March 2014

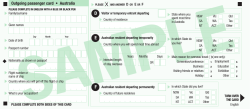

March 2014 New precedent objection for ECT assessments Editor: The SIS Regulations clearly allow a superannuation contribution received in one month to be credited to the relevant member's account by the 28th day of the following month. This has given rise to 'contribution reserving' strategies (described further below), particularly for contributions made at year-end. However, despite the fact such strategies have effectively been approved by the ATO, they will not change the tax returns to allow for contributions made in one year to be reported as counting for the following year. Instead the ATO has suggested that affected taxpayers should simply object against any excess contributions tax (ECT) assessment they receive. Therefore, to assist taxpayers (and tax agents) in this situation, we approached DBA Lawyers to draft us up just such an objection. Contribution reserving has become increasingly popular in recent times, especially with the ATO’s recent release of TD 2013/22. If handled correctly, it can be a worthwhile strategy. However, many who have already implemented contribution reserving have received ‘please explain’ letters from the ATO, or ECT assessments. This article from DBA Lawyers provides a practical solution to dealing with such matters. Background to contribution reserving Contribution reserving broadly allows a member to make a concessional contribution – and claim an associated tax deduction – in one financial year, whilst counting the contribution in the member’s concessional contributions cap for the following financial year. The implementation of contribution reserving requires upfront and detailed paperwork (including a contribution reserving strategy and trustee resolutions). Expert advice should be sought if there is any doubt. NTAA Corporate offers a Contribution Reserving Kit that contains a detailed memo outlining the practical ‘how to’, pros, cons and inherent risks of contribution reserving, as well as template resolutions for those wishing to implement such Voice a strategy. ATO ‘please explain’ letters Following the implementation of a contribution reserving strategy, the member may receive an ATO letter notifying them that they may have exceeded their concessional contributions cap for the relevant financial year. Editor: We suspect that this is because the ATO is unable to distinguish from a member’s personal tax returns whether the member is legitimately using contribution reserving or whether the member simply has concessional contributions that exceed their cap for a given year. This notification letter will provide the member with the opportunity to explain why they have not exceeded their concessional contribution cap (e.g., because they were using a contributions reserving strategy). If the ATO does not receive a response to this ‘please explain’ letter, or are not satisfied with the response they do receive, they may issue an ECT assessment. An objection can then be submitted to the ATO in response to this assessment. Assuming the objection is appropriately worded, the result should be that, upon receiving the objection, the ATO amends the assessment to nil. Note: An objection can only be made once the excess contributions tax assessment is received, and not in response to the initial ‘please explain’ letter. For your reference, a sample objection is provided in the Members' Section of our website under the March Edition of Voice. A full version of the objection is now available as part of the Contribution Reserving Kit, at no additional cost to members. The spectre of having to respond to an ATO ‘please explain’ letter or assessment emphasises the importance of ensuring that the contribution reserving paperwork is adequate from the outset. Ref: DBA Lawyers. This article is for general information only and should not be relied upon without first seeking advice from an appropriately qualified professional. Page 1 Voice Contribution reserving — sample objection Disclaimer The NTAA provides the following sample objection as a general guide to the type of wording that should be included in an objection to an excess contributions tax assessment arising from contribution reserving. It is designed for objections that are lodged within the allowed time limits and acts as a guide to enable tax practitioners to help their clients lodge an objection to the ATO. The sample objection will need to be tailored to each client’s circumstances as not every item will necessarily be relevant to your client nor does the sample objection purport to identify your client’s factual scenario, possible issues, or grounds that could arise in relation to the denial of their claim. Importantly, tax practitioners should be aware that as a general rule, taxpayers’ review rights are limited to the grounds stated in their objection (e.g., in a Federal Court or Administrative Appeals Tribunal hearing). Particular care should therefore be taken to ensure the facts and grounds stated in each objection are framed to cover the client’s specific situation to protect their legal rights should the objection be disallowed and your client wishes to pursue their review rights further. Furthermore, any statement or claim asserted in an objection must be true and correct. The reason for this requirement is that where any statement or claim asserted is found to be false and misleading, administrative and criminal penalties could result for the client, and potentially the tax practitioner. It is important to ensure that all details are received from your client and any assistance provided is strictly in accordance with the client's instructions. Under no circumstances should a tax practitioner make statements about the affairs of a client unless they are known to be true or are based on sound argument and logical reasoning. For that reason, it is prudent to ensure that all instructions from a client are in writing and any statements made by a tax practitioner are confined accordingly. The sample objection has been designed such that the client signs and lodges the objection and not the Tax Agent on behalf of the client. This approach has been taken in light of the decision of the Supreme Court in Saxby v R [2011] TASCCA 1, where the Commissioner successfully prosecuted a taxpayer for making a false statement in objection notices lodged with the Tax Office. This in turn resulted in a criminal conviction and imprisonment of the taxpayer. Accordingly, to protect tax practitioners, especially, where the tax practitioner may have been involved in the preparation and lodgement of the income tax return for the client, which