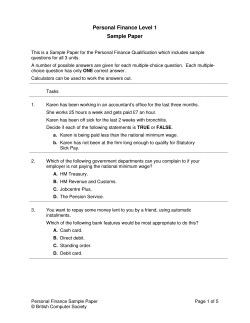

OnLine Application System Manual O

ONLINE APPLICATION OnLine Application System Manual User Manual for the FAME OnLine Application, Version 4 April 2014 ONLINE APPLICATION TABLE OF CONTENTS Getting Started………………………………………………….. ....................... 3 System Requirements and Recommendations...........…………………… 3 Preface…………………………………… .................................................. 4 Obtaining Login Credentials………………….. ......................................... 5 Changing Password…………………………………………….. .................... 6 Password Criteria………………………………………………. ................... 6 Logging In ...………………………………………………………………………..7 Main Menu………………………………………………………….. ..................... 8 Entering an Application……………………………………… ...................... 9 Borrower Information………. ................................................................... 9 Adding Co-Borrowers or Guarantors……………………………………….10 Entering Business Financial Information …………………. ................... 10 Entering Individual Financial Information …………………..................... 11 Loan Information…………………. ......................................................... 12 Refinancing Existing Lender Debt………………… ................................ 13 Uninsured Debt………………………………………………………………14 Collateral…………………………………………………………………….. 15 Submitting the Application ………………………………………………… 16 Calculation Results…………………………………………… ..................... 17 Procedure Post-Submission & Fees……………………………..…….. 18 Viewing Unsubmitted (Saved) Applications…….…….... ................. 19 Viewing Submitted Applications…………………………… .................. 20 Renewing Loan Insurance……………………………………. .................. 21 Finishing Up………………………………………………………… ................. 22 Logging Out of OLA…………………………………………… .................. 22 Security…………………………………………………………….. .................... 23 Contact Information…………………………………………. ....................... 24 Auditing OLA Applications …...……………………………………………25 APPENDIX 1: OLA Fact Sheet………………………………………. ............. 26 APPENDIX 2: Disclosure and Confidentiality Statement……………. ......... 27 APPENDIX 3: OLA Audit Worksheet…………………………………………..28 GLOSSARY……………………………………………………………. 30 NOTE: Any future changes to the User Manual will be available online. User Manual for the FAME OnLine Application, Version 4 April 2014 2 ONLINE APPLICATION Getting Started System Requirements and Recommendations OLA has been tested using Mozilla Firefox version 25.0, Google Chrome and Internet Explorer version 10. If you are using that version of one of these browsers, you should not have any problems accessing and using the system. If you are using an earlier version of Firefox or Internet Explorer certain functions and cookies may become disabled. If this happens, the application may not work. The FAME OLA system will work with any browser that meets the following requirements: HTML Version 4 Cookies Enabled 128 Bit encryption Secure Socket Layer Java Script enabled Cascading Style Sheets enabled PDF Reader (like Adobe) User Manual for the FAME OnLine Application, Version 4 April 2014 3 ONLINE APPLICATION Preface The OnLine Application (OLA) system is a secure web application that allows banks to apply for loan insurance. In situations where FAME exposure is $3,000 (at a maximum of 75% loan insurance) or less, a lender is able to input a limited amount of data over the Internet, and receive an immediate response as to whether the loan insurance is approved. Overview of System Flow The following flow chart illustrates the loan insurance application process using the OLA system. User Manual for the FAME OnLine Application, Version 4 April 2014 4 ONLINE APPLICATION Obtaining Login Credentials Eligibility to Use the OnLine Application System To be eligible to utilize the OLA system, a lender must have on file with FAME, a Loan Insurance Agreement and Addendum. The Addendum designates one person to coordinate lender’s employees who can access the OnLine Application program. New Users must obtain permission from their Lender Liaison to be granted access to the system. (See OLA Lender Liaison below.) In the event a Lender has not yet signed an Addendum to Loan Insurance Agreement and designated an OLA Liaison, one will need to be executed prior to OLA access being provided. Obtaining a Login and Password Login and passwords for Users are provided by FAME. The Lender Liaison must provide FAME’s OLA System Coordinator (1-800-228-3734 or via e-mail at [email protected]) with the name, email address, phone number and mailing address of each user. FAME will generate a login and password via secure email to the User. This password must be changed after initial login into the program. Note: Once a password has