Hydro One Networks Inc. 8 Floor, South Tower

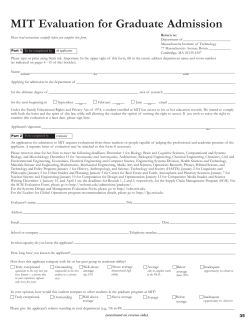

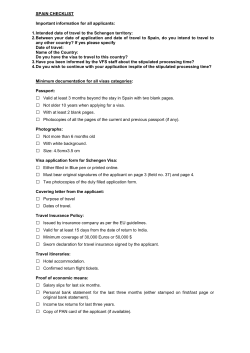

Hydro One Networks Inc. 8th Floor, South Tower 483 Bay Street Toronto, Ontario M5G 2P5 www.HydroOne.com Tel: (416) 345-5722 Fax: (416) 345-5866 [email protected] Greg Van Dusen Director - Distribution Applications Regulatory Affairs BY COURIER October 7, 2009 Ms. Kirsten Walli Secretary Ontario Energy Board 2300 Yonge Street, Suite 2700 Toronto, ON M4P 1E4 Dear Ms. Walli: EB-2009-0348 - Hydro One Networks’ Request for Leave to Sell Distribution Assets to Ontario Power Generation (“OPG”) – Update of the Application I am attaching two (2) copies of the updated application for Hydro One Networks’ (“Hydro One”) request to sell distribution assets to Ontario Power Generation (“OPG”) that was filed on September 22, 2009. The update is to make a correction to sections 2.5 and 2.6 of the application as illustrated in the amended application attached to this letter. Also, please find additional information below as requested in the Board’s letter dated October 1, 2009. The application states that the assets being sold to OPG are being used to serve customers of Niagara Peninsula Energy. a) Please provide information on what the assets are currently used for and what the assets are expected to be used for after the transaction. The assets described as 26 wood poles of the M2 feeder from Stanley TS are currently used for supplying a single phase load inside OPG Beck Property. After the transaction, the assets will continue to be used for that purpose for OPG. b) Please explain why these assets are being sold to OPG rather than Niagara Peninsula Energy. Initially, Hydro One discussed with OPG and Niagara Peninsula Energy service area of which covers the location of the assets. However, Niagara Peninsula Energy expressed no interest in taking over the assets. Instead, OPG subsequently obtained Niagara-On-The-Lake Hydro’s (“NOTL Hydro”) agreement to supply this load from NOTL Hydro’s service territory which is within eight spans of the load. For this purpose, OPG will make a supply arrangement for the single phase load to be fed from NOTL Hydro. Please confirm that Niagara Peninsula Energy has been informed of this transaction and advise of its position on this transaction. As already noted in part b of the previous response, Niagara Peninsula Energy expressed no interest in taking over the assets. An electronic copy of the complete report has been filed using the Board's Regulatory Electronic Submission System (RESS) and the proof of successful submission is attached. Sincerely, ORIGINAL SIGNED BY GREG VAN DUSEN Greg Van Dusen Attachment Application Form for Applications Under Section 86(1)(b) of the Ontario Energy Board Act, 1998 Application Instructions 1. Purpose of This Form This form is to be used by parties applying under section 86(1)(b) of the Ontario Energy Board Act, 1998 (the "Act"). Please note that the Board may require information that is additional or supplementary to the information filed in this form and that the filing of the form does not preclude the applicant from filing additional or supplementary information. 2. Completion Instructions This form is in a writeable PDF. The applicant must either: • type answers to all questions, print two copies, and sign both copies; or • print a copy of the form, clearly print answers to all questions, make a copy, and sign both copies. Please send both copies of the completed form and two copies of any attachments to: Board Secretary Ontario Energy Board P.O. Box 2319 27th Floor 2300 Yonge Street Toronto ON M4P 1E4 If you have any questions regarding the completion of this application, please contact the Market Operations Hotline by telephone at 416-440-7604 or 1-888-632-6273 or email at [email protected]. The Board’s “Performance Standards for Processing Applications” are indicated on the “Corporate Information and Reports” section of the Board’s website at www.oeb.gov.on.ca. Applicants are encouraged to consider the timelines required to process applications to avoid submitting applications too late. If the submitted application is incomplete, it may be returned by the Board or there may be a delay in processing the application. PART I: 1.1 IDENTIFICATION OF PARTIES Name of Applicant Legal name of the applicant: Name of Primary Contact: Title/Position: Address of Head Office: Phone, Fax, Email: Hydro One Networks Inc. Yoon Kim Applications Analyst, Regulatory Affairs 483 Bay Street, 8th Floor, South Tower, Toronto, ON, M5G 2P5 416-345-5228, 416-345-5866, [email protected] 1.2 Other Party to the Transaction (If more than one attach a list) Name of other party: Ontario Power Generation Name of Primary Contact: Greg Judd Title/Position: Systems Support Manager Address of Head Office: 14000 Niagara Parkway, Niagara-on-the-Lake, Ontario, L0S 1J0 Phone, Fax, Email: 905-357-6949, 905-374-5466, [email protected] 1.3 If the proposed recipient is not a licensed distributor or transmitter, is it a distributor or transmitter that is exempted from the requirement to hold a distribution or transmission licence? Yes No Page 1 of 4 The recipient is not a licensed distributor. While section 57 of the OEB Act ("the Act") requires a distributor to hold a licence, section 4.0.1(1)(b) of Ontario Regulation 161/99 provides an exemption to section 57 of the Act for a distribution system owned or operated by the distributor that is entirely located on land owned or leased by the distributor. As such, since the assets to be sold are entirely on land owned by the recipient, Ontario Power Generation (“OPG”) would be exempted from section 57 of the Act PART II: 2.1 DESCRIPTION OF ASSETS TO BE TRANSFERRED Please provide a description of the assets that are the subject of the proposed transaction. The assets to be sold are described as 26 wood poles of the M2 feeder from Stanley TS. These poles are located inside the OPG Beck Property within the service area of Niagara Peninsula Energy Inc. (“Niagara Peninsula Energy”) and do not serve any Hydro One customers. 2.2 Please indicate where the assets are located – whether in the applicant’s service area or in the proposed recipient’s service area (if applicable). Please include a map of the location. The 26 wood poles are located inside Beck OPG property within the service area of Niagara Peninsula Energy Inc. 2.3 Are the assets surplus to the applicant’s needs? Yes No If yes, please indicate why the assets are surplus and when they became surplus. 2.4 Are the assets useful to the proposed recipient or any other party in serving the public? Yes No If yes, please indicate why. Upon purchase of the 26 wood poles, OPG will facilitate their alternate supply arrangement. Safety and reliability will be maintained. 2.5 Please identify which utility’s customers are currently served by the assets. OPG is currently served by the assets. Hydro One currently owns the M2 feeder from the Stanley TS and the feeder supplies a single phase load inside OPG Beck Property. 2.6 Please identify which utility’s customers will be served by the assets after the transaction and into the foreseeable future. Upon purchase of the assets, OPG will make a supply arrangement to be fed from Niagara-On-TheLake Hydro (“NOTL Hydro”) to be connected at NOTL Hydro’s boundary. Page 2 of 4 PART III: 3.1 DESCRIPTION OF THE PROPOSED TRANSACTION Will the proposed transaction be a sale, lease or other? Sale Lease Other 3.2 If other, please specify. Please attach the details of the consideration (e.g. cash, assets, shares) to be given and received by each of the parties to the proposed transaction. This is a cash sale. The 26 wood poles will be sold for a nominal consideration of $1 on an “as is, where is” basis. The nominal consideration of $1 is more economical than otherwise where Hydro One would incur metering costs associated with maintaining the assets that are within Niagara Peninsula Energy with no Hydro One customers connected or expected to be connected to the poles. 3.3 Would the proposed transfer impact any other parties (e.g. joint users of poles) including any agreements with third parties? Yes No If yes, please explain how. 3.4 Would the proposed transfer impact distribution or transmission rates of the applicant? Yes No If yes, please explain how. 3.5 Will the transaction adversely affect the safety, reliability, quality of service, operational flexibility or economic efficiency of the applicant or the proposed recipient? Yes No If yes, please explain how. PART IV: WRITTEN CONSENT/JOINT AGREEMENT 4.1 Please provide the proposed recipient’s written consent to the transfer of the assets by attaching: (a) a letter from the proposed recipient consenting to the transfer of