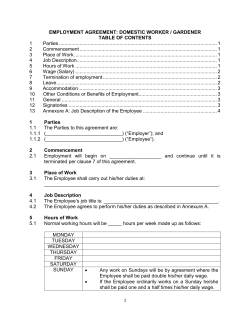

DIVISION OF LABOR STANDARDS ENFORCEMENT