American Integrity Agent’s Manual Agents’ Procedure Manual 04.11.2014 Page 1

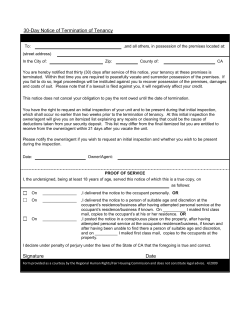

American Integrity Agent’s Manual Voluntary Business General Procedures Agents’ Procedure Manual 04.11.2014 Page 1 Table of Contents WELCOME TO AMERICAN INTEGRITY ............................................................................................................4 GENERAL INFORMATION .................................................................................................................................5 CLAIMS REPORTING ..........................................................................................................................................5 GENERAL CONTACT INFORMATION ............................................................................................................6 AGENT REPORTS .................................................................................................................................................8 PRODUCTS ........................................................................................................................................................... 12 DISCOUNTS .......................................................................................................................................................... 12 HOME TYPES ....................................................................................................................................................... 13 INELIGIBLE RISKS ............................................................................................................................................ 14 General Characteristics ...................................................................................................................................... 14 Property Features .............................................................................................................................................. 14 Property Condition ............................................................................................................................................ 15 Liability Exposure(s) ......................................................................................................................................... 15 Property Value(s) or more than one home on the property ........................................................................... 15 Applicant characteristics and Loss History ...................................................................................................... 15 Additional INELIGIBLE CHARACTERISTICS - Manufactured home ............................................................... 16 BILLING ................................................................................................................................................................ 17 LAPSE IN COVERAGE OR FORCE PLACED INSURANCE ....................................................................... 18 SYSTEM FEATURES/HINTS ............................................................................................................................. 19 Notices/Memos/Notes.......................................................................................................................................... 19 Images.................................................................................................................................................................. 20 Full History . ……………………………………………………………………………………………………20 FOREIGN MAIL ADDRESS ............................................................................................................................... 20 CANCEL/REWRITE ............................................................................................................................................ 22 NEW CONSTRUCTION/NEW ADDRESS ........................................................................................................ 22 CORRESPONDENCE/DOCUMENTS REQUIRED ......................................................................................... 23 INSPECTIONS ...................................................................................................................................................... 23 DWELLING CHARACTERISTICS ................................................................................................................... 27 MINIMUM/MAXIMUM VALUES ..................................................................................................................... 29 VALUATION ......................................................................................................................................................... 30 ANIMALS/ACREAGE ......................................................................................................................................... 31 PROTECTION CLASS......................................................................................................................................... 31 LLC’S (LIMITED LIABILITY CORP) .............................................................................................................. 32 TRUSTS.................................................................................................................................................................. 32 ESTATES ............................................................................................................................................................... 33 FORECLOSURES OR REPOSSESSIONS ........................................................................................................ 33 CONCENTRATION OF RISK ............................................................................................................................ 33 OCCUPANCY ....................................................................................................................................................... 34 Agents’ Procedure Manual 04.11.2014 Page 2 VACANT OR UNOCCUPIED PROPERTIES ................................................................................................... 34 OPTIONAL COVERAGE .................................................................................................................................... 35 MANUFACTURED HOMES ............................................................................................................................... 37 Agents’ Procedure Manual 04.11.2014 Page 3 WELCOME TO AMERICAN INTEGRITY At American Integrity Insurance Company (AIIC), we strive for excellence in every aspect of our company, from experienced staffing and valued agency partners to the excellent treatment of our customers and superior claims resolution. AIIC was incorporated and received its Certificate of Authority to conduct business in the state of Florida in September 2006. Since inception, we currently have over 100,000 homeowners, manufactured homes and dwelling fire policies and are represented by over 600 voluntary agents statewide. Our Claims operation has a dedicated and professional staff to help manage the risks in everyday life. In addition, we have a catastrophe team of experienced adjusters ready to respond to a disaster with full emergency resources in place. American Integrity holds a Demotech Financial Stability rating of A, and is backed by multiple Reinsurance carriers, each holding an AM Best rating of A- or better. We are ready to meet the challenges of the Florida insurance marketplace and have been approved to write Homeowners Policies (HO3), Dwelling Fire (DP3and DP1, DP1 Vacant), and Manufactured Homes. The purpose of this manual is to assist the Agents or CSR in identifying the risks which American Integrity is seeking. It is designed to outline procedure and answer frequently asked questions. This document will be updated as requirements and procedures change. Agent and CSR feedback is strongly encouraged. Agents’ Procedure Manual 04.11.2014 Page 4 GENERAL INFORMATION Agents and Insureds, visit our website: http://www.aiicfl.com For Insureds: For Agents: Find an Agent, or Report a Claim, or Make a Payment Make a Payment, or Form and Manual Library, or Live Chat for agents, etc. Agent Portal: http://www.aiicfl.net for quotes, access policies and process non-premium bearing changes (i.e. mortgage change updates, etc.) AIIC NAIC Company Code: 12841 Helpful Hints for each line of business are available from your Sales/Marketing representative. They are a snapshot of what coverages/options