the assets; (b) a letter or proposed sale agreement jointly signed by the applicant and the proposed recipient agreeing to the transfer of the assets; or (c) the proposed recipient’s signature on the application. The letter is found in Attachment 1 – Letter. Page 3 of 4 PART V: 5.1 REQUEST FOR NO HEARING Does the applicant request that the application be determined by the Board without a hearing? If yes, please provide: (a) an explanation as to how no person, other than the applicant or licence holder, will be adversely affected in a material way by the outcome of the proceeding; and (b) the proposed recipient’s written consent to dispose of the application without a hearing. (a) The proposed sale of the 26 poles has no material effect on any party other than the purchaser and the seller. (b) The letter is found in Attachment 1 – Letter. PART VI: 6.1 OTHER INFORMATION Please provide the Board with any other information that is relevant to the application. When providing this additional information, please have due regard to the Board’s objectives in relation to electricity. PART VII: CERTIFICATION AND ACKNOWLEDGMENT STATEMENT 7.1 Certification and Acknowledgment I certify that the information contained in this application and in the documents provided are true and accurate. Signature of Key Individual Print Name of Key Individual Title/Position Greg Van Dusen Director - Regulation, Distribution Applications Company Date Hydro One Networks Inc. (Must be signed by a key individual. A key individual is one that is responsible for executing the following functions for the applicant: matters related to regulatory requirements and conduct, financial matters and technical matters. These key individuals may include the chief executive officer, the chief financial officer, other officers, directors or proprietors.) Page 4 of 4 ATTACHMENT 1- Letter I nvci ro~’ one Hydro One Networks Inc. 483 Bay Street North Tower, 1 4th Floor Toronto, Ontario, M5G 2P5 Aug 5, 2009 Ontario Power Generation 14000 Niagara Parkway Niagara on the Lake, Ontario LOS 130 Re: Purchase of 26 Poles inside OPG Beck Property Dear: Mr. Dave Heath This letter is to confirm Hydro One Networks Inc.’s (“Hydro One”) agreement to sell 26 poles inside the OPG Beck property to Ontario Power Generation for $ 1.00 plus GST, conditional to the OEB’s approval. This also confirms that Ontario Power Generation supports Hydro One to proceed with the Section 86(1 )(b) application without a hearing. The assets will be sold, following the OEB’s approval, on an “as is, where is” basis, pursuant to Hydro One Networks Inc.’s standard asset purchase and sale agreement. The assets being sold in this transaction are generally described as follows and supported by the attached map: 26 poles inside the OPG Beck property If you are in agreement with these conditions of sale, please sign and return this letter at your earliest convenience. On receipt of this signed letter of consent and indemnity, we will proceed to obtain formal approval to sell these assets to Ontario Power Generation. Thank you for your assistance in this matter. Yours truly, Robert Davidson Account Executive Customer Business Relations Acknowledgement I, Dave Heath , OPGI agree with content, terms and conditions set out in this letter regarding the purchase of 26 poles inside the OPG Beck property for $ 1.00 plus GST and support Hydro One to proceed th the Sectio 86(1) ) application without a hearing. Per: Dave Heath Plant Manager NPG OPGI I have authority to bind the Corporation. _________________ - cc. Gregory Judd, Asset Management Date: /7 ATTACHMENT 2- Map PGS Crossover Gauge NOTL line openers Pole mounted trans OPG Gate 6 Strabag TBM supply C A NOTL Hydro Circuit B OPG Canal 12M1 Poles From Point A to B to be owned by OPG. Poles from A to B to carry communication line from SAB2 to crossover gauge only. 13.8kV conductors to be removed by H1 Poles from Point C to D to be owned by OPG. Poles from C to D to be transferred in "made ready" state for use, with conductors in tact, for single phase supply from NOTL. Conductor to be removed between point B and C by H1.(Live conductor to dead end at transformer) H1 to provide design and cost estimate for stabilizing remaining circuits/poles (Make Ready) =Make Ready for Comm line (Remove conductors) = Make ready fror single phase supply from NOTL Hydro D

© Copyright 2026