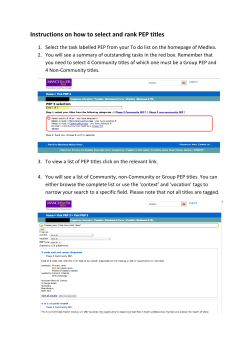

Land Titles Registration Practice Manual