Connect Legal Manual for Self-Employed Women

Connect Legal Manual for Self-Employed Women Connect Legal is a registered charity that provides free legal services for small businesses. Registration number: 84434 5264 RR0001 This information is provided for your convenience only and does not constitute legal advice. Connect Legal does not assume responsibility for loss or damage arising from using this guide. Table of Contents About Connect Legal ...................................................................................................................................... 3 About the Manual............................................................................................................................................. 3 Business Structures ............................................................................................................................................. 4 Rules & Regulations ........................................................................................................................................... 5 Financing Your Business .................................................................................................................................... 6 Opening a Bank Account ............................................................................................................................... 7 Income Support for Small Business ................................................................................................................. 7 Understanding Contracts ................................................................................................................................ 8 A Connect Legal Success Story: Carolina Velez ......................................................................................... 9 Hiring Employees ............................................................................................................................................. 10 Protecting Your Name and Products .......................................................................................................... 11 Passing on Your Family Business .................................................................................................................... 11 Renting versus Buying – Space and Equipment ........................................................................................ 12 Case Study: Oriental Falls Spa v Turk Investments Ltd. ............................................................................. 13 Marketing .......................................................................................................................................................... 14 Connect Legal Workshop and Free Lawyer Matching Programs ......................................................... 15 Appendices ...................................................................................................................................................... 17 Appendix 1: Women Specific Resources ............................................................................................. 18 Appendix 2: Links to Helpful Resources ................................................................................................. 24 Appendix 3: “Are You an Entrepreneur” Quiz ..................................................................................... 25 Appendix 4: How to Avoid Legal Troubles ........................................................................................... 27 Appendix 5: Checklist for Creating and Using Contracts ................................................................. 28 Appendix 6: Sample NUANS Name Search Corporations ................................................................ 29 Appendix 7: Sample Master Business License ...................................................................................... 30 Appendix 8: Sample Articles of Incorporation .................................................................................... 31 Appendix 9: Sample Business Name Registration ............................................................................... 33 Page 2 About Connect Legal Connect Legal is a registered charity that fosters entrepreneurship in the immigrant community by providing free legal advice and educational services to low-resource small business owners. Our staff and volunteer lawyer network recognize that some small business owners may face challenges due to limited financial resources, language barriers and unfamiliarity with the Canadian legal system. By helping these entrepreneurs to succeed, Connect Legal seeks to contribute to the overall economic prosperity of the community. To find out more about our services and to sign up for our newsletter visit www.connectlegal.ca As a registered charity, we gratefully appreciate financial donations along with the contributions of volunteer lawyers. Find out how you can support our efforts to foster successful small businesses in your community at www.connectlegal.ca About the Manual This manual and the appendices are not intended to provide legal advice, but it will provide an overview of some of the legal issues you should be thinking of as a small business owner. This guide features a special resource section and tools tailored to women entrepreneurs; however, the legal guidelines cover generic legal issues due to the gender neutral nature of the law. An electronic version of the guide and resources is available on our website. For legal advice, you will need to consult a lawyer. Page 3 Business Structures