are available for each lines of business. CLAIMS REPORTING All claims are to be reported to American Integrity by phone, on the main website, email/fax or mail as soon as possible following a loss. 24- Hour Claims Service: 866-277-9871, option 1 (This is the best option to report a claim.) http://www.aiicfl.com / Report a Claim (The next best option to report a claim.) Email: [email protected] or Fax: 866-801-5451 (Please allow 24-48 hrs to process.) Claims Services (This is the last option which should be utilized due to the obvious delays in notification): American Integrity Claims Services PO Box 26349 Tampa FL 33623 After a claim is reported any additional questions, comments, inquiries can be directed to: 866-277-9871, option 2 Agents’ Procedure Manual 04.11.2014 Page 5 GENERAL CONTACT INFORMATION A. Phone Numbers Main: Claims: Customer Care: Credit Card/Billing: Underwriting: Marketing/Sales: Main Fax: Direct Fax: 866-968-8390 866-968-8390, option 5 866-968-8390, option 4 866-968-8390, option 3 866-968-8390, option 6 866-968-8390, option 7 727-507-7596 813-884-1144 B. Addresses Payment Mailing Address: American Integrity Insurance Co of Florida (or AIIC) MSC#504 P.O. Box 830469 Birmingham AL 35283 Overnight Payment Mailing Address: AIIC 5426 Bay Center Drive, Suite 650 Tampa, FL 33609 Corporate Office: 5426 Bay Center Drive, 6TH Floor Tampa FL 33609 C. Email Endorsements/Agent responses: upload request to file or email to [email protected] (Please allow 5-7 business days for handling.) Wind Loss Mitigation Inspections: [email protected] . Add a Manufactured Home Park(to our list of eligible parks): [email protected] Agent of Record request: [email protected] To order a sinkhole inspection: www.sdii-inspections.com D. Customer Care and Billing The Customer Care and Billing team should be the first contact with any questions and/or changes pertaining to policies/quotes/bills. They handle all the correspondence/communication submitted by agents/insureds. For any urgent matters requiring a supervisor, Kathy Hall, Customer Care Manager can be reached at 866968-8390 extension 2056. Agents’ Procedure Manual 04.11.2014 Page 6 E. Underwriting Underwriters are assigned to an agency by county/territory and can be reached for an exception or eligibility concern. The underwriting team consists of: Michael Clark: Brian Loomis: Sara Hernandez: Michelle Rudkin: Suzanne Smith: Mike Begonis John Murphy Maribeth Whorton ext 2085 ext 2097 ext 2038 ext 2055 ext 2047 ext 2152 ext 2087 ext 2140 [email protected] [email protected] [email protected] [email protected] [email protected] [email protected] [email protected] [email protected] Donna Baker- Underwriting Manager ext 2035 [email protected] Note: To ensure prompt service, when an exception or override is required make sure to obtain the contact information of the Underwriter providing the exception. F. Agency Management The Agency Management team is available to assist with any Agent of Record changes, agency address updates, buy/sell agreements, or any other agency transactions. Priscilla Stewart: Seeta Deonarain: ext 2031 ext 2021 [email protected] [email protected] G. Territory Sales Manager Team The Territory Sales Manager team is eager to assist with inquiries pertaining to territory, sales initiatives, rollovers, skim deals, etc. Barbara Carter Cell: 813-494-5281 [email protected] Juan (JC) Mahfouz Cell: 813-952-7670 [email protected] Justin Waters Cell: 813-786-1512 [email protected] Patricia (Pat) Hankins Cell: 813-786-0586 [email protected] Andy Timmons Cell: 941-321-6404 [email protected] Agents’ Procedure Manual 04.11.2014 Page 7 AGENT REPORTS A daily transaction report can be sent to the principal of the agency or any designee. To obtain the report via email contact your Territory Sales Manager. The purpose of this report is to provide the agent with a daily transaction summary of policy updates, renewals, cancellation, etc. The report may also be obtained manually. From the main agent area of the website click: Agent Tools (The system will automatically populate the dates for the past week). If you wish to customize the search, you can enter different search dates, then click: Find Policies Otherwise, look to see if you have any policy prefixes on the left side of the page: AIH or AIM Click on one of the policy prefixes to expand the selection to show policy transaction types. Then choose (by clicking) on one of the policy transactions (Cancel Invoice, Deg Page – RN, etc) to expand the list of those transactions. Then click on the customer’s policy number hyperlink to view the transaction. Below is the sequence of screens referred above: Agents’ Procedure Manual 04.11.2014 Page 8 Agents’ Procedure Manual 04.11.2014 Page 9 The agent dashboard provides a snapshot of the agency’s book of business. It provides a summary of policy, renewals, cancellations, etc. as well as the agency loss ratio. The following steps outline how to obtain the report: Agents’ Procedure Manual 04.11.2014 Page 10 All of the figures below are hyperlinks and clicking on any one of them will provide individual details of Memos Pending can be accessed here. Agents’ Procedure Manual 04.11.2014 The loss ratio for HO (DP) as well as MHO is displayed in this section. Page 11 PRODUCTS This chart is a summary of the products offered and acceptable occupancies. Occupancy Time Occupied Short Term Annual 10-12 4-9 Vacant month month Unoccupied X X X X X X X X X X X X X X Products HO3 DP3 DP1 DP1 Condo DP1 Condo/Vacant DP1 Vacant MH- Adult MH- Family MH- Approved Sub MH- Private Property Seasonal Owner Secondary Tenant X X X X X X X X X X X X X X X X DISCOUNTS This is a summary at a glance of the possible discounts available. Line of Business Discount Proof of Updates/New Roof Hardiplank Protective Devices: Central Burglar Central Fire Fire Extinguisher/ Smoke alarm Sprinkler System Secured Community Senior/Discount Over 50 Age Book Transfer AARP, AAA or FMHO Age of Home ANSI/ASCE Agents’ Procedure Manual 04.11.2014 HO3 X X X X X X X DP3 DP1 X X if theft selected X X X X X X MHO X X X X X X X X Page 12 Surcharge Lapse in Coverage/No Prior Open Foundation X X X X HOME TYPES A. DUPLEX A duplex may be written as a Homeowners Policy if the insured is residing in one section of the home on a full time basis. If this is a secondary residence, the policy must be written under the Dwelling program. B. TRIPLEX OR QUADPLEX A triplex or quadplex may only be considered under the Dwelling program. C. TOWN HOMES A town or row home may be eligible for any program depending upon occupancy. The town or row house may require an exception under the HO3 Program if coverage A is less than 150k. D. MODEL HOMES Model homes are newly constructed properties that the builder uses to let the public view their various floor plans that are available for purchase. Many times, the builder will sell the model home, but continue to let the public walk through the property until the new owner has taken possession. The risk is ineligible until the owner takes possession and the property is no longer being used as a model home. E. MODULAR HOMES A modular home is eligible on the HO3 program. Agents’ Procedure Manual 04.11.2014 Page 13 INELIGIBLE RISKS This is a summary of Ineligible Risks, for complete details refer to the appropriate AIIC program manual. If a risk warrants a possible exception please contact Underwriting. GENERAL CHARACTERISTICS Business Exposure- Properties where business is conducted. Farms and Ranches– Properties (dwellings) which are part of a "commercial working farm," working ranch, orchard or grove. Condemned Properties Inaccessible Properties Isolated properties Risks built on Landfills/Refuse– Properties built on landfills previously used for refuse. Commercial Properties Dwellings located in Citizens High Risk Area or within 1500 feet of tidal waters. Homes located in a Special Flood Hazard Area (any combination of Zone A or V) must be covered by a Federal Flood insurance policy with matching Coverage A limit (or maximum limit available). Dwellings Constructed Over Water Do-It-Yourself Construction Non-Habitational Properties Fraternity or Sorority Houses Vacant or Unoccupied Properties- Vacant homes eligible on DP1 Vacant form only – see occupancy section for possible exceptions Risks located in a Protection Class 10- Exceptions may be made. Properties subject to brush or forest fire. Premium financing as a payment option Daily or Weekly rentals PROPERTY FEATURES Dwellings of unconventional construction or materials including