TP Touchstone Properties! ! (213) 389-8600

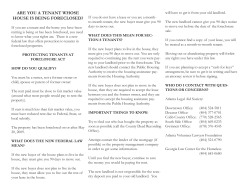

! ! ! ! ! ! TP Touchstone Properties! Orchestrating Maximum Profit ! ! ! ! ! ! ! ! (213) 389-8600" 611 S. Catalina St., Suite 414" Los Angeles, CA 90005 " ! Full Service Property Management ! ! • Rent collection! • Biweekly building inspections! • Weekly bill payment! • Computerized management and accounting! • Income and expense analysis! • Maintenance and repair administration! • Trilingual staff (English, Spanish and Korean)! • Tenant management including 24-hour voicemail! • Vacancy preparation, marketing and leasing! • Monthly bank reconciliation! • Monthly owner reports (email available)! • Monthly profit distribution (direct deposit available)! • Monthly trial balance review! ! ! ! ! Licensed • Bonded • Insured (copies available upon request) Table of Contents Property Management!.................................................................................5! Why You Should Hire Professional Management!..................................................5! Questions You Should Ask When Interviewing Managers!.....................................5! Who Touchstone Properties Is!...................................................................................6! What Touchstone Properties Will Do For You!........................................................6! Achieving Maximum Profit!........................................................................7! Increasing Income!.......................................................................................................7! Lowering Expenses!.....................................................................................................8! Figure 1 – Average Occupancy Statistics!................................................................8! Capital Improvements!................................................................................................9! Less Owner Stress!.......................................................................................................9! Management Systems!................................................................................10! Banking and Reporting!............................................................................................10! Timelines of Service!..................................................................................................10! Daily!............................................................................................................................10! Weekly!........................................................................................................................10! Monthly!......................................................................................................................11! Semi-Annually (April and December)!...................................................................11! Annually (year’s end)!...............................................................................................11! Upon Vacancy!............................................................................................................12! Plan of Action!............................................................................................................13! Sample Financial Reports!..........................................................................14! Balance Sheet!.............................................................................................................15! Profit and Loss Statement!........................................................................................16! Statement of Cash Flow!............................................................................................17! Cash Receipts Journal!...............................................................................................18! Cash Disbursements Journal!...................................................................................19! Customer (Tenant) Ledger!.......................................................................................20! Case Study!...................................................................................................21! 3615 Keystone Avenue!..............................................................................................21! Figure 2 – Keystone Net Income!............................................................................21! Figure 3 – Keystone Value!.....................................................................................22! Other Services!.............................................................................................23! Property Tax Reduction!............................................................................................23! Recent Tax Reductions!...........................................................................................23! Multi-Family Dwelling Brokerage!..........................................................................24! Homeowners’ Association Management!...............................................................25! Real Estate Investment!.............................................................................................25! Notes!.............................................................................................................26! Property Management Touchstone Properties is a leading property manager in the Los Angeles area. With our handson management philosophy and over two decades of experience, we provide our