Morgan Stanley Investment Funds US Advantage Fund Investment objective Fund facts

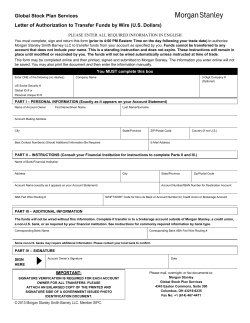

Investment management FACTSHEET | DATA AS OF September 30, 2014 Morgan Stanley Investment Funds US Advantage Fund Investment objective Fund facts Seeks long term capital appreciation, measured in US Dollars, by investing primarily in securities issued by US companies and on an ancillary basis in securities issued by companies that are not from the US. Fund launch Investment team 4 Share Class I Risk and Reward profile The higher the category (1 - 7), the greater the potential reward, but also the greater the risk of losing the investment. Category 1 does not indicate a risk free investment. Download the fund’s Key Investor Information document (KII) for share class tailored risk ratings and warnings at: www.morganstanleyinvestmentfunds.com Class I shares vs. benchmark 1,2 Performance of 100 U.S. dollars invested since inception 250 Cash Value 100 May 10 Sep 14 Index Returns in U.S. dollars vs. benchmark 1,2 Period I A B Index AH Index 3 (USD) (USD) (USD) (USD) (EUR) (EUR) One month Last three months YTD One year Three years (ann.) Five years (ann.) Since inception (ann.) (0.22) 2.54 3.92 15.79 19.64 16.95 9.20 (0.27) 2.35 3.33 14.89 18.71 16.04 n/a (0.38) (1.40) 2.08 1.13 2.53 8.34 13.73 19.73 17.52 22.99 14.89 15.89 n/a 7.57 (0.30) 2.31 3.32 14.73 17.98 15.42 n/a (1.53) 1.42 7.69 18.84 21.63 14.57 n/a 12 months to: September 2014 September 2013 September 2012 September 2011 September 2010 Fund Index P/CF P/BV P/E Yield Number of holdings 18.39 5.23 26.14 0.85 36 10.54 2.64 18.50 2.03 502 15.79 21.84 21.37 6.43 20.02 14.89 20.89 20.43 5.62 19.09 13.73 19.67 19.25 4.55 17.99 19.73 19.34 30.20 1.15 11.08 14.73 20.13 19.16 5.32 18.44 % FACEBOOK INC AMAZON.COM INC GOOGLE INC TWITTER INC MEAD JOHNSON NUTRITION CO. BERKSHIRE HATHWY STARBUCKS CORP PROGRESSIVE CORP/THE LINKEDIN CORP CHRISTIAN DIOR S.A. Total 150 Fund (net of fees) % Portfolio characteristics Top 10 holdings 200 50 Dec 05 Fund Location Base currency Benchmark Total assets NAV Class I December 2005 Dennis Lynch, David Cohen, Sam Chainani, Alexander Norton, Jason Yeung, Armistead Nash New York U.S. dollars S&P 500 Index $ 4.0 billion $ 54.40 18.84 18.71 27.55 3.35 6.13 Past performance is not a reliable indicator of future results. Returns may increase or decrease as a result of currency fluctuations. All performance data is calculated NAV to NAV, net of fees, and does not take account of commissions and costs incurred on the issue and redemption of units. 8.44 7.55 6.95 4.67 3.88 3.26 3.19 3.14 3.02 3.00 47.10 Sector distribution % Information Technology Consumer Discretionary Consumer Staples Financials Health Care Industrials Cash & equivalents Total 32.47 21.58 18.87 9.95 9.07 1.75 6.31 100.00 Statistics (Class I shares) % Alpha Beta R squared Information ratio Tracking error Fund volatility (Standard deviation) Index volatility (Standard deviation) (3.36) 1.03 0.76 (0.55) 6.06 12.44 10.57 Based on monthly observations, annualised over last 3 years. Charges Management Fee % TER % Z I A AH B 0.70 0.85 0.70 0.90 1.40 1.68 1.40 1.73 1.40 2.68 Please read in full including the footnotes and Important Information. Morgan Stanley Investment Funds US Advantage Fund Share Class A AH B BH C I Z ZH ZX CCY USD EUR USD EUR USD USD USD EUR USD ISIN LU0225737302 LU0266117927 LU0225744001 LU0341469269 LU0362496845 LU0225741247 LU0360484686 LU0360484769 LU0360613169 Bloomberg MORAMFA LX MORAMAH LX MORAMFB LX MORAMBH LX MSAMRFC LX MORAMFI LX MORAMFZ LX MORAMZH LX MORAMZX LX FACTSHEET | DATA AS OF September 30, 2014 Launch 01.12.2005 31.10.2006 01.12.2005 05.12.2008 28.07.2008 01.12.2005 05.09.2008 04.11.2008 04.06.2014 Footnotes Publication date: 15 October 2014. 1 See the ‘Share Class’ section for inception date(s). 2 The benchmark for the Fund is a blend of the S&P 500 Index to 31 August 2009, the Russell 1000 Growth Net 30% Withholding Tax TR Index to 31 March 2010 and the S&P 500 Index thereafter. The benchmark is calculated by geometrically chain-linking the monthly returns. 3 The benchmark for the Fund is a blend of the S&P 500 Index Euro Hedged to 31 August 2009, the Russell 1000 Growth Euro Hedged TR Index to 31 March 2010 and the S&P 500 Index Euro Hedged thereafter. The benchmark is calculated by geometrically chain-linking the monthly returns. 