CORPORATE PRESENTATION TSX-V: PKT OCTOBER 2014

CORPORATE PRESENTATION OCTOBER 2014 TSX-V: PKT DISCLAIMER ! This presentation and the information contained herein, (“Presentation”) is being issued by Parkit Enterprise Inc. (the “Company”) for information purposes only. This Presentation is not for release, distribution or publication into or in the United States or any other jurisdiction where applicable laws prohibit its release, distribution or publication. Reliance on this Presentation for the purpose of engaging in any investment activity may expose an individual to a significant risk of losing all funds invested. ! This Presentation is not a prospectus, offering memorandum, advertisement, or solicitation and does not constitute or form part of, and should not be construed as, an offer or invitation to sell or any solicitation of any offer to purchase or subscribe for any securities of the Company in Canada, the United States or any other jurisdiction. Neither this Presentation, nor any part of it nor anything contained or referred to in it, nor the fact of its distribution, should form the basis of or be relied on in connection with or act as an inducement in relation to a decision to purchase or subscribe for or enter into any contract or make any other commitment whatsoever in relation to any securities of the Company. No representation or warranty, expressed or implied, is given by or on behalf of the Company, its directors and affiliates or any other person as to the accuracy or completeness of the information or opinions contained in this Presentation and no liability whatsoever is accepted by the Company, its directors and affiliates or any other person for any loss howsoever arising, directly or indirectly, from any use of such information or opinions or otherwise arising in connection therewith. ! This Presentation does not constitute a recommendation regarding the Company or an investment therein. The Company has not been and will not be registered under the United States Investment Company Act of 1940, as amended or the US Securities Act of 1933, as amended. ! The contents of this Presentation are confidential and may not be copied, distributed, published or reproduced in whole or in part, or disclosed or distributed by recipients to any other person. No reliance may be placed for any purpose whatsoever on the information or opinions contained in this Presentation or on its completeness, accuracy or fairness. Readers should not treat the contents of this Presentation as advice relating to legal, taxation or investment matters, and must make their own assessments concerning these and other consequences of the various investments, including the merits of investing and the risks. Readers are advised to consult their own personal legal, tax and accounting advisors and to conduct their own due diligence and agree to be bound by the limitations of this disclaimer. ! Certain statements, beliefs and opinions in this Presentation (including those contained in graphs, tables and charts) are forward-‐looking, which reflect the Company’s current expectations and projections about future events. By their nature, forward-‐looking statements involve a number of risks, uncertainties and assumptions that could cause actual results or events to differ materially from those expressed or implied by the forward-‐looking statements. These risks, uncertainties and assumptions could adversely affect the outcome and financial effects of the plans and events described herein. Forward-‐looking statements contained in this Presentation regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. The Company does not undertake any obligation to update or revise any forward-‐looking statements, whether as a result of new information, future events or otherwise. Readers should not place undue reliance on forward-‐looking statements, which speak only as of the date of this Presentation. TSX-‐V: PKT OTCQX: PKTEF | www.parkitenterprise.com 2 VISION & FOCUS Parkit Enterprise Inc. (TSX-‐V:PKT) (OTCQX:PKTEF) is a real estate investment firm specializing in the acquisition and management of income-‐producing parking facilities in the United States. ! Parkit and Parking Real Estate LLC (owned by officers of Propark America) have established a platform to acquire, aggregate, and enhance the value of a diversified portfolio of assets. ! ! “Our vision is to be the leading aggregator of quality, income-‐producing parking assets” ! ! ! ! ! PKT OTCQX: PKTEF | www.parkitenterprise.com TSX-‐V: -‐ Rick Baxter, CEO 3 ! EXECUTIVE SUMMARY • Parkit has a focused strategy within an alternative real estate asset class with the following characteristics: • Diversified by geography and type, across the United States • Stability of cash flows • Enhanced values through optimized