clientele with the very best in property management.! Because we have managed dozens of buildings for many years, we know the marketplace and can therefore ensure that your property is being rented at its maximum market potential. Touchstone Properties maintains a highly visible and approachable relationship with all the tenants. All policies and lease obligations will be enforced on an evenhanded basis to protect the building owner as well as the tenants.! Touchstone Properties, using cost-effective techniques and having a results-orientated attitude, will increase your profits and handle the inevitable problems of building ownership. Our goal is to maximize your investment and minimize the problems for you of owning income-producing real estate.! Why You Should Hire Professional Management Increasing the profit of residential income property is management intensive. This is where Touchstone Properties can help. We will handle absolutely everything in regard to your property. The only thing you will need to concern yourself with is reviewing the financial reports and depositing your profit at the end of the month. And you can get their professional management for effectively no cost. When we take over the management of a building, the increase in profit that we effectuate typically exceeds the cost of our management fee. The end result is professional management of your property, more profit for you, and the elimination of the headaches of income-property ownership.! Questions You Should Ask When Interviewing Managers 1. How long have you been in the business and who is the licensed real estate broker of the company? California requires all property managers to be licensed real estate broker. An agent’s license is not sufficient. You can check the status of a licensed real estate broker by going to the Department of Real Estate website at http://www.dre.cahwnet.gov/. By going to licensees in the left column, you will be able to research any licensed salesperson, broker or corporation operating in the State of California to check how long they’ve been a broker and if they are in good standing. 2. Do you personally own an apartment building? You are assured of getting the very best in management if the manager manages your building as she manages her own. Can someone who doesn’t own an apartment building really know what it is like to manage one for maximum profit? 3. Do you manage other properties in the area of mine? The property manager may not have easy access to your property location. Some take accounts far away from their service areas. It is important to learn if the property manager actually manages other properties in your area. In an emergency, your property manager must be able to respond quickly and efficiently. 4. Do you review my existing rental agreements, and are you able to upgrade these contracts with my existing tenants at no additional cost? In the absence of rent control, you may upgrade your existing rental agreements by simply issuing a Change of Terms of Tenancy Notice. In these cases, you can effectively change the terms of the tenancy, without the existing tenant’s signature. 5. Do you have experience with rent control issues and housing department code enforcement concerns, and have you actually been to any hearings with these entities? Some violations, if left unresolved, can result in criminal prosecution against you. Hands-on experience with code enforcement concerns is imperative. 6. Do you advertise my vacancies, and how long do you think it would take to fill a vacancy in my building? Are you able to advertise on different Internet sites as well as newspapers and trade papers? There are many free websites advertising vacancies. Newspaper and trade papers can be expensive. It becomes cost prohibitive to advertise a lower priced rental in some of these publications. If your property manager manages properties in the same general location of your property, you can benefit by getting the rental inquiry overflow from their other properties. 7. Does your company offer a website, and can your company communicate with me via email If you are able to communicate with your property manager via email, you should be kept up-to-date no matter where you are, even overseas. We communicate (sometimes daily) with clients as far away as South America. 8. Are there members in your company who are bilingual, and do they speak Spanish? If your property manager does not speak Spanish, you will lose many potential applicants who may qualify for your vacancy. You may also have difficulty in communicating with some workmen. 9. Does your company offer other services, such as financing, brokerage or property tax reduction that may tie into their property management services (and save you money)? This can benefit you greatly.! Who Touchstone Properties Is Touchstone Properties is staffed with professionals who have experienced every facet of property management and have effectively dealt with its many challenges. We are all qualified personnel using the best technology available including a 24-hour voicemail system and advanced property management software. Our accounting system generates thorough financial records and accounting reports in an easy to understand format. ! Our small size allows us to provide service that is customized to the specific needs of the property owners and their respective tenants. Touchstone Properties’ basic philosophy is that if the tenants are happy, they won’t move, turnover costs will be minimized and the property