but not limited to Log/Dome homes, etc. Dwellings in the course of construction with asbestos, EIFS (Synthetic Stucco) siding, nonstandard or hazardous building materials (Chinese drywall). Dwellings with an open foundation; Risks built on piers, piling or stilts may be eligible if compliant with 2001 FBC (refer to Underwriting for possible exception if home was built 2002 or newer). Roofing: A roof that is worn, with patched areas, multi-layered or has unrepaired damage Asbestos shingle, tin/aluminum or wood shingle roofs. A flat roof unless it is less than 20% of the total roof structure. Plumbing - Dwellings with polybutylene plumbing, PEX plumbing Heating - Dwellings heated in whole or in part by solid fuel heating devices, or heated by a device which is not controlled by a wall-mounted thermostat. Agents’ Procedure Manual 04.11.2014 Page 14 Electrical: o Properties with “knob & tube” wiring, fuses, aluminum branch wiring, or any potential hazardous electrical conditions ,i.e. FPE (Federal Pacific Electrical Panels), Stab Loc, Zinsco, Challenger, or Sylvania Electrical Panels. o Properties equipped with electrical service less than 100 amps PROPERTY CONDITION Property in Disrepair/Existing Damage Dwellings which are not properly maintained or which lack pride of ownership LIABILITY EXPOSURE(S) A pit bull, pit bull terrier or Staffordshire terrier, wolf, wolf hybrid or any mix of such dogs Any animal with aggressive tendencies, history of attack or trained as an attack animal. This includes non-domesticated and/or exotic animals. Pools not completely fenced, walled or screened. The pool may not have a diving board or slide. Trampolines in unfenced yards. Attractive nuisances including but not limited to: racing or activity courses, large play grounds, skate board or bicycle ramps. Disabled, unused, or untagged vehicles on the premises Risks where the insured owns recreational vehicle(s) including but not limited to: ATV, Dune Buggy, Go Cart, or Dirt Bike. Risks are acceptable if insured provides proof of separate liability coverage with the same limit as provided on this policy. Evidence must be maintained in Agent’s Office and is subject to audit at the request of the Company. PROPERTY VALUE(S) OR MORE THAN ONE HOME ON THE PROPERTY Coverage Limits – Minimum/Maximum- Properties for which replacement cost (Coverage “A”) is either below or above the Minimum and Maximum values. Replacement Cost/MARKET Value Ratio–exceeding 1 1/2 times the MARKET value, excluding land values may be eligible for the DP1 program only. Homes which have been a recent foreclosure/repossession are eligible for the DP1 Program only. Underwriting approval is required prior to binding on an HO3 or DP3 policy form. (See Foreclosures or Repossessions section of the manual). Risks with more than one dwelling on the premises, whether a home or manufactured home, without separate parcel, deed or separate address. Single family residence occupied by more than one family. APPLICANT CHARACTERISTICS AND LOSS HISTORY Risks with any prior or current Sinkhole activity on the premises whether or not it results in a loss to the dwelling. If any prior sinkhole loss, coverage cannot be bound. Arson or Insurance Fraud– At the time of application, applicants convicted of arson in the past 25 years, cancelled for insurance fraud in the past 15 years or material misrepresentation on an application for insurance in the past 7 years. Agents’ Procedure Manual 04.11.2014 Page 15 Applicant(s) who have had a bankruptcy, repossession or foreclosure requires underwriting approval prior to binding. The risk is ineligible for applicants who have sustained more than one (1) loss of any type, other than a weather related event, within the last 36 months. For applicants who have sustained a fire or personal liability loss in the last 60 months, coverage cannot be bound. Refer to underwriting for further review. ADDITIONAL INELIGIBLE CHARACTERISTICS - MANUFACTURED HOME Homemade multi-sectionals- two or more homes connected by a common roof that was constructed on site. Property deeded to an LLC, trust, estates, corporation, or company (see Properties deeded in an LLC, trust or Corporation section of the manual) Located on very low land exposed to flooding or high waters Any location posing extraordinary high risk conditions of any kind Any Recreational Vehicle (RV’s), RV Ports, Motor Homes, fifth- wheel trailers, travel trailer, park trailers or similar structures. Risks located in a Protection Class 10 Agents’ Procedure Manual 04.11.2014 Page 16 BILLING There is no grace period for a payment due. The premium is due on the renewal date of the policy. If the payment is not received by12:01a.m. on the effective date the policy lapses. AIIC offers 4 different payment plans and credit card for premium payment. Agencies should never take policyholder payments made out to their agency. If they do and the check is NSF, AIIC will be unable to assist them. A. Reinstatement A REINSTATEMENT can be considered under certain conditions. The home should be in good condition, no outstanding requests pending, no disrepair, no prior losses or payment lapses, not meeting underwriting standards, no closed zip code etc. If the risk meets the criteria then a Statement of No Loss (Accord form) or a written statement from the insured along with Credit Card payment will be necessary to reinstate the policy. B. Renewals A renewal package is sent to the insured approximately 60 days prior to expiration with the renewal invoice. The insured has until the expiration to pay the premium. If the policy is mortgagee billed a duplicate statement is sent to the mortgage company. It is the insured’s responsibility to ensure payment is received in a timely fashion. When a payment is not received 20 days prior to the expiration date, a legal notice of cancellation is automatically issued advising coverage will cease on the renewal date. Even though the insured has until the expiration date to make the payment we have to comply with legal notice requirements. When the renewal payment is received post the expiration date, it is not automatically reinstated. The check will be cashed and the refund sent to the insured. The mortgage company has up to 90 days to submit a payment post expiration date. C. Equity Billing AIIC policies are equity billed. What this means is that a statement is not generated until the policy is running out of money. Sometimes the insured is not billed almost until the expiration of the policy. It is important these billing notices are not disregarded since it can lead to a cancellation for non-payment. D. Mortgage Bill A policy may be designated to send the invoice to the mortgage company. In these situations, the insured will continue to receive an invoice but a duplicate one will be sent to the mortgage company. E. Refunds A refund is always sent to the insured unless prior arrangements have been made with AIIC. When a refund is to Agents’ Procedure Manual 04.11.2014 Page 17 be sent to someone other than the Named Insured, a written signed request must be submitted along with the specific details directing where the payment is to be sent. F. Changing Payment Plans A payment plan may only be changed at the inception or renewal of the policy. Mid-term changes to the payment plan are not accepted. G. Payment Options The preferred method for AIIC is credit (debit) card online payments but we accept checks. At the writing of this manual we are not able to handle electronic checks or EFT. Premium financing is not an option. To submit a credit card payment, access our website www.aiicfl.com Access the link MAKE A PAYMENT and follow the prompts. Either the insured or the agent can access and make a payment to an active policy. There is no fee for using a credit card payment online. A payment cannot be made on a policy which has been cancelled. If a reinstatement is pending, a phone call is required to Credit Card/Billing: 866-968-8390, option 3 to process the credit card transaction. We accept MASTER CARD, VISA or DISCOVER. Note: It takes 24- 48 hours for the credit card transaction to be posted on the account. H. Fees and Surcharges I. II. III. IV. V. Insufficient Funds: When a check is returned for NSF, there is a $15 NSF fee applied. Installment Service Charge: $3.00 for each payment when the policy is not paid in full. MGA (Managing General Agency) Fee: $25.00 fully earned collected with the first payment. Service Fee: $10.00 one time service fee collected with the first payment when the policy is not