ax Ohio T Workshop N

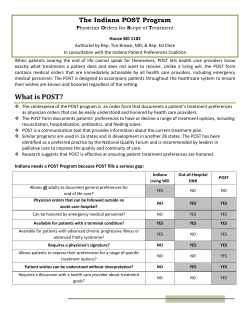

Ohio Tax Workshop N Kentucky & Indiana Business Tax Update … What’s Going On and How to Benefit from It Tuesday, January 28, 2014 3:00 p.m. to 4:00 p.m. Biographical Information Kevin Zins, Partner, Grant Thornton 4000 Smith Road, Suite 500 Cincinnati, OH 45209 [email protected] 513.345.4528 Fax 513.241.6125 His experience covers both industrial and consumer products businesses. Outside of public accounting, Mr. Zins’ experience includes approximately four years in the accounting and tax department of Cintas Corporation, a corporate identity uniform manufacturer, distributor and industrial laundry service company with operations in about 40 states. Mr. Zins has a broad base of federal tax, state tax and project management experience. Industry experience Conducts multi-state tax return reviews for income, franchise, sales/use and payroll taxes; identifies state tax credit opportunities; develops, designs and implements strategic tax planning services for large and mid-size, multi-state corporations; participates in due diligence reviews relating to restructuring transactions (including acquisitions, divestitures and mergers) and conducts nexus reviews and negotiates voluntary disclosure agreements to minimize liabilities and exposures; negotiates for audit defense, including representing clients for income, sales and use, and property tax challenges Professional qualifications and memberships American Institute of Certified Public Accountants Ohio, Kentucky and Indiana Societies of Certified Public Accountants Ohio and Kentucky Societies of Certified Public Accountants Tax Committee Member (2005 current) Ohio and Kentucky Chamber of Commerce Tax Committee Member (2005 – current) Education Bachelor of Business Administration – Accounting - Bowling Green State University Mark Loyd, Partner & Chair, Tax & Finance Group, Bingham Greenebaum Doll LLP 3500 National City Tower, 101 South Fifth Street, Louisville, Kentucky 40202 [email protected] 502-587-3552 Fax: 502-540-2245 Mark A. Loyd, ESQ., is a partner and Chair of the Tax and Finance Group of Bingham Greenebaum Doll LLP, a regional business law firm with offices in Kentucky, Indiana and Ohio. His areas of practice concentration are state, local and federal taxation, tax litigation, tax controversy resolution and tax planning for multistate and multinational companies. He is licensed to practice law in Kentucky, Indiana, Ohio and Tennessee. Prior to joining BGD, Mark managed the state and local tax function for Brown & Williamson Tobacco Corporation, a multi-state, multi-billion dollar corporation and U.S. subsidiary of British American Tobacco. Mark is also a Certified Public Accountant, having begun his career with Coopers & Lybrand, now PricewaterhouseCoopers. Mark is the Co-Chair of the ABA/IPT Advanced Property Tax Seminar, Co-Chair of IPT’s Basic Income Tax School, and Chair of the Editorial Board of The Kentucky CPA Journal, among other endeavors. Mark also serves as the Chair of the Board of Directors of Park Community Credit Union, a $600 million dollar financial institution. He is a past Chair of the Tax Section of the Kentucky Bar Association, a past Chair of the Tax Section of the Louisville Bar Association, and a past Chair of the Kentucky Society of Certified Public Accountants’ Taxation Committee and is also a former member of the KyCPA’s Board of Directors and former Chair of its Educational Foundation. He has written extensively on tax matters in publications such as The Tax Lawyer, the Journal of State Taxation, The Kentucky CPA Journal, and State Tax Notes, among others. He has been a speaker and panelist on various tax matters at conferences, forums and for groups such as IPT, ABA, the Federation of Tax Administrators and others. Mark received his