is the subject of the objection notice, it is prudent that the client signs and lodges the objection and not the Tax Agent on behalf of the client. For those tax practitioners still wanting to sign and lodge the objection notice as Tax Agent on behalf of the client, we strongly suggest specialist legal advice be sought as the template objection notices do not cater for this. Process To make an objection, the following form should be completed and lodged: ‘Objection form — for taxpayers’ (NAT 13471) (available from: http://www.ato.gov.au/Forms/ Objection-form---for-taxpayers/) Completion of the majority of the form should be relatively self-explanatory. Question 11, however, requires an understanding of the relevant legislative provisions and background to contribution reserving. NTAA Corporate offers a Contribution Reserving Kit that includes template wording that can be used to complete question 11. Below, we provide a sample, reduced version of this wording. Page 2 March 2014 March 2014 Division 293 tax The use of a contribution reserving strategy may also give rise to a division 293 tax assessment for high income earners. Depending on the specifics of the case, such an assessment may be objected to on a similar basis as an objection to an excess contributions tax assessment. The following sample objection does not cater for an objection to a division 293 tax assessment. Instead, expert advice should be sought. RESPONSE TO QUESTION 11 OF ATO FORM <insert date> ATO ref:<insert reference> Australian Taxation Office PO Box 3100 PENRITH NSW 2740 Fax: 1300 669 846 Dear Sir/Madam Re: Notice of Objection to excess contributions tax (‘ECT’) assessment — additional information to accompany NAT 13471 Taxpayer: <name of member> Tax File Number: <x> This letter details the response to Question 11 of Section D of the attached completed ‘Objection form — for taxpayers’ (NAT 13471). RESPONSE TO QUESTION 11: What are your reasons for the objection? 1SUMMARY The ATO has incorrectly treated me as having excess concessional contributions in the <x> financial year (‘First Financial Year’). The discrepancy arises from the fact that an ‘unallocated contributions account’ has been utilised as envisaged by the ATO in ATO ID 2012/16 and TD 2013/22 however the income tax return and self managed superannuation fund return do not capture this subtlety. Accordingly, the entire amount of excess concessional contributions tax is excessive and should be remitted or reduced to nil along with interest. 2 BACKGROUND FACTS The background facts relevant to this objection are as follows: • I was born on <date of birth>. Voice Page 3 Voice • At all relevant times, I have been a member of <name of super fund> (‘Fund’). • At all relevant times, I passed the work test and was eligible to contribute to a regulated superannuation fund. • The Fund was at all relevant times a regulated and complying superannuation fund. • The trustee of the Fund maintains a contribution reserve account for the Fund that can be used at any time that a contribution is received before it is actually allocated to a particular member’s account. • During the First Financial Year, total concessional contributions of <$x> were made in respect of me. Only <$x> of this amount was allocated to me during the First Financial Year. • In the following financial year (‘Second Financial Year’), the trustee of the Fund resolved to make the following allocations in respect of me: Contribution reference Allocation date Contribution (CC or NCC) Amount • The ATO has issued an excess contributions tax notice of assessment in respect of the First Financial Year. I hereby object to the associated alleged liability. • The trustee of the Fund was allowed to maintain an ‘unallocated contributions account’ pursuant to the Fund’s governing rules and s 115(1) of the Superannuation Industry (Supervision) Act 1993 (Cth), which provides as follows: A trustee of a superannuation entity may maintain reserves of the entity. • All allocations from the ‘unallocated contributions account’ were made pursuant to reg 7.08(2) of div 7.2 of the Superannuation Industry (Supervision) Regulations 1994 (Cth), which provides as follows: If a trustee receives a contribution in a month … the trustee must allocate the contribution to a member of the fund: 3 (a) within 28 days after the end of the month; or (b) if it is not reasonably practicable to allocate the contribution to the member of the fund within 28 days after the end of the month — within such longer period as is reasonable in the circumstances. TAXPAYER ARGUMENTS The key facts are substantially identical to those in ATO Interpretative Decision ATO ID 2012/16 and consistent with the example provided in Taxation Determination TD 2013/22. In both ATO ID 2012/16 and TD 2013/22, the ATO conclude that where a contribution is made to a regulated superannuation fund in respect of a member and is subsequently allocated to the member under div 7.2 of the Superannuation Industry (Supervision) Regulations 1994 (Cth), it is only counted as a concessional contribution at the time of allocation. This is consistent with case law. The ATO ID cited Carden’s case (ie, Executor Trustee and Agency Company of South Australia Ltd v Federal Commissioner of Taxation (1932) 48 CLR 26) as authority in reaching this conclusion. Page 4 March 2014 March 2014 For completeness, ATO ID 2012/16 refers to div 292 of the Income Tax Assessment Act 1997 (Cth) (which applied to concessional contributions prior to 1 July 2013), whereas TD 2013/22 refers to div 291 of the Income Tax Assessment Act 1997 (Cth) (which applies to concessional contributions from 1 July 2013). This difference is immaterial for the purposes of this objection. I submit that the ATO’s reasoning in ATO ID 2012/16 and TD 2013/22 is entirely correct and endorse it completely. Accordingly, I submit that the reasoning that the ATO set out in ATO ID 2012/16 and TD 2013/22 should be applied here. Further, I note that TD 2013/22 is a public ruling and the Commissioner must apply the law as set out in TD 2013/22 for contributions made on or after 1 July 2013. 4CONCLUSION My total concessional contributions for the First Financial Year amount to <$x>. The amount of <$x> was held in a contributions reserve until after that 30 June to be allocated in the subsequent financial year. Thus, my concessional contributions are within my cap for the First Financial Year. Accordingly, the entire amount of excess concessional contributions tax in respect of the First Financial Year is excessive and should be remitted or reduced to nil along with any interest or penalties. Voice Page 5

© Copyright 2026