Fred Turner The Akiko Yamazaki and Jerry Yang University

Fred Turner

The Akiko Yamazaki and Jerry Yang University

Fellow in Undergraduate Education and

Associate Professor of Communication

2015

FACULTY

BENEFITS

SUMMARY

Effective January 1, 2015

Table of Contents

Who Is Eligible for Stanford Benefits?............................... 4

Commit to Your Health with BeWell@Stanford............ 21

What is My Contribution to My Health Plan?................... 7

Fitness and Healthy Living Classes

with Health Improvement Program (HIP)...................... 22

When Does Coverage Start?................................................ 8

What Happens if I Don’t Enroll?.......................................... 9

Medical Plans....................................................................... 10

Health Savings Account (HSA).......................................... 12

Prescription Drugs............................................................... 12

Mental Health and Substance Abuse.............................. 13

Dental Plans......................................................................... 14

Vision Care............................................................................ 15

Flexible Spending Accounts.............................................. 16

Life and Accident Insurance.............................................. 18

Disability (Wage Replacement)......................................... 19

Retirement Savings Plan.................................................... 20

2

2015 Faculty Benefits Summary | benefits.stanford.edu

Tuition Grant Program (TGP)............................................ 23

Stanford WorkLife Office.................................................... 24

Unemployment Insurance................................................. 25

Workers’ Compensation.................................................... 25

Other Resources and Services.......................................... 26

Faculty Information Resources......................................... 27

2015 Benefits Plan Comparison Charts.......................... 28

2015 Dental Plan Comparison Charts............................. 34

Legal Notices........................................................................ 36

Contact Information........................................................... 44

Dear Faculty Member,

Stanford University is committed to providing you a comprehensive

benefits package from health, life and disability insurance to educational

assistance and work-life integration resources.

We understand that selecting benefits is an important process. In addition

to providing an overview of your benefits, this Faculty Benefits Summary

includes health plan comparison charts and other information to assist you

with selecting a plan that is the best fit for you and your family.

Whether you are new to Stanford or a current employee choosing to

change benefits during Open Enrollment, this guide is intended to help

you make educated choices so you get the most out of your Stanford

experience.

For updates or additional information regarding your benefits, visit the

Stanford Benefits website, http://benefits.stanford.edu.

In good health,

Stanford Benefits

benefits.stanford.edu | 2015 Faculty Benefits Summary

3

Dan Elison Azagury

Assistant Professor of Surgery (General Surgery),

Stanford University Medical Center,

wife Tatiana Maratchi

along with son Leo and daughter Olivia

Who Is Eligible for

Stanford Benefits?

You Are Eligible for Stanford

Benefits If You Are:

• Scheduled to work in a benefits-eligible

position for at least six months; and

• A full-time employee working between

75 and 100 percent time; or

• A part-time employee working between

50 and 74 percent time.

Your Eligible Family Members

Are Your:

• Spouse, same or opposite sex, if not

legally separated

• Registered domestic partner

• Children to age 26

»» Natural children

»» Stepchildren

»» Legally adopted children

»» Children for whom you are the

legal guardian

»» Foster children

4

2015 Faculty Benefits Summary | benefits.stanford.edu

»» Children placed with you for adoption

»» Children of your registered domestic

partner who depend on you for support

and live with you in a regular parent/

child relationship

»» Unmarried children for whom you are

legally responsible to provide health

coverage under the terms of a Qualified

Medical Child Support Order (QMCSO)

• Unmarried children over the age limit if:

»» Dependent on you for primary financial

support and maintenance due to a

physical or mental disability;* incapable

of self-support; and

»» The disability existed before reaching

age 19.

* You may be asked to provide documentation or

proof of disability to your medical plan provider for

review and approval of continued coverage. In most

cases, coverage for a disabled child can continue

as long as the child is incapable of self-support,

unmarried and fully dependent on you for support.

WHO IS ELIGIBLE FOR STANFORD BENEFITS?