J.D. degree, magna cum laude, from the University of Louisville’s Louis D. Brandeis School of Law, where he was Class Salutatorian. He also has an M.B.A., with distinction, from the University of Louisville and is a graduate of Bellarmine University where he received his B.A. in Accounting, summa cum laude. Kentucky & Indiana Business Tax Update: What’s Going On and How to Benefit From It 23rd Annual Ohio Tax Conference, Columbus, Ohio Workshop N January 28, 2014 Mark A. Loyd Chair, Tax & Finance Practice Group [email protected] Kevin M. Zins Partner and Practice Leader, State and Local Tax [email protected] January 29, 2013 Presenters KEVIN M. ZINS, CPA Partner and Practice Leader, State and Local Tax Grant Thornton LLP 4000 Smith Road, Suite 500 Cincinnati, OH 45209‐1967 (513) 345‐4528 – Phone (513) 241‐6125 – Fax [email protected] – E‐mail www.grantthornton.com – Web www.grantthornton.com Mark A. Loyd, Esq. Partner and Chair, Tax & Finance Practice Group Bingham Greenebaum Doll LLP 101 South Fifth Street, 3500 National City Tower Louisville, KY 40202 (502) 587‐3552 – Phone (502) 540‐2245 – Fax [email protected] – E‐Mail www.bgdlegal.com ‐ Web www.bgdlegal.com • Kentucky Update 3 www.grantthornton.com www.grantthornton.com 3 www.bgdlegal.com Kentucky Administrative Developments Limited Liability Entity Tax Assessments LLET (Limited Liability Entity Tax) Assessments • Kentucky Department of Revenue Conducting Desk Audits • KDOR Disallows Use of Gross Profits Method, i.e., All Cost of Goods Sold • KDOR Disallows Certain COGS Deductions, Allowing Only Deductions for Materials and Direct Labor • Sending Assessments Without Prior Contact • Businesses Should • Avoid Reporting Expenses as “Other” or “Miscellaneous” • Protest Any Inaccurate or Erroneous Assessment Page 4 4 www.grantthornton.com www.bgdlegal.com Kentucky Tax Amnesty Kentucky Tax Amnesty Program Amnesty Background 5 • Conducted by KDOR from 10/1/12 – 11/30/12 • Taxable periods 12/1/01 – 10/1/11 • Available for all Kentucky taxes except certain ad valorem taxes on real property, personal property, motor vehicles and motor boats, and penalties for cigarette tax violations • Waived all penalties (civil and criminal) & ½ interest • Add’l interest, penalties & “cost‐of‐collection” fees www.grantthornton.com www.bgdlegal.com Kentucky Tax Amnesty Post‐Amnesty Issues . . . . • Disallowed Amnesty • “Cost‐of‐Collection Fees” . . . Penalties! • 6 • 25% of taxes which are assessed and collected after the amnesty period for taxable periods ending or transactions occurring prior to October 1, 2011 – at time of assessment! • 50% for taxpayer who failed to file a return for tax period for which amnesty was available • 25% of taxes which are or become due and owing for any reporting period, regardless of when due Additional 2% interest rate www.grantthornton.com www.bgdlegal.com Kentucky Tax Case Developments Income Tax – Recycling Credit • Dep’t of Revenue v. Bavarian Trucking Co., Inc. No. 2011‐CA‐002198 (Ky. App May 24, 2013), rev’g, Civil Action No. 10‐CI‐3173 (Boone Cir. Ct., Div. I, Nov. 14, 2011), aff’g, File No. K09‐ R‐16, Order No. K‐21008 (KBTA Dec. 9, 2010) • 7 Holding: Equipment used in collecting methane gas generated by landfill waste which is later burned to generate electricity is not eligible for the recycling or composting equipment credit www.grantthornton.com www.bgdlegal.com Kentucky Tax Case Developments Income Tax – Ethanol Tax Credit • Dep’t of Revenue v. Commonwealth Agri‐Energy, LLC, 2011‐CA‐000512‐MR (Ky. App. Nov. 16, 2012) (not to be published), motion for discretionary review denied, No. 2012‐SC‐ 822‐D (Ky. Sept. 18, 2013) 8 • Holding: Ethanol tax credit application was timely filed, even though the application was filed after the deadline required by statute, because the Department had not issued the reporting form