Daily StockWatch Market Summary VN-Index:

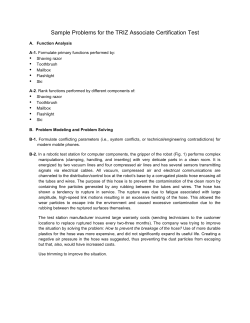

Daily StockWatch Issue 65 For internal use only June 09, 2008 FPT Securities Joint Stock Company Headquarters: 2nd Floor, 71 Nguyen Chi Thanh St, Dong Da Dist, Hanoi Tel: (84.4) 773 7070 Fax: (84.4) 773 9058 Website: www.fpts.com.vn HCM City Branch: 3rd Floor - Citilight Tower, 45 Vo Thi Sau St, Dist 1, HCM City Tel: (84.8) 290 8686 Fax: (84.8) 290 6070 Market Summary VN-Index: - Close: 379.12 - Change: -5.12 (-1.33%) - Volume traded: 3,008,520 units - Value traded: VND 214.09 bil - 52 weeks high: 1,106.6 - 52 weeks low: 379.1 Comments: Opening a new week, no supportive information made investors be still under heavy selling pressure. The southern bourse continuously lost another 1.33%, to close at 379.12 points, extending its losing streak to 23 days. The market saw 12 shares increasing, seven standing still and 135 falling. The most gainers today were VTC with an addition of 1.99%, BT6 with 1.92% and SGT with 1.91%. SGT performed as the most active stock with 106,250 shares changed hands. Fund certificate, MAFPF1, was the biggest decliner, dropping 2.08% to VND4,700 per share, followed by BMC and fund certificate, PRUBF1, with 2% slump. SJD slid 14.29% on ex-dividend date. Foreign investors bought 46 share codes with the total volume of 339,200 units, of which SGT reached biggest volume of 95,740 shares. HaSTC-Index: - Close: 108.46 - Change: -1.40 (-1.27%) - Volume traded: 1,071,600 shares - Value traded: VND 19.09 bil - 52 weeks high: 393.6 - 52 weeks low: 108.5 Comments: The HaSTC today slipped to 108.46 points after dropping 1.40 points, or 1.27%. Amongst 138 listed shares, the stock market witnessed 10 shares increasing while 96 others decreasing, four remained unchanged and 28 with no trades. VBH was the biggest advancer, jumping 2.9% to VND14,200 per share with 100 unit only changed hands, followed by HCC 2.73% and TBC 2.5%. TBC remained the most active stock, gaining 2.5% on 105,500 shares traded, followed by CSG with 83,600 shares and NVC with 74,300 shares. Foreign investors today bought 14,300 shares valued VND335 million and sold 6,500 shares valued VND122 million. Daily StockWatch 1 January 15, 2008 Daily News and Trading Statistics HOSE HASTC Top 5 Gainers Ticker VTC BT6 SGT AGF CII Closing 15.4 42.5 42.7 22.3 23.3 +/0.3 0.8 0.8 0.4 0.4 % 1.99 1.92 1.91 1.83 1.75 Top 5 Losers Ticker SJD MAFPF1 BMC PRUBF1 VNE Closing 14.4 4.7 49.0 4.9 14.8 +/-2.4 -0.1 -1.0 -0.1 -0.3 % -14.29 -2.08 -2.00 -2.00 -1.99 Top 5 by Volume Ticker SGT DXP VIC CII LBM Closing 42.7 13.7 75.0 23.3 12.5 Units 106,250 74,070 54,800 48,610 42,060 % 11.73 8.18 6.05 5.37 4.64 Value (VND1000) 4,523,124 4,110,000 1,382,845 1,267,065 1,129,156 % Total Value 17.48 15.89 5.34 4.89 4.36 Top 5 by Trading Value Ticker W.A.Price 14.2 11.3 12.3 12.5 9.7 +/0.4 0.3 0.3 0.3 -0.3 % 2.90 2.73 2.50 2.46 2.00 Top 5 Losers Ticker BLF ILC PVI SJC CTB W.A.Price 8.7 19.5 19.5 16.3 16.3 +/-1.3 -0.6 -0.6 -0.5 -0.5 % -3.00 -2.99 -2.99 -2.98 -2.98 Top 5 by Volume Ticker TBC CSG NVC SD6 QNC W.A.Price 12.3 8.6 29.0 12.0 20.9 Units 105,500 83,600 74,300 52,800 41,100 % 9.94 7.87 7.00 4.97 3.87 Value (VND1000) 2,184,900 2,155,370 1,296,940 1,034,190 975,100 % Total Value 11.60 11.44 6.89 5.49 5.18 Top 5 by Trading Value Closing SGT VIC VNM FPT CII Top 5 Gainers Ticker VBH HCC TBC NLC BBS 42.7 75.0 96.5 55.5 23.3 Ticker KBC NVC TBC SCJ VC2 W.A.Price 176.2 29.0 12.3 32.8 27.6 (Above values in order-matching session) HOSE DCC: Share Buyback Result DESCON Construction Corporation finished buying back 200,000 shares as treasury shares. The buyback finished on June 5, 2008.. NSC: Approved to List New Shares National Seed Joint Stock Company has been approved to list 2,165,950 additional shares at total par value of VND21.659 billion DTT: Insider Trading Do Thanh Technology Corporation, represented by Le Quang Hiep, chairman of BOD, registered to buy 100,000 shares from June 9 to July 30, 2008. He expected to raise his holdings to 275,000 shares (5.28%) VIC: Trading Result of Affiliated Person Vietnam Prudential Life Insurance Co. Ltd, having relation with Tran Le Khanh, member of BOD in the listed firm, sold 3,750,000 shares on May 22, 2008. It now has 3,750,000 shares (3.125%) RIC: Resolution of BOD VNM: Holland Funds Standard Dairy Cattle Farm * Pass the company's borrowing plan Vietnam Dairy Products Joint Stock Company (Vinamilk) and Dutch Campina Company inaugurated a training center for dairy cattle farmers and a model dairy cattle farm in the Central Highlands province of Lam Dong on June 6. - To complete the building of Four Points Sheraton, expanding casino area and entrainment park and seaborne commercial area - To supplement working capital - Total long-term loans: VND100 billion - Total short-term loans: VND50 billion * Assign Mr. Do Tri Vy, general director, to negotiate and sign contracts with banks. TDH: Trading Result of Affiliated Person Pham Thi Xuan Lan, wife of Le Chi Hieu, chairman of BOD cum General Director in the listed firm, bought 30,000 shares on February 25, 2008. She registered to buy 50,000 shares from June 13 to December 13, 2008 The two dairy cattle facilities belong to a 1.2 million euro project, to which the Netherlands Government contributes half of the investment and the rest is equally shared between Vinamilk and Campina. With the aim of improving the volume and quality of local milk sources in Lam Dong, the project has helped hold training courses for milk cow farmers, invested in model dairy cattle farms, set up milk collection stations and supported satellite farms. The project has provided 15,000 euros for 30 families to buy calves, build or repair cow stables, grow meadows and build irrigation systems, turning them into satellite farms. The Campina-Vinamilk project will expire by late 2008 and will be transferred to Vinamilk to continue the job till 2010. Daily StockWatch 2 January 15,and 2008Trading Statistics Daily News Put through Trading Ticker Trading volume DPM Trading value (VND1,000) 20,000 732,000 SSI 100,000 3,020,000 STB 183,000 4,044,300 Bond Trading Statistics Ticker Term (year) Price (VND1,000) Coupon (%) Yield (%) Trading Volume Trading Value (VND1,000) CPB0810010 2 89.0 7.7 15.7 3,520,000 313,139,200 QH070906 2 94.2 7.7 18.3 1,500,000 141,316,500 QH070918 2 90.1 6.6 21.5 1,500,000 135,108,000 QH060817 2 103.1 7.7 0.0 300,000 30,920,400 QH060817 2 101.9 7.7 0.0 1,000,000 101,990,000 QH071212 5 77.9 8.1 16.6 1,600,000 124,667,200 CP061320 7 74.0 8.6 16.1 1,600,000 118,428,800 CPB070945 2 91.1 7.9 14.7 1,015,000 92,445,185 QH061113 5 85.4 8.7 14.6 90,000 7,694,100 QH061113 5 81.7 8.7 16.4 925,000 75,612,275 TP1A1106 5 81.1 8.8 17.9 1,000,000 81,053,000 CPB071234 5 69.5 7.9 18.6 850,000 59,103,900 CP4A3004 15 116.4 9.0 6.8 500,000 58,221,000 CPD0813009 5 65.9 8.5 20.5 800,000 52,749,600 TP1A5505 3 96.6 8.2 14.9 500,000 48,309,500 CPB070939 2 87.6 7.7 18.1 500,000 43,823,000 TP1A0406 5 78.1 8.8 16.2 500,000 39,035,000 TP1_0706 5 75.1 8.8 21.1 500,000 37,534,500 TP1A1406 15 63.1 9.3 16.2 450,000 28,404,000 CP1_0603 5 99.9 8.4 8.3 8,000 799,592 CP1_0603 5 98.7 8.4 10.8 200,000 19,758,800 CP1_0904 5 117.0 8.4 50,000 5,850,200 Treasury Stock Trading Ticker B/S Registered Volume Today trading volume %/registered volume Accumulated volume %/ registered volume Remains %/ registered volume Expiry date SJS b 500,000 10,000 2.00% 210,000 42.00% 290,000 58.00% 11/06/2008 VIP b 1,000,000 30,000 3.00% 909,540 90.95% 90,460 VGP b 500,000 50 0.01% 158,470 31.69% 341,530 68.31% 07/07/2008 HDC b 200,000 10,000 5.00% 60,600 30.30% 139,400 69.70% 04/08/2008 SCD b 100,000 1,400 1.40% 10,450 10.45% 89,550 89.55% 10/06/2008 DHA b 100,000 5,000 5.00% 13,000 13.00% 87,000 87.00% 15/08/2008 CII b 500,000 20,380 4.08% 277,520 55.50% 222,480 44.50% 28/08/2008 ALT b 200,000 3,530 1.77% 29,030 14.52% 170,970 85.49% 02/09/2008 9.05% 10/06/2008 Daily StockWatch 3 Daily News and Trading Statistics HASTC 50 Most Active Stocks by Traded Volume HOSE BVS: Insider Trading Bui Quang Bach, deputy general director, registered to sell 3,900 shares, reducing his holding