paid in full. EMPATF: $2.00 fully earned annual surcharge collected with the first payment. LAPSE IN COVERAGE OR FORCE PLACED INSURANCE Risks with a lapse in coverage that exceed 30 days from the date of the lapsed/cancelled policy or have had no prior insurance, must obtain Underwriting approval prior to binding. A Statement of No Loss must accompany any request. If approved, the risk will be subject to a 10% surcharge which will be applied for one (1) year from the date of issuance of the policy. The surcharge does not apply to first time home buyers or renewals. Any lapse in coverage greater than 90 days will be eligible for the DP1 program only. Force placed insurance is not considered acceptable proof of prior insurance. Agents’ Procedure Manual 04.11.2014 Page 18 SYSTEM FEATURES/HINTS Policy ID: AGH200000 Territory: 521 Name: John Doe Company: AIH Inception Date: 9/26/2012 Company ID: 000410 PlanID: HO3 PolicyCoverage Property Features Customer/Lien Billing Notices/Memos/Notes Images Claims Full History Notices/ Memos/ Notes: An agent can add a note to the policy any time by clicking on the hyperlink of the same name. Underneath the Action heading, click on – NEW NOTE – on the right hand of the screen. Typical notes include comments about dogs, exceptions, losses, or any other noteworthy items. NOTICES / MEMOS / NOTES Type UserId Print / Entry Message Action Note TEST 9/26/2012 12:00:00 AM New New Note Memo TEST 9/26/2012 12:00:00 AM New New Memo Under TEST 9/26/2012 12:00:00 AM New New DNOC NOTES PAGE - 1 OF 2 Please add your note in the space provided. Images: Includes all correspondence sent or received pertaining to the policy. Property or 4pt inspections, mortgage and coverage change requests are some documents typically found in this section. Use the hyperlink to view each document. Policy ID: AGH200000 Territory: 521 Name: John Doe Company: AIH Agents’ Procedure Manual 04.11.2014 Page 19 Inception Date: 9/26/2012 Company ID: 000410 PlanID: HO3 Policy Coverage Property Features Customer/Lien Billing Notices/Memos/Notes Images Claims PDF IMAGES Outbound Documents Sinkhole Loss Selection/Rejection Form: 7/3/2012 OIR-B1-1655: 7/3/2012 Agent Notice: 8/27/2012 Reminder Notice #1: 7/3/2012 New Business Dec Page 7/3/2012 New Business Application 7/3/2012 Documents Received ANS 9/12/2012 9:32:58 AM EB 7/11/2012 4:03:07 PM INSPECT/IZANANCHO 8/29/2012 8:42:24 AM Lookup Endorsement Cancel Menu Non-$$ Endorse Agents’ Procedure Manual 04.11.2014 Page 20 Full History Full History: An agent may click on the full history which will expand the screen so all of the insured information is viewable. The scroll bar on the right side of the screen will assist in the navigation. Policy ID: AGH202298 Territory: 521 Name: Test Test Company: AIH Inception Date: 9/26/2012 Company ID: 000410 PlanID: HO3 Policy Coverage Property Features Customer/Lien Billing Notices/Memos/Notes Images Claims Full History FOREIGN MAIL ADDRESSES 1. Enter as much of the address that can fit in the boxes labeled ADDRESS 1: & ADDRESS 2: as shown below 3. 2. The country’s postal code should be entered in the box labeled CITY: Enter 2 dashes in the box labeled State: 4. The box labeled ZIP CODE: may be used to enter the country’s name Agents’ Procedure Manual 04.11.2014 Page 21 CANCEL/REWRITE When a closing date changes, in most circumstances, the policy does not have to be reissued. The Cancel/Rewrite button at the bottom of the screen can be selected and the new date entered. All of the information including documents, any payments, notes etc will be moved to the new policy. The original policy will be automatically cancelled and a cross-reference notated in the Notices, Memos and Notes section of the application. Note: This feature is only available for nine(9) days past the effective date of the policy. Lookup Force Renew al Endorsement Non-$$ Endorse Cancel Claim Menu Cancel / Rew rite After the 9th day the policy will need to be rewritten via a new quote and a request to cancel the original policy sent to [email protected] NEW CONSTRUCTION/NEW ADDRESS All addresses must be validated prior to binding. If a client is purchasing a new home construction and the system is unable to validate the new address, contact Underwriting. In these situations, an address from a close by locale (must be the same zip code) will need to be obtained in order to validate the necessary rating data for a quote. Agents’ Procedure Manual 04.11.2014 Page 22 CORRESPONDENCE/DOCUMENTS REQUIRED A. New Business AIIC expects all agencies to know the risk property and verify it meets our guidelines prior to binding coverage. Photos, drive-by or inspection should be completed for upfront underwriting prior to writing with our company. AIIC requires only three (3) documents to be routinely submitted, they are: 1. 2. 3. Wind Mitigation inspections including the required photos. We only accept WLM inspections completed on the 2010 or 2012 forms. Email WLM inspections to [email protected] . 4pt Inspection a. HO3- homes 31 years or older b. DP3- homes 31 years or older, buy back Replacement Coverage and/or Limited Water Consent to Rate, DP1 Vacant only All other documents should be retained in the agents’ office and are subject to a company audit. The documents should support any discount provided, features of the home, when a claim is disclosed- evidence of completed repairs, photos of the home, appraisals, HUD statements, RCE, etc. This includes the signed application, rejection forms, etc. Note: It is important that the application, any waivers or rejection forms to be properly signed and initialed. B. Existing Business Any change in coverage to the betterment of the insured, i.e. adding/increasing coverage, does not require a signed request from the insured. The request can be submitted directly by the agent via email. A signature is required for a reduction of any coverage. It is also required for any change, either an increase or decrease, to Coverage A- Dwelling (along with RCE to support new value) or AOP/Hurricane deductibles, removing any coverage, Named Insured, etc. INSPECTIONS A. General Inspections Agents should stress that a condition inspection will be performed shortly after a policy is issued. In addition, renewals may also trigger an inspection. A higher value home may require an inside/outside inspection. When it is required, the inspection company will contact the client to schedule an appointment. It is important the insured cooperate to limit any delays in the inspection process. Agents’ Procedure Manual 04.11.2014 Page 23 If an inspection cannot be completed the policy is subject to underwriting action which can include cancellation. (The application discloses our right to inspect the property). The inspection cycle is approximately 6-8 weeks from request to review by the underwriter. If an inspection identifies concerns with the property, underwriting action could result. Typically, underwriting action could be in the form of a policy cancellation or a request for repairs/remediation via a memo or phone call. Notes will be added to the file in such cases. If the property is vacant at the time of inspection and not written on a DP1 Vacant form, the policy will be subject to cancellation. A completed inspection is always available for review. Refer to the System Features/Hints section of the manual for complete details on how to access Images. B. 4PT Inspections (including color photos) Four Point Inspections which include color photos are required for: • HO3- 31 years and older as part of the eligibility requirements • DP3 - 31 years and older if the policy is issued with the Limited Water Damage endorsement and/or Replacement Cost Loss Settlement is wanted. The 4 point inspection and color photos must be sent to: [email protected] within 30 days of issuance otherwise the policy will be subject to underwriting action which could include cancellation. The 4 point inspection with accompanying photos must be performed by an independent third party who is a certified home inspector. It must provide the following: • Age, type, and condition of each system (electrical, plumbing, heating, roofing) • Estimated remaining serviceable life of each system • Color Photos • Be signed and dated by the inspector The following applies to each system: ELECTRICAL SYSTEM: o No fuses o Minimum 100 amps of service o No knob and tube o No Federal Pacific, Stab-Loc, Zinsco, Challenger, or Sylvania Electrical Panels or breakers o No aluminum branch wiring unless COPALUM repair procedure and/or has