and made it official until after the filing deadline had passed • Takeaway: This case is more about the application process than the underlying credit. www.grantthornton.com www.bgdlegal.com Kentucky Tax Case Developments Transactional Tax (Sales and Use Tax and UGRLT) • Ohio Valley Aluminum Co. v. Dep’t of Revenue No. 2013‐CA‐000507 (Ct. App. Mar. 15, 2013), on appeal from Civil Action No. 12‐CI‐368 (Shelby Cir. Ct., Jun. 12, 2012), aff’g, File Nos. K10‐R‐35 & K10‐R‐36, Order No. K‐22086 (KBTA May 22, 2012) • Holding: Parent company (toller of aluminum billets) could not exclude the cost of raw materials from its “cost of production” for purposes of an exemption from sales and use tax and UGRLT paid on the cost of energy pursuant to KRS 139.480(3) and KRS 160.613(1) when the owner and purchaser of the raw materials to be processed by parent is its wholly‐owned subsidiary Raw Material Ohio Valley Toller MFR Finished Goods OVACO (Owner of Aluminum) 9 www.grantthornton.com www.bgdlegal.com Kentucky Tax Case Developments Transactional Tax (Sales and Use Tax) • Progress Metal Reclamation Co. v. Dep’t of Revenue Civil Action Nos. 12‐CI‐637 & 12‐CI‐805 (Franklin Cir. Ct. Sept. 23, 2013), aff’g, Order No. K‐22015, File No. K11‐R‐03 (KBTA Apr. 18, 2012) 10 • Holding: Liquid oxygen used by taxpayer in cutting torch was exempt from sales and use tax as an industrial supply. A hammer pin (used by taxpayer to hold hammer in place on rotor which turns to break up metal) was not an industrial tool pursuant to KRS 139.470(11), and thus, not exempt from sales and use tax. • Takeaway: Case example of commonly disputed exemption. www.grantthornton.com www.bgdlegal.com Kentucky Tax Case Developments Transactional Tax (Sales and Use Tax) • Ace Clinique of Medicine, LLC v. Dep’t of Revenue File No. K11‐R‐15, Order No. K‐24090 (KBTA Sept. 24, 2013) • 11 Holding: The KBTA held that taxpayer’s aircraft was subject to Kentucky use tax when it purchased the aircraft from an out‐of‐state company. Taxpayer argued that the company from which it purchased the aircraft was not a retailer under KRS 139.330, and even if it was, the purchase was exempt as an occasional sale. www.grantthornton.com www.bgdlegal.com Kentucky Tax Case Developments Property Tax • Dep’t of Revenue v. Cox Interior, Inc. 400 S.W.3d 240 (Ky. June 20, 2013) 12 • Holding: A taxpayer is entitled to a refund of its payment of a tangible personal property tax assessed despite not protesting the assessment prior to paying the taxes. • Takeaway: Example of a case where the taxpayer had to fight all the way to the Kentucky Supreme Court to get to the right answer. www.grantthornton.com www.bgdlegal.com Kentucky Tax Case Developments Miscellaneous Tax (Property – Public Service Co. Tax) • Dayton Power & Light Co. v. Dep’t of Revenue 405 S.W.3d 527 (Ky. App., Nov. 2, 2012), discretionary review denied, (Ky. Aug. 21, 2013) 13 • Holding: The Department was correct in taxing a public service company’s (“PSC”) franchise as separate from the PSC, resulting in a higher tax rate for the franchise and subjecting it to local taxation. • Takeaway: The Department had previously computed the PSC tax by allocating the franchise value to each asset thus exempting the portion of the franchise related to that asset. This is effectively an across the board tax increase on all PSCs. www.grantthornton.com www.bgdlegal.com Kentucky Tax Case Developments Property Tax • Pinkerton Tobacco Co. v. Dep’t of Revenue File No. K11‐R‐20, Order No. K‐23033 (KBTA Mar. 27, 2013), on appeal, No. 13‐CI‐00480 (Franklin Cir. Ct.) 14 • Holding: Taxpayer was exempt from ad valorem taxation after it reasonably demonstrated that its tobacco products will be shipped to an out‐of‐state destination within six months of manufacture. • Takeaway: Examine your inventory classification on your