to 4,100 shares from June 9 to July 9, 2008. PAN: Insider Trading Result Diamond Investment Joint Stock Company (Paragon), member of BOD, sold 150,000 shares from April 29 to May 31, 2008. Paragon now has 200,000 shares. CDC: Trading Result of Major Shareholder Rubber Finance Company bought 97,700 shares from April 8 to May 30, 2008. It now holds 324,750 shares (9.021%) VTS: Resolution of 2008 Annual Shareholders Meeting * 2007 audited financial statement - Revenue: VND41,503 million - Profit after tax: VND2,8 million -* Profit allocation in 2007 - Owners' equity restructuring: VND111.58 million of owner's equity was put in development investment fund - Profit allocation in 2007 * Remuneration for Board of Directors and Supervisory Board in 2007 * An increase of the company's charter capital from VND11,100 million to VND12,987 million in the seasoned issue in 2008 * Plans for 2008 - Revenue: VND66,670 million - Profit before tax: VND8,645 million - Fixed asset depreciation: VND5,841 million - Accounts receivable: VND4,500 million - Fixed asset investment: VND5,300 million - Average income: VND2.56 mil./person/month - Dividend payout ratio: at least 25% of the charter capital * Chairman of Board of Directors was assigned to concurrently hold Managing Director * Changes in Supervisory Board - Ms Tran Thi Minh Loan was appointed Member of Supervisory Board replacing Ms Nguyen Thi Suu - Ms Nguyen Thi Thuy's, Member of Supervisory Board, resignation was approved - Ms Ta Vu Nam Giang was appointed Member of Supervisory Board. Ticker SGT DXP VIC CII LBM PET STB VIP DHA PRUBF1 ICF FPT HDC VPK BHS AGF SAM GTA VNM RAL HAS SJS HPG FMC VFMVF1 Volume 106,250 74,070 54,800 48,610 42,060 40,890 36,230 33,990 32,890 23,650 23,430 22,830 21,240 20,510 18,280 16,060 14,840 14,470 14,330 13,630 13,230 11,030 10,500 9,550 9,250 Price 000 VND 42.70 13.70 75.00 23.30 12.50 13.00 22.10 17.90 17.30 4.90 10.00 55.50 34.00 9.60 19.60 22.30 23.30 12.20 96.50 27.70 13.70 60.00 45.40 15.40 9.70 Market cap (Bnl VND) 1,922 71 8,999 932 52 627 9,832 1,071 175 245 128 5,100 273 73 363 287 1,509 127 16,914 319 81 2,400 5,993 121 970 FY EPS (VND) 4,266 2,811 2,772 3,107 3,274 2,203 3,200 2,616 4,607 N/A 1,627 8,265 3,468 1,221 2,480 2,271 3,218 1,452 5,461 7,048 2,525 9,333 7,598 3,608 N/A Price 000 VND 12.30 9.40 29.70 12.40 20.80 9.70 12.50 10.20 28.00 12.20 8.70 32.80 11.30 12.80 15.10 13.10 10.90 10.90 9.70 25.80 40.90 10.70 9.40 176.00 13.50 Market cap (Bnl VND) 3,235 14 87 1,080 19 49 38 918 1,242 15 10 118 28 7 31 20 321 19 47 19 61 76 19 244 14 FY EPS (VND) 1,255 N/A N/A 5,512 4,132 N/A 3,832 1,768 7,930 1,515 2,320 10,457 3,267 4,603 1,826 1,465 2,563 1,709 N/A 12,808 8,877 N/A 3,149 3,641 5,450 P/E 10.01 4.87 27.06 7.50 3.82 6 6.91 6.84 4 N/A 6.15 6.72 9.80 7.87 7.90 9.82 7.24 8.40 18 3.93 5.42 6 5.97 4.27 N/A P/B 3.19 1.13 4.88 1.20 0.86 1 1.34 1.38 1 N/A 0.81 2.58 1.96 0.78 0.87 0.46 0.62 1.18 3.92 0.81 0.53 2 1.91 0.65 N/A ROA (%) ROE (%) 17% 15% 14% 7% 5% 0 2% 13% 0 N/A 7% 20% 5% 7% 9% 6% 8% 8% 21% 8% 6% 0 24% 9% N/A 41% 25% 22% 17% 11% 0 20% 24% 0 N/A 16% 50% 25% 13% 15% 8% 12% 14% 29% 20% 13% 0 37% 20% N/A HASTC Ticker TBC CSG NVC SD6 QNC BLF NLC POT VC2 HNM TXM SCJ SJE PTS XMC BCC S64 VFR PGS S99 ACB L18 TNG KBC VMC Volume 105,500 83,600 74,300 52,800 41,100 40,300 40,300 37,000 35,300 34,600 32,900 31,500 31,500 29,600 26,500 25,000 23,500 21,300 21,200 18,500 18,200 15,100 13,500 12,400 12,200 P/E 0.01 N/A N/A 0.00 0.01 N/A 0.00 0.01 0 0.01 0.00 0.00 0.00 0.00 0.01 0.01 0.00 0.01 N/A 0.00 0.00 N/A 0.00 0.05 0.00 P/B 1.11 N/A N/A 0.32 1.26 N/A 0.81 0.61 1 0.64 0.64 0.83 0.56 0.64 0.85 1.21 0.40 0.82 0.90 1.03 1.72 N/A 0.69 7.14 0.37 ROA (%) ROE (%) 11% N/A N/A 7% 5% N/A 11% 6% 0 5% 6% 24% 3% 21% 4% 6% 6% 7% 0% 27% 3% N/A 8% 11% 2% 12% N/A N/A 26% 34% N/A 28% 12% 0 8% 17% 33% 15% 48% 10% 14% 13% 14% 0% 79% 43% N/A 36% 15% 20% Daily StockWatch 4 Company Insight Vietnam Petroleum Transport Joint Stock Company (HOSE: VIP) Sector: Transportation Equitization date: December 26, 2005 Establishment date: July 22, 1980 Listed date: December 21, 2006 Website: www.vipco.com.vn Email: [email protected] Business highlights Stock statistics as at June 06, 2008 Being established from the privatization of a SOE – Vietnam Petroleum Transport Joint Stock Company I. Thereafter, the State (Petrolimex) maintains a controlling stake of 51%. VIPCO is currently operating with a parent company, 5 subsidiaries and 1 branch; Market cap (VNDb) VIPCO is involving in multi-industries, including water-borne petroleum and other petrochemicals transport, water-borne petroleum trading, marine agency and brokerage, real estate development, import-export of and temporary import for re-export of merchandise. Transport is the main business line, comprising of 50% and 90% of the firm’s total revenue and profit respectively. Petroleum trading also contributes to 30% of total revenue, but its operation has not yet shown efficiency; Chartered capital (VNDb) 1,088.50 Current price (VND) 30 day av trading volume Outstanding share (mil) Adjusted EPS (VND) Dividend yield(%) Stock 9.04 1.35 1.56 0.85 7.73 1.23 3.40 13.28 1.17 12.43 33.75 2.91 19.49 3,318 N/A 4,878 25.85 5.92 23.82 Current ratio (x) 4.22 2.48 2.60 Debt/equity (x) 1.66 0.81 0.38 14.07 3.06 49.00 Current foreign ownership (%) 842,593 670,400 43,457 169,873 116,819 68,445 Net operating profit 27,888 138,857 98,334 31,398 Profit before tax 27,949 147,572 102,772 31,448 Profit after tax 27,599 149,693 102,570 25,856 2007 520,202 2006 388,256 2005 371,156 989,667 1,001,047 298,818 349,236 98,980 28,580 2,700 2,100 Balance sheet (VNDm) Current assets Fixed assets & CIP Long-term investment Other long-term assets 31/3/2008(*) 425,736 7,011 4,450 423 200 1,521,394 1,554,279 690,197 722,692 Short-term liabilities 81,437 115,380 29,821 125,393 Long-term liabilities 632,331 650,094 205,103 238,465 Owner’s equity 796,499 779,800 455,273 358,834 11,127 9,005 - - 1,521,394 1,554,279 690,197 722,692 2007 2006 2005 Total assets Minorities’ Interest Total resources Ratios Growth Sales (%) 24.71 25.69 N/A Net profit(%) 45.95 296.70 N/A Owner’s equity(%) 71.28 26.88 N/A Total assets (%) 125.19 (4.50) N/A Gross profit margin(%) 16.17 13.86 10.21 Net profit margin(%) 14.25 12.17 3.86 ROA (%) 13.34 14.52 N/A ROE (%) 24.24 25.20 N/A Basic EPS(VND) 2,631 1,833 N/A Current ratio (x) 4.51 13.02 2.96 Debt/equity (x) 0.83 0.45 - For more details of information regarding this stock, please log on to our EzSearch website at https://EzSearch.fpts.com.vn 1,916.03 P/B (x) In 2007, VIPCO was placed amongst TOP 500 largest Vietnam companies and was amongst 50 largest firms in Vietnam stock market by market capitalization. VIPCO was also granted “Top Trade Services 2007” by Ministry of Industry and Trade and “Top ten outstanding companies in Hai Phong”. 278,919 1,050,800 GMD N/A Net profit margin (%) Gross profit PVT 5.45 Adjusted EPS (VND) (**) Net sales VTO 1,086.00 ROE (%) 2005 1.37 25.52% TTM P/E (x) (**) VIPCO is amongst leading Vietnamese water-borne transporters of imported petroleum, controlling a market share of around 10% (other domestic transporters jointly represent 25%). Regarding domestically transporting petroleum, VIPCO approximately serves 13% of national demand. Waterborne petroleum trading mainly occurs in Hai Phong and Quang Ninh where above 60% of the market share belongs to the Company; 2006 6.96 2,616 P/B(x) 1,173.60 ROA (%) 2007 18,200 598.08 TTM P/E (x) Comparables as at June 06, 2008 Market cap (VNDb) QI 08 (*) 73,700 59.81 52 weeks low 6.59 Current foreign ownership Petrolimex’s controlling shareholding grants the firm not only assured sources of inputs but also stable demands for transporting petroleum into Vietnam and along the country. Besides, a synchronous, modern sea-going fleet which meets internationally safety standards and has high transport capacity (especially with 35,758 DWT M/T Petrolimex 06) has enabled VIPCO to well exploit promising both international and domestic transport routes; Profit & loss (VNDm) 18,200 48,918 52 weeks high Dividend yield(%) Financial highlights 2006, the first year of operation