5 1,46 0,37 20 1,30 0,42 19,7 1,28 0,43 Financial ratios / Real estate, renting and other business activities (EVRK section : K): 2007, IVQ 2008, IQ 2008, IIQ Number of enterprises A profitable share out of the total number of enterp. (%) A non profitable share out of the total number of enterp. (%) Ratio of gross profit to sales Current assets to current liabilities Liabilities to assets 8069 9000 9176 67,2 57,8 62,9 32,8 42,2 37,1 42,8 1,44 0,42 45,4 1,45 0,41 44,1 1,54 0,43 CURRENT ECONOMICAL SITUATION IN LITHUANIA (MASS-MEDIA REVIEW) Respublika 04-09-2008/ The sad forecasts of transport companies are coming true, a ccording to the data of the Bankruptcy administration department – in 3 summer mont hs insolvency procedures were initiated for 20 transport companies. The president o f the national freight carriers association “Linava” Algimantas Kondrusevičius, say s that the number of insolvency procedures will grow especially if relations with R ussia will become more tense. European Union market will not be a proper alternativ e. 80 % of "Linava" members are working on Russian market. Vz.lt 11-09-2008/ After calming down of the real estate market in Lithuania, in th e first half year there were 44 bankruptcy procedures started for the real estate c ompanies. i.e. much more than during the same period in 2007 and 2006 when insolv ency procedures were started for 21 and 13 this type companies respectively. Durin g January- June bankruptcy procedures were initiated for 141 retail and wholesale c ompany and 126 manufacturing companies. During 6 months of 2008 the total number o f insolvency procedures was 420, i.e. 1/3 more than in 2007 (315). Alfa.lt 10-09-2008/ Nordea Bank analysts announced that they expect Lithuania’s eco nomy to keep growing and avoid negative growth that has been predicted in Estonia a nd Latvia. "Slow growth awaits,” is how Anssi Rantala, Nordea Markets chief analyst for the Baltic States, thinks about Lithuania. He said Lithuania is the only Balti c state, where economy will post growth this and next year. "It will not be a consi derable growth, however it will remain stable.” Nordea Markets forecast that this y ear the Lithuanian economy will grow 3.8 percent, next year 1.9 percent and in 2010 by 2.9 percent. Current economic growth is reported at 5.1 percent by the Lithuani an Department of Statistics. BC, Vilnius, 16.09.2008/ According to the forecasts of the Department of Statistics of Lithuania, the monthly inflation calculated according to the harmonized index o f consumer prices (HICP) will reach 0.4% in September 2008 and the annual inflation will stand at 11.11% compared to August 2008. The average annual inflation should reach 10.74% in September 2008. In August, compared to July, the monthly inflation (according to HICP) was 0.2%, the annual inflation – 12.2% and the average annual i nflation amounted to 10.4%. In July, the annual inflation calculated according to H ICP amounted to 12.4%, and the average annual inflation – 9.9%, whereas the monthly inflation stood at 0.4%.If the forecasts proved to be right, the level of annual i nflation would decrease already in the third month in a row, the monthly inflation would continue stabilizing and a slight increase would only be observed in the aver age annual inflation. BC, Vilnius, 17.09.2008/ It is likely that the sinking of the oil prices on the wor ld markets will be long-term and will simplify the recovery of national economies a s well as reduce inflation, claims Marius Bxxxxxx, head of the analysis and evalua tion department of the financial brokering company Fxxxxxxx. This tendency will favo rably influence the Lithuanian economy. The analyst’s claims are confirmed by Lithu ania"s inflation forecasts. According to the forecasts of the Lithuanian Department of Statistics, the monthly inflation calculated according to the harmonized