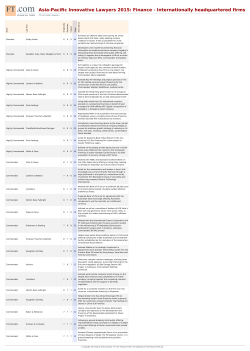

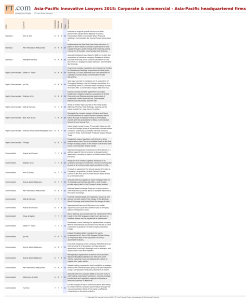

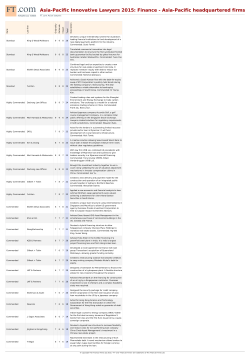

Most innovative law firms in Finance 2014

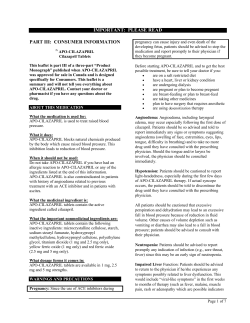

Most innovative law firms in Finance 2014 Law firm Rank Total Originality Rationale Impact Description FT.com Innovative Lawyers Linklaters Standout 27 9 9 9 Created securitisation structures based on new regulatory frameworks to finance energy and infrastructure projects. Baker & McKenzie Standout 26 8 9 9 Developed a structure to enable the first domestic securitisation of consumer loans in the Russian market. CMS Standout 26 8 9 9 Helped drive changes to the UK Space Growth Action Plan and creation of the Satellite Finance Network. 9 Advised Spanish bank BBVA on the first European contingent convertible securities issue under the Capital Requirements Directive IV. Garrigues Standout 26 9 8 Shearman & Sterling Standout 26 9 9 8 Acted for bondholders of the Co-operative Bank on a recapitalisation plan that led to the first voluntary bailin of a UK bank. Skadden, Arps, Slate, Meagher & Flom Standout 26 9 9 8 Advised Cyprus-based QIWI on the first listing of foreign equity securities on the Moscow stock exchange. A&L Goodbody Highly Commended 25 7 9 9 Worked on the liquidation of Irish Bank Resolution Corporation, the first eurozone bank liquidation. Allen & Overy Highly Commended 25 8 9 8 Devised a risk-allocation mechanism for GE Corporate Finance Bank to use in the European Loan Programme (ELP). King & Wood Mallesons (EU) Highly Commended 25 8 8 9 Overcame capital requirements to introduce equity bridge financing into the French market. Latham & Watkins Highly Commended 25 8 9 8 Conducted risk analysis for Ares Capital Corporation in its joint venture with GE Corporate Finance Bank for the ELP. Baker & McKenzie Highly Commended 24 7 9 8 Advised on the first sale of a property loan portfolio by Sareb, the Spanish "bad bank". 8 Found a way for Centerbridge Partners to restructure a German company that held New York law bonds through the UK. Cadwalader, Wickersham & Taft Highly Commended 24 8 8 Eversheds Highly Commended 24 7 9 8 Assisted HM Treasury and HM Revenue & Customs on the establishment of UK-authorised contractual schemes. NautaDutilh Highly Commended 24 8 8 8 Modified existing covered bond structures to create a €5bn conditional pass-through programme for NIBC Bank. 7 Advised Dow Chemical on the joint venture construction and operation of a $20bn Saudi petrochemical complex. Shearman & Sterling Highly Commended 24 8 9 Addleshaw Goddard Highly Commended 23 8 8 7 Created a hybrid administration and insolvency model to restructure UK Coal in the UK’s shortest administration. Cuatrecasas, Gonçalves Pereira Highly Commended 23 8 9 6 Engineered a novel structure to allow Unicaja Banco to acquire Banco CEISS through security swaps. Skadden, Arps, Slate, Meagher & Flom Highly Commended 23 8 7 8 Advised alcoholic beverages company CEDC on its restructuring, which involved a series of firsts for a Polish or Russian company under US bankruptcy law. Ashurst Commended 22 7 8 7 A team of lawyers, project managers and information technology consultants assisted Commerzbank on its sale of Hypothekenbank Frankfurt’s UK operations. Dechert Commended 22 7 8 7 Advised Wells Fargo on the acquisition of Hypothekenbank Frankfurt's UK operations, and on financing provided to Lonestar to acquire the nonperforming assets. Dechert Commended 22 8 8 6 Advised Development Bank of Kazakhstan on the first intermediated exchange offer under US Rule 144A. Herbert Smith Freehills Commended 22 8 7 7 Devised risk analysis for project financing to build investor confidence in Kenya and help it achieve its energy goals. 7 Advised on refinancing Toys R Us Properties (UK), which included the first commercial mortgage-backed securities (CMBS) transaction not involving a bank. Paul Hastings Commended 22 7 8 Sidley Austin Commended 22 8 7 7 Helped to create European CMBS 2.0 investor guidelines, used in the Debussy DTC transaction by Toys R Us. Slaughter and May Commended 21 7 7 7 Partnered Aviva Group on the de-risking of the Aviva Staff Pension Scheme. Allen & Overy Commended 20 7 7 6 Advised Credit Suisse on dual-language documentation for an online investment tool offered to the bank's customers. Freshfields Bruckhaus Deringer Commended 20 7 7 6 Created a flexible refinancing structure using a multitranche, multi-source debt platform to refinance AA Group's debt. Fried, Frank, Harris, Shriver & Jacobson Commended 20 7 6 7 Advised Navios Maritime Partners and Navios Partners Finance (US) as borrowers in connection with a $250m term loan B financing, the first of its kind in the shipping industry. Macfarlanes Commended 20 6 7 7 Devised an inter-creditor agreement for Marlin Financial Group, giving lenders different priorities over secured assets split into separate pools. 7 Advised UniCredit Tiriac Bank and UniCredit Consumer Financing IFN on the complex transfer of RBS Bank Romania customers and staff following the financial crisis. 6 Devised the idea and coordinated three different but concurrent bond issues to allow NH Hotels to refinance its debt. 7 Delivered the complex second-lien financing to enable a syndicate of banks to acquire a 70 per cent stake in Scout24, the Germany online classifieds business. Tuca Zbarcea & Asociatii Uría Menéndez Weil, Gotshal & Manges Commended Commended Commended 20 20 20 6 6 6 7 8 7 © Copyright The Financial Times Ltd 2014. "FT" and "Financial Times" are trademarks of The Financial Times Ltd.

© Copyright 2026