under joint stock ownership, saw a great efficiency improvement compared to the previous year. As a result, VIPCO’s growth ratios leapt in 2006, particularly net profit growth hit mostly 300%. In the second year after equitization, i.e. 2007, VIPCO’s operation continued to be well-performed, especially high growing in total assets (125.19%) entailed from large investment in fixed assets; It is noteworthy that the entire short term investment portfolio of the Company as at 2007’s balance sheet date were speculative stocks and increased by VND85 billion compared to the same period last year. This investment was very profitable in 2007 and generated roughly VND51 billion of income which represented approximately 35% VIPCO’s total profit before tax; The increasing of gross profit margin and net profit margin for the year 2007 proofed the constant efforts of the Company to improve efficiency in revenue and expense management. ROA and ROE although decreased, its magnitude was insignificant and they were still comparatively high against some other competitors; Business operation in QI/2007 has been in line with the plan and profit before tax increased by 21% compared to the same period last year. However, if compared to QIV/2007, this profit was downed by 50%. The main reason, nevertheless, was because transportation was the main source of income for the first quarter in combination with the fact that M/T Petrolimex 10 was in schedule for periodical maintenance for 25 days in Jan 2008. Yet, it should also been noted that the balance of securities investment portfolio has been shrunk to just VND52 billion in this quarter (while provision for impairment loss was still unchanged at mostly VND4 billion), the strained condition of the Vietnam stock market since the last few months of 2007 would have some negative impacts on the VIPCO’s operational results in the upcoming period. Current event and future event updates In 2008, VIPCO will continue with on-going projects carried forward from 2007 in conjunction with newly investment in two 10,000 – 40,000 DWT chemical and oil product tankers, 25-storey VIPCO tower and starting the VIPCO Petrochemical – Container Terminal Project (with nearly VND3,000 billion of investment capital); March 12, 2008 – June 10, 2008: registration time for VIPCO to buy back 1,000,000 shares using retained earnings source. (*)Source: Unaudited consolidated FS of VIP for Q1/2008 (**): as per HOSE's bulletin as at June 06, 2008 Investment Analysis Department, FPT Securities JS C Analyst : Tran Hong Linh - [email protected] Daily StockWatch 5 OTC Market Eximbank Boosts Capital Base by One-third Export Import Commercial Bank, 15% owned by Sumitomo Mitsui Financial Group Inc, said over the weekend it has raised its capital base by one-third after ending its share sales to foreign investors. Eximbank, Vietnam's eighth-largest lender by assets, said in a statement its registered capital rose 33.3% to VND3.73 trillion (US$231 million) in late May as it ended selling shares to Sumitomo Mitsui, Japan's thirdlargest bank. Last August, the Japanese bank bought the 15% Eximbank stake for US$225 million to become a strategic investor in the Ho Chi Minh Citybased lender. OTC Share Update Price unit: VND1,000 Issuers Vietcombank Sym. Low High VCB 28 Eximbank EIB Habubank HBB Average Face value 30 29 10 20 22 21 10 12 13 13 10 MB 12 13 13 10 Military Bank two-year bonds TMB 800 900 850 1,000 VIB Bank VIB 14 15 15 10 Phuong Nam Bank PNB 13 15 14 10 An Binh Bank ABB 9 10 10 10 Maritime Bank MSB 9 11 10 10 Military Bank The lender said last week it also sold 5% of stake to British Virgin Islandsregistered VOF Investment Ltd, 4.5% to MAE under South Korea's top mutual fund Mirae Asset group and 0.5% to Mirae Asset Maps Opportunity Vietnam Equity Balanced Fund1. VP Bank VPB 12 13 13 10 Saigon-Hanoi Bank SHB 7 8 8 10 Bao Viet BVI 17 18 18 10 PVFC 15 16 16 10 Traphaco TRAPHACO 60 62 61 10 Eximbank's total assets at the end of April rose 15% from the end of 2007 to VND38.79 trillion (US$2.4 billion). Pharbaco PHARBACO 44 47 46 10 Ha Tay Pharmaceuticals HATAPHAR 40 45 43 10 Vietnam caps foreign ownership in a domestic bank at 30% with a 15% limit for a strategic investor. In exceptional cases, the government could allow a foreign strategic investor to own a maximum 20% in a Vietnamese bank. Quoc Cuong Gia Lai QCGL 34 36 35 10 PVFC Hoang Anh Gia Lai Vinaconex DECOFI CIC 8 Techcombank Raises Interest Rates for VND, USD Deposits Vietnam Technological and Commercial Joint Stock Bank has just announced new higher interest rates for deposits in Vietnamese dong with the highest rate hitting 15.8% a year. With one and three month terms, depositors will enjoy an interest rate of 15.35% per year and 15.45% a year respectively. The new interest rate for deposits of 6 to 12 month terms is set at 15.55% per year. Particularly, for Phat Loc saving interest rates, depositors will be given additional bonus interest rates if their deposits exceed VND 100 million. Specifically, with deposits of VND 100 million to VND 500 million, the bonus is 0.1% a year. It is 0.15% a year for deposits of over VND 500 million to VND1 billion; 0.2% a year for deposits of over VND1 billion to VND 3 billion. With deposits of over VND 3 billion, the bonus is 0.25% a year. HAGL 82 86 84 10 VINACONEX 14 15 15 10 DECOFI 21 22 22 10 9 11 10 100 SACOMREAL 29 30 30 10 HADO 25 27 26 10 Binh Chanh House BCCI 17 19 18 10 Ha Tien 2 Cement XMHT2 15 16 16 10 PMC 19 21 20 10 Sacomreal HADO Post Office Materials Bong Sen Hotel CIC 8 BSHC 49 51 50 10 SABECO 34 35 35 10 Thanh Hoa Beer THB 22 23 23 10 Bac Kan Minerals BAMCORP 50 55 53 10 APP 14 15 15 10 Mong Duong Coal VMDC 21 22 22 10 Ha Lam Coal VHLC 21 22 22 10 Nosco NOSCO 18 20 19 10 Vosco VOSCO 15 16 16 10 Sabeco APP Earlier, in late May, Techcombank also adjusted its interest rates for deposits in US dollar. Accordingly, the new interest rates for 1 month, three month, six month and nine month terms are 6.85% a year, 7.15% a year, 7.25% a year and 7.4% a year respectively. For terms of over 12 months, the interest rate is set at 7.55% a year.The highest interest rate for deposits in US dollar for Phat Loc Saving product is 7.8% a year (for deposits of over US $300,000 for 36 month term). Daily StockWatch 6 OTC Market List of Upcoming Secondary Offerings Chartered Capital (VND1,000 ) Issuer Tan Tien Textile Factory 96,711,000,000 Offering Volume Starting Price 3,283,800 10,010 Advisor Reg. Date Auction Date Location From 06/04 06/27/08 HoSE Auction Result 120 Mechanics Factory Agriculture Construction and Rural Development Company Vang Danh Coal JSC 05/13/08 04/29/08 04/09/08 1,157,200 3,671,500 36,914 Par value (VND) 10,000 10,000 10,000 Beginning price (VND) 11,100 10,000 32,000 Bidding volume (shares) 254,000 3,671,700 43,000 Highest bidding volume (shares) 150,000 1,630,000 10,000 Lowest bidding volume (shares) 4000 200 5,000 Highest winning price (VND/share) 11,100 10,800 32,100 Lowest winning price (VND/share) 11,100 10,000 32,000 Average winning price (VND/share) 11,100 10,001 32,014 3 16 6 254,000 3,671,500 36,914 0 0 2,819,400,000 36,717,220,000 Issuer Auction date Offer volume (shares) Total successful bidders Total volume sold (shares) of which shares bought by foreign investors Proceeds (VND) 1,181,748,000 Daily StockWatch 7 Economic News State Bank Cracks down on Forex Violations The State Bank of Vietnam cracked down on foreign currency exchange violations on June 6 in an effort to end US dollar speculation. The SBV governor issued Document 5063/NHNN-QLNH on June 6 to ask leaders of SBV's branches in cities and provinces nationwide to tighten supervision of foreign exchange activities in their localities. Under current regulations, agents can buy foreign currencies from individuals, but are not allowed to sell them back to individuals. They can only sell to credit institutions. However, in practice, individuals have been buying foreign currencies, including the US dollar from exchange agents. “Over the past few days, the exchange rate of the dollar against Vietnamese dong on the free market has increased sharply