owners will enjoy optimal cash flow.! What Touchstone Properties Will Do For You Touchstone Properties provides each client with a customized line of services including:! • Rent collection and administration of rental increases, common area maintenance increases, lease violation notices, notification lists and any other correspondence required.! • Semimonthly building inspections to ensure that your property is being maintained according to the highest standards.! • Weekly bill payment to assure avoidance of late fees and penalties.! • Monthly profit distribution including comprehensive financial reports to keep you informed on the status of your investment. Our reports are available by mail or email. Direct deposit of distributions is also available.! • Income and expense analysis including review of insurance coverage, property taxes (which we are often able to reduce; see Property Tax Reduction later in this brochure), maintenance contracts, leases and any other related documents to ensure accuracy and cost effectiveness.! • Maintenance and repair administration coordinated with pre-screened vendors. Due to the volume of business we give them, we are able to establish competitive prices while retaining quality. Nevertheless, we still bid out large repairs or improvements in order to obtain the best value possible. When possible, jobs are given to our handyman to get the lower cost of labor.! • Tenant management including 24-hour voicemail so that we can respond to building issues and emergencies in a timely manner.! • Vacant unit renovation, marketing and leasing handled promptly to maximize cash flow. ! • Monthly bank reconciliation and trial balance review to assure accurate accounting.! Achieving Maximum Profit Through years of experience, Touchstone Properties has developed systems to deal with every aspect of property management. These systems allow us to consistently increase the profit on the buildings that we manage. They also allow us to prevent problems and quickly solve those that are unavoidable.! Increasing Income The quickest way to increase profit is to increase rents. However, care must be taken in doing so. Many cities (including Los Angeles, Santa Monica and West Hollywood) have rent control laws that limit how often and by how much rent can be increased. In order to avoid penalties (and perhaps litigation), familiarity with these ordinances is paramount. Through our extensive experience, we are intimately familiar with all rent control laws in the cities in and around Los Angeles county.! Touchstone Properties’ rent increase system has been designed to work within the constraints of rent control. It automatically reminds us when and by how much to raise the rent on every unit we manage by taking into consideration the rent control for that area, market rents for that area, when the tenant moved in, when their rent was last increased and by how much. Based on all of these factors, we will increase the rent by an appropriate amount. We are careful not to raise it too much to avoid having the tenant move out (unless that is our goal). This system allows us to maximize your rental income on a continual basis.! Touchstone Properties also examines other sources of income such as the laundry room and telecommunication services. We carefully review the laundry lease and look for ways to increase income from this source. Sometimes we can re-negotiate the laundry lease so that a higher percentage of the income is paid to you. Or we may be able to resell the lease for thousands of dollars to a different provider.! The newest profit center for multi-family properties is packaging telecommunication services. We can often negotiate a profit sharing arrangement with providers to offer packages including telephone, cable, satellite TV, and Internet access.! Lowering Expenses The second way Touchstone Properties increases profit is by lowering expenses. Expenses can be lowered in many ways. Vacancies are the largest controllable expense because they include lost income, rehabilitation costs, advertising, prospective tenant screening costs and, in some cases, legal costs to get delinquent tenants out. Keeping vacancies to a minimum is our highest priority in managing your property. We have developed detailed systems for keeping vacancies to a minimum and minimizing the cost of vacancies that do occur.! The best way to minimize vacancies is to ensure that your tenants are happy with their apartment. It is much less expensive to keep an existing tenant happy than to have to deal with a vacant apartment after that tenant moves out. Touchstone Properties is always available to the tenants. We have a 24-hour voicemail system as well as a convenient and user-friendly maintenance request system. Satisfied tenants will take better care of their apartments, thereby reducing rehabilitation costs when they do move out.! Figure 1 – Average Occupancy Statistics Vacant Paid Late Figure 1 shows the monthly average vacancy factor, move-out factor and late payment factor on the buildings Touchstone Properties has managed in the past several years. A low vacancy factor indicates an efficient use of resources. With more units rented, more income is generated which increases profit. A low move-out factor indicates happy tenants. With fewer units being vacated, there are fewer rehabilitation costs and a lower vacancy factor. A low late payment factor indicates responsible tenants who are satisfied and who tend to take better care of their units. With tenants paying on