You can set-up your business as a: Sole proprietorship, where you are the business and any profits and losses arising out of the business are personal. As a sole proprietor, your personal wealth is exposed to business liability. Corporation, where the business is legally separate from you and your personal wealth. Any profits or losses arising out of the business belong to the corporation. Partnership, where the business profits and losses are shared between you and one or more owners. Partnerships can be individuals or corporations. Cooperative (co-op), where the members who use the services jointly pool resources and share ownership of the business. Consider: Who will own the business, make decisions and bear risk? Financial and tax benefits with different business structures. Next Steps: Visit ServiceOntario’s “Business” website. Choose a business structure and file necessary paperwork. Register the name of your business and get a Master Business License. Consider (i) a partnership agreement, if a partnership, (ii) articles of incorporation and by-laws for a corporation. Page 4 Rules & Regulations You will want to research whether any licenses and permits will be needed to run your business. Governments and business partners often require these documents. Some of the benefits of obtaining the necessary licenses and permits are: Major suppliers and customers will then be able and more willing to do business with you. You can avoid fines or being shut down for not having the proper paperwork or permissions. You can get basic guidelines and instructions on how to conduct your business safely. Getting things started on the right track will allow your business to grow. Consider: What is the real cost of running a properly licensed business? Are there restrictions on the sort of businesses you want to start? Next Steps: Visit BizPal.ca to search for applicable permits and licenses. Contact your local city government office to find out the kind of business that is permitted at your location and whether there are any restrictions. Understand the taxes (e.g. sales taxes, employee-related taxes, such as payroll deductions and remittances) you must collect and send to the government and register your business with the Canada Revenue Agency. Visit the CRA’s website for small business and self-employed individuals to learn about your tax obligations. Page 5 Financing Your Business Ways to raise money for your business include: Borrowing money from family and friends. Taking a loan or using credit from a bank or lender. Selling a part of your business to an investor. Making sure that your customers pay on time. Consider: What is the true cost of each type of financing? Credit cards and loans can be very expensive. Check the interest rate: is it fixed or can it be raised? If borrowing money from family and friends, when do you need to pay them back and will you owe interest? Do you have a business plan? Some lenders and investors will require it. If you sell part of your business to an investor, what rights will the investor have in the business? Next Steps: Make sure you know and write down that you are receiving a gift of money, a loan or an investment. Clearly write down any terms or conditions attached to the money. Have a clearly written agreement with lenders or investors (even if they are family) outlining the terms attached to the money. Talk to your bank or local micro-lender to learn how you can become a borrower. Consider attending a financial literacy class. Page 6 Opening a Bank Account No matter how small your business is, you should consider opening a bank account in order to keep your personal funds separate from your business funds. This is especially the case if you choose to operate your business through a corporation or partnership. In order to open a bank account, the bank will require proof that you have established a business. For example, a bank may require personal identification from you as well as the documents establishing existence of the business. You should consult your local bank to discuss the bank account options offered as well as to find out the documentation required to open an account. Income Support for Small Business If you are currently receiving government income support, you may qualify for small business development program. Self-employed individuals may be able to apply for special EI benefits if they are registered for access to EI. Next Steps: Investigate if you qualify for any of the following: Ontario Works, Ontario Self Employment Benefits Program, or Ontario Disability Support Program. Page 7 Understanding Contracts A contract: Is an agreement between people or legal entities to do or not to do particular things. Examples include agreements for buying or selling, leases, and services contracts. Is an opportunity to write down what everyone agreed to, so that you can minimize misunderstandings. Can sometimes be overruled by government laws and regulations (such as employment law, human rights law, consumer protection laws etc). Can be a good tool to manage your business risk. Consider: Who is part of the deal? Take a close look at the person or legal entity signing. How and when do you get paid or need to make a payment? Have you included important details such as quantity, quality, timing and effort requirements? What happens if something goes wrong? What rights or obligations do you have? Next Steps: Develop the contracts you will need for your business by looking for examples and talking to a lawyer. Take time to understand contracts before you sign, and do not sign if you