and unusually due to rising demand and speculation,” read the SBV document. “That has triggered adverse impacts on the psychology of residents and enterprises. SBV asked branches to hand out serious penalties for illegal foreign exchange activities, including temporarily suspending operation or withdrawing operation licenses. The central bank also asked branches to send in daily reports on their supervision activities and violations. Over the past few days, dollar prices have been pushed up to a record rate of VND18,500 per dollar on the black market, while the interbank rate hovered at VND16,200. Tran Bac Ha, management board chairman of the Bank for Investment and Development of Vietnam, attributed the rise to speculation and rumors. He affirmed that foreign currency reserves of the central bank could intervene in the market. The flow of foreign currency from foreign direct investment, tourism, overseas Vietnamese, and other sources were strong enough to supply foreign currency into the local market, therefore the Vietnamese dong should not be dropping. There was also no evidence supporting the rumor that the Vietnamese Government would devalue the Vietnamese dong, as dollar rate stabilization has become essential, he said. Construction Industry to Slash Spending, Projects The Ministry of Construction recently decided to suspend the progress of several projects after the Government's order to limit public expenditure in a bid to control inflation. Out of the 505 projects planned in the beginning of the year, 52 projects were cut, 63 delayed and 87 extended. Most of the projects on the list have to do with housing and infrastructure. Meanwhile 11 new projects were added. More than VND4 trillion (US$250 million) was cut out of the investment capital registered at the beginning of the year, totaling more than VND40 trillion (US$2.5 billion). According to Deputy Construction Minister Dinh Tien Dung, the capital cut was mainly concentrated in five areas: electricity plants, housing, urban infrastructure development, cement plants and construction materials projects. Electricity plants projects have had the most capital reduced: nearly VND2.3 trillion (US$143.8 million). Experts said that the capital reduction for hydroelectricity plant projects is a reasonable cut as these projects require large amounts of investment with high bank loans, while interest rates are fluctuating and construction material prices have sharply risen. Investment capital for housing and urban infrastructure was also reduced significantly, staying at VND10.37 trillion (US$648 million). More than VND2 trillion (US$125 million) was reduced, with 25 projects delayed and 45 others extended. The capital reduction for housing and infrastructure projects was attributed to difficulties in capital mobilization and the fact that the property market was frozen. Moreover, some projects faced difficulties in administrative procedures, land clearance and compensation so the cut seemed reasonable. Seven cement plant construction projects had their progress suspended with VND766 billion (US$47.9 million) cut. As the cement industry aims to meet its 2010 target set by the Government of producing 50 million tons of cement and stabilizing cement supply for the domestic market, ongoing cement projects have not seen a reduction in their investment capital. Depositors Laugh All the Way to the Bank, Borrowers Cringe With banks being allowed to set their own interest rates, they have hiked deposit rates to mobilize funds and raised loan rates to ensure they don't make losses. While depositors are reaping the rewards of the central bank's decision to scrap the cap on interest rates, borrowers face a brutal interest rate regime. The State Bank of Vietnam last month jettisoned a 12% deposit interest cap, and gave commercial banks the freedom to set both loan and deposit interest rates at up to 150% of the benchmark rate of 12%. Banks immediately raced to raise deposit rates to mobilize funds and fixed loan rates accordingly. A deputy director of a commercial bank, who asked not to be named, said despite raising the lending interest rate to the 18% brim, banks also have to charge fees since deposit rates of 15-16% mean the spread is meager. “We will suffer losses if we lend at 18% since 20% of the deposits have to be maintained as reserve balances with the central bank,” he said. But this means borrowers end up paying exorbitant rates. A customer at a HCMC private bank said he got a loan at 18% plus a fee of 4.2% per year for a five-year, VND200 million (US$12,500) loan. “I have to pay a fee of VND42 million, or 21% of the total value of the loan, immediately after getting the loan,” he said. “It means I get only VND160 million (US$10,000) but still have to pay interest on a VND200 million loan.” A shipping firm said a bank has agreed to provide a loan at a fair rate of 17.52% but it has to pay a so-called capital mobilization fee of 0.35% per month. Banks collect these fees not only for new borrowers, but also existing clients. “It's necessary for the government to tighten monetary policy to battle the accelerating inflation,” Dr. Tran Hoang Ngan of the Ho Chi Minh City Economics University said. “But banks shouldn't charge fees. They should support companies more at this difficult time.” He also suggested the central bank should pay banks interest on the reserves they maintain or reduce the reserve requirement. Banks, striving to attract deposits, have not only raised deposit interest rates but also launched many promotions. Eximbank has a “Call 48 hours” program, which offers 11.5% per year for deposits for 48 hours on amounts of VND100,000 and above. Dong A Bank offers bonuses for deposits of VND50 million to VND10 billion (US$3,100-620,000). A HCM City customer said he makes profits every day since his bank offers a bonus on demand deposits. But state-owned banks are offering slightly lower rates of 14.4-15% per year. Daily StockWatch 8 Foreigner Trading HOSE Ticker Foreignowned volume Foreignowned Current Room Ratio Trading Volume Ratio Buy Sell (%) 40 0.25 2,000 Ratio (%) 12.45 Trading Value (VND 1,000) Ratio Ratio Buy Sell (%) (%) 892 0.25 44,200 12.39 AGF 6,301,051 49.00 0 BHS 2,989,508 17.74 5,265,878 0 0.00 70 0.38 0 0.00 1,330 0.38 BMC 880,825 14.93 2,010,812 20 3.70 0 0.00 980 3.70 0 0.00 6,819,216 48.94 8,150 80 88.89 90 100.00 4,000 88.89 4,500 100.00 19,572,790 48.93 27,210 7,010 14.42 0 0.00 163,301 14.46 0 0.00 CYC 405,430 20.37 569,929 4,000 98.77 0 0.00 37,200 98.77 0 0.00 DHA 3,718,654 36.82 1,230,184 8,850 26.91 630 1.92 153,690 26.93 10,962 1.92 DMC 6,443,096 46.79 304,203 220 9.48 0 0.00 22,840 9.48 0 0.00 DPM 53,759,507 14.15 132,440,493 550 6.04 0 0.00 20,130 6.04 0 0.00 FMC 2,264,740 28.67 1,606,260 9,000 94.24 1,000 10.47 138,600 94.24 15,400 10.47 FPT 22,078,080 24.02 22,952,654 17,420 76.30 4,280 18.75 966,810 76.30 237,540 18.75 GMC 401,623 8.60 1,886,430 0 0.00 1,980 34.74 0 0.00 29,898 34.67 GTA 165,523 1.59 4,930,477 0 0.00 3,300 22.81 0 0.00 40,260 22.81 HAP 4,209,298 28.48 3,032,643 2,680 93.06 0 0.00 67,268 93.06 0 0.00 HAS 1,267,929 21.16 1,668,104 350 2.65 0 0.00 4,795 2.66 0 0.00 HDC 1,265,910 15.57 2,716,810 9,140 43.03 200 0.94 317,430 43.55 7,020 0.96 HPG 20,936,460 15.86 43,743,540 6,970 66.38 30 0.29 316,438 66.38 1,362 0.29 229,640 2.30 4,670,360 1,000 75.76 0 0.00 17,100 75.76 0 0.00 BMP CII HSI ICF 268,130 2.09 6,007,300 7,000 29.88 1,860 7.94 68,600 29.64 18,228 7.88 ITA 43,382,935 37.72 12,966,932 5,900 98.17 0 0.00 395,300 98.17 0 0.00 KDC 18,137,739 38.59 4,892,096 1,000 99.01 0 0.00 84,500 99.03 0 0.00 LBM 115,450 2.79 1,910,974 8,550 20.33 0 0.00 106,875 20.33 0 0.00 NKD 4,189,126 41.56 749,967 4,950 96.68 0 0.00 376,650 96.62 0 0.00 NTL 695,320 8.48 3,322,680 1,670 93.82 0 0.00 51,371 93.83 0 0.00 PAC 2,107,060 14.05 5,242,940 200 95.24 0 0.00 6,860 95.32 0 0.00 PGC 4,468,704 17.87 7,781,296 3,000 63.03 0 0.00 40,500 63.03 0 0.00 PPC 52,592,954 16.12 107,262,196 700 43.75 1,600 100.00 18,690 43.75 42,720 100.00 3,056,370 6.11 21,443,630 1,000 4.23 0 0.00 4,900 4.23 0 0.00 PVD PVT 30,230,281 2,204,640 27.45 3.06 