time, bills are paid on time, thus eliminating late charges and allowing for fewer reserves to be held. And that ultimately means more cash flow to you.! Inevitably, there will be vacancies. The key is attracting the highest number of prospective tenants but at the lowest possible rehabilitation cost. Touchstone Properties knows which improvements are most attractive to prospective tenants and can get them done at the lowest possible cost.! Prospective tenant screening is also very important. If we can eliminate troublesome tenants before they move in, we eliminate the often-exorbitant costs (legal fees, lost rent, and rehabilitation) of getting them out. Touchstone Properties diligently checks prospective tenants for poor credit, bad check writing, unlawful detainers, judgments and criminal records. We verify previous and current residency and employment. We firmly believe that it costs less in the long run to do a thorough check and have a unit vacant for a bit longer than to lease to a questionable tenant and deal with the potentially expensive consequences.! Because the professionals at Touchstone Properties have managed properties for so long, we have worked with many vendors. Over the years we have found the highest quality vendors. We have negotiated the lowest possible price with them for the highest possible quality. We verify that all the vendors we work with are properly licensed and have liability and workman’s compensation insurance. If you have established vendors with whom you regularly contract with, we will continue with them, if you prefer. Through our availability to tenants and our thorough biweekly property inspections, problems at the building are quickly discovered and repaired, thereby keeping the tenants safe and happy. Regular inspections can also save money on utility bills by reducing wasted water and electricity from faulty fixtures. Finally, ensuring a well-maintained property greatly reduces the risk of accidents and possible litigation.! Capital Improvements Touchstone Properties’ semimonthly property inspections will discover improvements that can be made that may increase the building’s value thereby improving profit at the time of sale or refinancing. Their expertise in knowing which improvements to make coupled with the low cost they are able to negotiate to make the improvements makes this a potentially huge profit center. Using their profit-maximizing and expense-minimizing systems to increase cash flow also allows them to make, in most cases, these improvements from cash flow, not requiring capital contributions from you.! Less Owner Stress Managing multi-family properties for maximum profit requires a great deal of expertise and an immense amount of time. In addition to that, it is fraught with problems that can lead to major stress. There is nothing worse than getting a call from an irate tenant at 2:00 a.m. regarding a water leak. If you are managing your building yourself, this is a problem you have to deal with immediately. You need to have capable and responsible personnel to deal with these situations. If you have someone else managing your building, you need to trust that they have these personnel in place and that they do not contract these jobs out at an exorbitant cost to you.! Touchstone Properties has contracted with trade professionals to handle these types of situations. We have pre-negotiated prices already established. We confirm that they are properly licensed and insured. We also have systems that minimize these problems in the first place. These include inspections of units by us and by the tenants and convenient tenant maintenance request procedures.! Management Systems Every step of the management process that Touchstone Properties uses is documented and includes a flow chart, checklist, or both. These systems have been refined over two decades and are able to deal with all aspects of management in a consistent, fair, and efficient manner. And of course they have been optimized to increase the profit of the buildings they are used on.! Banking and Reporting Touchstone Properties will open an operating account for your building exclusively at an FDIC insured bank. They will make deposits one or more times a week and pay all bills related to your building from this account. At the end of each month, they will send you the net cash flow by check from this account.! Touchstone Properties typically prepares a Balance Sheet, Profit and Loss Statement, Statement of Cash Flow, Cash Receipts Journal, Cash Disbursements Journal and Tenant Ledger each month. At the end of the year they send a Balance Sheet and Profit and Loss Statement for use in your tax preparation. If you would like additional reports or at different intervals, they will customize the financial reporting to your liking. Please refer to Sample Financial Reports later in this brochure for examples of these reports.! Timelines of Service In addition to day-to-day operations such as phone calls, preparing correspondence and meetings with tenants, venders and owners, Touchstone Properties’ team members follow timelines for other tasks they perform. Following are the timelines for those tasks. Nearly every step in the timelines has a detailed, written or computerized system for implementation.! Daily Account for tenant payments received Account for vendor invoices received Review and schedule tenant-requested repairs Weekly Day Task Tuesday Bank deposits, advertise vacancies Wednesday Pay bills Thursday Inspect vacant apartments Friday