property tax return. www.grantthornton.com www.bgdlegal.com Kentucky Tax Case Developments Property Tax • Dep’t of Revenue v. Petrotek, LLC, et. al. No. 2013‐CA‐001152 (Ky. App.), on appeal from Civil Action No. 12‐CI‐49 (Franklin Cir. Ct. June 4, 2013), aff’g, Order No. K‐21660, File Nos. K09‐R‐34, K09‐R‐35, K09‐R‐36, K09‐R‐37, K09‐R‐38, K09‐R‐39, K09‐R‐40, and K09‐R‐341 (KBTA, Dec. 15, 2011) 15 • Holding: In determining the 2009 property tax valuations of four oil wells, the Department was incorrect in using 2008 values in the standard formula [total value of oil produced x % interest x revenue factor x allowance credit]. The Department should have instead used the actual production records for calendar year 2009 which showed a significant decline in production from 2008. • Takeaway: This is a valuation case. www.grantthornton.com www.bgdlegal.com Kentucky Tax Case Developments Real Property Tax • College Heights Corporation v. Kentucky Board of Tax Appeals 2011‐CA‐000546‐MR (Ky. App. Feb. 22, 2013) (Not to be Published), rev’g, Civil Action No. 10‐CI‐00285 (Knox Cir. Ct. Feb. 28, 2011) 16 • Holding: The valuation method used by the Property Valuation Board’s hearing officer lacked substantial evidence when the method was outside the guidelines of the Uniform Standards of Professional Appraisal Practice and relied on comparable property, despite the fact that no comparable properties were used in the valuation. • Takeaway: USPAP matters. www.grantthornton.com www.bgdlegal.com Kentucky Tax Legislation Income Taxes • HB 440 17 • Management Fees: Requires the same disclosure and burden of proof standards to deduct management fees paid to a related entity, a foreign corporation, or a member of an affiliated group that are required for intangible expenses and interest expenses. • Effective for tax years beginning on or after January 1, 2013. • KDOR released Schedule RPC for tax years beginning on or after January 1, 2012. www.grantthornton.com www.bgdlegal.com Kentucky Tax Legislation Sales and Use Tax • HB 440 • Use Tax Notification: Requires out‐of‐state retailers selling products for consumption or use inside Kentucky to notify its customers of each purchaser’s obligation to report and pay Kentucky use tax • Vendor’s Compensation Reduced: Retailers will receive a reimbursement on 1.75% of the first $1,000 of sales tax collected and 1.5% of tax collected over $1,000 • 18 www.grantthornton.com However, will lower the current cap on the reimbursement of $1,500 per month to $50 per month www.bgdlegal.com Kentucky Tax Legislation Other Taxes • HB 440 – Tax Collection Tools 19 • Installment Agreements: Allows KDOR to pursue statutory remedies against taxpayers who do not comply with the terms of an installment payment agreement • License Revocation: A delinquent taxpayer may have his or her driver’s license, attorney license, motor vehicle registration, or other occupational or professional license suspended or revoked by KDOR, and may be denied the ability to register his or her motor vehicle, if such taxpayer owes tax to Kentucky www.grantthornton.com www.bgdlegal.com Kentucky Tax Legislation Tobacco Taxes • HB 361 – Changes to OTP Taxes & New Licensing 20 • Effective August 1, 2013, changes rates of excise tax on distributors selling tobacco products in Kentucky. • Requires retailers in Kentucky to purchase tobacco products for resale to consumers only from distributors that are licensed in Kentucky, or from a distributor who is granted a distributor’s license for the privilege of purchasing untaxed tobacco products and remitting the tax directly to the state • Allows Kentucky licensed distributors to sell untaxed tobacco products to another licensed distributor without payment of excise tax, so long as the purchasing licensed distributor pays such tax • Declares as contraband any untaxed tobacco products held, owned, or possessed by any unauthorized party, and provides for the seizure and forfeiture of any such contraband www.bgdlegal.com www.grantthornton.com Page 20 www.bgdlegal.com Kentucky Tax Legislation – To Be Proposed? 