DAYS OF INFAMY

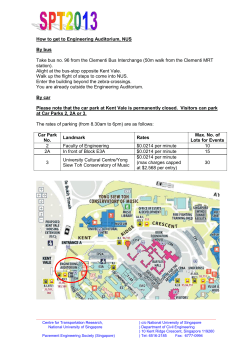

Explains The pounding of the pennies In Singapore’s blue chip-dominated stock market, penny stocks often make a lot of noise but little impact on the overall market. All of that changed on Oct 4, 2013, when the unexpected collapse of a number of stocks sparked a sell-off among smaller counters and a shockwave of changes for the rest of the market. Notwithstanding the Singapore Exchange’s unusual intervention measures, regulators are pursuing changes that will change the fundamental nature of the Singapore market in areas like contra trading. Several individuals and companies are also under the spotlight of a police investigation and numerous lawsuits. Sept 26, 2013: UOB Kay Hian imposes online trading curbs on 14 securities, including Asiasons, Blumont and LionGold shares Oct 4, 2013: SGX suspends Asiasons, Blumont and LionGold after their shares collapse Oct 7, 2013: SGX designates Asiasons, Blumont and LionGold Oct 21, 2013: SGX removes designation Oct 24, 2013: MAS, SGX confirm review of crash Nov 1, 2013: Lawsuits begin to emerge. Among the largest is Interactive Brokers’ US$68m claim against at least 10 clients Feb 7, 2014: MAS, SGX propose sweeping rule changes April 2, 2014: CAD launches investigation Indexed closing stock price (Aug 1, 2013 = 100) 300 200 100 0 Aug 1, 2013 Sept 1 Oct 1 Nov 1 Dec 1 Jan1, 2014 Feb 1 Mar 1 Apr 1 2013 S$2.70 Asiasons Oct 3 2014 99% S$0.033 2013 S$2.02 Blumont Oct 3 2014 98% S$0.031 2013 S$1.51 LionGold Oct 3 2014 97% S$0.042 May 1 June 1 July 1 Aug 1 Sept 1 Oct 1 BIG CHILL DAYS OF INFAMY Although the price impact was contained, the hit on liquidity has been more profound. Market activity has dried up, especially for smaller counters. The average value per traded share was 57 Singapore cents in September 2014, compared to 29 Singapore cents a year earlier, suggesting a shift in the market toward larger counters. The market has yet to recover. One year ago, the market pounded its pennies into a hole. Just how deep was that hole? Compared to other major market events in Singapore, the overall price impact of the penny meltdown seemed benign. But that was largely because the damage in 2013 was mostly confined to smaller counters. August 2013 = 100 Average daily trading volume August 2013 = 100 180 140 160 120 140 120 Hong Kong 80 80 60 Singapore 1.7b shares -67% y-o-y 40 20 Hong Kong 100 100 60 Average daily trading value Singapore S$957m -34% y-o-y 40 One-day STI* loss 20 0 0 A S O N D J 2013 F M A M J 2014 J A S A S O N D J 2013 F M A M J 2014 J A S UNDER PRESSURE GAME CHANGE The saga has also set off a legal maelstrom. In April, the white collar-crime fighting Commercial Affairs Department conducted an unprecedented sweep to seek information on 13 individuals as part of its investigation into the penny saga. The probe is ongoing. Separately, at least 10 banks and brokers have taken legal action against clients. The biggest impact of the penny meltdown so far has come in the form of regulatory changes. Some of the adjustments that have been proposed by the Singapore Exchange and the Monetary Authority of Singapore were planned before Oct 4, 2013, but their announcement was accelerated as a result of that fateful day. Targeted in CAD probe James Hong Gee Ho Blumont: Former executive director Neo Kim Hock Blumont: Former executive chairman Peter Chen Hing Woon Blumont: Director of business and corporate development Lynne Ng Su Ling Blumont: Former independent director LionGold: Independent director ITE Electric: Former secretary Wong Chin-Yong Innopac: CEOAnnica: Shareholder Koh Teng Kiat Magnus Energy: Former COO Luke Ho Magnus Energy: CFO Trade with caution SGX will issue a ‘Trade with caution’ announcement if issuers cannot explain unusual trading acitivity questioned by the exchange Status: Implemented March 2014 Board approval of replies to trading queries Directors must approve an issuer’s reply to the exchange's queries about unusual trading activities Status: Implemented March 2014 Early notification of major deals Issuers must give SGX