index of consumer prices (HICP) will reach 0.4% in September this year and the annual inf lation will stand at 11.11% compared to August. The average annual inflation should reach 10.74% in September. BC, Vilnius, 18.09.2008/ Financial analysts warn that Lithuania will soon feel the effects of the global financial crisis. A rise in interest rates, stricter loan res trictions and fewer exports are all possible. However, government officials urge pe ople not to panic. Additionally, Gxxxxxxx Nxxxxxxx, advisor to the president of SEB B ank, said that not only will interest rates increase, but that there will be strict er conditions on receiving loans and that profits from investment funds will decrea se. Finance Minister Rxxxxxxxx Sxxxxxxxx has asserted that this week's announcement of the bankruptcy of Lehman Brothers – America's fourth largest and the oldest invest ment bank – should cause everyone great concern. 18.09.2008 Alfa.lt The results of the companies for the IIQ 2008 illustrate their ability to survive i n the time of economic challenges. The profit of the real estate companies is still high - 1,6 times up, the profit of construction companies decreased by 20%, profi t of transport companies, hotels and restaurants decreased respectively by 40 and 4 4%. Trade companies still manage to keep the profit level, that decreased only by 4% and total profit reached appr. 1 bln LTL. The share of profitable companies in I IQ 2008 was 63% and in IIQ 2007 it was (73%). In the first half of 2008 the compani es managed to adjust to the more difficult business situation, but it is forecasted that in the second half the profitability will be lower due to the more complicate d situation on domestic and main export markets. 22.07.2008 Alfa.lt One of the largest travel operators “Noxxxxxxx” announced about cancelation of plan ed flights to Mxxxxxxx. One of the main reasons is decrease in number of travelers. D ue to the same reason the company stopped the flights to Italy in June of this year . For the travel agents it is more difficult to sell “last minute” travels even whe n the price is cut down by half. Therefore the companies exclude more expensive and not so popular travels from the schedule. The price for flights is a bit higher co mpared to the previous years and it will go up because of the petrol fee. 25.09.2008 Alfa.lt Referring to the data provided by the Association of wholesalers and manufacturers of alcoholic beverages, the sales of alcohol this year dropped down by 15%. The si tuation was influenced by increase of excise on strong beverages by 20%, increase b y general costs by 15%, inflation and decrease of purchasing power. In the last 12 months price of alcoholic drinks went up by 15-20% not taking into account increas e of excise. 25.09.2008 Alfa.lt In January - July 2008 insurance market went up by 5,3% i.e. only 3.3% more that du ring the same period of 2007. During the same period of 2007 the market grew by 44, 7%. Decrease in signed insurance premium is registered in all insurance groups except o f property and annuities, the sharpest decrease registered in premium volume for Mo tor vehicle liability insurance and Life investment assurance. Life assurance premi um volume went down by 24,9%, premium volume for non-life insurance increased by 8,6%. The number of signed insurance contracts went down by 3,4% compared to 2007. APPENDIX A Financial Statements - 31.12.2008 :Fiscal period: 12 month(s), currency: LTL BALANCE SHEET ASSETS A. NON-CURRENT ASSETS I. I.1 I.2 I.3 I.4 I.5 II. INTANGIBLE ASSETS Research and development costs Goodwill Rights obtained (licenses, patents etc.) Software Other intangible assets TANGIBLE ASSETS II.1 II.2 II.3 II.4 II.5 equipment II.6 II.7 III. III.1 related Land Buildings and constructions Plant and equipment Transport vehicles Other fixtures, fittings, tools and Construction in