Bank deposits Monthly Day Task 1 Archive previous month’s records 2-4 Collect rent and post late reminders; inspect buildings 3-5 Deposit rents; schedule repairs 4-7 Collect late rents; serve 3-day notices to non-paying tenants 8 - 11 Send paperwork to attorney to start evictions 12 Reconcile bank accounts 13 Review previous month’s trial balances 14 Prepare 30-day notice of rent increases 15 Mail previous month’s financial statements to owners 16 - 19 Inspect buildings; serve rent increase notices 20 Schedule repairs 21 Call tenants with balances due and schedule payments 25 Check status of evictions 26 Pay management fee Last Distribute net cash flow to owners Semi-Annually (April and December) Pay property taxes Annually (year’s end) Update, close and archive records for year ending Send year-end financial statements and management summary to owners for tax preparation ! Upon Vacancy Send tenant city mandated information. Inspect apartment. Send “Post-Occupancy Inspection” report to owner for approval. Schedule repairs and cleaning. Inspect apartment for rent-ready condition. Account for and refund security deposit as required by law. Advertise in newspaper and on internet. Advise tenants in building of vacancy and referral fee. Thoroughly screen applicants. Meet applicant at apartment for inspection and completion of paperwork. Give keys to the new tenant. ! Plan of Action In order to facilitate a smooth and trouble free transition from your current management to Touchstone Properties, they have designed this Plan of Action.! 1. Meet with you to understand and establish your goals and objectives so that a management plan of action can be developed for your property. Once established, our plan will be implemented immediately.! 2. Notify tenants of change in management.! 3. Notify vendors of change in management. Have them mail any unpaid invoices to us along with a copy of the contract for your building(s).! 4. Conduct a thorough inspection of the property utilizing our own staff. Based on this inspection, we will provide a comprehensive report noting specific problems. We will also make suggestions as to the best way to correct these problems and ways to improve the value of your investment through capital improvements, cost-cutting measures or additional income streams.! 5. Conduct a thorough inspection of any vacant apartments to verify that they are rent ready. Make any necessary repairs and cleaning. Install a “For Rent” sign. Immediately begin advertising.! 6. Review tenant accounts for delinquencies. Notify tenants of balances and establish a timetable for payment.! 7. Review vendors for quality work and competitive pricing.! 8. Establish a report format and schedule suitable to your needs. Establish procedures for bank deposits and cash distributions according to your wishes. Our local office will perform all accounting, collections and billings.! 9. Conduct a thorough review of all property files for your building including real estate tax information, rent role, leases, budgets, maintenance contracts and any other applicable files.! 10. Ensure tenant, vendor, governmental and property insurance concurrence. Review and implement security programs if deemed necessary.! 11. Develop the following documents and procedures. Present them to you for your approval within 30 days after the commencement of management operation.! a.! List of preventative maintenance programs and procedures for all mechanical and associated equipment for your property.! b. Rules and regulations regarding occupancy as well as tenant improvements and remodeling.! c. Insurance requirements to contractors and tenants.! d. Recommendations based upon our inspection and review of property improvements and service contracts.! e. A lease abstract summary for all tenants’ leases.! ! Sample Financial Reports ! ! ! • Balance Sheet! • Profit and Loss Statement! • Statement of Cash Flow! • Cash Receipts Journal! • Cash Disbursements Journal! • Customer (Tenant) Ledger! ! Balance Sheet 006 - 5345 La Mirada Ave. c/o Touchstone Properties 4311 Wilshire Blvd., Suite 302 Los Angeles, CA 90010 Balance Sheet As of August 2007 12/18/07 5:48:58 PM Assets Current Assets Cash On Hand Checking Account Total Cash On Hand Accounts Receivable Total Current Assets Total Assets Liabilities Current Liabilities Accounts Payable Security Deposits Held Total Current Liabilities Long-Term Liabilities Mortgages Payable Total Long-Term Liabilities Total Liabilities Equity Owner's Equity Owner's Withdrawal Total Owner's Equity Retained Earnings Current Year Earnings Historical Balancing Total Equity Total Liability & Equity $1,000.05 $1,000.05 $210.72 $1,210.77 $1,210.77 $3,065.49 $167.00 $3,232.49 ($1,379.87) ($1,379.87) $1,852.62 ($53,495.03) ($53,495.03) $2,009.85 $45,389.61 $5,453.72 ($641.85) $1,210.77 Profit and Loss Statement 006 - 5345 La Mirada Ave. c/o Touchstone Properties 4311 Wilshire Blvd., Suite 302 Los Angeles, CA 90010 Profit & Loss [With Year to Date] October 2007 12/18/07 5:49:36 PM Selected Period INCOME Rental Income Other Income Laundry Income Late Payment Fee Returned Check Fees Repairs Income SCEP Fee Annual Registration Fee Total INCOME Adjustments to Scheduled Rent Pass Throughs Tenant Late Fee Total Adjustments to Scheduled Rent % of Sales Year to Date % of YTD Sales $9,395.67 98.4% $92,236.23 97.8% $120.00 $0.00 $0.00 $0.00 $29.60 $0.00 $9,545.27 1.3% 0.0% 0.0% 0.0% 0.3% 0.0% 100.0% $1,348.50 $100.04 $35.00 $192.00 $296.00 $93.50 $94,301.27 1.4% 0.1% 0.0% 0.2% 0.3% 0.1% 100.0% $0.00 0.0% $0.00 0.0% $9,545.27 100.0% $94,301.27 100.0% $99.42 $868.37 1.0% 9.1% $1,967.85 $3,909.77 2.1% 4.1% $0.00 $3,177.00 0.0% 33.3% $3,296.36 $3,177.00 3.5% 3.4% $0.00 $500.