early notification of discussions or negotiations that could lead to a major deal Status: Implemented March 2014, codification expected in March 2015 Trading restriction disclosure Securities Association of Singapore to develop disclosure guidelines for brokers’ trading restrictions on stocks Status: Industry guidelines expected by end-2014 Quah Su-Yin ISR Capital: CEO Ho Cheng Leong ITE Electric: Former CEO Ang Cheng Gian ITE Electric: Former COO Goh Hin Calm ITE Electric: Former independent director Annica: Independent director Edwin Sugiarto Annica: Chairman Lim Meng Check Annica: Former CEO Quah Su-Ling Ipco International: CEO Lee Chai Huat Powerlite Ventures: Former shareholder (sold to Blumont) Cheng Wah Nelson Fernandez Acadian Mining: Former shareholder (sold to LionGold) Kuan Ah Ming Tan Boon Kiat Ooi Cheu Kok Blumont: Shareholder No of reported lawsuits faced Independent enforcement committees Listing, disciplinary and appeals committees could help SGX to address concerns about its dual role as a for-profit market operator and a regulator. Status: Target implementation by Q1 2015 Minimum trading price Raise the minimum trading price on the mainboard to 20 Singapore cents per share. Status: Consultation, targeted implementation around March 2016 Collateral requirements Brokers to impose 5 per cent collateral requirement, ending the practice of unsecured contra trading. Status: Targeted implementation in mid-2016 Faster settlement Shorten settlement period to T+2 from T+3 Status: Consultation and details to be announced -12.1% Black Monday, Oct 19, 1987 -11.9% Pan-Electric collapse, Dec 5, 1985 -3.9% Clob and Malaysia currency controls, Sept 1, 1998 -3.3% Lehman Brothers bankruptcy, Sept 15, 2008 -1.0% Barings scandal, Feb 27, 1995 -0.5% China Aviation Oil shock, Nov 30, 2004 -0.2% Penny meltdown, Oct 4, 2013 * Straits Times Industrial Index before 1998 Source: Bloomberg, Shareinvestors.com, Singapore Exchange, Hong Kong Exchanges and Clearing, company announcements and annual reports BT Graphics: Kenneth Lim, Simon Ang & Jonathan Goh Explains The pounding of the pennies In Singapore’s blue chip-dominated stock market, penny stocks often make a lot of noise but little impact on the overall market. All of that changed on Oct 4, 2013, when the unexpected collapse of a number of stocks sparked a sell-off among smaller counters and a shockwave of changes for the rest of the market. Notwithstanding the Singapore Exchange’s unusual intervention measures, regulators are pursuing changes that will change the fundamental nature of the Singapore market in areas like contra trading. Several individuals and companies are also under the spotlight of a police investigation and numerous lawsuits. Sept 26, 2013: UOB Kay Hian imposes online trading curbs on 14 securities, including Asiasons, Blumont and LionGold shares Oct 4, 2013: SGX suspends Asiasons, Blumont and LionGold after their shares collapse Oct 7, 2013: SGX designates Asiasons, Blumont and LionGold Oct 21, 2013: SGX removes designation Oct 24, 2013: MAS, SGX confirm review of crash Nov 1, 2013: Lawsuits begin to emerge. Among the largest is Interactive Brokers’ US$68m claim against at least 10 clients Feb 7, 2014: MAS, SGX propose sweeping rule changes April 2, 2014: CAD launches investigation Indexed closing stock price (Aug 1, 2013 = 100) 300 200 100 0 Aug 1, 2013 Sept 1 Oct 1 Nov 1 Dec 1 Jan1, 2014 Feb 1 Mar 1 Apr 1 2013 S$2.70 Asiasons Oct 3 2014 99% S$0.033 2013 S$2.02 Blumont Oct 3 2014 98% S$0.031 2013 S$1.51 LionGold Oct 3 2014 97% S$0.042 May 1 June 1 July 1 Aug 1 Sept 1 Oct 1 BIG CHILL DAYS OF INFAMY Although the price impact was contained, the hit on liquidity has been more profound. Market activity has dried up, especially for smaller counters. The average value per traded share was 57 Singapore cents in September 2014, compared to 29 Singapore cents a year earlier, suggesting a shift in the market toward larger counters. The market has yet to recover. One year ago, the market pounded its pennies into a hole. Just how deep was that hole? Compared to other major market events