23,738,186 33,075,360 5,500 1,200 87.30 90.91 6,100 0 96.83 0.00 371,250 19,560 87.30 91.06 411,750 0 96.83 0.00 RAL 3,897,324 33.89 1,737,676 12,000 88.04 0 0.00 332,400 88.04 0 0.00 SAM 28,942,248 44.25 3,103,367 10,800 72.78 12,790 86.19 251,640 72.78 298,007 86.19 SBT 3,448,600 7.69 18,515,244 20 1.03 0 0.00 200 1.03 0 0.00 SGT SJD 5,674,029 8,376,781 12.61 32.22 16,375,971 4,363,219 95,740 0 90.11 0.00 800 1,300 0.75 43.19 4,078,620 0 90.17 0.00 34,030 18,720 0.75 43.19 SJS 11,815,909 29.54 7,784,091 0 0.00 7,050 63.92 0 0.00 423,000 63.92 SSI 50,372,261 36.86 16,594,407 400 6.60 0 0.00 12,080 6.60 0 0.00 ST8 4,013,010 48.94 4,990 100 41.67 0 0.00 3,270 41.67 0 0.00 TAC TCM TCR 6,474,420 2,249,839 3,446,289 34.11 11.85 44.96 2,825,878 7,051,584 309,698 300 100 1,000 93.75 6.80 95.24 0 0 0 0.00 0.00 0.00 22,800 1,450 12,700 93.87 6.80 95.24 0 0 0 0.00 0.00 0.00 TRC 7,938,320 26.46 6,761,680 80 57.14 0 0.00 4,680 57.14 0 0.00 TRI 3,302,894 43.76 395,802 4,000 98.77 2,790 68.89 73,600 98.77 51,336 68.89 PRUBF1 * Table shows order-matching values only Daily StockWatch 9 Foreigner Trading HOSE Ticker Foreignowned volume Foreignowned Current Room Ratio Trading Volume Ratio Sell (%) Buy Ratio (%) Trading Value (VND 1,000) Ratio Ratio Buy Sell (%) (%) TS4 2,913,690 34.40 1,236,781 0 0.00 20 100.00 0 0.00 224 100.00 TTP 6,674,819 44.50 675,180 0 0.00 150 88.24 0 0.00 5,085 88.24 UIC 51,900 0.65 3,868,100 300 3.52 0 0.00 3,150 3.52 0 0.00 VIC 5,901,075 4.92 52,890,671 28,430 51.88 0 0.00 2,132,250 51.88 0 0.00 VIP 15,245,368 25.49 14,060,446 1,000 2.94 2,000 5.88 17,900 2.94 35,800 5.88 VNM 79,377,580 45.29 1,249,228 13,450 93.86 14,330 100.00 1,297,925 93.86 1,382,845 100.00 VPK 40,450 0.53 3,683,550 0 0.00 10 0.05 0 0.00 94 0.05 VPL 20,147,850 20.15 28,852,150 180 27.69 0 0.00 19,800 27.77 0 0.00 VSC 791,414 9.85 3,146,879 1,500 74.63 0 0.00 54,750 74.63 0 0.00 VSH 32,650,882 23.75 34,721,304 800 28.37 1,070 37.94 19,280 28.37 25,787 37.94 VTO 8,442,630 14.07 20,957,370 1,000 70.42 0 0.00 17,800 70.42 0 0.00 Total 279,200 65,450 12,132,825 3,140,098 HASTC Ticker Foreignowned volume Foreignowned Current Room Ratio Trading Volume Ratio Sell (%) Buy 2,300 0.05 2,447,700 2,300 5.71 CMC 794,200 26.13 695,400 100 100.00 DAE 38,557 2.57 695,796 0 0.00 HAI 565,800 4.73 5,299,500 1,000 14.08 HCC 6,900 0.43 788,273 1,300 61.90 HPC 805,950 4.19 8,624,761 100 KBC 9,582,400 10.89 33,537,600 KMF 4,446,084 42.82 641,612 8,000 0.23 NBC 1,118,600 NTP 3,436,150 PVI Ratio (%) 0.00 22,310 5.71 0 0.00 1,660 100.00 0 0.00 200 100.00 0 0.00 2,100 100.00 0 0.00 20,500 13.97 0 0.00 0 0.00 14,690 61.90 0 0.00 25.00 0 0.00 2,070 25.00 0 0.00 800 6.45 100 0.81 140,800 6.44 17,400 0.80 100 100.00 0 0.00 1,890 100.00 0 0.00 1,707,000 3,100 20.53 0 0.00 33,170 20.22 0 0.00 18.64 1,821,400 400 9.09 0 0.00 11,040 9.09 0 0.00 15.86 7,181,659 100 5.88 0 0.00 2,540 5.88 0 0.00 5,900,940 6.96 35,650,388 600 14.63 4,100 100.00 11,700 14.63 79,950 100.00 QNC 8,700 0.07 6,116,300 1,000 2.43 0 0.00 20,700 2.41 0 0.00 SD9 279,878 1.87 7,070,122 200 28.57 0 0.00 3,000 28.57 0 0.00 SDC 65,400 4.36 669,600 1,000 100.00 0 0.00 22,100 100.00 0 0.00 SRA 188,800 18.88 301,200 1,500 88.24 0 0.00 17,250 88.24 0 0.00 SSS 27,800 1.11 1,197,200 500 8.06 0 0.00 5,750 8.06 0 0.00 TLC 3,069,600 30.76 1,820,600 100 7.14 0 0.00 790 7.14 0 0.00 VFR 19,500 0.13 7,330,500 0 0.00 2,100 9.86 0 0.00 22,890 9.93 VSP 226,630 1.64 6,535,370 100 1.27 0 0.00 3,590 1.27 0 0.00 BLF L18 Total 14,300 0 Trading Value (VND 1,000) Ratio Ratio Buy Sell (%) (%) 6,500 335,550 0 0.00 122,340 * Table shows order-matching values only Daily StockWatch 10 Sector Classification for Listed Companies Ticker Company Full Name ABT ACB ACL AGF ALP ALT ANV ASP B82 BBC BBS BBT BCC BHS BHV BLF BMC BMI BMP BPC BT6 BTC BTH BTS BVS C92 CAN CAP CDC CIC CID CII CJC CLC CMC COM CSG Stock Listed date Exchange Bentre Aquaproduct Import and Export Joint Stock Company HOSE 12/25/2006 Asia Commercial Bank HASTC 11/21/2006 Cuulong Fish Joint Stock Company HOSE 09/05/2007 An Giang Fisheries Import and Export Joint Stock Company HOSE 05/02/2002 Alphanam Joint Stock Company HOSE 12/18/2007 Alta Company HOSE 11/22/2006 Namviet Corporation HOSE 12/07/2007 An Pha S.G Petrol Joint Stock Company HOSE 02/15/2008 Joint - Stock Company No 482 HASTC 03/17/2008 Bien Hoa Confectionary Corporation HOSE 12/19/2001 But Son Cement Packing Joint Stock Company HASTC 01/04/2006 Bach Tuyet Cotton Corporation HOSE 03/15/2004 Bim Son Cement Joint Stock Company HASTC 11/24/2006 Bien Hoa Sugar Joint Stock Company HOSE 12/20/2006 Viglacera Ba Hien Joint Stock Company HASTC 11/22/2006 Bac Lieu fisheries joint stock company HASTC 06/02/2008 Binh Dinh Minerals Joint Stock Company HOSE 12/28/2006 Bao Minh Insurance Corporation HASTC 11/28/2006 Binh Minh Plastic Joint Stock Company HOSE 07/11/2006 Bimson Packing Company HOSE 04/11/2002 620 - Chau Thoi Concrete Corporation HOSE 04/18/2002 Binh Trieu Construction and Engineering Joint Stock Company HOSE 02/18/2002 Ha Noi Transformer Manufacturing and Electric Material Joint HASTC 01/04/2008 But Son Cement Joint Stock Company HASTC 12/05/2006 Baoviet Securities Company HASTC 12/18/2006 Engineering Construction Joint Stock Company No. 492 HASTC 11/19/2007 Ha Long Canned Food Stock Corporation HOSE 10/22/2001 Yen Bai Joint Stock Forest Agricultural and Foodstuffs Company HASTC 01/09/2008 Chuong Duong Assembly Construction & Investment Joint Stock HASTC 10/25/2007 Cotec Investment Land - House Development Joint Stock HASTC 12/29/2006 Construction and Infrastructure Development Joint Stock HASTC 07/14/2005 Ho Chi Minh City Infrastructure Investment Joint Stock Company HOSE 05/18/2006 Central Area Electrical Mechanical Joint Stock Company HASTC 12/14/2006 Cat Loi Joint Stock Company HOSE 11/16/2006 Construction and Mechanical Joint-Stock Company No 1. HASTC 12/11/2006 Meterials - Petroleum Joint Stock Company HOSE 08/07/2006 Saigon Cable Corporation HASTC 05/06/2008 CTB CTN CYC DAC DAE DBC DCC DCS DCT DHA DHG Hai Duong Pump Manufacturing Joint – Stock Company Underground Works Construction JS Company- Vinavico Chang Yi Ceramic Joint Stock Company Dong Anh Ceramic Joint Stock Company Educational Book Joint Stock Company in Danang City Bac Ninh Agricultural Products Joint Stock Company Descon Construction Corporation Dai Chau Joint Stock Company Dongnai Roofsheet & Construction Material Joint Stock Company Hoa An Joint Stock Company Haugiang Pharmaceutical Joint Stock Company HASTC HASTC HOSE HASTC HASTC HASTC HOSE HASTC HOSE HOSE HOSE 10/10/2006 12/20/2006 07/31/2006 09/20/2006 12/28/2006 03/18/2008 12/12/2007 12/17/2007 10/10/2006 04/14/2004 12/21/2006 DHI DIC DMC Dien Hong Printing Joint Stock Company Dic Investment and Trading Joint Stock Company Domesco Medical Import-Export Joint Stock Company HASTC HOSE HOSE 12/04/2006 12/28/2006 12/25/2006 DNP DPC DPM DPR DQC DRC DST DTC DTT DXP DXV Dongnai Plastic Construction Joint Stock Company Da Nang Plastic Joint Stock Company Petrovietnam Fertilizer and Chemical Joint Stock Company Dong Phu Rubber Joint Stock Company Dien Quang Joint Stock Company Da Nang Rubber Joint Stock Company Nam Dinh Educational Books and Equipment Joint Stock Viglacera Dong Trieu Joint Stock Company Do Thanh Technology Corporation Doan Xa Port Joint Stock Company, Da Nang Construction Building Materials and Cement Joint Stock HOSE HOSE HOSE HOSE HOSE HOSE HASTC HASTC HOSE HOSE HOSE 12/20/2006 11/28/2001 11/05/2007 11/30/2007 02/21/2008 12/29/2006 10/16/2007 12/25/2006 12/22/2006 01/04/2006 02/26/2008 Charter Capital Sector (FPTS) (VND) 81,000,000,000 Food Producers 2,630,059,960,000 Banks 110,000,000,000 Food Producers 130,000,000,000 Food Producers 300,000,000,000 Construction & Materials 39,951,259,000 General Industrials 660,000,000,000 Food Producers 126,000,000,000 Gas, Water & Multiutilities 15,000,000,000 Construction & Materials 189,542,740,000 Food Producers 30,000,000,000 General Industrials 90,000,000,000 Personal Goods 900,000,000,000 Construction & Materials 168,477,270,000 Food Producers 9,000,000,000 Construction & Materials 50,000,000,000 Food Producers 59,013,000,000 Mining 