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 0.0% 5.2% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% $375.97 $500.00 $84.75 $470.00 $106.00 $165.96 $65.00 $1,525.78 $208.20 0.4% 0.5% 0.1% 0.5% 0.1% 0.2% 0.1% 1.6% 0.2% $71.50 $165.00 0.7% 1.7% $786.50 $3,056.33 0.8% 3.2% $0.00 0.0% $542.30 0.6% $0.00 $4,881.29 0.0% 51.1% $9.00 $20,246.77 0.0% 21.5% $4,663.98 48.9% $74,054.50 78.5% Other Expenses Interest Expense Mortgage Interest Total Other Expenses $1,971.26 $1,971.26 20.7% 20.7% $19,669.21 $19,669.21 20.9% 20.9% Net Profit / (Loss) $2,692.72 28.2% $54,385.29 57.7% Gross Profit EXPENSES Utilities Expense Natural Gas Water & Electricity Taxes & Insurance Expense Property Tax Insurance Maintenance & Repairs Expense Electrical Flooring Fire & Safety HVAC Janitorial Lock & Key Paint & Sundries Plumbing Misc. Maintenance & Repair Management Expense On Site Management Services Expense Garbage Removal Landscaping Administrative Expense Rent Control Expense Annual Registration Fees Paid Banking Expense Total EXPENSES Operating Profit Other Income Statement of Cash Flow 006 - 5345 La Mirada Ave. c/o Touchstone Properties 4311 Wilshire Blvd., Suite 302 Los Angeles, CA 90010 Statement of Cash Flow October 2007 12/18/07 5:50:07 PM Cash Flow from Operating Activities Net Income Accounts Receivable Accounts Payable Mortgages Payable Net Cash Flows from Operating Activities $2,692.72 $221.50 $868.37 ($401.37) $3,381.22 Cash Flow from Investing Activities Net Cash Flows from Investing Activities Cash Flow from Financing Activities Owner's Withdrawal Net Cash Flows from Financing Activities Net Increase/Decrease for the period Cash at the Beginning of the period Cash at the End of the period $0.00 ($4,500.00) ($4,500.00) ($1,118.78) $0.20 ($1,118.58) Cash Receipts Journal 006 - 5345 La Mirada Ave. c/o Touchstone Properties 4311 Wilshire Blvd., Suite 302 Los Angeles, CA 90010 Cash Receipts Journal 10/1/07 To 10/31/07 12/18/07 6:13:53 PM ID# CR CR CR CR Acct# Account Name 10/4/07 Payment; Aaron Kraft CR000172 1-1160 Undeposited Funds CR000172 1-1200 Accounts Receivable CR000172 1-1200 Accounts Receivable 10/4/07 Payment; Erika Dowdell CR000173 1-1160 Undeposited Funds CR000173 1-1200 Accounts Receivable Debit Credit $1,004.46 $117.50 $886.96 $1,020.21 $1,020.21 10/4/07 Payment; Joseph Ayala CR000174 1-1160 Undeposited Funds CR000174 1-1200 Accounts Receivable $886.96 10/4/07 Payment; Tyler Compton CR000175 1-1160 Undeposited Funds CR000175 1-1200 Accounts Receivable $940.31 $886.96 $940.31 CR 10/4/07 Payment; Chane't/Dennis Johnson/Moore CR000176 1-1160 Undeposited Funds $911.01 CR000176 1-1200 Accounts Receivable $911.01 CR 10/4/07 Payment; Jorge & Reina Loarca CR000177 1-1160 Undeposited Funds CR000177 1-1200 Accounts Receivable CR000177 1-1200 Accounts Receivable $46.00 $912.46 $958.46 CR 10/4/07 Payment; Patricia/Carlos/Matt Estrada/Guy/Jones CR000178 1-1160 Undeposited Funds $1,300.00 CR000178 1-1200 Accounts Receivable $1,300.00 CR 10/4/07 Payment; Patricia/Carlos/Matt Estrada/Guy/Jones CR000179 1-1160 Undeposited Funds $2.96 CR000179 1-1200 Accounts Receivable CR 10/4/07 Payment; Julio Chavez CR000180 1-1160 Undeposited Funds CR000180 1-1200 Accounts Receivable $776.72 10/4/07 Payment; Sonya Vasquez CR000181 1-1160 Undeposited Funds CR000181 1-1200 Accounts Receivable $990.96 10/4/07 Payment; Jenepher Lattibeaudiere CR000182 1-1160 Undeposited Funds CR000182 1-1200 Accounts Receivable $854.72 CR CR CR Page 1 10/4/07 Bank Deposit CR000183 1-1110 Checking Account CR000183 1-1160 Undeposited Funds CR000183 1-1160 Undeposited Funds CR000183 1-1160 Undeposited Funds CR000183 1-1160 Undeposited Funds CR000183 1-1160 Undeposited Funds CR000183 1-1160 Undeposited Funds CR000183 1-1160 Undeposited Funds CR000183 1-1160 Undeposited Funds CR000183 1-1160 Undeposited Funds CR000183 1-1160 Undeposited Funds CR000183 1-1160 Undeposited Funds $2.96 $776.72 $990.96 $854.72 $9,646.77 $1,004.46 $1,020.21 $886.96 $940.31 $911.01 $958.46 $1,300.00 $2.96 $776.72 $990.96 $854.72 Job No. Cash Disbursements Journal 006 - 5345 La Mirada Ave. c/o Touchstone Properties 4311 Wilshire Blvd., Suite 302 Los Angeles, CA 90010 Cash Disbursements Journal 10/1/07 To 10/31/07 12/18/07 5:50:30 PM ID# CD 13938 13938 CD Page 1 Acct# Account Name 10/3/07 Kevin Saunders 1-1110 Checking Account 3-1200 Owner's Withdrawal $4,500.00 10/10/07 Ismael Sanchez 1-1110 Checking Account 2-1200 Accounts Payable 2-1200 Accounts Payable $65.00 $100.00 auto auto 10/15/07 World Savings 1-1110 Checking Account 2-1200 Accounts Payable $2,372.63 13940 13940 10/24/07 White Oak Insurance Services, Inc. 1-1110 Checking Account 2-1200 Accounts Payable $3,177.00 13941 13941 10/24/07 Quality Maintanence & Repair 1-1110 Checking Account 2-1200 Accounts Payable 13942 13942 10/24/07 Gas Company 1-1110 Checking Account 2-1200 Accounts Payable $99.42 13943 13943 10/24/07 Athens Services 1-1110 Checking Account 2-1200 Accounts Payable $71.50 CD CD CD CD Grand Total: Credit $4,500.00 13939 13939 13939 CD Debit $165.00 $2,372.63 $3,177.00 $500.00 $500.00 $99.42 $71.50 $10,885.55 $10,885.55 Job No. Customer (Tenant) Ledger 006 - 5345 La Mirada Ave. c/o Touchstone Properties 4311 Wilshire Blvd., Suite 302 Los Angeles, CA 90010 Customer Ledger 10/1/07 To 10/31/07 12/18/07 5:53:08 PM Date Src Page 1 ID# Joseph Ayala 10/1/07 SJ 00000140 10/4/07 