54 “Tax Reform” Proposals of Blue Ribbon Tax Reform Commission Report Sets Out 54 “Tax Reform” Proposals for Consideration 21 • Individual Income Tax • Corporation Income Tax • Sales & Excise Taxes • Property Taxes • Severance Taxes • Other Taxes • Tax Administration www.grantthornton.com www.bgdlegal.com Kentucky Tax Legislation – To Be Proposed? Blue Ribbon Tax Reform Commission “Tax Reform” Highlights Individual Income Tax 22 • Reduce Tax Rates – Top Rate Reduced 0.2% to 5.8% • Cap of $17,500 on Itemized Deductions • Amend $41,110 Pension Income Exclusion To $30,000, with $ For $ phase out for total income over $30,000 • Update IRC Reference Date from 12/31/06 to 12/31/12 • Provide 529 College Savings Plan Tax Deduction www.grantthornton.com www.bgdlegal.com Kentucky Tax Legislation – To Be Proposed? Blue Ribbon Tax Reform Commission “Tax Reform” Highlights Corporate Income Tax 23 • Reduce Tax Rates – Top Rate Reduced 0.2% to 5.8% • Add Back Deduction for Management Fees • Adopt Single Sales Factor (now 3‐Factor with 2x Sales) • Adopt Destination Sourcing for Services • Reduce LLET Exemption from $3 Million to $1 Million with $ for $ phase out • Decouple from U.S. Production Activities Deduction • Establish Angel Investor Credit for Small Businesses • Expand R&D Credit to Human Capital with Cap and Requiring Approval (e.g., by KEDFA) www.grantthornton.com www.bgdlegal.com Kentucky Tax Legislation – To Be Proposed? Blue Ribbon Tax Reform Commission “Tax Reform” Highlights Sales and Excise Tax 24 • Apply Sales and Transient Room Taxes to Entire Hotel Price • Expand Sales Tax to Select Household Services (e.g., home and automotive services) with a Clear Nexus to Kentucky • Exempt Direct Mail Charges • Exempt Certain Equine‐Related Agricultural Purchases • Increase Collection of Out‐of‐State and Internet Sales • Impose 1% Gross Receipts Tax on Residential and Business Utilities for Additional School Funding • Increase Cigarette Tax Rate 40₵ to $1/pack & OTP Tax • Reinstate Cigarette Rolling Paper Tax • • Repeal 5₵ per case Distilled Spirits Tax Amend Constitution to Allow General Local Sales Tax www.grantthornton.com www.bgdlegal.com Kentucky Tax Legislation – To Be Proposed? Blue Ribbon Tax Reform Commission “Tax Reform” Highlights Property Taxes 25 • Create Income Tax Credit for Bourbon Industry to Offset Property Tax on Stored Bourbon Barrels • Exempt Inventory from State Property Tax • Inventory Taxed at 5₵/$100 • Raw Materials Taxed at State Rate Only • Inventory Held for Shipment Out‐of‐State Exempt • Freeze State Property Tax Rate at 12₵/$100 • Clarify PSCs Subject to PSC Tax (e.g., all companies generating or marketing power) • Require Reporting of Rental Space for Watercraft and Airplanes • Convert Negligible State‐Only Rates to Exemptions www.grantthornton.com www.bgdlegal.com Ongoing Income Tax Challenges • Mandatory Nexus Consolidated Returns • requires direct ownership • when is inclusion determined • Remember Member Disclosure / Add‐Back Rules • Net Operating Loss Carry Forwards 26 www.grantthornton.com www.bgdlegal.com Ongoing Sales Tax Challenges • Limitations on Manufacturing Exemption • Kentucky versus Other States • Anything that starts with a "R"…Repair, rebuild, replace • Industrial tools and supplies…to be exempt it has to touch the product and "effectuate a change • Occasional sale exemption narrowly defined and applied • Property Classification 27 www.grantthornton.com www.bgdlegal.com • Indiana Update 28 www.grantthornton.com www.grantthornton.com 28 www.bgdlegal.com Indiana Legislative Developments Income Tax • Indiana