755,000,000,000 Nonlife Insurance 139,334,000,000 Chemicals 38,000,000,000 General Industrials 109,978,500,000 Construction & Materials 13,512,860,000 Industrial Engineering 30,000,000,000 Electronic & Electrical 900,000,000,000 Construction & Materials 150,000,000,000 General Financial 12,000,000,000 Construction & Materials 50,000,000,000 Food Producers 11,000,000,000 Forestry & Paper 36,000,000,000 Construction & Materials 24,714,510,000 Construction & Materials 5,410,000,000 Construction & Materials 501,000,000,000 Construction & Materials 20,000,000,000 Industrial Engineering 100,800,000,000 General Industrials 15,200,000,000 Industrial Engineering 80,000,000,000 Oil & Gas Producers 300,000,000,000 Technology Hardware & Equipment 17,143,300,000 Industrial Engineering 48,850,000,000 Construction & Materials 90,478,550,000 Construction & Materials 7,500,000,000 Construction & Materials 6,500,000,000 Media 70,000,000,000 Food Producers 103,000,000,000 Construction & Materials 20,000,000,000 Construction & Materials 240,194,692,000 Construction & Materials 100,595,510,000 Construction & Materials 200,000,000,000 Pharmaceuticals & Biotechnology 13,831,800,000 Media 80,000,000,000 Construction & Materials 137,700,000,000 Pharmaceuticals & Biotechnology 40,000,000,000 Chemicals 32,000,000,000 Chemicals 3,800,000,000,000 Chemicals 400,000,000,000 Chemicals 157,170,000,000 Household Goods 130,389,750,000 Chemicals 10,000,000,000 Media 5,000,000,000 Construction & Materials 52,000,000,000 Chemicals 52,500,000,000 Industrial Transportation 99,000,000,000 Construction & Materials Daily StockWatch 11 Sector Classification for Listed Companies Ticker Company Full Name Stock Listed date Exchange HASTC 12/21/2006 HOSE 01/14/2008 HOSE 12/07/2006 HOSE 07/25/2006 HOSE 12/13/2006 EBS FBT FMC FPC FPT Educational Book Join Stock Company In Hanoi City Ben Tre Forestry and Aquaproduct Import - Export Joint Stock Fimex Vietnam Full Power Joint Stock Company The Corporation For Financing and Promoting Technology GHA GIL GMC GMD GTA HAI HAP HAS HAX HBC HBD HBE HCC HCT HDC HEV HHC HJS HLY HMC HNM HPC HPG HPS HRC HSC HSI HT1 HTP HTV HUT ICF IFS ILC IMP Hai Au Paper Joint Stock Company Binh Thanh Import - Export Product and Trade Joint Stock Saigon Garmex Manufacturing Trade Joint Stock Company Gemadept Corporation Thuan An Wood Processing Joint Stock Company H.A.I Joint Stock Company Hapaco Joint Stock Company Hanoi P&T Construction and Installation Joint Stock Company Hang Xanh Motors Service JSC Hoa Binh Construction & Real Estate Corporation Binh Duong Pp Pack Making Joint Stock Company. Hatinh Book and Equiptment Education Joint Stock Company Hoa Cam Concrete Joint Stock Company Hai Phong Cement Trasport and Trading Joint Stock Company Ba Ria - Vung Tau House Development Joint Stock Company Higher Educational and Vocational Book JSC. Haiha Confectionery Joint Stock Company Nam Mu Hydropower Joint Stock Company Ha Long I - Viglacera JSC Ho Chi Minh City Metal Corporation Hanoimilk Joint Stock Company Haiphong Securities Joint Stock Company Hoa Phat Group Joint Stock Company Hoa Phat Construction Stone Joint Stock Company Hoa Binh Rubber Joint Stock Company Hacinco Joint Stock Company General Materials Biochemistry Fertilizer Joint Stock Company Hatien 1 Cement Joint Stock Company Hoaphat Textbook Printing Joint Stock Company Hatien Transport Joint Stock Company Tasco Joint Stock Company Investment Commerce Fisheries Corporation Interfood Shareholding Company International Labour and Sevices Joint Stock Company Imexpharm Corporation HASTC HOSE HOSE HOSE HOSE HASTC HOSE HOSE HOSE HOSE HOSE HASTC HASTC HASTC HOSE HASTC HASTC HASTC HASTC HOSE HASTC HASTC HOSE HASTC HOSE HASTC HOSE HOSE HASTC HOSE HASTC HOSE HOSE HASTC HOSE 07/14/2005 01/02/2002 12/22/2006 04/22/2002 07/23/2007 12/27/2006 08/04/2000 12/19/2002 12/26/2006 12/27/2006 12/29/2006 02/22/2008 12/24/2007 11/27/2007 10/08/2007 12/11/2007 11/20/2007 12/20/2006 12/25/2006 12/21/2006 12/27/2006 12/15/2006 11/15/2007 12/25/2006 12/26/2006 07/14/2005 12/21/2007 11/13/2007 12/14/2006 01/05/2006 04/11/2008 12/18/2007 10/17/2006 01/02/2006 12/04/2006 ITA KBC KDC KHA KHP KLS KMF L10 L18 L62 LAF LBE LBM LGC LSS LTC LUT MCO MCP MCV MEC MHC MIC Tan Tao Industrial Park Corporation Kinhbac City Development Share Holding Corporation Kinh Do Corporation Khanh Hoi Import Export Joint Stock Company. Khanh Hoa Power Joint - Stock Company Kim Long Securities Corporation Mirae Fiber Joint Stock Company Lilama 10 Joint Stock Company Construction and Investment Joint Stock Company No 18 Lilama 69-2 Joint Stock Company Long An Food Processing Export Joint Stock Company Long An School Book and Equipment Joint Stock Company Lam Dong Building Materials Joint Stock Company Lugia Mechanical Electric Jointstock Company Lam Son Sugar Joint Stock Corporation Low Current - Telecom Joint Stock Company Luong Tai Construction Joint Stock Company Investment and Construction JSC No.1 My Chau Printing & Packaging Holdings Co Cavico Vietnam Mining and Construction Joint Stock Company Song Da Mechanical Assembling Joint Stock Company Hanoi Maritime Holding Company Quang Nam Mineral Industry Corporation HOSE HASTC HOSE HOSE HOSE HASTC HASTC HOSE HASTC HASTC HOSE HASTC HOSE HOSE HOSE HASTC HASTC HASTC HOSE HOSE HASTC HOSE HASTC 11/15/2006 12/18/2007 12/12/2005 08/19/2002 01/04/2006 01/28/2008 12/14/2007 12/25/2007 04/23/2008 04/21/2008 12/15/2000 02/22/2008 12/20/2006 12/27/2006 01/09/2008 12/14/2006 01/04/2008 12/21/2006 12/28/2006 12/11/2006 12/14/2006 03/21/2005 12/24/2007 Charter Capital (VND) 25,548,710,000 150,000,000,000 89,000,000,000 329,999,910,000 923,525,790,000 Sector (FPTS) Media Food Producers Food Producers Construction & Materials Technology Hardware & Equipment 12,894,800,000 Forestry & Paper 102,285,000,000 Personal Goods 46,694,970,000 Personal Goods 455,000,000,000 Industrial Transportation 104,000,000,000 Construction & Materials 114,000,000,000 Chemicals 240,002,510,000 Forestry & Paper 60,000,000,000 Construction & Materials 45,000,000,000 Automobiles & Parts 178,600,100,000 Construction & Materials 30,750,000,000 General Industrials 10,000,000,000 Media 16,228,020,000 Construction & Materials 10,415,580,000 Industrial Transportation 81,280,000,000 Real Estate 10,000,000,000 Media 54,750,000,000 Food Producers 60,000,000,000 Electricity 5,000,000,000 Construction & Materials 205,400,000,000 Industrial Metals 70,495,000,000 Food Producers 112,817,800,000 General Financial 1,320,000,000,000 Industrial Metals 15,652,500,000 Construction & Materials 172,800,000,000 Chemicals 5,800,000,000 Travel & Leisure 100,000,000,000 Chemicals 870,000,000,000 Construction & Materials 12,600,000,000 Media 100,800,000,000 Industrial Transportation 55,000,000,000 Construction & Materials 368,000,000,000 Food Producers 291,409,920,000 Food Producers 40,740,510,204 Industrial Transportation 116,598,200,000 Pharmaceuticals & Biotechnology 1,149,982,000,000 Real Estate 1,000,000,000,000 Real Estate 469,982,250,000 Food Producers 141,204,690,000 Real Estate 174,090,860,000 Electricity 315,000,000,000 General Financial 103,830,540,000 Personal Goods 90,000,000,000 Industrial Engineering 35,000,000,000 Construction & Materials 30,000,000,000 Industrial Engineering 57,989,010,000 Food Producers 11,000,000,000 Media 41,355,600,000 Construction & Materials 30,000,000,000 Electricity 300,000,000,000 Food Producers 15,000,000,000 Construction & Materials 55,500,000,000 Construction & Materials 23,999,960,000 Construction & Materials 50,000,000,000 General Industrials 69,000,000,000 Mining 40,000,000,000 Construction & Materials 140,820,000,000 Industrial Transportation 12,950,000,000 Mining Daily StockWatch 12 Sector Classification for Listed Companies Ticker Company Full Name Stock Listed date Exchange HOSE 12/20/2007 HOSE 12/22/2006 HASTC 12/27/2006 HASTC 03/06/2008 HOSE 12/16/2005 HOSE 12/15/2004 HASTC 12/14/2006 HASTC 12/27/2006 HOSE 12/21/2006 HASTC 12/29/2006 HOSE 12/21/2007 HASTC 12/11/2006 HASTC 01/24/2008 HOSE 12/12/2006 HASTC 12/22/2006 HOSE 09/12/2007 Charter Capital (VND) 700,000,000,000 80,000,000,000 60,000,000,000 