been updated to conform to current local codes. o Recommended that electrical panels have been replaced within the last 20 years. Older panels will be considered only if in good condition, properly maintained, and sufficient size service for building. PLUMBING SYSTEM: o All plumbing(supply lines) from walls out (toilets, sinks, appliances) should be updated within the last 15 years o No polybutylene pipes o Copper, PVC, CPVC supply lines are preferred o No tank style water heaters older than 15 years (tankless water heaters no matter the age are acceptable) o No PEX plumbing HEATING SYSTEM: o Furnace/heat exchanger (HVAC) cannot be older than 15 years o Primary source of heat cannot be a portable heater or have an open flame o A room window unit which can cool and heat the home is an acceptable source if not older than 15 years. Agents’ Procedure Manual 04.11.2014 Page 24 ROOFING SYSTEM: o Asphalt or composition shingle roofs - no more than 20 years old. o Tile, slate, or metal roofs - no more than 40 years old o No asbestos tile, wood shingles, or tin/aluminum roofs o A flat roof unless < than 20% of the total roof structure (does not include a screen enclosed porch, etc.) Flat roofs greater than 20% are eligible under the DP1 program. o Roofs must be in good condition; have a minimum of three years serviceable life remaining, not be worn, have unrepaired damage, missing shingles, cracked tiles, patched, etc. o No roofs with more than 2 layers C. Wind Loss Mitigation Inspections Wind loss mitigation discounts are available to a homeowner that has taken efforts to protect their home against hurricane force winds. The wind loss mitigation building codes were initially changed in Miami-Dade and Broward counties in 1994. They were approved October 1, 2001, but not enforced until March 1, 2002, for the rest of the state. We will accept the 2010 or 2012 edition of the Uniform Mitigation Verification Inspection Form (OIR-B1-1802). However, we prefer the 2012 version. It is a more comprehensive edition requiring photos as further evidence the characteristics noted on the inspection are accurate. The form is valid for up to 5 years, provided no material changes have been made to the structure. When reviewing the form to apply the credits, make sure that all areas requiring a signature are signed and the information meets verifiable standards. Example- If the structure was built in 1982, and the inspector wrote that the roof is the original, but it meets the 2001 Florida Building Code, you’ll know that the inspector was mistaken when completing the form. D. Sinkhole Coverage Inspection Requests Sinkhole Loss Coverage can only be added at time of issue or renewal and a signed Sinkhole Loss Coverage Selection/Rejection Form, AIIC SKS 01 12 must accompany any request. For a renewal, the request should be received within 30 days of term expiration and an inspection of the risk is required prior to considering the addition of coverage. Note: The process will take approximately 6 weeks before a decision is rendered. Agents will be advised via memo of the final decision. To order a Sinkhole Inspection through SDII: The Sinkhole Inspection is an inside/outside inspection of the property, so it is necessary for the insured to be available for an appointment. Note: Sinkhole coverage may be removed any time during the policy period. Obtain a signed Sinkhole Loss Coverage Selection/Rejection Form AIIC SKS 01 12 from the named insured and submit it to AIIC prior to the renewal. NOTE: For NEW BUSINESS, the form must be signed at inception and submitted to the carrier once policy is bound. The Sinkhole Inspection is ordered through SDII: 1. Agent must sign register with SDII through their website: http://www.sdii-inspections.com 2. Select Agent Registration. Use registration code: sdiiagent and complete the on-line form. 3. The insured will be required to provide a credit card in order to pay the pre-arranged fee of $70 which is ½ the amount of the total inspection fee; American Integrity will pay the other half. 4. For all other inquiries in regards to specifics regarding the inspection or to check the status of the inspection the agent or insured may call SDII at 1-800-454-7344. Agents’ Procedure Manual 04.11.2014 Page 25 IS IT NECESSARY TO SUBMIT A FOUR POINT INSPECTION AND PHOTOS? NO YES a Four Point inspection is NOT required if: a Four Point inspection IS required if: HO3 DP1 75 YEARS OLD OR LESS. HO3 30 YEARS OLD OR LESS. DP3 30 YEARS OLD OR LESS. OVER 30 years old. DP3 OVER 30 years old AND Limited Water Damage was added OR Replacement Cost on Dwelling is desired. OPTIONAL: An underwriter MAY request a four point inspection to establish year of updates for a DP1 over 75 years old. NOTE: If a four point inspection and photos are required, the inspection must show: Whether the electrical breakers/box were updated within the past 20 years. Whether the plumbing located under all sinks/toilets were updated within the past 15 years as well as the hot water heater. If HVAC air handler & compressor were updated within the past 15 years Composition or Asphalt shingle roofs may not be more than 20 years old. Roofs comprised of tile, metal or slate may not be more than 40years old. FYI: As a convenience to our agency partners & their affiliates, we created a Four-Point Inspection form which specifies all of the areas we need addressed in order for the risk to meet our guidelines. It is not required that the inspector use this form, but it can be helpful for the inspector to know the specific information required. A copy of the form is available on our public website www.aiicfl.com under the AGENTS tab, then FORMS LIBRARY, followed by VOLUNTARY FORMS, next select HOMEOWNER and finally click on 4 POINT INSPECTION FORM. Agents’ Procedure Manual 04.11.2014 Page 26 DWELLING CHARACTERISTICS A. Age/Condition Homes should be well maintained and show pride of ownership. A home with existing damage or disrepair will be cancelled or non-renewed. AGE: YEAR OF CONSTRUCTION HO3 – Homes 75 years of age or newer are eligible for this program. If the property is 31 years or older a 4pt inspection is required as part of eligibility requirements. Failure to submit this inspection will result in underwriting action to include cancellation. Water Damage is excluded for homes over 40 years of age. Limited Water Damage can be purchased with a satisfactory 4pt inspection along with written request. DP3, 31+ - We will write homes of any age. If the property is 31 years or older, the policy is written with the Water Damage Exclusion Endorsement (AIIC DP 09 WD) and loss settlement for Coverage A and B is changed to Actual Cash Value. To request loss settlement change to replacement cost or add limited water a satisfactory 4pt inspection must be submitted along with a written request. DP1- We will write homes of any age, as long as the property is occupied. There is a 10% surcharge for homes over 36 years of age. The maximum age limit for a vacant home written under the DP1 Vacant Home Program using Consent to Rate is 75 years. B. Construction Any home of frame construction greater than 33 1/3% must be rated as frame construction. A home with more than 66 2/3 % brick veneer exterior can be rated as masonry. Hardiplank siding is considered frame and the dwelling should be rated accordingly. The risk may be eligible for the hardiplank discount. C. Pools (Slides or Diving Boards) AIIC only accepts pools completely fenced, walled or screened. The fence or wall must be of a material that provides a reasonable barrier to entry (e.g. chain link, wood, steel or aluminum), be at least 4’ high, permanently installed, comply with local ordinances, and have a self-locking gate or door. The pool may not have a diving board or slide. Above ground pools must have steps that can be locked in the up position. The child safety fences required by local ordinance do not meet the requirements of a permanent barrier. Note: Kiddie pools are acceptable and do not have to meet the above requirements. A kiddie pool is a wading pool for young children; it is usually inflatable. Agents’ Procedure Manual 04.11.2014 Page 27 D. Trampolines AIIC only accepts trampolines in completely fenced yards. The fence or wall must be of a material that provides a reasonable barrier to entry (e.g. chain link, wood, steel or aluminum), be at least 4’ high, permanently installed, comply with local ordinances, and have a self-locking gate or door. E. Roofs The main concern with a roof is its age. Asphalt/Composition shingle