conformity to the IRC updated as of January 1, 2013 • Legislation eliminated a number of previously required state income tax addbacks • Reduction in personal income tax rate: • Rate for 2015 and 2016 is reduced to 3.3% from current 3.4% • Rate after 2016 is reduced to 3.23% • Private school scholarship tax credits available is increased to $7.5 million from $5 million • Several other credits repealed, expanded or amended • Provides the method for apportioning income of race team members involved in motorsports racing 29 www.grantthornton.com www.bgdlegal.com Indiana Legislative Developments Inheritance Tax • The Inheritance Tax expires effective January 1, 2013 rather than January 1, 2022 when it was originally due to expire. • The Generation‐Skipping Transfer Tax is repealed effective January 1, 2013 Sales and Use Tax • Use tax amnesty program for race horses • Applies to unpaid tax for claiming transactions prior to 6/1/12 • Amnesty period is July 1 through December 31, 2013 • Interest, penalties, collections costs or other costs are abated • Research and development property exemption • Exemption for aviation fuel; now subject to excise tax • Exemption for parts used in aircraft repairs and maintenance 30 www.grantthornton.com www.bgdlegal.com Indiana Legislative Developments Financial Institutions Tax • Rate after December 31, 2013 is reduced from 8.5% to 8.0% • Rate is reduced .5% for each year until January 1, 2017, when the rate will be 6.5% Miscellaneous Tax • An admission fee is imposed for tickets purchased for a race day at a qualified motorsports facility • 2% on admissions charge less than $100 • 3% on admissions charge of at least $100 but less than $150 • 6% on admissions charge of at least $150 31 www.grantthornton.com www.bgdlegal.com Indiana Administrative Developments Sourcing of Service Revenue • Department of Revenue defines "cost of performance" related to taxpayer selling audience profile information ‐ See LOF 02‐20120316 • Department of Revenue defines "cost of performance" related to information service provider ‐ See LOF 02‐20130238 Claims of Distortion of Income • Department of Revenue requires the use of a "stacking" method to apportion income on a consolidated return See LOF 02‐20120134 • Sale of subsidiary was business income, interest expense deduction disallowed – See LOF 02‐20120140 • Forced Combination – Taxpayer required to file on a combined unitary basis – See LOF 02‐20120008 32 www.grantthornton.com www.bgdlegal.com Indiana Tax Court Cases Income Tax • Caterpillar v. Indiana State Dep’t of Revenue No. 49T10‐0812‐TA‐70 (Ind. Tax Ct. Mar. 28, 2013) • 33 Holding: Foreign service dividends received by Caterpillar, Inc. from its foreign subsidiaries were deductible in calculating Caterpillar’s Indiana net operating losses, including those available for carryover as a deduction from taxable income in future years. www.grantthornton.com www.bgdlegal.com Indiana Tax Court Cases Income Tax • Vodafone Americas Inc. v. Dep’t of State Revenue Cause No. 49T10‐1002‐TA‐7, (Ind. Tax Ct. June 18, 2013) • 34 Holding: Income received by a partner of a general partnership that was doing business in Indiana was income derived from sources within Indiana for purposes of computing the adjusted gross income tax. www.grantthornton.com www.bgdlegal.com Indiana Tax Court Cases Income Tax • United Parcel Service, Inc. v. Indiana Dep’t of State Revenue Cause No. 49T10‐0704‐TA‐24 (Ind. Tax Ct. Sept. 16, 2013) • 35 Holding: UPS’s affiliated foreign reinsurance companies must be physically present in Indiana to satisfy the statutory requirement of “doing business” for purposes of Indiana’s gross premium privileges tax. Such a requirement was not unconstitutional. www.grantthornton.com www.bgdlegal.com Indiana Tax Court Cases Income Tax • Gibson v. Indiana Dep’t of State