CR CR000174 Memo Transaction Amount 03 Rent; Ayala, J Payment; Jose $886.96 ($886.96) Total: Julio Chavez 10/1/07 SJ 00000141 10/4/07 SJ SJ000034 10/4/07 CR CR000180 $0.00 10 Rent; Chavez, Chavez, Julio: Payment; Juli Total: Tyler Compton 10/1/07 SJ 00000142 10/4/07 CR CR000175 Erika Dowdell 10/1/07 SJ 00000143 10/4/07 SJ SJ000033 10/4/07 CR CR000173 $0.00 02 ($43.00) ($43.00) $974.21 $0.00 ($1,020.21) ($24.32) $949.89 $949.89 ($70.32) ($46.00) ($70.32) 01 Rent; Dowdel Dowdell, Erik Payment; Erik $1,302.96 ($1,300.00) ($2.96) $0.00 Total: $870.01 ($911.01) ($41.00) 09 Rent; Kraft, A Payment; Aar Total: Rent; Lattibe Payment; Jene ($41.00) $26.00 $854.72 ($854.72) $0.00 $854.72 $0.00 $958.46 ($958.46) $0.00 07 Rent; Vasquez $0.00 $870.01 ($41.00) ($91.50) $0.00 Total: $0.00 $912.96 ($1,004.46) 08 Rent; Loarca, J Payment; Jorg $0.00 $1,302.96 $2.96 $0.00 $117.50 $1,030.46 $26.00 04 Total: ($27.00) Total: Total: Sonya Vasquez 10/1/07 SJ 00000149 ($27.00) $749.72 $749.72 ($27.00) $0.00 $897.31 ($43.00) Chane't/Dennis Johnson/Moore 06 10/1/07 SJ 00000145 Rent; Johnson/ 10/4/07 CR CR000176 Payment; Cha Jorge & Reina Loarca 10/1/07 SJ 00000148 10/4/07 CR CR000177 $0.00 $897.31 ($940.31) Patricia/Carlos/Matt Estrada/Guy/Jo 05 10/1/07 SJ 00000144 Rent; Estrada 10/4/07 CR CR000178 Payment; Patr 10/4/07 CR CR000179 Payment; Patr Jenepher Lattibeaudiere 10/1/07 SJ 00000147 10/4/07 CR CR000182 $0.00 $886.96 $0.00 Rent; Compto Payment; Tyl Total: Aaron Kraft 10/1/07 SJ 00000146 10/4/07 CR CR000172 $776.72 $0.00 ($776.72) Balance $990.96 $0.00 $46.00 $1,004.46 $46.00 $46.00 ($4.00) $986.96 Case Study 3615 Keystone Avenue The owner purchased this building in the summer of 1996 for $370,000. He hired Touchstone Properties to begin managing the building at the close of escrow. The building was in poor condition and the rents were accordingly below market. In addition, the operating expenses were unnecessarily high. The current tenants had also taken advantage of the previous owner who managed the building himself. They paid their rent late on a regular basis; didn't take care of their apartments; and they convinced the owner to lower their rents several times.! When we took over, we distributed a copy of our Apartment House Rules to each tenant. Within a few months, every tenant was paying by the third day of the month. The repair costs were also reduced because we held the tenant responsible for the vast majority of the problems in their apartment. The tenants were required to pay the cost of repair for all non-wear-and-tear damage. If they did not, they were evicted and the cost was deducted from their deposit. We then raised everyone's rent the maximum allowed under rent control.! Figure 2 – Keystone Net Income Income Expense Net The combination of these actions inspired some of the tenants to move out. In fact, over the first two years of management, 71% of the original tenants moved out (a goal of the owner). Granted, this led to increased expenses for rehabilitating the apartments. But the end result was new, well-screened tenants paying substantially higher rent. We orchestrated these actions so that there were never more than two vacancies at the same time. Thus cash flow was not significantly reduced. Figure 2 illustrates the net income of this building. As you can see, it has increased dramatically through the implementation of our profit-maximizing systems.! To lower the operating expenses, we did a thorough review of the invoices and discovered that the utilities were unusually high. After inspecting the property, we installed low flow toilets in each apartment, had a plumber inspect all the plumbing and repair any leaks, installed a new water heater, and changed all outdoor incandescent light fixtures to florescent. Again, this immediately increased expenses but these improvements lowered operating costs over the long run.! Because multi-family properties are typically valued based on a multiple (determined by the market) of the income that they produce, the value of a building rises along with the income if the multiplier remains constant. Figure 3 illustrates the value of this same building over the same time period.! Figure 3 – Keystone Value ! The building runs with a low turnover rate, which helps keep the operating expenses down. In fact, the building is operating at a 28% expense factor, which includes our management fee. The rents are at or near market levels and the building is very profitable, having thousands of dollars of positive cash flow each month.! The building was sold the summer of 2006 for $1,232,250. Much of that profit was the result of good management.! ! Other Services Property Tax Reduction There are many property owners who are overpaying on their property tax bills. This is a result of the devaluation of their property for a variety of reasons ranging from a change in the economy to a change in demographics including the designated use of the property. Yet the government does not automatically reduce the tax bill when a decrease in value occurs. (However, they do automatically raise it when they think it is worth more.) There is a lengthy and difficult process involved that the property owner (or their agent) must instigate and then complete in order to get their taxes reduced.! Touchstone Properties can help owners to reduce their property taxes. It is not necessary that we manage the property in order to reduce the taxes if they are excessive. However, the more familiar we are with the property, the better our chances of success