10,000,000,000 14,249,960,000 100,797,820,000 50,000,000,000 10,593,000,000 60,000,000,000 30,331,330,000 82,000,000,000 216,689,980,000 160,000,000,000 150,000,000,000 70,000,000,000 482,535,000,000 MPC NAV NBC NGC NHC NKD NLC NPS NSC NST NTL NTP NVC PAC PAN PET Minh Phu Seafood Joint Stock Company Nam Viet Joint – Stock Company Vinacomin– Nui Beo Coal Joint Stock Company Ngoquyen Processing Export Joint Stock Company Nhi Hiep Brick Tile Joint Stock Company North Kingdo Food Joint Stock Company Naloi Hydropower Joint Stock Company Phu Thinh - Nha Be Garment Joint Stock Company Nationak Seed Joint Stock Company Ngan Son Joint Stock Company Tu Liem Urban Development Joint Stock Company Tien Phong Plastic Joint Stock Company Namvang Corporation Dry Cell and Storage Battery Joint Stock Company Pan Pacific Corporation Petrovietnam General Services JS Corporation PGC Petrolimex Gas Joint Stock Company HOSE 11/24/2006 250,000,000,000 PGS PIT PJC PJT PLC PMS Petro Vietnam Southern Gas Joint Stock Company Petrolimex International Trading Joint-Stock Company Petrolimex Hanoi Transportation and Trading Joint Stock Petrolimex Joint Stock Tanker Company Petrolimex Petrochemical Joint Stock Company Petrolimex Mechanical Joint Stock Company HASTC HOSE HASTC HOSE HASTC HOSE 11/15/2007 01/24/2008 12/25/2006 12/28/2006 12/27/2006 11/04/2003 150,000,000,000 97,704,790,000 15,631,500,000 70,000,000,000 160,561,000,000 52,000,000,000 PNC Phuong Nam Cultural Joint Stock Corporation HOSE 07/11/2005 65,000,000,000 POT Post and Telecommunication Equipment Factory HASTC 12/20/2006 PPC PPG PRUBF PSC PTC PTS PVC Pha Lai Thermal Power Joint Stock Company Phu Phong Corporation Prudential Balanced Fund Petrolimex Saigon Transportation and Services Joint Stock Post and Telecommunication Investment and Construction Joint Hai Phong Petrolimex Transportation and Services Joint Stock Drilling Mud Joint Stock Company HOSE HASTC HOSE HASTC HASTC HASTC HASTC 05/19/2006 12/20/2006 10/04/2006 12/29/2006 12/25/2006 12/01/2006 11/15/2007 PVD Petrovietnam Drilling and Well Services Joint Stock Company HOSE 12/05/2006 PVE PVI PVS Petrovietnam Investment Consultancy and Engineering Joint Petrovietnam Insurance Joint Stock Company Petroleum Technical Services Corporation HASTC HASTC HASTC 01/02/2008 08/10/2007 09/20/2007 PVT QNC RAL RCL REE RHC RIC S12 S55 S64 S91 S96 S99 SAF SAM Petrovietnam Transportation Corporation Quang Ninh Construction and Cement Joint Stock Company Rangdong Light Source and Vacuum Flask Joint Stock Company Cholon Real Estate Joint Stock Company Ree Corporation Ry Ninh Ii Hydroelectric Joint Stock Company Royal International Corporation Song Da No. 12 Joint Stock Company Song Da 505 Joint Stock Company Song Da 6.04 Joint Stock Company Song Da 9.01 Joint Stock Company Song Da 9.06 Joint Stock Company Song Da 909 Joint Stock Company Safoco Foodstuff Joint Stock Company Cables and Telecommunications Material Joint Stock Company HOSE HASTC HOSE HASTC HOSE HOSE HOSE HASTC HASTC HASTC HASTC HASTC HASTC HOSE HOSE 12/10/2007 01/17/2008 12/06/2006 06/14/2007 07/28/2000 06/15/2006 07/31/2007 01/16/2008 12/22/2006 12/25/2006 12/20/2006 01/09/2008 12/22/2006 12/28/2006 07/28/2000 SAP SAV SBT SC5 SCC Textbook Printing Joint Stock Company In Ho Chi Minh City Savimex Corporation Sucrerie De Bourbon Tay Ninh Construction Joint Stock Company No 5 Song Da Cement Joint Stock Company HASTC HOSE HOSE HOSE HASTC 12/14/2006 05/09/2002 02/25/2008 10/18/2007 12/20/2006 Sector (FPTS) Food Producers Construction & Materials Mining Food Producers Construction & Materials Food Producers Electricity Personal Goods Food Producers Tobacco Real Estate Chemicals Industrial Metals Electronic & Electrical Support Services Oil Equipment, Services & Distribution Oil Equipment, Services & Distribution Gas, Water & Multiutilities Food Producers General Retailers Industrial Transportation General Retailers Oil Equipment, Services & Distribution General Retailers 180,000,000,000 Technology Hardware & Equipment 3,252,350,000,000 Electricity 40,000,000,000 Construction & Materials 500,000,000,000 Equity Investment 12,900,000,000 General Retailers 100,000,000,000 Construction & Materials 17,400,000,000 Industrial Transportation 120,000,000,000 Oil Equipment, Services & Distribution 1,101,400,000,000 Oil Equipment, Services & Distribution 34,519,960,000 Construction & Materials 847,986,280,000 Nonlife Insurance 1,000,000,000,000 Oil Equipment, Services & Distribution 720,000,000,000 Industrial Transportation 125,000,000,000 Construction & Materials 115,000,000,000 Household Goods 15,000,000,000 Real Estate 575,149,920,000 Construction & Materials 32,000,000,000 Electricity 410,319,760,000 Travel & Leisure 50,000,000,000 Construction & Materials 7,000,000,000 Construction & Materials 7,000,000,000 Construction & Materials 15,000,000,000 Construction & Materials 25,000,000,000 Construction & Materials 15,000,000,000 Construction & Materials 27,060,000,000 Food Producers 654,000,000,000 Technology Hardware & Equipment 11,700,000,000 Media 100,000,000,000 Household Goods 1,419,258,000,000 Food Producers 86,000,000,000 Construction & Materials 19,800,000,000 Construction & Materials Daily StockWatch 13 Sector Classification for Listed Companies Ticker Company Full Name SCD SCJ SD2 SD3 SD5 SD6 SD7 SD9 SDA SDC SDD SDJ SDN SDT SDY SFC SFI SFN SGC SGD SGH SGT Stock Listed date Exchange Chuong Duong Beverages Company HOSE 12/25/2006 Sai Son Cement Joint Stock Company HASTC 09/19/2007 Song Da 2 Joint Stock Company HASTC 11/30/2007 Song Da 3 Joint Stock Company HASTC 12/25/2006 Song Da No. 5 Joint Stock Company HASTC 12/27/2006 Song Da No 6 Joint Stock Company HASTC 12/25/2006 Song Da No 7 Joint Stock Company HASTC 12/27/2006 Song Da No 9 Joint Stock Company HASTC 12/20/2006 Song Da International Manpower Supply and Trading Joint Stock HASTC 12/21/2006 Song Da Consulting Joint Stock Company HASTC 12/25/2006 Song Da Investment and Construction Joint Stock Company HASTC 01/23/2008 Song Da 25 Joint Stock Company HASTC 12/25/2007 Dong Nai Paint Corporation HOSE 12/25/2006 Song Da N0 10 Joint Stock Company HASTC 12/14/2006 Song Da Yaly Cement Joint Stock Company HASTC 12/25/2006 Sai Gon Fuel Company HOSE 09/21/2004 Sea & Air Freight International HOSE 12/29/2006 Saigon Fishing Net Joint Stock Company HOSE 12/28/2006 Sa Giang Import Export Corporation HOSE 09/05/2006 Educational Book Joint Stock Company in Ho Chi Minh City HASTC 12/28/2006 Saigon Hotel Corporation HOSE 07/16/2001 Saigon Telecommunication & Technologies Corporation HOSE 01/18/2008 SHC SIC SJ1 SJC SJD SJE SJM SJS SMC SNG SRA Saigon Maritime Joint Stock Co.Ltd Song Da Investment- Development Joint Stock Company Seafood Joint Stock Company No 1 Song Da 1.01 Joint Stock Company Can Don Hydro Power Joint Stock Company Song Da No 11 Joint Stock Company Song Da 19 Joint Stock Company Song Da Urban & Industrial Zone Investment and Development Smc Investment Trading Joint Stock Company Song Da No 1 Joint Stock Company Sara Vietnam Joint Stock Company HOSE HASTC HOSE HASTC HOSE HASTC HASTC HOSE HOSE HASTC HASTC 08/15/2006 12/27/2006 12/29/2006 11/21/2007 12/25/2006 12/14/2006 01/10/2008 07/06/2006 10/30/2006 12/25/2006 01/18/2008 SRB SSC SSI SSS ST8 Sara Joint Stock Company Southern Seed Joint Stock Company Sai Gon Securities Inc. Song Da No 6.06 Joint Stock Company Sieu Thanh Join-Stock Corporation HASTC HOSE HOSE HASTC HOSE 03/17/2008 03/01/2005 12/15/2006 08/29/2007 12/18/2007 STB STC STP SVC TAC TBC TCM TCR TCT TDH TJC TKU TLC TLT TMC TMS TNA TNC TNG TPC TPH TRC TRI Saigon Thuong Tin Commercial Joint Stock Bank Book and Educational Equipment Joint Stock Company Song Da Industry Trade Joint Stock Company Sai Gon General Service Corporation Tuong An Vegetable Oil Joint – Stock Company Thac Ba Hydropower Joint Stock Company Thanh Cong Textile Garment Joint Stock Company Taicera Enterprise Company Tay Ninh Cable Car Tour Company Thu Duc Housing Development Corporation Transporation and Trading Services Joint Stock Company Tung Kuang Industrial Joint Stock Company Thang Long Telecommunications Joint-Stock Company Viglacera Thang Long