yields, redevelopment and aggregation • Off-‐market pipeline sourcing ! • Parkit and Propark America have established a US parking acquisition platform and are in discussions with potential equity partners to accelerate growth ! • Parkit will contribute up to US$12 million in equity to the platform ! • Goal to aggregate $500 million of assets over 3 to 4 years and divest for capital gain; and initiate a second platform ! • Parkit represents a unique opportunity for shareholders to participate in both monthly cash-‐ flow from assets and upside equity growth TSX-‐V: PKT OTCQX: PKTEF | www.parkitenterprise.com 4 ! RECENT DEVELOPMENTS ! • Third Quarter Financial Results: • $2,700,000 record quarterly revenue • $325,000 record quarterly net operating income • Corporate current liabilities $880,000 -‐ down from $11 million October 31, 2013 ! ! • Market Capitalization: • $21 million at September 30, 2014 • $4.5 million at October 31, 2013 ! ! • Expresso Acquisition • Parkit closes US$18.6 million purchase on September 29, 2014 • First asset into parking acquisition platform ! • OTCQX listing TSX-‐V: PKT OTCQX: PKTEF | www.parkitenterprise.com 5 PIPELINE & OPPORTUNITY OFF-‐MARKET SOURCING: • Propark operated properties • Propark generated leads • 425 locations in 53 cities across the US • Previously underwritten properties • Bank owned real estate properties • Targeted marketing ON-‐MARKET SOURCING: • Bids and offerings • Divestment of non-‐core assets MARKET OPPORTUNITY: • Cap rates are coming off historic highs and net operating incomes off lows providing an excellent opportunity to acquire quality assets at depressed valuations. ! • Interest rates are near all time lows, which allows for acquisition financing at very attractive rates. ! • Parking assets purchased 5-‐7 years ago are experiencing refinancing difficulties and offer further opportunity for deep value acquisitions. ! • Property modernization alongside technological upgrades enhance NOI. ! • Industry is fragmented and high barriers to entry exist for potential competitors that do not have the national scale of Propark. TSX-‐V: PKT OTCQX: PKTEF | www.parkitenterprise.com 6 INVESTMENT STRATEGY INVESTMENT TARGETS ! ! YALE NEW HAVEN HOSPITAL • Structured and surface parking facilities in niche industries including off-‐airport, hospitals, universities, courthouses, stadiums & arenas and municipal locations • Opportunistic investments within Propark’s current footprint • Off-‐market properties where assets have yet to be listed • Properties offering commercial redevelopment potential • Municipalities moving towards restrictive parking bylaws & zoning ! TARGETED PORTFOLIO ECONOMIC PROFILE: • Stable, cash-‐flowing • Diversified by type and geography • Redevelopment assets (10%) ! TECHNOLOGY: DUVALL COUNTY COURTHOUSE • Sustainability, smart payment machines, remote management • Dynamic pricing, yield management, Park Now App (BMW) ! ECONOMICS: • Acquire at a value 7-‐8% cap, optimize by 2-‐3%, aggregate, and divest at 6% cap TSX-‐V: PKT OTCQX: PKTEF | www.parkitenterprise.com 7 THE TEAM RICK BAXTER | CEO & DIRECTOR Mr. Baxter is an entrepreneur and strategic business leader with over 25 years of experience in aviation and transportation. He was CEO of West Coast Air, a commuter floatplane service, and led the company’s growth to 20 aircraft and 150 employees before selling to a strategic buyer. Mr. Baxter currently serves on the Canadian Advisory Board for Marsh & McLennan Companies, and was Chairman of the Tourism Vancouver Board during the 2010 Olympic Winter Games. ! PATRICK BONNEY | VP, CORPORATE DEVELOPMENT & DIRECTOR Mr. Bonney has over 20 years of international experience in investment banking with leading institutions Deutsche Bank and RBC. Most recently he was co-‐ founder/CIO of two alternative real estate investment funds with $500 million of committed institutional capital. ! JOHN LAGOURGUE | VP, CORPORATE COMMUNICATIONS & DIRECTOR Mr. LaGourgue has 20 years of management, sales and financial experience in public and private companies. He has been serving in senior management and directors’ roles full-‐time for micro cap companies since 2009. Prior to 2009, Mr. LaGourgue built a $10 million a year sales channel in the oil and gas services sector, as well as co-‐founded an investor relations firm. ! SIMON BUCKETT | CFO Mr. Buckett has over twelve years of finance and project management experience working for private and publicly listed companies in the UK, US, and Canada. Mr. Buckett’s career spans KPMG in London and Vancouver as Senior Auditor, later joining Ernst & Young as an audit department Manager. ! BOB EMRI | DIRECTOR Mr. Emri is President of Emri Group, a real estate investment firm founded in 2005. He has more than 20 years experience in commercial real estate which includes office, industrial, retail, multi-‐family, and land assets. Mr. Emri has extensive experience in acquisitions, asset management, financing and development. ! PACE GOLDMAN | DIRECTOR Mr. Goldman is a principal of Silvercove Capital, and has held senior roles on both the buy-‐side and sell-‐side of Bay Street. Mr. Goldman has many years in both equity research and equity sales. He and his team have raised in excess of $1 billion of new equity capital in the Real Estate and Hard Asset sectors. !! !! PKT OTCQX: PKTEF | www.parkitenterprise.com TSX-‐V: ! 