been changed, please make sure to keep this information available for future entry into the OLA system. This Password is not necessarily the same password as the secure email password. Please see “Changing Password” on page 6. Permission Levels FAME is the Administrator of the OLA system and, as Administrator, will be able to see all applications that have been entered by all Users. Lender Permissions will be based on the following two-tier levels: 1. OLA Lender Liaison - Designee of Lender, who also may have access to all information entered by any authorized User of that lender. This party will have the responsibility of providing prompt written notice of any additions to or deletions from lender’s list of authorized Users. 2. User - Users with the security level of “User” will only be able to see applications that they have entered. User Manual for the FAME OnLine Application, Version 4 April 2014 5 ONLINE APPLICATION Changing Password Your password will need to be changed every six months to ensure the security of the OLA system. Password Criteria Passwords are restricted with the following rules: 1) Password expires every 180 days 2) System remembers 3 previous passwords 3) The password must be at least eight characters long The password must contain characters from at least three of the following four categories (one upper and lower case and one digit or special character): uppercase letters lowercase letters number special character (For example: !, $, #, or %) Changing Your Password To change your password: Log in to OLA click on the “Change Password” link on the left side of the Main Menu. Current Password New Password New Password Click Change PW Enter your current password. Enter your new password. Enter your new password again for confirmation. Click the change password button. You will receive a confirmation message that your password has been changed. Any problems contact FAME 1-800-228-3734 User Manual for the FAME OnLine Application, Version 4 April 2014 6 ONLINE APPLICATION Logging into OLA 1. Run your favorite browser (Internet Explorer, Firefox or Chrome). 2. Type the URL for OLA: https://onlinedb.famemaine.com/ola/login.asp. 3. You should see the OLA login screen in your browser: Links in the top toolbar will take you to the FAME website. Enter the Login and Password provided by FAME. Passwords are case sensitive – make sure CAPS LOCK is not on. When you login the first time, an option will appear on the left toolbar to change your password. OLA specific topics. Demonstration Site provides link to test/practice loan scenarios. Information will NOT transfer to the live application. OnLine User Manual is this booklet; Fact Sheet is a summary of OLA Eligibility Requirements and Underwriting Criteria Response Team lists names and contact information for FAME Commercial Lending Staff Help generates an email to FAME. Newsletter provides helpful tips and information to the Users, as well as notice of modifications or updates to the OLA system. Note: Work must be saved within 30 minutes or automatic log out will occur. User Manual for the FAME OnLine Application, Version 4 April 2014 7 ONLINE APPLICATION Entering an Application Consider whether the loan should be put through the OLA Demonstration site before being entered into the Live site. If there is a low credit score, shortfall of collateral or cash flow problem, FAME recommends using the Demonstration site before entering a loan into Live. If you have never used the Demonstration site, it is exactly the same as the Live site, but it does not create a live loan in FAME’s database. You receive instant notification about whether or not a loan will be accepted for insurance based on the figures you input, just like on the Live site. New loan insurance application - Takes the User to a blank application. Unsubmitted (saved) loan insurance applications - Displays all applications that have been saved, but not submitted by current User. (See Viewing Unsubmitted (Saved) Applications on page 19.) Lender Liaison can view all applications submitted by financial institution’s Users. Submitted loan insurance applications/Renewals - Displays all applications that have been previously submitted by current User. Lender Liaison can view all applications submitted by financial institution’s Users. For Renewing Loan Insurance, go to page 21. User Manual for the FAME OnLine Application, Version 4 April 2014 8 ONLINE APPLICATION Entering an Application cont’d. After logging into the system and selecting “New Loan Insurance Application”, the following application screen should display. 