Ceramic Tiles Joint - Stock Company Thu Duc Trading and Import Export Joint Stock Company Transforwarding Warehouse Joint Stock Company Thien Nam Trading & Import-Export Corporation Thong Nhat Rubber Company Tng Investment and Trading Joint Stock Company Tan Dai Hung Plastic Joint Stock Company Hanoi Texbooks Printing Joint Stock Company Tay Ninh Rubber Joint Stock Company Saigon Beverages Joint Stock Company HOSE HASTC HASTC HASTC HOSE HASTC HOSE HOSE HOSE HOSE HASTC HASTC HASTC HASTC HOSE HOSE HOSE HOSE HASTC HOSE HASTC HOSE HOSE 07/12/2006 12/27/2006 10/09/2006 12/21/2006 12/26/2006 08/29/2006 10/15/2007 12/29/2006 12/06/2006 12/14/2006 12/17/2007 06/26/2006 12/28/2006 12/08/2006 12/26/2006 08/04/2000 07/20/2005 08/22/2007 11/22/2007 11/28/2007 12/15/2006 07/24/2007 12/28/2001 Charter Capital (VND) 85,000,000,000 27,742,000,000 35,000,000,000 20,000,000,000 60,940,000,000 44,777,000,000 15,000,000,000 150,000,000,000 70,000,000,000 10,000,000,000 50,000,000,000 18,384,000,000 27,220,000,000 117,000,000,000 15,000,000,000 34,000,000,000 31,385,000,000 30,000,000,000 40,887,000,000 15,000,000,000 17,663,000,000 630,000,000,000 Sector (FPTS) Beverages Construction & Materials Construction & Materials Construction & Materials Construction & Materials Construction & Materials Construction & Materials Construction & Materials Support Services Construction & Materials Construction & Materials Construction & Materials Construction & Materials Construction & Materials Construction & Materials General Retailers Industrial Transportation Support Services Food Producers Media Travel & Leisure Software & Computer Services 30,000,000,000 Industrial Transportation 50,000,000,000 Real Estate 35,000,000,000 Food Producers 21,100,000,000 Construction & Materials 260,000,000,000 Electricity 50,000,000,000 Construction & Materials 15,000,000,000 Construction & Materials 400,000,000,000 Real Estate 109,943,009,000 Industrial Metals 19,000,000,000 Construction & Materials 10,000,000,000 Software & Computer Services 56,500,000,000 Support Services 100,000,000,000 Food Producers 1,366,678,750,000 General Financial 25,000,000,000 Construction & Materials 82,000,000,000 Technology Hardware & Equipment 4,448,814,170,000 Banks 28,800,000,000 General Retailers 35,000,000,000 General Industrials 148,734,100,000 General Retailers 189,802,000,000 Food Producers 635,000,000,000 Electricity 189,824,970,000 Personal Goods 335,703,440,000 Construction & Materials 15,985,000,000 Travel & Leisure 221,000,000,000 Real Estate 30,000,000,000 Industrial Transportation 163,910,450,000 Industrial Metals 99,800,000,000 Electronic & Electrical 22,500,000,000 Construction & Materials 35,545,070,000 General Retailers 63,480,000,000 Industrial Transportation 33,000,000,000 General Retailers 192,500,000,000 Chemicals 80,000,000,000 Personal Goods 104,000,000,000 General Industrials 18,000,000,000 Media 300,000,000,000 Chemicals 115,483,600,000 Beverages Daily StockWatch 14 Sector Classification for Listed Companies Ticker Company Full Name Stock Listed date Exchange HOSE 08/08/2002 HOSE 10/04/2007 HASTC 12/13/2007 TS4 TSC TST Seafood Joint Stock Company N0 4 Techno - Agricultural Supplying Joint Stock Company Telecommunication Technical Service Joint Stock Company TTC TTF TTP TXM TYA UIC UNI Thanh Thanh Joint Stock Company Truong Thanh Furniture Corporation Tan Tien Plastic Packaging Joint Stock Company Gypsum and Cement Joint Stock Company Taya (Vietnam) Electric Wire and Cable Joint Stock Company Idico Urban and House Development Joint Stock Company Vien Lien Joint Stock Company HOSE HOSE HOSE HASTC HOSE HOSE HOSE 08/08/2006 02/18/2008 12/05/2006 12/11/2006 02/15/2006 11/12/2007 07/03/2006 VBH VC2 VC3 VC5 VC6 VC7 VCS VDL VE9 VF1 Viettronics Binh Hoa Joint Stock Company Viet Nam Construction Joint Stock Company No2 Construction Joint Stock Company No. 3 Construction Joint Stock Company No. 5 Vinaconex 6 Joint Stock Company No. 7 Vietnam Construction Joint Stock Company Vinaconex Advanced Compound Stone Joint Stock Company Lamdong Foodstuffs Joint-Stock Company Vneco 9 Electricity Construction Joint Stock Company Vietnam Securities Investment Fund HASTC HASTC HASTC HASTC HASTC HASTC HASTC HASTC HASTC HOSE 12/29/2006 12/11/2006 12/13/2007 01/16/2008 01/28/2008 12/28/2007 12/17/2007 11/27/2007 01/23/2008 11/08/2004 VFC VFR VGP VHC VHG Vinafco Joint Stock Corporation Transport and Chartering Corporation The Vegetexco Port Joint Stock Company Vinh Hoan Corporation Viet- Han Corporation HOSE HASTC HOSE HOSE HOSE 07/24/2006 12/28/2006 12/21/2006 12/24/2007 01/28/2008 VIC VID VIP VIS VMC VNC VNE VNM VNR VPK VPL VSC VSH VSP VTA VTB VTC Vincom Joint Stock Company Vien Dong Paper Joint Stock Company Vietnam Petroleum Transport Joint Stock Company Vietnam-Italy Steel Joint Stock Company Machinery Erection and Construction Joint Stock Company The Vietnam Superintendence and Inspection Joint Stock Vietnam Electricity Construction Joint Stock Company Vinamilk Vietnam National Reinsurance Corporation Vegetable Oil Packing Joint Stock Company Vinpearl Tourism and Trading Joint Stock Company Vietnam Container Shipping Joint Stock Company Vinh Son - Song Hinh Hydropower Joint Stock Company Vinashin Petroleum Investment and Transport Joint Stock Vitaly Joint Stock Company Viettronics Tanbinh JSC Vtc Telecommunications Joint Stock Company HOSE HOSE HOSE HOSE HASTC HASTC HOSE HOSE HASTC HOSE HOSE HOSE HOSE HASTC HOSE HOSE HOSE 09/19/2007 12/25/2006 12/21/2006 12/25/2006 12/11/2006 12/21/2006 08/09/2007 01/19/2006 03/13/2006 12/21/2006 01/31/2008 01/09/2008 01/04/2006 12/25/2006 12/29/2006 12/27/2006 02/12/2003 VTL VTO VTS VTV XMC YBC YSC Thang Long Joint Stock Company Vietnam Tanker Joint Stock Company Viglacera Tu Son Ceramic Joint-Stock Company Cement Materials and Transportation JSC Vinaconex Xuan Mai Concrete & Construction Joint Stock Yen Bai Cement and mineral joint stock company Hapaco Yen Son Joint Stock Company HASTC HOSE HASTC HASTC HASTC HASTC HASTC 07/14/2005 10/09/2007 09/20/2006 12/18/2006 12/20/2007 05/20/2008 12/29/2006 Charter Capital Sector (FPTS) (VND) 84,425,325,000 Food Producers 83,129,150,000 Chemicals 48,000,000,000 Technology Hardware & Equipment 60,000,000,000 Construction & Materials 150,000,000,000 Household Goods 149,550,000,000 General Industrials 35,000,000,000 Construction & Materials 265,668,440,000 Electronic & Electrical 80,000,000,000 Electricity 100,000,000,000 Technology Hardware & Equipment 29,000,000,000 Electronic & Electrical 50,000,000,000 Construction & Materials 80,000,000,000 Construction & Materials 50,000,000,000 Construction & Materials 50,000,000,000 Construction & Materials 50,000,000,000 Construction & Materials 100,000,000,000 Construction & Materials 12,000,000,000 Food Producers 31,000,000,000 Construction & Materials 300,000,000,000 Equity Investment Instruments 200,000,000,000 Industrial Transportation 150,000,000,000 Industrial Transportation 62,016,080,000 Industrial Transportation 300,000,000,000 Food Producers 250,000,000,000 Technology Hardware & Equipment 1,200,000,000,000 Real Estate 195,000,000,000 Forestry & Paper 598,077,850,000 Industrial Transportation 200,000,000,000 Industrial Metals 35,000,000,000 Construction & Materials 52,500,000,000 Support Services 320,000,000,000 Construction & Materials 1,752,756,700,000 Food Producers 343,000,000,000 Nonlife Insurance 76,000,000,000 General Industrials 1,000,000,000,000 Travel & Leisure 80,373,340,000 Industrial Transportation 1,500,000,000,000 Electricity 40,000,000,000 Oil & Gas Producers 60,000,000,000 Construction & Materials 120,000,000,000 Leisure Goods 40,426,900,000 Technology Hardware & Equipment 18,000,000,000 Beverages 600,000,000,000 Industrial Transportation 11,100,000,000 Construction & Materials 25,000,000,000 Industrial Transportation 100,000,000,000 Construction & Materials 22,108,800,000 Construction & Materials 7,300,000,000 Forestry & Paper This material is for reference only. In no event shall FPTS be liable for any damages or losses in connection with the use of the material or the inability to use the material. Daily StockWatch 15

© Copyright 2026