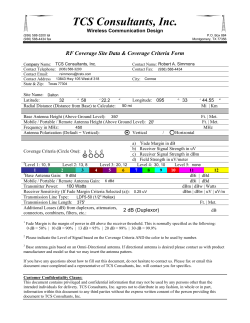

Company Description