4 Dennis Lynch, David Cohen, Sam Chainani, Alexander Norton, Jason Yeung and Armistead Nash started to manage the fund in June 2009. Important information This document has been prepared by Morgan Stanley Investment Management Limited solely for informational purposes and does not seek to make any recommendation to buy or sell any particular security (including Shares in the Fund) or to adopt any specific investment strategy. MSIM has not authorised financial intermediaries to use and to distribute this document, unless such use and distribution is made in accordance with applicable law and regulation. Additionally, financial intermediaries are required to satisfy themselves that the information in this document and an investment in Shares of the Fund is suitable for any person to whom they provide this document in view of that person’s circumstances and purpose. MSIM shall not be liable for, and accepts no liability for, the use or misuse of this document by any such financial intermediary. If such a person considers an investment in Shares of the Fund, she/he should always ensure that she/he has satisfied herself/himself that she/he has been properly advised by that financial intermediary about the suitability of an investment. Past performance is not a reliable indicator of future results. Returns may increase or decrease as a result of currency fluctuations. The value of the investments and the income from them can go down as well as up and an investor may not get back the amount invested. There are additional risks involved with this type of investment. Please refer to the Prospectus and relevant Key Investor Information for full risk disclosure. This Financial Promotion has been issued and approved in the UK by Morgan Stanley Investment Management Limited, 25 Cabot Square, Canary Wharf, London E14 4QA, authorised and regulated by the Financial Conduct Authority. This document contains information relating to the sub-funds (‘Funds’) of Morgan Stanley Investment Funds, a Luxembourg domiciled Société d’Investissement à Capital Variable. Morgan Stanley Investment Funds (the “Company”) is registered in the Grand Duchy of Luxembourg as an undertaking for collective investment pursuant to Part 1 of the Law of 17th December 2010, as amended. The Company is an Undertaking for Collective Investment in Transferable Securities (“UCITS”). This communication is only intended for and will only be distributed to persons resident in jurisdictions where such distribution or availability would not be contrary to local laws or regulations. In particular, the Shares are not for distribution in the United States or to US persons. If you are a distributor of the Morgan Stanley Investment Funds, some or all of the funds, or Shares in individual funds, may be available for distribution. Please refer to your sub-distribution agreement, for these details before forwarding fund information to your clients. Applications for shares in Morgan Stanley Investment Funds should not be made without first consulting the current Prospectus, Key Investor Information Document (KII), Annual Report and Semi-Annual Report (‘Offering Documents’), or other documents available in your local jurisdiction, which are available free of charge from the Registered Office: European Bank and Business Centre, 6B route de Trèves, L-2633 Senningerberg, R.C.S. Luxemburg B 29 192. In addition, all Italian investors should refer to the ‘Extended Application Form’, and all Hong Kong investors should refer to the ‘Additional Information for Hong Kong Investors’ section, outlined within the Prospectus. Swiss investors are advised that the Prospectus, the Key Investor Information Document (KIID), the Articles of Incorporation of the Company, the audited Annual Reports and the unaudited Semi-Annual Reports may be obtained free of charge from the Swiss representative. Morgan Stanley & Co. International plc, London, Zurich Branch, Bahnhofstrasse 92, 8001 Zurich, is the Swiss representative of the Company and RBC Investor Services Bank S.A., Esch-sur-Alzette, Zurich Branch, Badenerstrasse 567, 8048 Zurich, is the Swiss paying agent. The source for all performance and index data is Morgan Stanley Investment Management Limited. Calculations are NAV to NAV. Performance is quoted net of fees and with income reinvested. For cash management purposes the Fund may invest in shares in the Liquidity Funds of Morgan Stanley Liquidity Funds. www.morganstanleyinvestmentfunds.com © 2014 Morgan Stanley CRC-771673 Exp. 11/29/2014

© Copyright 2026