progress and prepayments Other tangible assets LONG-TERM FINANCIAL ASSETS Capital participation and investments in companies III.2 Loans to subsidiaries and associated companies III.3 Long-term accounts receivable III.4 Other long-term financial assets B. CURRENT ASSETS I. I.1. I.1.1 I.1.2 I.1.3 I.1.4 STOCKS AND CONTRACTS IN PROGRESS Stocks Raw materials and consumables Work in progress Finished products Goods purchased for sale 3 003 916.00 111 825.00 36 928.00 27 358.00 47 539.00 2 796 057.00 329 970.00 233 311.00 1 079 507.00 1 153 269.00 96 034.00 91 387.00 4 647.00 5 564 013.00 2 428 728.00 2 358 679.00 5 685.00 2 352 I.2 I.3. II. II.1. Advanced payments Contracts in progress SHORT-TERM ACCOUNTS RECEIVABLE Trade debtors II.2 Loans to subsidiaries and associated companies II.3. Other accounts receivable III. OTHER CURRENT ASSETS III.1 Short-term investments III.2 Deposit accounts III.3 Other current assets IV. CASH IN HAND AND BANK ACCOUNT TOTAL ASSETS EQUITY AND LIABILITIES C. CAPITAL AND RESERVES I. I.1. CAPITAL Authorized capital I.2. Uncalled capital I.3 Share premium account I.4 Own shares II. REVALUATION RESERVE III. RESERVES III.1. Legally prescribed reserevs III.2. Non-distributable reserves III.3. Other reserves IV. RETAINED EARNINGS IV.1 Profit (loss) from the current year IV.2 Profit (loss) brought forward from previous years D. FINANCING (GRANTS AND SUBSIDIES) E. ACCOUNTS PAYABLE AND LIABILITIES I. I.1 I.1.1 I.1.2 LONG-TERM ACCOUNTS PAYABLE Financial loans Leasing and other similar obligations Amounts owed to credit institutions I.1.3 Other financial loans I.2 Trade creditors I.3 Advanced payments under contracts in progress I.4 Provisions I.4.1 Liabilities repayment I.4.2 Benefit and similar liabilities I.4.3 Other provisions I.5 Deffered taxes I.6 Other accounts payable and long-term liabilities II. SHORT-TERM LIABILITIES II.1 II.2 II.2.1 II.2.2 II.3 Short-term portion of long-term debts Financial debts To credit institutions Other loans Trade creditors 994.00 70 049.00 2 804 101.00 2 343 146.00 444 080.00 16 784.00 50 768.00 50 768.00 280 507.00 8 567 929.00 1 855 453.00 1 000 000.00 1 000 000.00 100 000.00 100 000.00 755 453.00 201 820.00 553 633.00 3 654.00 6 708 822.00 3 394 306.00 3 394 306.00 171 506.00 2 910 000.00 312 800.00 3 314 516.00 100 243.00 273 272.00 273 272.00 2 124 II.4 Advanced payments under contracts in progress II.5 Profit tax liabilities II.6 Taxes, accrued payroll and social insurance payments II.7 Provisions II.8 Other accounts payable and short-term liabilities TOTAL EQUITY AND LIABILITIES 559.00 20 492.00 245 388.00 79 065.00 471 246.00 251.00 8 567 929.00 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - PROFIT AND LOSS ACCOUNT I. SALES AND SERVICES 14 022 782.00 II. COSTS OF GOODS SOLD AND SERVICES 8 419 135.00 RENDERED III. GROSS PROFIT (LOSS) 5 603 647.00 IV. OPERATING EXPENSES 5 155 475.00 IV.1 Expenses on sales IV.2 Administrative and other expenses V. OPERATING PROFIT (LOSS) 448 172.00 VI. OTHER OPERATIONS 86 926.00 VI.1 Revenue from other operations 138 333.00 VI.2 Expenses on other operations 51 407.00 VII. FINANCIAL AND INVESTMENT ACTIVITIES -219 831.00 VII.1 Revenue from financial and investing 9 471.00 activities VII.2 Expenses on financial and investing 229 302.00 activities VIII. BASIC ACTIVITY PROFIT (LOSS) 315 267.00 IX. EXTRA-ORDINARY PROFIT X. EXTRA-ORDINARY LOSS XI. PROFIT LIABLE TO TAXATION (LOSS) 315 267.00 XII. PROFIT TAX 113 447.00 XIII. NET PROFIT (LOSS) 201 820.00 - 31.12.2007 :Fiscal period: 12 month(s), currency: LTL BALANCE SHEET ASSETS A. NON-CURRENT ASSETS I. I.1 I.2 I.3 I.4 I.5 II. INTANGIBLE ASSETS Research and development costs Goodwill Rights obtained (licenses, patents etc.) Software Other intangible assets TANGIBLE ASSETS II.1 II.2 II.3 II.4 II.5 equipment II.6 Land Buildings and constructions Plant and equipment Transport vehicles Other