do not understand. Negotiate everything! Page 8 A Connect Legal Success Story: Carolina Velez Carolina arrived in Canada with a Colombian business degree. She found that her lack of Canadian experience limited her ability to climb the corporate ladder. To overcome this challenge, she started her own business. Carolina formed ColombiaExotic to bring some of her favourite Colombian fruits to Canadian supermarkets. She became among the first distributors of an exotic fruit called yellow pitahaya. Carolina first learned about business structures from a Connect Legal workshop. Further volunteer lawyer assistance enabled her to read and negotiate supplier contracts with confidence. After just 12 months in business, Carolina imported over two tons of yellow pitahaya per week and is quickly expanding to other product lines. "The lawyer explained to me about my liability, how to protect my interests in the worst scenarios and let me see all the blind spots. There are just a lot of [legal] landmines in business." Carolina believes that Canada is a country of possibilities and anyone can achieve their goals with hard work and perseverance. Page 9 Hiring Employees To build a good relationship with your employees while protecting your business, take the time to: Get to know all the laws that protect employee rights, getting legal advice as necessary. Draft a good job description so that both you and your employee can evaluate whether the employee is doing a good job. Use an employment contract that complies with existing laws: o The law states that some employee rights (such as minimum wage) cannot be changed by the contract; o A contract can offer the employer certain protections such as ensuring that the employee does not go to a competitor and that confidential information is not shared with others. Make deductions and file government documents and returns. Make employee decisions based on job performance. Keep detailed records of all employee matters e.g., vacation, sick days, performance evaluations, problems and jobs well done. Consider: What is the true cost of hiring each employee: are you ready to commit to an employee including all wages, training costs, mandatory payroll taxes and remittances and potential severance costs? Next Steps: Visit the Government of Ontario’s A Workbook for Employers web page. Visit the Canada Revenue Agency’s Hiring an Employee web page. Page 10 Protecting Your Name and Products To protect your business name and reputation, search online for similar names in use when you register your name with the government. Your name receives limited protection where you do business, but consider paying for a trademark for enhanced cross-Canada protection. As your business grows, speak to a lawyer about more ways to protect your business name and products. Next Steps: Ensure your business name is registered with the government. Consider registering a trademark with the Canadian Intellectual Property Office. Passing on Your Family Business Who should inherit your business? Your legal will ensures that your business interests are distributed according to your wishes in a timely and cost-effective manner. If a business has multiple owners, all owners need to plan how the business can survive. Consider: What will happen to your business if something happens to you or your partner? How will your family pay the bills? Next Steps: Seek a lawyer’s help to draft or revise your will. There are special requirements in law that must be satisfied for a will to be valid. Make business arrangements in the event something happens to you to ensure your wishes are carried out. Page 11 Renting versus Buying – Space and Equipment Starting a business may have significant upfront property and equipment costs. When deciding whether to rent or buy think about more flexible and less costly alternatives: Instead of renting a long-term space, consider sharing a desk, renting a stall, using an agent or operating online. When choosing a location, consider your all-in costs, uses permitted and convenience for your customers. For equipment consider quality, customization needed, availability of customer support and the reputation of the seller or lessor. Your space and equipment commitments should be flexible. Consider: Do you have cancellation rights? What are the penalties? Who are your neighbours? Are they a good fit for your business? Are you allowed to operate your business out of your house? What insurance do you need? Next Steps: Figure out what your business can afford and be careful not to over commit. Carefully research the seller, landlord or person renting to you. Review the lease or purchase agreement and negotiate concessions, preferably with advice from a lawyer. Page 12 Case Study: Oriental Falls Spa v Turk Investments Ltd. Oriental Falls Spa launched legal action against Turk Investments for return of the deposit after their agreement to lease was terminated. This commercial lease was conditional on Oriental Falls Spa obtaining the proper business license, which required the appropriate zoning to be in place. It was the landlord’s responsibility to ensure that the zoning covered the proposed use of the business – but he failed to do so. By failing to secure the proper zoning, the landlord broke their agreement. Ultimately, this husband and wife business team was entitled to their money because the landlord had breached the warranty that zoning would be in place. This is an excellent lesson in understanding your rights as a tenant and ensuring your lease protects your business. Page 13 Marketing Telling potential customers