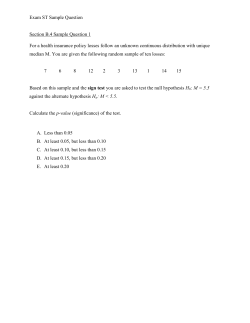

16 Chapter Generalizing a Sample’s Findings to Its