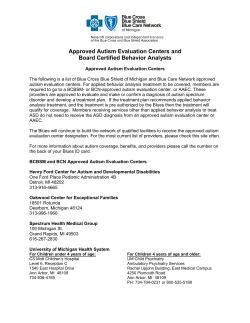

BCN Advantage BCN Provider Manual Contents