Revenue No. 49T10‐1204‐TA‐20 (Ind. Tax Ct. Nov. 1, 2012) • 36 Holding: A taxpayer’s refund request was properly denied because the taxpayer filed the return 11 days late. www.grantthornton.com www.bgdlegal.com Indiana Tax Court Cases Income Tax • Indiana Dep’t of State Revenue v. Miller Brewing Co. No. 49S10‐1203‐TA‐136, 975 N.E.2d 800 (Ind. July 26, 2012) motion for rehearing denied (Ind. Nov. 5, 2012), rev’g, No. 49T10‐0607‐TA‐69 (Ind. Tax Ct. Aug. 18, 2011) • 37 Holding: Sales by a beverage manufacturer that were delivered by common carriers to Indiana customers were allocable to Indiana for purposes of calculating the manufacturer’s gross income. www.grantthornton.com www.bgdlegal.com Indiana Tax Court Cases Income Tax • Indiana Dep’t of State Revenue v. Rent‐A‐Center East, Inc. No. 49S10‐1112‐TA‐683, 963 N.E.2d 463 (Ind. Mar. 9, 2012), rev’g, No. 49T10‐0612‐TA‐106, 952 N.E. 2d 387 (Ind. Tax. Ct. May 27, 2011). • 38 Holding: A taxpayer’s challenge to the issue of whether taxpayer was required to report its Indiana adjusted gross income tax on a combined return should survive summary judgment, as the Department’s notice of a proposed assessment was prima facie evidence that the combined report was necessary to reflect the taxpayer’s adjusted gross income. www.grantthornton.com www.bgdlegal.com Indiana Tax Court Cases Income Tax • AE Outfitters Retail Co. Indiana Dep’t of State Revenue No. 49T10‐1012‐TA‐66, 957 N.E.2d 221 (Ind. Tax Ct. Oct. 25, 2011) • 39 Holding: Department must apply all the methodologies in the Indiana Code before it may require a taxpayer to report its Indiana adjusted gross income using a combined income tax return. www.grantthornton.com www.bgdlegal.com Indiana Tax Court Cases Transactional Taxes • Wendt LLP v. Indiana Dep’t of State Revenue No. 02T10‐0701‐TA‐2 (Ind. Tax Ct. Oct. 30, 2012) • Holding: Certain purchases of tangible personal property by a licensed common carrier were not entitled to the transportation exemption from sales tax, as the carrier’s services were not a series of separate services but were instead provided as continuous, integrated process of transporting its customers’ oversized equipment on the highways. 40 www.grantthornton.com www.bgdlegal.com Indiana Tax Court Cases Transactional Taxes • Indiana Dep’t of State Revenue v. AOL, Inc. No. 49S10‐1108‐TA‐514, 963 N.E.2d 498 (Ind. Mar. 16, 2012), motion for rehearing denied (Ind. June 28, 2012), rev’g, No. 49T10‐0903‐TA‐7, 940 N.E.2d 870 (Ind. Tax Ct. Dec. 29, 2010) • Holding: AOL, an online service provider, was liable for use tax on promotional mailers sent to prospective customers in Indiana because the promotional materials were purchased by AOL in retail transactions. 41 www.grantthornton.com www.bgdlegal.com Indiana Tax Court Cases Property Tax • Virginia Garwood v. Indiana Dep’t of State Revenue No. 82T10‐1208‐TA‐46, (Ind. Tax Ct. Oct 31, 2013) • Holding: The Indiana Tax Court denied the Department of Revenue’s motion to dismiss and held that it has subject matter jurisdiction over a taxpayer’s refund claim for sales tax, interest, and penalties assessed on the sales of seized property. 42 www.grantthornton.com www.bgdlegal.com Indiana Tax Court Cases Property Tax • Indiana MHC, LLC v. Scott County Assessor No. 39T10‐10009‐TA‐52, 2013 Ind. Tax LEXIS 10 (Ind. Tax Ct. May 3, 2013) • Holding: Indiana Tax Court held that taxpayer had not comported with standard methods for using the income capitalization method and should have included data from similar properties in challenging the property value assessment. 43 www.grantthornton.com www.bgdlegal.com Indiana Tax Court Cases Property Tax • Kooshtard Property VIII, LLC v. Shelby County Assessor No. 49T10‐1011‐TA‐58, 2013 Ind. Tax LEXIS 8 (Ind. Tax Ct. Apr. 29, 2013) • Holding: Taxpayer did not establish a prima facie case that the Department’s use of a 100% positive influence factor test (reflects actual value of the property in question) was erroneous. Taxpayer presented no evidence to support its claim. 