that you are offering products and services is vital to the growth of your business. However, when you are advertising, you must ensure that you do not violate the Competition Bureau of Canada guidelines. Advertising is generally acceptable if it is not fraudulent, misleading or deceptive. To find customers, consider who your target customers are and what type of advertising they will be most impacted by (Google ads, newspaper ads, radio, etc.). You may also consider building a website to help you advertise your business online. Websites establish credibility and help you to market your business. Consider: Creating appropriate a privacy policy and using customer information accordingly. How to protect customer data from theft. Ways to ensure that you do not spam your customers. Next Steps: Visit the Competition Bureau of Canada’s website. Visit the Privacy Guide for Small Business at the website of the Privacy Commissioner of Canada. Review Canada’s Anti-Spam Legislation Page 14 Connect Legal Workshop and Free Lawyer Matching Programs Connect Legal offers workshops on legal issues for small businesses in cooperation with Community Partners. These workshops are ideal for new small business owners looking to get a good overview about the legal issues that would apply to their small business. If you would like to become a Community Partner, please contact us. Connect Legal also offers free one-on-one legal advice for eligible low-resource small business owners who are new to Canada. A volunteer lawyer can help you: Review government rules and regulations to help your business successfully operate. Create or review contracts for use when buying or selling products and services. Other legal matters related to the growth of your business. Connect Legal also has many resources and useful links on legal issues for your small business. See our website for eligibility criteria and further details of our programs. Visit us at http://www.connectlegal.ca. Page 15 Front cover photo: Carolina Velez, Colombia Exotic Courtesy of Jacquie Labatt Back cover photo: Karla Polanco, Panda Party Inc. Written, edited, and produced by Connect Legal: Advice for Immigrant Entrepreneurs With funding from Ontario Women's Directorate Phone: 416-964-3933 Website: http://www.connectlegal.ca E-mail: [email protected] 20 Bloor Street East P.O. Box 75005 Toronto, ON M4W 3T3 Registered Charity Number: 84434 5264 RR0001 Appendices Appendix 1: Women Specific Resources Research conducted by the Canadian Women’s Foundation confirms that women face different challenges in achieving economic success. Women define ‘economic success’ in the context of their life situation, therefore it is particularly important for women to have a holistic range of support. In 2009, nearly 1 million Canadian women were self-employed.1 Connect Legal has prepared a list of resources in hopes of empowering women to manage competing priorities and gain control over their economic futures. DISCLAIMER: Links and third party organizations referenced in the Connect Legal Manual for Self-Employed Women are provided as a convenience for readers and are intended for information purposes only. Their inclusion in this Manual does not constitute an endorsement or recommendation from Connect Legal and readers should make their own determination about whether these resources will be helpful to them. Please note that for-profit organizations are contained entirely in the sections entitled “Building Your Network “ and “Making a Good Impression” and are identified with an asterisk (“*”). All other links and third party organizations referenced are non-profit or government organizations. A. Exploring Your Potential Self-employment can be a good option for people who crave independence and flexibility. While more women are starting their own businesses, women are still less likely than men to do so. A study conducted by BMO Financial Group revealed that 71% of Canadian women would like to start their own business. 2 Are you one of them? Find out if you are by completing the Connect Legal Quiz in Appendix 3. Next, measure your entrepreneurial potential by completing a self-assessment questionnaire created by the Business Development Bank of Canada. 1 2 Statistics Canada. Women in Canada: A Gender-based Statistical Report – Paid Work (May 2013). BMO Financial Group. BMO Women’s Day Study (March 2012). Page 18 B. Getting Started In Canada, 2 of 3 new businesses do not survive their fifth year. These odds improve substantially if the business goes through an incubation process. 4 out of 5 small business owners who participated in a formal training and development program continue to thrive after 5 years.3 Canada Business Ontario – “Women in Business Guide” – Introduces aspiring women entrepreneurs to national resources MicroSkills – Offers training and support services to women who want to establish and operate small businesses Ontario Chamber of Commerce – Affinity Programs – Offers business support and group insurance for self-employed persons Prosper Canada – Offers services to improve financial literacy and asset building in order to develop and advance a broader range of proven financial empowerment approaches Skills for Change – Offers immigrant and employment services include professional development and training. YWCA – Offers literacy, life skills, employment and counselling programs, and childcare services Don’t forget to check local university business programs and colleges for tradespecific programs! 