roofs must have been replaced within 20 years. Homes with roofs less than 3 years life expectancy will be non-renewed the following year. AIIC will not consider patched, multi-layer, or worn roofs. i. FLAT The flat roof rules apply to the main roof structure, which is living area only. Do not consider roofs of porches or carports that are attached only to the fascia or wall of the host structure over unenclosed space in the determination of roof geometry classification. Any risk with a flat roof section which is 20% or greater of the overall roof structure of the home is not eligible for the HO3 program. If the risk is over 31 years old it may be written on a DP3 with the Limited Water Exclusion or a risk of any age with a flat roof may written on a DP1. Agents’ Procedure Manual 04.11.2014 Page 28 ii. HIP A hip roof with no other roof shapes greater than 10% of the total roof system perimeter may have the hip roof discount applied. F. Open Foundation Since many older homes are built off the ground, the following should be considered to determine the appropriate program: a. b. c. Homes with an open foundation are ineligible for an HO3. A risk with an open foundation may be eligible for DP program with the appropriate surcharge. Crawlspace foundations must be enclosed to be acceptable for HO3. Lattice is not an acceptable material to enclose a crawlspace foundation. Typical acceptable materials used to enclose a crawlspace foundation are brick and concrete. Small openings for ventilation and/or maintenance are common and acceptable. Homes built on stilts or pilings may be considered on an exception basis. Newer construction is preferred (should conform to the 2002 FL Building Code). MINIMUM/MAXIMUM VALUES Dwellings under $150,000 The minimum eligible dwelling limit for all coastal counties is $150k on the HO3 Program. We can consider writing a policy with a minimum dwelling value < $150k on an exception basis. We require color photos of the exterior and a recently completed RCE to consider exceptions. Homes that are well maintained, newer construction are preferred to be considered for an exception. Note: The value as determined by a Cost Estimator must meet the minimum requirements to be eligible for the HO3 program, i.e. a cost estimator with value of $145k would not be eligible and is subject to underwriting approval. Dwellings $750,000 - $1.5 Million: High Value Homes AIIC will only consider an HO3 policy for homes valued $750,000 - $1.5 million, if the following are met: Risk must be the insured’s primary home and must be owner occupied (no seasonal, secondary, rental, vacant, unoccupied homes) Risk must have a centrally installed burglar alarm with current contract Fire Protection Class must be 1-8, no PC9/10s. Must meet all new business guidelines Agents’ Procedure Manual 04.11.2014 Page 29 The Agent of Record is responsible to pre-qualify the risk to verify it meets the above guidelines prior to binding. Once bound, an inspection will be ordered. The inspection will be an inside/outside inspection which will require an appointment. The inspection will confirm eligibility, condition, value, and rating factors. If an inspection identifies concerns with the property, underwriting action could result. Typically, underwriting action could be in the form of a policy cancellation or a request for repairs/remediation via a memo or phone call. Notes will be added to the file in such cases. VALUATION A. HO3- Replacement Replacement cost on the dwelling is part of the HO3 program. ISO360 is the vendor chosen for our on-line value substantiation tool and the link to ISO360 can be found in the on line quoting system. We prefer ISO360, but will accept other cost estimators. If a request is received for more than the substantiated replacement cost, a copy of the cost estimator is required to support the increase. We will not insure any home for an amount less than 100% of the cost to rebuild. B. DP3- Replacement or ACV (based on age of home) Risks must be insured for 100% of replacement cost as determined by an acceptable cost estimator. A home older than 30 years of age must be insured at 100% of Actual Cash Value which can be obtained by adjusting the cost estimator for depreciation. If the cost estimator tool does not have a depreciation factor, it is acceptable to use 80% of the total value calculated. Losses under Coverage A & B are covered at replacement cost subject to certain conditions unless DP 04 76 – Actual Cash Value Loss Settlement is attached changing settlement to ACV. This endorsement is required on homes older than 30 years of age. Replacement can be added back if an acceptable 4pt inspection is provided. C. DP1- ACV only Risks must be insured for 100 % of Actual Cash Value as determined by an acceptable cost estimator. The Actual Cash Value can be obtained by adjusting the cost estimator for depreciation. If the cost estimator tool does not have a depreciation factor, it is acceptable to use 80% of the total value calculated. Actual cash value means the amount which would cost to repair or replace covered property with material of like kind and quality, less allowance for physical deterioration and depreciation, including obsolescence. Dwellings with actual cash value above $500,000 must be referred to underwriting with a completed cost estimator and color photos. Minimum coverage for a Dwelling Property form with the Condominium UnitOwners Coverage is $25,000. D. Coinsurance In the event of a loss, the 80% coinsurance penalty is applied to any risk that is not insured to value. Agents’ Procedure Manual 04.11.2014 Page 30 ANIMALS/ACREAGE A. Dogs or other pets AIIC recognizes applicants have pets of all kinds. We do not restrict ownership except for the following concerns: non-domesticated or exotic animals are not eligible dogs with a history of biting, aggressive tendencies or attack are not eligible law enforcement K-9’s are not eligible none of the following breeds are not eligible: o Pit Bull Terrier, Pit Bull, Staffordshire Terrier, o Wolf or Wolf Hybrid, and/or o Any mixed breed dog that includes any of the aforementioned breeds. The number of animals on the property may also be a concern. When the applicant has more than 5 dogs or a combination of any other animals, prior approval should be obtained from underwriting. Refer to the section pertaining to properties with farm animals or horses for more details. B. Properties w/Farm Animals or Horses (Not on a Farm) We can consider a risk with up to 5 horses. We prefer 1 acre per animal and a risk with a small number of animals that are typically found on a farm, such as pigs, chickens, cows, or goats. We will accept a “hobby farm” or a “gentleman’s farm”, where the animals are kept as pets and they are not sold to the public. The following questions should be developed for underwriting approval: Type of animals and how many? Use- (Pets, food, breeding, horse racing, etc) Is the land fenced? Who cares for and feeds the animals? Are there any employees? Is farming the primary occupation? Horses- Are riding lessons taught on the property? Are non owned horses boarded on the property? PROTECTION CLASS A. Split PC 9/10 A split PC 9/10 will be categorized as PC10 when there is a fire station within 5 miles and no hydrant within a 1000ft. This requires the risk to be issued with an underwriting override but differentiates the risk from the true PC 10 which does not have either the fire station or the hydrant within a 1000ft. For a dwelling located in a Protection Class (PC) 10, the following information will be required by the Company to determine eligibility: a. b. c. d. e. f. Name of the responding fire department Response time Is the station voluntary or paid? Water source? Distance to the hydrant or approved alternate water source. The number and carrying capacity of the pumper and tanker trucks Does the home have a central fire alarm, accessible roads and visible from the road? Note: When a split PC has no hydrant within 1000ft, the second PC must be selected. Agents’ Procedure Manual 04.11.2014 Page 31 B. PC10 property (fire station over 5 miles) is ineligible C. Properties located on more than 5 acres AIIC prefers to limit acreage to 5 acres or less. Properties located on more than 5 acres in a PC9 or PC10 are ineligible. PC8 or less are subject to underwriting approval. D. Fire Protection Verification When the distance to the nearest fire station or fire hydrant cannot be confirmed by the inspector and is in dispute, the following documentation is acceptable: Letter from the responding fire department on their letterhead verifying the protection class and distance to the fire hydrant. A draft water source or dry hydrants are not accepted as a hydrant within a 1000ft of the home. This equipment still requires additional action to be properly utilized. LLC’S (LIMITED LIABILITY CORP) LLC’s are generally formed for tax purposes and to limit the amount of personal liability for the debts and actions of the LLC. They can be formed of 1 or many individuals, corporations, other LLC’s or foreign entities. We want to limit our exposure to the liability associated with this risk because of the LLC’s broad nature. The only acceptable policy for a home that is owned by an LLC is a DP3 or DP1 with liability excluded. Number of Rentals Accepted per Insured – DP3 We will accept up to 5 rentals per insured whether in the name of an individual or LLC. If an individual or LLC owns more than 5 rental properties, the risk is considered commercial and would not be eligible. If an exception is warranted, contact Underwriting with the following information: How many rentals does the insured own and are there any plans to buy more? Is there a commercial liability policy in force? If yes, what is the name of the company and limit of coverage? Where are the properties located, and what is the approximate age of the risks? - We don’t want to be the pre-dominant insuring company in any one neighborhood or on any one street. Are they in an individual’s name, an LLC, PC or other business entity? Number of Rentals Accepted per Insured – DP1 We will accept an unlimited number of properties with no liability subject to the concentration of risk concerns (no more than 2 homes on the same street and/or properties are a minimum of 1 mile from each other.) We don’t want to be the pre-dominant insuring company in any one neighborhood or on any one street. TRUSTS (ALL FORMS) A policy is only acceptable if the home is owned by a Living or Testamentary Trust. When writing a policy on a residence owned by the trust, coverage is issued with the name of the Grantor or Trustee as the named insured and the Trust as the Additional Insured. The policy should always be in the name of the Grantor/Trustee of the trust in order to provide them with personal Agents’ Procedure Manual 04.11.2014 Page 32 property and liability coverage. The Trust, listed as Additional Insured, will have coverage for its interest in the home only and liability is limited to on-premises only. Trusts – other than Living or Testamentary: All other Trusts are unacceptable for an HO3 policy. This includes land trusts. We can only consider these on the DP program with liability excluded. ESTATES A. Insure becomes deceased during policy term If the insured expires during the policy term the policy may be subject to underwriting approval and/or action upon renewal. A primary concern is the occupancy of the home. Details pertaining to occupancy and estate handling need to be developed so that appropriate updates can be initiated on the policy (i.e. mail address, etc.). If the risk is vacant or the ownership has transferred then the policy will need to be cancelled and rewritten to the appropriate policy form. Note: AIIC policies are not transferrable or assumable. B. New policy – deed in the name of an estate An estate in not eligible for an HO3 policy form but may be written under the DP program with liability excluded. FORECLOSURES OR REPOSSESSIONS With foreclosure rates continuing to rise in Florida, we thought it would be helpful to provide you with general concerns we have been experiencing with regard to insuring homes that are going through foreclosure or have recently been purchased as a foreclosed/bank owned home. The following information is provided to help you determine if a risk would be considered acceptable to AIIC. Homes that have gone through the foreclosure process tend to have been vacant for several months. These homes are targets for theft and vandalism. They tend to lack necessary maintenance and have higher risks of water and mold damages. In addition, they are more likely to be purchased in an “as is” condition with existing or unrepaired damages. For these reasons, homes that were purchased through a bank foreclosure will only be acceptable for our DP1 program. If the home will not be either tenant or owner occupied within 30 days of policy inception, it will only be acceptable under our DP1 Vacant program. All homes must be in good condition, with no unrepaired or existing damage. If you are trying to secure coverage on a DP3 or HO3 policy, Underwriting will consider on an exception basis upon review of a pre-purchase inspection report. The inspection must provide us with the age, type, and condition of all major systems (electrical, plumbing, heating & a/c, roof) as well as check for existing damages (plumbing leaks, missing appliances, etc). The inspection should include color photos of the property. If you have any questions regarding foreclosures, please contact Underwriting: 866-968-8390, option 6 CONCENTRATION OF RISK The increase in foreclosures has created opportunities for investors. AIIC has concerns when there are several properties located on the same street, subdivision or community. In these circumstances, we request no more than 2 homes on the same street and/or properties are a minimum of 1 mile from each othe Agents’ Procedure Manual 04.11.2014 Page 33 OCCUPANCY AIIC requires an owner occupied property to be occupied 10 – 12 months a year. This requirement applies to annual rental properties as well. If the property is not occupied as indicated above, the following may apply A. Seasonal/Secondary A dwelling unoccupied by the owner for more than 3 months annually is considered a Secondary/Seasonal residence. A Secondary/Seasonal residence with a rental exposure may be eligible for the DP program only. Secondary/Seasonal residences are not eligible for coverage in this program unless the residence is owner occupied for a minimum of 4 months per policy year, AND: residence is located within a gated or guarded community or secured access building (requires security guard or passkey gates), OR residence has a functioning central station fire and burglar alarm system. B. Short Term Rentals A dwelling policy may be written for either an owner occupied or tenant occupied dwelling. If the risk is tenant occupied, we prefer a copy of an annual lease in your records. A rental for less than 12 months is considered a short term rental and needs further review before accepting the risk. VACANT OR UNOCCUPIED PROPERTIES What is a vacant property? A “vacant” property is a risk which lacks the necessary amenities, adequate furnishings, or utilities and services to permit occupancy of the dwelling as a residence. An “unoccupied” property is a dwelling that is not being inhabited as a residence. AIIC considers a dwelling with less than 4 months annual occupancy to be unoccupied. When it is evident from an inspection report or other source that the property is vacant; the policy will be cancelled or non-renewed unless the policy is written on a DP1 Vacant policy form. The cancellation/non-renewal may be rescinded with a signed statement from the insured indicating the home is occupied and a current utility bill(s) with their name and property address. Depending upon the vacancy details, AIIC has two options for coverage. When a rental property has periods of vacancy between tenants the following option should be considered when issuing a policy: A. Vacancy endorsement may be added at inception or renewal to accommodate periods of vacancy due to lease expiration. The dwelling must be tenant occupied or have a lease agreement for occupancy within 30 days of policy issuance. The endorsement is not be used for vacant/unoccupied homes. When the dwelling is vacant or unoccupied then the best option is the DP1 VACANT program. An unoccupied dwelling includes a risk with contents if the dwelling is no longer a place of usual return. B. DP1 – Vacant is designed to accommodate the “for sale” property, estate or investment property which is not occupied. The program requires the insured to sign the Consent to Rate form acknowledging the rates and 25% fully earned premium. If the named insured is an LLC, a copy of the Power of Attorney should be submitted along with the Consent to Rate form and notes added to the policy stating the contact name and information for the POA. Reminder: A signed Consent to Rate Form MUST be submitted to the company after the