1) Enter the Borrower demographic information (Profile 1) or select an existing borrower from the drop down box to auto-fill the information. Telephone and Address fields are required for all profiles; e-mail is optional Begin with a borrower. (There can only be one borrower.) 1) Select from an existing relationship with your Institution from the drop down; or 2) Create a new Profile. Submit for Approval when the application is complete. Save Progress – application may be saved without logging out. Select Profile Type, Relationship Type and Business Type. This will determine the information you will need to provide later in the application. NOTE: Choose Profile Type BEFORE entering any information. Logout – this will remove you from the OLA system. Industry Description - Brief description of what the company does. Select Town to Find Market Area - Select the town that the business is primarily located in Project Labor Market Area - Automatically populated by selecting the town. Salary Ranges - Fill in the number of jobs (based on wage level). Must be at least one job. Created Retained User Manual for the FAME OnLine Application, Version 4 April 2014 9 ONLINE APPLICATION Entering an Application cont’d. 2) Enter the Borrower Financial Information. The information required will vary based on whether Business or Individual was selected. BUSINESS FINANCIAL INFORMATION Blue Information Icons - click on these for additional information. The information will appear under the Logout button. EBITDA and Debt Service Coverage Ratio are automatically calculated based on prior input. To add Co-Borrowers, Personal or Corporate Guarantors to the loan, click the Add Profile button. User Manual for the FAME OnLine Application, Version 4 April 2014 10 ONLINE APPLICATION Entering an Application cont’d. INDIVIDUAL FINANCIAL INFORMATION Be careful not to double count information in Schedules C & F. If it appears under another Profile, do not add it or subtract it again. For example, Business Borrower with Schedule C cash flow or debt service – don’t include the same figures on the individual’s profile. After all Profiles have been entered, a Global Debt Service Coverage Ratio will appear here. Global Debt Service Coverage Ratio Estimated Living Expenses, Estimated Personal Cash Flow and Profile Debt Service Coverage Ratio auto calculate based on prior data entry. User Manual for the FAME OnLine Application, Version 4 April 2014 11 ONLINE APPLICATION Entering an Application cont’d. 3) Loan Information. You can apply for loan insurance for up to four loans to the same borrower with each application. (Note: Loans to different Borrowers require separate applications). Enter the Loan Information based on the eligibility criteria on the Fact Sheet. Insurance Requested plus any existing FAME exposure to any borrower or guarantor must be no greater than $375,000. $500,000 maximum loan if a line of credit. 40% loan insurance on refinance of existing lender debt (this may be a blended rate). 60% loan insurance for start-up business. 75% loan insurance for all other loans. Refinance of Existing Bank Debt. When this box is checked a new pop up window will appear. Please fill out the required information, check the Certification box and click submit. (See next page for screen shot.) The Blended Rate Detail box auto-fills from the pop up screen. Uninsured Debt. When the User clicks into this box a new pop up window will appear. Please fill out the required information. (See page 14 for screen shot.) Information entered will populate Uninsured Debt and Equity boxes. User Manual for the FAME OnLine Application, Version 4 April 2014 12 ONLINE APPLICATION Refinance of Existing Debt Pop Up Box By checking the box, I am certifying the following: • This request is for FAME loan insurance on existing lender debt not currently insured by FAME; • 1st lien positions on collateral securing these loans, with a maximum LTV of 120%; • Debt service coverage to be at a minimum of 8:1 after refinance; • Company/borrower must be viable currently and refinance allows for continued viability; • Current loans cannot be > 60 days past due based on the current interest paid to date and date of last payment; • Public benefit must be met. This is determined by: the need to retain jobs; the impact this industry has on jobs at other businesses and/or other industries in the region; and the impact on unemployment rates in the region. Please list the public benefit in the box. • Verify that this refinance must create a cash flow benefit of a minimum 15% savings on payments for the borrower; Please verify the 15% minimum savings in this box. If this is a blended rate due to a refinance with new money, please provide below the refinance amount, the new money amount and how you calculated the blended rate. You may also use this box to indicate any other information