3 Ministry of Research and Innovation. Ontario Business Report. Business Incubation to Support Business Growth (2012). Page 19 C. Financing Your Business Women entrepreneurs are often able to acquire some form of external financing. However, they are less likely to be approved for short-term debt financing, such as lines of credits and credits cards, than their male counterparts. In 2007, only 77% of women entrepreneurs were approved. This is strikingly low in comparison to the 94% of male entrepreneurs who were approved.4 Access to financing is a significant barrier to success. Consider alternative means to traditional financing. Access Community Capital Fund – Up to $5,000 for first time borrowers and $10,000 for second time borrowers. Alterna Savings Community Micro-Finance Program – Loans range from $1000 to $15,000 Futurpreneur Canada – Up to $15,000 in start-up financing + partnership with BDC – Business mentorship for 2 years Ontario Women’s Directorate: Microlending Program – OWD’s Microlending for Women program supports low-income women who are seeking to start their own business by providing financial literacy training, entrepreneurial mentoring and skills development and life skills support. Nishnawbe Aski Development Fund (OWD Program) – Offers microlending circles for Aboriginal women in northwestern Ontario PARO Centre for Women’s Enterprise (OWD Program) – Offers a microlending program to remote communities in northeastern Ontario for Aboriginal, Francophone and rural women 4 Industry Canada. Financing Profile: Women Entrepreneurs (October 2010). Page 20 Welland Heritage Council (OWD Program) – Offers a microlending program for immigrant and francophone women in the Niagara region Women’s Center of York Region (OWD Program) – Offers a microlending program in the York Region to graduates of their business training program YWCA Hamilton (OWD Program) – Offers a microlending program to women in the Hamilton region D. Protecting Yourself and Your Family Despite the fact that men are becoming more involved with housework, women still dedicate more time to family responsibilities than men. Women spend over double the amount of time than men in taking care of young children and seniors.5 In order to succeed as entrepreneurs, women could greatly benefit from childcare support and resources to manage other family-related issues. Family Law Education for Women – Provides broad range of online and printed resources in different languages Family Law Resources in Ontario (Community Legal Education Ontario) – This booklet contains a directory of legal resources, information and referral sources. Legal Aid: Types of Help – Resources to get support for different family law issues North York Community House – Family Support Program – Offers services targeted to newcomers to Canada of all ages Ontario Women’s Justice Network – Provides resources to women at risk of being subject to violence 5 Statistics Canada. Women in Canada: A Gender-based Statistical Report – Families, Living Arrangements and Unpaid Work (May 2013). Page 21 Ontario Ministry of Attorney General – Describes how the court system can help resolve family law related issues Ontario Ministry of Education – Provides different licensed childcare options in Ontario E. Building Your Network Developing new business contacts and connections can help women open doors. Networking is about creating a community of support where people can learn from each other. Consequently, 8 in 10 women say that access to role models or mentors would be critical to their success as business owners.6 Please note that many of the organizations contained the following section are for profit businesses. These businesses are identified with an asterisk * to distinguish them from non-profits and government run organizations. As with all organizations listed in this Manual, their inclusion is for informational purposes only and does not constitute an endorsement or recommendation from Connect Legal. Business and Professional Women's Clubs of Ontario * – Membership in BPW Ontario provides women with personal development tools to help them achieve their career goals Company of Women * – Membership provides cost-effective solutions for purchasing health care services and stationary Ember Business Exchange * – A networking community targeted to women entrepreneurs Mombiz * – Teaches women how to run a successful business while putting their roles as moms first 6 BMO Financial Group. BMO Women’s Day Study (March 2012). Page 22 Mompreneur Networking Group Inc. * – Supports, educates, and empower moms in business Roaring Women * – Offers Business growth, Business Support, Marketing Services, Business Coaching and even “Do it yourself Marketing” to women in business, female entrepreneurs and independent representatives of companies Thorncliffe Neighbourhood Office – Offers Multicultural Women’s Group and Senior Women’s Group for newcomers Women Entrepreneurs of Canada * – Helps local businesses to expand nationally and internationally. F. Making a Good Impression Credibility comes from how you present yourself and your business. It is important for women to understand how they can best portray what they have to offer. Dress for Success – Provides professional attire for disadvantaged women Mind Tools * – Offers online resources to help people learn practical skills and excel in their careers Right Brain Business Plan * – Offers services and products to help entrepreneurs develop business plans in visual and creative ways WEConnect Canada * – Certifies women-led firms and connects them with global suppliers Page 23 Appendix 2: Links to Helpful Resources Below are the current links to all