in getting a reduction and the reduction would probably be greater. We handle the entire process, from the initial filing through the commissioner hearings and follow-up paperwork.! We have saved our clients thousands of dollars in property taxes (see the list below). No property is too small or too large. We have handled dozens of reassessments on single-family dwellings, apartment buildings, retail centers, industrial malls, office buildings, churches, auto centers and even vacant land.! Recent Tax Reductions Property Description Old Value New Value First Year Tax Savings 244 units, Mid-Wilshire $25,000,000 $13,500,000 $143,750 204 units, Canoga Park 18,000,000 11,500,000 81,250 Retail center, Santa Monica 4,800,000 2,600,000 27,500 Industrial center, Compton 4,832,000 2,700,000 26,650 110 units, Hollywood 4,100,000 2,000,000 26,250 Retail center, Tarzana 6,200,000 4,550,000 20,625 SFR, Belair 5,100,000 3,450,000 20,200 26 units, North Hollywood 2,585,000 1,750,000 10,438 Industrial center, Santa Monica 8,000,000 7,300,000 8,750 785,000 420,000 4,563 Vacant land, Palos Verdes ! Multi-Family Dwelling Brokerage Managing income producing real estate gives Touchstone Properties a great advantage when it comes time to buy or sell. It is amazing when you realize that most commercial brokers don’t own or manage multi-family real estate, the product they sell. Could you imagine a computer sales person who has never owned a computer? Managing property to maximize profit as we do allows us to sell the properties we manage at the highest possible price. And knowing how to maximize profit allows us to help sellers whose buildings we don’t manage to get top dollar too.! If you are selling property, we will use the following methods to expose your property to the highest number of buyers:! • Multiple Listing Service • Broker’s Forums • Direct Mail to Brokers and Owners • Networking with Brokers and Owners • Newspaper Advertising • Internet Listing Service Brokers sell the vast majority of multi-family properties. Therefore the focus of our marketing is to them. We have established relationships with many brokers over the years that we have worked in the real estate industry. We let them all know about the properties we have for sale.! Knowing what is involved in managing to increase profit also allows a Touchstone Properties to find those great deals on properties for sale. We use our broker network, as well as other methods, to find these great deals. Rest assured, if there is a property for sale that meets your requirements, we will find it.! Once the property you are interested in has been found, our broker will determine what it is worth. The average broker will do only a market analysis of the property you are considering. After all, they are not familiar with all of the intricacies involved in managing multi-family real estate. Our broker does a market analysis like other brokers but then goes a step further. Managing properties gives us the added ability to do an in-depth analysis of the building's condition, books and records, rents and other income, expenses and ultimately, cash flow.! One of the axioms of real estate investing is that the majority of the profit is made at the purchase. In other words, purchasing the property at the right price is of utmost importance. Having us represent you will help you buy a property without paying too much and knowing the future profit potential before investing a dime.! ! Homeowners’ Association Management Touchstone Properties applies its hands-on management philosophy along with our experience to also manage homeowners’ associations. We handle all standard accounting including collections, hiring and supervising vendors for repair and maintenance, addressing owner complaints and other day-to-day management of the HOA.! We will help prioritize the work that needs to be done to the common areas and get competitively priced bids to have the work completed in a timely manner. We will prepare financial statements in the form and frequency that the board requires.! Another facet of our management is to make sure that the association is in compliance with state and local laws. We also make sure that you have the proper insurance and enough reserves for common area repairs and replacement.! Touchstone Properties will manage the association under the complete supervision of the board of directors within the guidelines of the association’s CC&Rs and state laws.! Real Estate Investment Investing in multi-family properties can be a lucrative place to invest your money and watch it grow. Unfortunately, many would-be investors lack the funds necessary to cover the associated down payment and closing costs. ! Touchstone Properties can help aspiring property owners to reach their investment goals by gathering groups of these like-minded people into what is known as a syndicate. We combine their investments and purchase a property that meets their investment criteria. We negotiate the purchase, manage the property and the syndicate, and dissolve the syndicate at the end of the predetermined investment period.! The investors will receive their share of the net cash flow and, upon the sale of the property, receive their investment back along with their share of the profit. They can then roll their money into a new syndicate to purchase another property with us or, if they have built up enough money, purchase a property on their own, which we would be happy to help them do and then manage it for them.! ! Notes

© Copyright 2026