you wish us to know about this refinance. Blended rate. Please show how you reached the blended rate (i.e., $100,000 refinance @ 40% + $25,000 new money @ 75%) This will auto populate the Blended Rate box on the application. Once the box is checked, no follow up is necessary. Evidence of compliance must be maintained in the file for FAME audit purposes. Please see Refinance Requirements for more information I agree submit User Manual for the FAME OnLine Application, Version 4 April 2014 13 ONLINE APPLICATION Uninsured Debt Pop Up Box Uninsured Debt Calculation Lender’s Debt – Includes all lender debt associated with only this project, whether or not FAMEinsured. Non-Lender Debt – Includes seller financing, vendor, or other agency debt associated with only this project. Can be $0. DO NOT INCLUDE any of borrower’s existing debt. User Manual for the FAME OnLine Application, Version 4 April 2014 14 ONLINE APPLICATION 4) Collateral Add Collateral To this Loan. Click here to open an entry screen to add collateral. User Manual for the FAME OnLine Application, Version 4 April 2014 15 ONLINE APPLICATION Entering an Application cont’d. Select a loan officer from the drop down box. If the loan officer does not appear, provide Name, Address, E-mail address and Phone Number of the loan officer responsible for the loan application. Use only 5 digit zip code. Submit for Approval - Submits the information entered in application to the system for calculation and a decision. User Manual for the FAME OnLine Application, Version 4 April 2014 16 ONLINE APPLICATION Calculation Results There are two possible outcomes to the calculation process: 1. Approved - The OLA system found that the information entered is sufficient to give the borrower an approval. The User will be shown an approval screen (example below) and will be e-mailed the authorization and a copy of the completed application. The Authorization and Application should be printed when received – after 14 days the secure email will disappear, and the documents will no longer be available. An invoice will follow within 24 hours. 2. Pending - The User will be shown a pending screen. The OLA system found that the loan would require FAME/Bank interaction to determine if the loan insurance will be approved. OLA provides the Lender additional opportunities to revise the application. FAME will contact the bank within 24 hours to discuss the loan application. The User will be emailed a copy of the completed application. APPROVED: Approval FAME loan number assigned to your loan. PENDING: Pending User Manual for the FAME OnLine Application, Version 4 April 2014 17 ONLINE APPLICATION AFTER SUBMISSION After receiving the Calculation Results screen, the following will occur: With Approval: 1. Within minutes, a secure email will be sent (to the data entry person and the loan officer listed in the application, if they are not the same person) with a copy of the application, the Authorization, and an Employment Plan (if more than 10 employees). PLEASE PRINT THESE DOCUMENTS. The secure email system will delete the email after 14 days, and they will no longer be available. 2. Within 24 hours, a secure email will be sent to the same two people listed in step 1, with an invoice for the insurance premium and instructions on what to return to FAME. PLEASE PRINT THIS INVOICE. For current fees, please visit http://www.famemaine.com/files/Content/business_general/Fee_Schedule_2013-14.pdf . 3. When the loan has been closed at the institution, ONLY the following items need to be returned to FAME immediately (unless you have been specifically asked to send additional items): a. the original signed Authorization; b. copy of the invoice with the institution’s loan number filled in; c. check; d. Employment Plan (if required) 4. Insurance is activated ONLY when all these items are received. 5. Automated emails will be sent to the loan officer and the institution’s OLA Liaison reminding of Commitment expirations, Line of Credit renewals, Extension expirations and Term Loan maturity. With Pending: 1. FAME will contact the loan officer listed in the application to discuss why the application was not automatically approved, and talk about the options which may be additional guarantors or collateral, or submission through the paper application process. ANNUAL FEE REMINDER: The Institution is FAME’s customer. When the annual insurance invoice is sent to the lender, the institution is responsible for paying the insurance in a timely manner (30 days). Fees cannot be added to the principal balance of the loan if the bank advances the funds for the customer. User Manual for the FAME OnLine Application, Version 4 April 2014 18 ONLINE APPLICATION Unsubmitted (Saved) Applications To Return to a Saved Application - Click on the “Unsubmitted (Saved) Loan Insurance Applications” link on the Main Menu. The “Unsubmitted (Saved) Loan Insurance Applications” screen lists all applications that have been saved but NOT submitted for approval or modified within the last 45 days. After 45 days with no modifications, these applications are deleted. Click on the application you wish to view on the screen below: Saved Application Links Delete Saved Application User Manual for the FAME OnLine Application, Version 4 April 2014 19 ONLINE APPLICATION Submitted Applications The “View Submitted Applications” screen lists all applications that have been submitted for approval. On the Main Menu click on the “Submitted Loan Insurance Applications” link. This may take a moment. ALL Users loans will load alphabetically (OLA Liaisons will upload all of lender’s loans.). If you wish to refine your search criteria you may enter information or select from the boxes on the screen. You may also click on any of the column labels for it to sort. For example, click on “Borrower” and all borrowers will be sorted alphabetically. Gold highlight & asterisk denote a loan that is renewable. Click on the loan amount to edit the application for renewal. To sort by: Borrower Name - Enter part or all of a borrower’s name in the empty box to display all related applications. Begin Date - Show all applications with a last saved or submitted date greater than or equal to this date. End Date - Show all applications with a last saved or submitted date less than or equal to this date. Status - Select the status of the loan you are looking for (2 choices): Approved Pending Show Renewable Only - Check this box to show Line type loans that are eligible for renewal. Note: Applications for renewal must be submitted prior to expiration date. Search - Press this button to refresh the list of results once you have made changes to the above search criteria. Submitted Application Links - Click on any part of the application row to see and/or continue working with the saved application. Clicking on the link takes the User to the application. * Renew Links - If the loan amount has a “ ” next to it, the loan is renewable. Click on the loan amount or * the “ ” to create a new loan insurance application for the loan by editing the existing one. User Manual for the FAME OnLine Application, Version 4 April 2014 20 ONLINE APPLICATION Renewing Loan Insurance If a loan that was previously insured using OLA is renewable (Line type) you can renew the loan insurance from within the OLA application. To Renew a Loan Using the OLA System: Click on the “Submitted Loan Insurance Applications” link on the Main Menu Other search criteria Gold highlight & asterisk denote a loan that is renewable. Click on the loan amount to edit the application for renewal. Click to view only loans that are currently renewable. Check the “Show Renewable Only” checkbox. Fill in any other search criteria to help narrow the search. Click “Search ”. Click on the loan amount or the “ ” next to the loan amount to create a new loan insurance application for the loan. NOTE: Automatically generated Reminder Notices will be sent via secure email to the lender’s loan officer and Liaison 30 days, 14 days and 1 day prior to renewal date. * User Manual for the FAME OnLine Application, Version 4 April 2014 21 ONLINE APPLICATION Finishing Up Logging out of OLA Please promptly log out of the OLA system when you are finished working. There are two ways to log out of the OLA system: 1. Click Logout 1. Click “Logout” on the left menu of the application. This will NOT save any application information that is currently displayed on your screen. 2. Click Logout 2. Click “Logout” on the application screen. Note: Inactivity for 30 minutes or greater will result in an automatic logout. User Manual for the FAME OnLine Application, Version 4 April 2014 22 ONLINE APPLICATION Security FAME uses state-of-the-art middleware technology to isolate customer data from our public web sites. Outside connections coming into any portion of the FAME network are processed through a multi-layer security system including dedicated hardware devices and software solutions. All hardware and software solutions are enterprise grade and routinely tested for effectiveness. Included in the security architecture is an enterprise grade intrusion detection and prevention system that is updated daily. Security audits of the web servers are completed on a scheduled basis. If you or your IT Department requires additional information, please contact FAME. Contact Information Representatives are available from 8:00 a.m. to 5:00 p.m., Monday through Friday, to assist with