in Singapore, the overall price impact of the penny meltdown seemed benign. But that was largely because the damage in 2013 was mostly confined to smaller counters. August 2013 = 100 Average daily trading volume August 2013 = 100 180 140 160 120 140 120 Hong Kong 80 80 60 Singapore 1.7b shares -67% y-o-y 40 20 Hong Kong 100 100 60 Average daily trading value Singapore S$957m -34% y-o-y 40 One-day STI* loss 20 0 0 A S O N D J 2013 F M A M J 2014 J A S A S O N D J 2013 F M A M J 2014 J A S UNDER PRESSURE GAME CHANGE The saga has also set off a legal maelstrom. In April, the white collar-crime fighting Commercial Affairs Department conducted an unprecedented sweep to seek information on 13 individuals as part of its investigation into the penny saga. The probe is ongoing. Separately, at least 10 banks and brokers have taken legal action against clients. The biggest impact of the penny meltdown so far has come in the form of regulatory changes. Some of the adjustments that have been proposed by the Singapore Exchange and the Monetary Authority of Singapore were planned before Oct 4, 2013, but their announcement was accelerated as a result of that fateful day. Targeted in CAD probe James Hong Gee Ho Blumont: Former executive director Neo Kim Hock Blumont: Former executive chairman Peter Chen Hing Woon Blumont: Director of business and corporate development Lynne Ng Su Ling Blumont: Former independent director LionGold: Independent director ITE Electric: Former secretary Wong Chin-Yong Innopac: CEOAnnica: Shareholder Koh Teng Kiat Magnus Energy: Former COO Luke Ho Magnus Energy: CFO Trade with caution SGX will issue a ‘Trade with caution’ announcement if issuers cannot explain unusual trading acitivity questioned by the exchange Status: Implemented March 2014 Board approval of replies to trading queries Directors must approve an issuer’s reply to the exchange's queries about unusual trading activities Status: Implemented March 2014 Early notification of major deals Issuers must give SGX early notification of discussions or negotiations that could lead to a major deal Status: Implemented March 2014, codification expected in March 2015 Trading restriction disclosure Securities Association of Singapore to develop disclosure guidelines for brokers’ trading restrictions on stocks Status: Industry guidelines expected by end-2014 Quah Su-Yin ISR Capital: CEO Ho Cheng Leong ITE Electric: Former CEO Ang Cheng Gian ITE Electric: Former COO Goh Hin Calm ITE Electric: Former independent director Annica: Independent director Edwin Sugiarto Annica: Chairman Lim Meng Check Annica: Former CEO Quah Su-Ling Ipco International: CEO Lee Chai Huat Powerlite Ventures: Former shareholder (sold to Blumont) Cheng Wah Nelson Fernandez Acadian Mining: Former shareholder (sold to LionGold) Kuan Ah Ming Tan Boon Kiat Ooi Cheu Kok Blumont: Shareholder No of reported lawsuits faced Independent enforcement committees Listing, disciplinary and appeals committees could help SGX to address concerns about its dual role as a for-profit market operator and a regulator. Status: Target implementation by Q1 2015 Minimum trading price Raise the minimum trading price on the mainboard to 20 Singapore cents per share. Status: Consultation, targeted implementation around March 2016 Collateral requirements Brokers to impose 5 per cent collateral requirement, ending the practice of unsecured contra trading. Status: Targeted implementation in mid-2016 Faster settlement Shorten settlement period to T+2 from T+3 Status: Consultation and details to be announced -12.1% Black Monday, Oct 19, 1987 -11.9% Pan-Electric collapse, Dec 5, 1985 -3.9% Clob and Malaysia currency controls, Sept 1, 1998 -3.3% Lehman Brothers bankruptcy, Sept 15, 2008 -1.0% Barings scandal, Feb 27, 1995 -0.5% China Aviation Oil shock, Nov 30, 2004 -0.2% Penny meltdown, Oct 4, 2013 * Straits Times Industrial Index before 1998 Source: Bloomberg, Shareinvestors.com, Singapore Exchange, Hong Kong Exchanges and Clearing, company announcements and annual reports BT Graphics: Kenneth Lim, Simon Ang & Jonathan Goh

© Copyright 2026