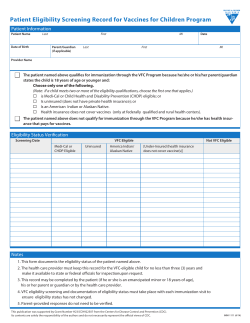

Eligibility Documentation