questions. Once a loan has been processed, the main contact becomes the FAME loan officer assigned to the loan. To view a list of current contact information, click on the ‘RESPONSE TEAM’ button on the left side menu bar of the OLA login page at: https://onlinedb.famemaine.com/ola/login.asp . Every effort is made to respond to all questions within twenty-four hours. User Manual for the FAME OnLine Application, Version 4 April 2014 23 ONLINE APPLICATION Contact Information OnLine Application System (OLA) 1-800-228-3734 For the most recent contact information, please use the Response Team button on the OLA Main Menu or the following link: https://onlinedb.famemaine.com/OLA/includes/OnlineContactForm.pdf User Manual for the FAME OnLine Application, Version 4 April 2014 24 ONLINE APPLICATION AUDITS Pursuant to the OnLine Application Addendum signed by each Lending institution: 3.“AUDIT OF COMPLIANCE. The Authority shall have the right, at its election, to conduct (or have a third party conduct) an audit of the Lender’s compliance with the OLA requirements, and the Lender’s credit and collateral files related to any loan for which loan insurance is issued under the OLA, upon reasonable advance notice to Lender. The results of such audits will be shared with Lender, and in the case of minor violations of the requirements of the OLA, the Loan Insurance Agreement, or this Addendum, the Lender shall be given an opportunity to correct such violations. In the case of material violations of the OLA requirements, the Loan Insurance Agreement or this Addendum, the Authority may terminate the Lender’s access to the OLA, and any loan insurance issued by the Authority that the Authority determines was affected by such violation may be reduced or terminated. The costs of such audits shall initially be borne by the Authority, although the Authority reserves the right to require that the Lender pay for all or a portion of the costs of audits in the future, after reasonable advance notice to Lender.” FAME conducts a yearly audit on OLA loans and contracts with an auditor to 1) visit the lender on site to review the OLA loan; or 2) receive electronic versions of the OLA submissions. Loans will be selected for audit based on the following: 1) Submitted between July 1 and June 30 of the previous year; 2) Every lender shall have a random sampling consisting of: a) one-third of the loans submitted during the period with a dollar amount below the median. b) one-third of the loans submitted during the period with a dollar amount above the median. 3) If two or fewer loans are submitted, then 100% of loans submitted will be audited. Following the audit, the OLA Liaison is provided with a full report of all the loans audited. If errors are discovered, the lender will work with their FAME loan officer to rectify the errors to the loans. FAME bears the cost of the audit for the lender during the first year of OLA use. Thereafter, the audit is conducted at the lender’s expense. To improve performance during the audit, FAME encourages lenders to have in their file a copy of the application they submitted through OLA and the Authorization. The auditor will be confirming that the numbers used by the lender in the OLA application can be verified by the back-up documents in their file. Please use Appendix 3 as a guide to make certain that your file is complete. User Manual for the FAME OnLine Application, Version 4 April 2014 25 ONLINE APPLICATION APPENDIX 1 Loan Insurance Program OnLine Application (OLA) Summary of Eligibility Requirements and Underwriting Criteria For the most recent Eligibility Requirements and Underwriting Criteria, please use the “Fact Sheet” button on the OLA Main Menu or use the following link: https://onlinedb.famemaine.com/OLA/includes/OnlineFactSheet.pdf User Manual for the FAME OnLine Application, Version 4 April 2014 26 ONLINE APPLICATION APPENDIX 2 Disclosure and Confidentiality Statement Certain information in the Authority's possession must be available for public inspection after an application for financial assistance is received. This information includes the names of applicants, including principals; the amounts, types and general terms of financial assistance; description of projects and businesses benefiting from the assistance; the number of jobs and the amount of tax revenues projected in connection with a project; and the names of the financial institutions participating with the Authority. Certain records of the Authority are designated confidential and will not be available to the public for inspection. This includes the disclosure of records that would constitute an invasion of an individual's privacy, such as personal tax returns or financial statements, assessments