44 www.grantthornton.com www.bgdlegal.com Indiana Tax Court Cases Property Tax • Shelbyville MHPI, LLC v. Thurston No. 49T10‐1003‐TA‐14 (Ind. Tax Ct. Nov. 5, 2012) • Holding: Board did not abuse its discretion when it considered “sky‐rocketing” sales prices from 2004 real property market as evidence of the correct property valuation of taxpayer’s property. 45 www.grantthornton.com www.bgdlegal.com Indiana Tax Court Cases Property Tax • Millennium Real Estate Investment, LLC v. Assessor, Benton County Indiana, No. 49T10‐1008‐TA‐42, (Ind. Tax Ct. Nov. 5, 2012), petition for review denied (Ind. Sup. Ct. June 20, 2013) • Holding: Court held that Indiana Board of Tax Review’s determination was supported by substantial and reliable evidence, even though the Board had failed to discount taxpayer’s June 2008 sales when these numbers showed that taxpayer’s parcels were recently sold for well below their collective assessed values. 46 www.grantthornton.com www.bgdlegal.com Indiana Tax Court Cases Property Tax • Marion County Auditor v. Sawmill Creek, LLC. No.49S02‐1106‐CV‐364, 964 N.E.2d 213 (Ind. Mar. 21, 2012), rev’g, No. 49A02‐0912‐CV‐1192, 938 N.E.2d 778 (Ind. Ct. App. Dec. 3, 2010) • Holding: County auditor’s attempts to notify the property owner of the tax sale, although unsuccessful, were sufficient to meet the Due Process Clause of the Fourteenth Amendment of the US Constitution. 47 www.grantthornton.com www.bgdlegal.com Indiana Tax Court Cases Property Tax • Tipton County Health Care Foundation, Inc. f/k/a Tipton County Memorial Hospital Foundation v. Tipton County Assessor No. 49T10‐1101‐TA‐6, 961 N.E.2d 1048 (Ind. Tax Ct. Feb. 16, 2012), petition for rehearing denied (Ind. Tax. Ct. April 13, 2012) • Holding: A health care foundation failed to raise a prima facie case that its assisted living facility was entitled to a charitable purpose property tax exemption because the foundation did not meet its burden of proving that its lease arrangement with a for‐profit corporation was driven by a charitable purpose. 48 www.grantthornton.com www.bgdlegal.com Indiana Tax Court Cases Open Records • Orbitz, LLC v. Indiana Dep’t of State Revenue No. 49T10‐0903‐TA‐2013 Ind. Tax LEXIS 25 (Ind. Tax Ct. Oct. 16, 2013) • Holding: The court held that contracts between online travel company Orbitz and various hotels are trade secrets under the Indiana Access to Public Records Act and ordered them to be sealed thus protecting them from access by Orbitz’s competitors. 49 www.grantthornton.com www.bgdlegal.com Ongoing Challenges • Filing Group determinations • Sales sourcing • Others? 50 www.grantthornton.com www.bgdlegal.com Questions… 51 www.grantthornton.com www.bgdlegal.com Tax Professional Standards Statement This document supports Grant Thornton LLP’s marketing of professional services, and is not written tax advice directed at the particular facts and circumstances of any person. If you are interested in the subject of this document we encourage you to contact us or an independent tax advisor to discuss the potential application to your particular situation. Nothing herein shall be construed as imposing a limitation on any person from disclosing the tax treatment or tax structure of any matter addressed herein. To the extent this document may be considered to contain written tax advice, any written advice contained in, forwarded with, or attached to this document is not intended by Grant Thornton to be used, and cannot be used, by any person for the purpose of avoiding penalties that may be imposed under the Internal Revenue Code. 52 www.grantthornton.com www.bgdlegal.com

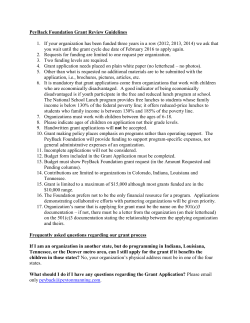

© Copyright 2026