the online sources mentioned throughout the toolkit. For the most updated information please visit the Connect Legal website. Business Structures Service Ontario Rules and Regulations BizPal Canada Revenue Agency Opening a Bank Account Royal Bank Scotia Bank TD Canada Trust CIBC Income Support for Small Business Owners Ontario Works Ontario Self Employment Benefits Program Ontario Disability Support Program Hiring Employees Ontario Government – “Workbook For Employers” Canada Revenue Agency – “Hiring An Employee” Marketing Competition Bureau of Canada Privacy Guide for Small Businesses Canada’s Anti-Spam Legislation Page 24 Appendix 3: “Are You an Entrepreneur” Quiz 1. I like working for a. a regular income b. the possibility of higher but irregular earnings 2. I prefer: a. A fixed work schedule with annual vacation time b. A flexible schedule, but often on-call and with no set vacation time 3. I like: a. Making my own decisions and taking the risks b. Getting specific instructions and doing what I’m supposed to do well 4. Unexpected suprises or uncertainty at work: a. Make me uncomfortable b. Are just part of life 5. I have an idea for a product or service that: a. I know there is a demand and market for b. I’m not yet sure if people are willing to pay for 6. I will describe myself as: a. creative, self-starting, and competitive if I need to b. laid-back and follow the lead 7. Routines and structure in my life: a. are very important b. make me uncomfortable Please look to the next page for your results! Page 25 Answers: 1. a =1 point b =2 points 2. a =1 point b =2 points 3. a = 2 points b = 1 point 4. a =1 point b =2 points 5. a = 2 points b = 1 point 6. a = 2 points b = 1 point 7. a =1 point b =2 points 11-14 points: Congratulations! Go for your entrepreneurial dream and you will reach your goals! 7-10 points: You have the work ethics and determination. Work hard and don’t give up, you too can become an entrepreneur! Page 26 Appendix 4: How to Avoid Legal Troubles Page 27 Appendix 5: Checklist for Creating and Using Contracts 1. Are the parties to the contract named? 2. Do the signing parties have the authority to enter the contract? 3. Are the important terms defined and do you understand them? 4. Does the contract specify important terms such as, timing, quality, payment provisions and penalties? 5. Does the contract specify what happens if one party does not do what they promise (Breach of Contract)? 6. How and when does the contract end? 7. Does the contract specify what happens in the event of a dispute? How will it be resolved? 8. Are all the pages of the contract numbered? 9. Have all the parties signed the contract? 10. Do you understand all the terms of the contract? *This checklist is for information purposes only and is intended as a general guide. Connect Legal does not assume any responsibility for such information or for any loss or damage that may arise from the use of the information. Page 28 Appendix 6: Sample NUANS Name Search Corporations A NUANS corporate name search report is required by the federal and most provincial / territorial governments when granting new corporate names for use. The reports list similar existing corporate names and trademarks; they are used to determine the availability of a new proposed name. Ensuring that new corporate names do not create confusion with others is intended to protect Canadian businesses and consumers. Below is a sample of NUANS search for “ROMP ‘N ROAM Dog Walkers LIMITED”: Page 29 Appendix 7: Sample Master Business License Page 30 Appendix 8: Sample Articles of Incorporation Page 31 5. Restrictions, if any, on business the corporation may carry on or on powers the corporation may exercise. 6. The classes and maximum number of shares that the corporation is authorized to issue: 7. Rights, privileges, restrictions and conditions (if any) attaching to each class of shares and directors authority with respect to any class of shares which may be issued in series: 8. The issue, transfer or ownership of shares is/is not restricted and the restrictions (if any) are as follows: 9. Other provisions, if any: 10. The names and addresses of the incorporators are: First name, middle names and surname or corporate name Full address for service or if a corporation, the address of the registered or head office giving street & No. or R.R. No., municipality, province, country and postal code These articles are signed in duplicate. Full name(s) and signature(s) of incorporator(s), in the case of a corporation set out the name of the corporation and the name and office of the person signing on behalf of the corporation. ________________ Signature / signature __________________________________________________________ Name of incorporator (or corporation name & signatories name and office) ________________ Signature / signature __________________________________________________________ Name of incorporator (or corporation name & signatories name and office) ________________ Signature / signature __________________________________________________________ Name of incorporator (or corporation name & signatories name and office) ** The format of the form was adapted for this toolkit from the original. You can access the original form with instructions at Service Ontario Website. Page 32 Appendix 9: Sample Business Name Registration Page 33

© Copyright 2026

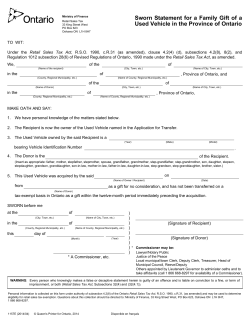

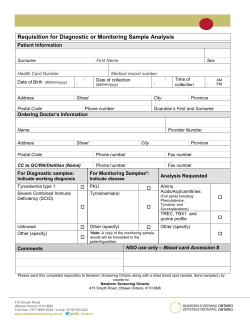

![Mid Western Ontario District Event [Oakville]](http://cdn1.abcdocz.com/store/data/000192548_1-753105a447977030eda8c92bf1e983c6-250x500.png)