of creditworthiness or financial condition, records obtained by the Authority in connection with any monitoring or servicing on an existing project, and any records or information the release of which the Authority had determined could cause a business or competitive detriment to the person to whom the information belongs or pertains. If an applicant desires certain information remain confidential, the applicant must clearly identify what information or documents it wishes to remain confidential. The applicant must also explain, in writing, the basis for such a request. Where the applicant asserts that the basis for the confidentiality request is that release of the information could cause a business or competitive disadvantage, or loss of a competitive advantage, the applicant must provide the Authority with sufficient information to independently determine the likelihood of such a detriment. Applicants may wish to consult their attorney or the Authority's legal counsel as to the scope of public disclosure and confidentiality as it relates to the Finance Authority of Maine and the business seeking assistance. User Manual for the FAME OnLine Application, Version 4 April 2014 27 ONLINE APPLICATION APPENDIX 3 User Manual for the FAME OnLine Application, Version 4 April 2014 28 ONLINE APPLICATION APPENDIX 3 (CONT’D) User Manual for the FAME OnLine Application, Version 4 April 2014 29 ONLINE APPLICATION GLOSSARY OF TERMS Approved – FAME reviews the information to verify that the loan insurance should be approved, and may call the User to discuss data entries. A copy of the Application, Authorization, Invoice and Employment Plan (if applicable) are e-mailed to the User. Authorization – The financial institution’s representation that it will make a loan upon the terms and conditions set forth in the OLA Application, and that it is in compliance with the terms and conditions of FAME’s Loan Insurance Agreement, as amended, between your financial institution and the Authority. If the terms and conditions are acceptable to the User, then the Authorization is signed and accepted by the User and returned with the invoice and insurance premium, upon completion of the loan transaction at the financial institution. Blended Rate – When FAME loan insurance on a new loan exposure is combined with existing financial institution debt, a Blended Interest Rate calculation must occur. The calculation is as follows: calculate the total of both the new and existing loans. Multiply the dollar amount of each loan by the percentage of commercial loan insurance being applied for, sum the products, and then divide the sum of the products by the previously calculated combined loan total. Change Password – Takes the User to Change Your Password screen. (See page 6.) Demonstration Site – use this link to test / practice loan scenarios. Information will NOT transfer to the live application. The Demonstration Site offers the same functionality as the active site; however it does not add new loans or make any changes to the active system. The site is identified by “Demonstration Site” at the top of each page. EBITDA – Defined as Earnings Before Interest, Taxes, Depreciation and Amortization. Employment Plan – In accordance with 10 MRSA Section 979, FAME is required to collect information from this form: http://www.famemaine.com/files/Content/business_general/Employment_Plan.pdf, from the financial institution’s applicants, with more than ten (10) employees and to provide it to the Maine Department of Labor and the Maine Department of Health and Human Services. This form will be automatically e-mailed to the User with the Authorization and Application, if the OLA Application indicates more than ten (10) employees. Error Message(s) – Will appear in red at the top of the Application, if applicable. Existing Borrower – A borrower which resides on the OLA system from previously submitted OLA application(s). These will be relationships from your financial institution only. Fact Sheet – Summary of OLA Eligibility Requirements and Underwriting Criteria (See Fact Sheet link on toolbar for most recent information.) Help – A link on the toolbar on the left of the screen brings User to an e-mail directive to FAME. (Click toolbar for most recent contact information.) User Manual for the FAME OnLine Application, Version 4 April 2014 30 ONLINE APPLICATION Invoice – An accounting of the amount of insurance premium and commitment fee due from the financial institution to FAME for the OLA Application which has been approved. This is e-mailed within 24 hours after the Application, Authorization, and Employment Plan, if applicable. - Click on these for additional information. Industry Description – Give a brief