policy is bound. A pre-filled version is available for printing under the same section as the new business application. Agents’ Procedure Manual 04.11.2014 Page 34 C. Homes under Renovation Homes under minor renovation that will be put up for sale after the renovation is complete may be eligible for the DP1 Vacant policy. The level of renovation needs to be determine by asking: Exactly what will be done- new roof, adding square footage, removing cabinets, etc? How long will this process take? Examples of major renovations not acceptable are: adding square footage, replacing plumbing and electric in the walls, or tearing down walls. Painting, replacing the roof, replacing the flooring or kitchen cabinets would be minor renovations. OPTIONAL COVERAGE A. Limited Water Damage Coverage Homes older than 40 years for an HO3 and 30 years old for a DP3 are written with the Water Damage Exclusion. Limited Water Damage Coverage may be added back to the policy after a 4 Pt inspection is submitted showing the plumbing system has been updated in the past 15 years and that there has been no water damage or mold claims in the past 3 years. This endorsement is only available at inception or upon renewal. B. Water back up and sump overflow A policy may be endorsed to provide coverage for loss resulting from water which backs up through sewers or drains or which overflows from the sump. The limit of liability under this option is $5,000. This endorsement is only available at inception or upon renewal. A 4 point inspection with accompanying photos is a requirement for the purchase of the coverage if the dwelling is over 30 years old on an HO3 and a DP3. Note: When a home is older than 30 years, Water Back Up and Sump Overflow is only available if Limited Water Damage Coverage has been purchased. C. Scheduled Personal Property All requests to add Scheduled Personal Property are subject to underwriting approval. A schedule with a total over $20k, individual items worth more than $5k, or if the total schedule is more than 15% of Coverage C will be referred to underwriting prior to binding the application. The following general information is required: An appraisal or bill of sale dated within the last 3 years, to add any item worth $2,500 or more. A color photo is required for any item worth $5k or more and for all fine arts regardless of value. A central station burglar alarm is required for schedules over $20k. The minimum acceptable value for any one item, pair (jewelry), or set (silverware) is $500. The maximum allowable total schedule value is $100k. Each scheduled item must have a complete description as follows: i. Jewelry Type – (ring, bracelet, necklace) and general description Color, cut, clarity and carat weight of gemstone and type Pearls- color and type (freshwater, saltwater, etc) and average size. Length of bracelet or necklace Type of setting- white or yellow gold and karat weight, platinum, silver Watches- manufacturer, model name/number, serial number, mans or woman’s, general description for band and face Agents’ Procedure Manual 04.11.2014 Page 35 Appraisal must be completed by a graduate or certified gemologist if valued at $20k or more or if there is a single diamond 2ct or larger. We also require a GIA certificate for any diamond of this size or value. Note: An engagement ring worn by the insured’s fiancée even if they do not reside in the same household is acceptable. ii. Fine Arts Antiques - Must be over 100 years old to be a true antique. Age and type of item, material and condition, country of origin, dimensions. Antiques refer to furniture only. Oriental rugs only if used as a tapestry. Note: Breakables (china, crystal, figurines like Hummel, Lladro’s, etc.) cannot be insured on a schedule. D. Personal Property Exclusion (HO only) Use form AIIC HO XC for the insured’s statement to exclude coverage for personal property. Scheduled personal property must also be removed if personal property is being excluded. We will not accept any other form. This exclusion may only be added or removed effective at the policy inception or renewal. E. Windstorm or Hail Exclusion (All programs) Use Form AIIC HO XW for the insured’s statement to exclude coverage for wind and hail. We will not accept any other form. This exclusion may only be added or removed effective at the policy inception or renewal. The following optional endorsements can only be considered at policy inception or at renewal: o Water Back Up and Sump Overflow o Personal Property Exclusion o Change to Hurricane Deductibles o Gold Endorsement o Limited Fungi o Limited Water Damage o Loss Assessments o Sinkhole Agents’ Procedure Manual 04.11.2014 Page 36 MANUFACTURED HOMES AIIC prefers to write manufactured homes built in 1994 OR NEWER, that are well maintained, show pride of ownership, and comply with all of the ANSI/ASCE construction standards. We are writing new business in Adult Parks, Family Parks, Approved Subdivisions and Private Property. A. VALUATION- ACV ONLY The mobile/manufactured home, including any structures that are permanently attached to the h ome (and subject to the requirements outlined elsewhere in this Manufactured Home Program Manual), may be insured for a maximum to 100% of the Actual Cash Value (ACV). If recently purchased, use the purchase price of the mobile/manufactured home. Otherwi se, use an authoritative source such as NADA. The value of the mobile/manufactured home includes the value of all “approved” structures (as detailed in Section B- Attached or “Add-On” Structures; it does not include the value of the land or finance charges. Actual cash value means the amount which would cost to repair or replace covered property with material of like kind and quality, less allowance for physical deterioration and depreciation, including obsolescence. B. ATTACHED OR “ADD-ON” STRUCTURES Add-on structures attached to the manufactured home such as screen rooms, utility rooms, attached sheds, and carports are not considered part of the dwelling. They are not covered under this policy unless they are specified on the declarations page and an additional premium is paid. All attached structures will be considered add-on unless they meet ALL of the following criteria: 1. Are weather tight and suitable for year round occupancy. 2. Are serviced with the same heating and air conditioning as the rest of the mobile home. 3. Are subject to the mobile home title requirements of the state of Florida. 4. The floor is at the same level as the kitchen and bathroom(s). A weather tight room is automatically considered part of coverage A, if it meets all 4 of the above criteria. It would not have to be listed as a separate item on the declaration page. C. COVERAGE B- OTHER STRUCTURES The maximum limit for Coverage B is 10% of Coverage A. However, if 10% of Coverage A is less than $2,000, we will provide a minimum limit of $2,000 for this coverage. Use of this limit does not reduce the Coverage A limit. Agents’ Procedure Manual 04.11.2014 Page 37 D. UNINSURABLE STRUCTURES OR ADDITIONS: Awnings or other attachments made of cloth or canvas Structures comprised of materials which are not strong or structures that do not conform to local building codes. Swimming pools Pool screen enclosures Greenhouses Satellite systems Barns E. MANUFACTURED VS. MODULAR HOME We will insure a Manufactured Home under our Manufactured Home program. A Modular Home can be insured under a Homeowners Policy. The following definitions will assist in determining the appropriate program form: “Manufactured Home” Home built entirely in a protected environment after the 1976 HUD Code. Built 1, 2 or 3 section home in protected building center, transported to home site on a frame and installed. There is a serial number. Built on steel beams with wheels under each section. Has a HUD sticker. The insured has a title rather than a deed to the home. “Modular Home” Built to local building codes in a controlled, environmentally protected center and transported to the site in pieces. Constructed at the site on a foundation. Has a DCA sticker typically attached to the electrical panel? F. ROOF OVER A manufactured home with a roof over may be eligible for coverage. G. REQUESTS TO ADD A PARK(TO OUR APPROVED LIST FOR QUOTING) Request to add a park can be sent to [email protected]. Include the following information in your email: a. The name of the park b. Full property address c. Phone number (if available) d. Website e. Requesting agent name and phone number Agents’ Procedure Manual 04.11.2014 Page 38

© Copyright 2026