8 THE TEAM JOHN SCHMID | PARTNER Under Mr. Schmid’s leadership, Propark has become a nanonal leader in parking management and investment. John co-‐founded Propark 30 years ago in Harpord, Connecncut. He launched PPREA in 2004 to acquire parking assets and helped create the Green Parking Council which develops environmental standards in the parking industry and currently serves as its chairman. John is also involved with the Nanonal Parking Associanon and Internanonal Parking Insntute. ! TOM BECHARD | PARTNER Mr. Bechard oversees development projects undertaken by PPREA, including Propark’s flagship asset, the Canopy Airport Parking Facility at Denver Internanonal Airport. Prior to joining Propark, Tom was a top-‐performing commercial real estate broker with Prudennal California. ! DAVID SCHMID | PARTNER Mr. Schmid is responsible for Propark Real Estate Associates’ (PPREA) investment acnvines. David sources, underwrites, finances and manages Propark’s growing real estate porpolio to drive cash flow and asset value. David has been a member of the Propark team for 24 years and served as both COO and CFO prior to becoming CIO. As COO, David oversaw 1,200 employees at 400 parking locanons in 51 cines across 15 states that had an asset value over $2 billion. He holds a chemical engineering degree from the University of Connecncut. ! TSX-‐V: PKT OTCQX: PKTEF | www.parkitenterprise.com 9 STRATEGIC PARTNER Leading private US owner/operator: ! • 30 years experience; founded in 1984 ! • 425 facilities across 53 cities in 15 states • 8th largest independent parking operator ! ! • Over 2000 employees nationwide • Clients include Google, Citibank, Travelers Insurance, Yale & Harvard • Employs leading technology and best-‐practices to optimize cash flow ! ! TSX-‐V: PKT OTCQX: PKTEF | www.parkitenterprise.com 10 DENVER ASSET CANOPY AIRPORT PARKING FACILITY | DENVER, COLORADO • Forecast 2014 EBITDA of US$3.1 million on Revenue of US$8.5 million ! • Currently valued at US$38 million; built in 2010 for US$19 million ! • Parkit’s ownership interest is US$12 million ! • Green Parking Council Demonstrator Site ! • LEED Gold Certified 46 acre property with 4,200 stalls -‐ including open air, covered, and valet ! • Occupancy, revenue, and NOI continue to improve each month year over year ! ! TSX-‐V: PKT OTCQX: PKTEF | www.parkitenterprise.com 11 OAKLAND ASSET EXPRESSO AIRPORT PARKING | SAN LEANDRO, CALIFORNIA • Forecast 2014 EBITDA of US$1.65 million on Revenue of US$5 million ! • Purchase price US$18.6 million (8.9% cap rate) ! • Leading off-‐airport parking facility servicing the Oakland Int’l Airport ! • 14 acre property with 1900 stalls -‐ including open air, covered, and valet ! • Operated by Propark since 2001 ! ! TSX-‐V: PKT OTCQX: PKTEF | www.parkitenterprise.com 12 FIRST CLOSE PORTFOLIO KEY STATISTICS - CONTROLLED ASSETS TYPE ACQUISTION VALUE* NOI** CAP RATE OPTIMIZED NOI OPTIMIZED YIELD Denver, CO Off-‐Airport $38,000,000 $3,100,000 8.15% $3,819,000 10.00% Oakland, CA Off-‐Airport $19,200,000 $1,674,000 8.72% $2,004,000 10.44% New Haven, CT Commercial Business District $10,500,000 $730,000 7.00% $933,000 8.90% Jacksonville, FL Commercial Business District $6,400,000 $424,000 6.60% $501,000 7.82.% New Haven, CT University & Medical Facility $4,500,000 $300,000 6.70% $341,000 7.60% East Granby, CT Off-‐Airport $4,000,000 $257,000 6.40% $387,000 9.70% $82,600,000 $6,485,000 7.85% $7,985,000 9.44% LOCATION 1 Canopy 2 Expresso 3 Chapel Square 4 Terra Park 5 Riccio Lot 6 Z Parking TOTALS Notes: * All US$ funds. ** 2014 Net Operating Income before debt service TSX-‐V: PKT OTCQX: PKTEF | www.parkitenterprise.com 13 SHARE ANALYSIS Shares Outstanding 30.9 Million Share Price (Oct 8, 2014) $0.71 52 Week Range $0.20 -‐ $0.80 Market Capitalization $21.9 Million Warrants 1.7 Million @ $0.40 3.9 Million @ $0.50 1.6 Million @ $0.60 1.0 Million @ $0.65 1.1 Million @ $1.00 Options 2.7 Million @ $0.50 Fully Diluted Shares Outstanding 42.9 Million Additional cash on exercise of Warrants/Options $6.7 Million TSX-‐V: PKT OTCQX: PKTEF | www.parkitenterprise.com 14 1088 – 999 WEST HASTINGS STREET | VANCOUVER, BC V6C 2W2 604.424.8700 | [email protected] ! www.parkitenterprise.com !

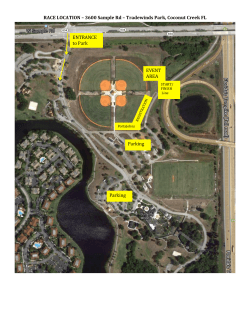

© Copyright 2026