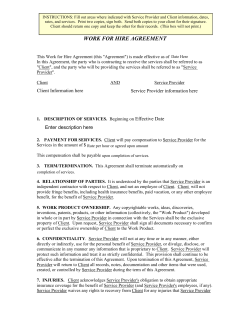

First+Plus Provider Manual 2014