description of the Borrower’s primary business operation that was used to determine the NAICS and SIC codes. Lender’s Debt – Includes all Lender debt associated with only this project, whether or not FAMEinsured. Lender Liaison – Designee of your financial institution who has access to all information entered by any authorized User of your financial institution. The Lender Liaison will have the responsibility of providing prompt written notice of any additions to or deletions from your financial institution’s list of authorized Users. Loan Insurance Agreement & Addendum – The addendum to the contract between your financial institution and FAME describing the OLA system usage agreements. Logout – Logs the User out, and returns User to the login screen. Most Recent Year Ending – Enter the date of the most recent year-end financial information. Natural Resource – Defined as; A company that is involved in growing, harvesting, or processing of natural resources, including agricultural, aqua culture, fishing, forestry, and wood manufacturing type businesses, as well as recreational companies that rely on natural resources as a core component of their business, such as skiing, rafting, hunting, and scenic touring type businesses. New loan insurance application – Takes the User to the Application (See Main Menu, shown on page 8.) Non-Lender Debt – Includes seller financing, vendor, or other agency debt associated with only this project. This can be $0. This does not include any of the Borrower’s existing debt. OnLine User Manual – Allows the User to download a PDF of the OLA User’s Manual. Password – Must meet the criteria on page 6 of the OLA User’s Manual. Pending – The Application results in a manual review by FAME of the loan and borrower information. FAME contacts the Bank to discuss the loan request. Profile- Demographic information about Borrower, Co-Borrowers and Guarantors. Click the Add Profile button to add additional Borrower, Co-Borrowers or Guarantors to the application. Be sure to choose the Profile Type before entering information. Profile Type (two separate types): oBusiness – Profile is a company (S Corp., Partnership, LLC, or C Corp.) Information gathered for this profile in the application will be company specific. User Manual for the FAME OnLine Application, Version 4 April 2014 31 ONLINE APPLICATION oIndividual- Profile is either a Personal Guarantor, a Sole Proprietor (d/b/a) filing a Federal Tax Return Schedule C, Schedule E, Schedule F. Information gathered for this profile in the application will be specific to individuals. Refinance of Existing Lender Debt – This is a request for FAME loan insurance on existing lender debt not currently insured by FAME, and will qualify for a maximum of 40% loan insurance, and is subject to the following guidelines: http://www.famemaine.com/files/Content/business_general/Lenderinsuranceonexistingdebt6-3009.pdf Relationship Type – The following Profile Types are available from the drop-down menu: Borrower Co-Borrower Corporate Guarantor (Business Profile only) Personal Guarantor (Individual Profile Only) Response Team – Contact information for assistance with the OLA Application process (Use the Response Team button on the toolbar for most recent contact information.) Save Progress – Application may be saved prior to completion by clicking this button. Work must be saved every 25 minutes or automatic logout will occur. FAME recommends clicking this button frequently during entry. Submit for Approval - When the User has completed the application, this button will submit to FAME for calculation and result. Submitted loan insurance applications / renewals – Displays all applications that have been previously submitted by a User for approval. Lender Liaison can view all applications submitted by financial institution’s Users. (See Viewing Submitted Applications on page 20.) To renew Loan Insurance, go to page 21. Unfunded CAPEX -- Unfunded capital expenditures (cap ex) are those items which were capitalized upon purchase (added to the assets on the balance sheet) and were acquired with cash flow, not debt. Uninsured Debt – Entire debt required to complete financing of the current project, less the amount of FAME insured loans requested. Unsubmitted (saved) loan insurance applications – Displays all applications that have been saved, but not modified or submitted for approval in the last 45-days. (See Viewing Unsubmitted (Saved) Applications on page 19.) Lender Liaison can view all applications submitted by financial institution’s Users. User – Designee of your financial institution approved by Lender Liaison to access the OLA system. User Manual for the FAME OnLine Application, Version 4 April 2014 32

© Copyright 2026