fixtures, fittings, tools and Construction in progress and prepayments II.7 Other tangible assets III. LONG-TERM FINANCIAL ASSETS 3 213 506.00 133 276.00 52 685.00 32 462.00 48 129.00 2 959 576.00 339 573.00 269 264.00 1 068 237.00 1 282 502.00 120 654.00 III.1 related Capital participation and investments in companies III.2 Loans to subsidiaries and associated companies III.3 Long-term accounts receivable III.4 Other long-term financial assets B. CURRENT ASSETS I. I.1. I.1.1 I.1.2 I.1.3 I.1.4 I.2 I.3. II. II.1. STOCKS AND CONTRACTS IN PROGRESS Stocks Raw materials and consumables Work in progress Finished products Goods purchased for sale Advanced payments Contracts in progress SHORT-TERM ACCOUNTS RECEIVABLE Trade debtors II.2 Loans to subsidiaries and associated companies II.3. Other accounts receivable III. OTHER CURRENT ASSETS III.1 Short-term investments III.2 Deposit accounts III.3 Other current assets IV. CASH IN HAND AND BANK ACCOUNT TOTAL ASSETS EQUITY AND LIABILITIES C. CAPITAL AND RESERVES I. CAPITAL I.1. Authorized capital I.2. Uncalled capital I.3 Share premium account I.4 Own shares II. REVALUATION RESERVE III. RESERVES III.1. Legally prescribed reserevs III.2. Non-distributable reserves III.3. Other reserves IV. RETAINED EARNINGS IV.1 Profit (loss) from the current year IV.2 Profit (loss) brought forward from previous years D. FINANCING (GRANTS AND SUBSIDIES) E. ACCOUNTS PAYABLE AND LIABILITIES I. I.1 I.1.1 I.1.2 I.1.3 I.2 LONG-TERM ACCOUNTS PAYABLE Financial loans Leasing and other similar obligations Amounts owed to credit institutions Other financial loans Trade creditors 91 387.00 29 267.00 4 835 484.00 2 089 137.00 2 028 954.00 67 454.00 1 961 500.00 60 183.00 2 521 671.00 2 180 557.00 331 916.00 9 198.00 58 388.00 58 388.00 166 288.00 8 048 990.00 1 653 633.00 1 000 000.00 100 000.00 100 000.00 100 000.00 553 633.00 -59 201.00 612 834.00 4 607.00 6 390 750.00 3 340 298.00 3 340 298.00 107 498.00 2 920 000.00 312 800.00 I.3 Advanced payments under contracts in progress I.4 Provisions I.4.1 Liabilities repayment I.4.2 Benefit and similar liabilities I.4.3 Other provisions I.5 Deffered taxes I.6 Other accounts payable and long-term liabilities II. SHORT-TERM LIABILITIES II.1 II.2 II.2.1 II.2.2 II.3 Short-term portion of long-term debts Financial debts To credit institutions Other loans Trade creditors II.4 Advanced payments under contracts in progress II.5 Profit tax liabilities II.6 Taxes, accrued payroll and social insurance payments II.7 Provisions II.8 Other accounts payable and short-term liabilities TOTAL EQUITY AND LIABILITIES 3 050 452.00 117 892.00 100 684.00 100 684.00 2 314 550.00 795.00 212 271.00 84 167.00 217 204.00 2 889.00 8 048 990.00 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - PROFIT AND LOSS ACCOUNT I. SALES AND SERVICES 12 102 668.00 II. COSTS OF GOODS SOLD AND SERVICES 7 384 593.00 RENDERED III. GROSS PROFIT (LOSS) 4 718 075.00 IV. OPERATING EXPENSES 4 488 758.00 IV.1 Expenses on sales IV.2 Administrative and other expenses V. OPERATING PROFIT (LOSS) 229 317.00 VI. OTHER OPERATIONS -85 995.00 VI.1 Revenue from other operations 150 951.00 VI.2 Expenses on other operations 236 946.00 VII. FINANCIAL AND INVESTMENT ACTIVITIES -135 418.00 VII.1 Revenue from financial and investing 45 966.00 activities VII.2 Expenses on financial and investing 181 384.00 activities VIII. BASIC ACTIVITY PROFIT (LOSS) 7 904.00 IX. EXTRA-ORDINARY PROFIT X. EXTRA-ORDINARY LOSS XI. PROFIT LIABLE TO TAXATION (LOSS) 7 904.00 XII. PROFIT TAX 67 105.00 XIII. NET PROFIT (LOSS) -59 201.00 This report is furnished by IGK GROUP in strict confidence solely for your use and no part of the report may be disclosed to any third party. IGK GROUP cannot accept any responsibility for any loss or damage caused by decisions made being based on data of this report. * * * E N D O F R E P O R T * * *

© Copyright 2026