Does Your Spouse/Registered Domestic Partner Work at Stanford?

You may not elect coverage as an employee and also receive coverage

as the dependent of another Stanford employee or retiree. Only one

university-employed parent may cover eligible dependent children.

YOUR SAME-SEX

SPOUSE

YOUR REGISTERED DOMESTIC PARTNER

You may cover your same-sex

is registered with the State of California. You do not have to live in

spouse under your Stanford

benefits if you married in a

state that recognizes same-sex

marriage. To receive the benefit

of pre-tax deductions, you must

reside in a state that recognizes

same-sex marriage.

You may cover your registered domestic partner if your partnership

California to register with the state. Visit the California Domestic

Partners Registry at www.ss.ca.gov/dpregistry for information

about domestic partnership in California.

You may register your domestic partner if you share a common

residence and your domestic partner is:

• Age 18 or older

• A member of your household for the coverage period

• Not related to you in any way that would prohibit

legal marriage

• Not legally married to anyone else or the same-sex

domestic partner of anyone else

benefits.stanford.edu | 2015 Faculty Benefits Summary

5

When May I Change

My Benefits Elections?

Changes to your benefits elections are

allowed during the Open Enrollment

period and when a Life Event occurs.

Kathryn Ann Moler

Professor of Applied Physics

and Ai Leen Koh, Research Scientist

Open Enrollment

The annual Open Enrollment period is an opportunity

for employees to change their health care elections,

add or drop eligible dependents from coverage or

re-elect flexible spending accounts.

Life Events

Certain events in your life allow you to make

election changes without the need to wait for

Open Enrollment. Examples of a life event include

the following:

• Job status (job change for you, your

spouse/domestic partner)

• Family (marriage, divorce, birth/

adoption of a baby)

Additional information regarding the types of Life

Events and the changes you can make to your

benefits is included in the Life Events section of the

Benefits website, http://benefits.stanford.edu.

Adding Dependents to

Your Benefits

Stanford University requires proof of dependent

eligibility for the dependents you cover. For a list of

acceptable documentation, view the Dependent

Eligibility Documentation Requirements,

available on the Stanford Benefits website at

http://benefits.stanford.edu.

6

2015 Faculty Benefits Summary | benefits.stanford.edu

Why Must I Provide

My Dependent’s Social

Security Number?

When you add a new dependent, you will be

prompted to include their social security number.

Centers for Medicare and Medicaid Services (CMS),

the agency that monitors the claims collections

from employers for Medicare, requires all employers

to provide the social security number of any

employee and dependent covered through an

employer-sponsored medical plan. CMS uses this

to cross-reference any Medicare participant who

also has coverage through an employer.

30 DAYS

You have 30 days from the date you added

your dependent to fax the documentation to

Stanford Benefits at 973-837-3330 or mail to:

Stanford Benefits

P.O. Box 199747

Dallas, TX 75219-9747

Please include your Stanford University ID

number on each document you submit.

What Is My Contribution to My Health Plan?

Stanford University pays for the majority of the cost of your

health and wellness benefits. Your individual contribution

is the amount that the university does not cover.

Stanford-Provided Benefits—

You Pay Nothing!

Stanford is one of the few employers in the Bay

Area that still offer an employee health plan that

is 100 percent employer-paid. Stanford covers the

costs for the following benefits:

• Employee-only coverage under the

lowest-cost medical plans (for full-time

employees only)

• Delta Dental Basic PPO dental coverage

for you and your eligible dependents

(full-time employees only)

• Employee-only basic life insurance

• Employee-only long-term

disability insurance

• Business Travel Accident (BTA) insurance

Employee Shared- and

Full-Cost Benefits

If you do not select one of the lowest-cost medical

plans, you pay the difference between what Stanford

pays for the lowest-cost plan and the cost of the plan

you select. You and Stanford also share the cost of

covering your dependents in the medical plans.

There are other benefits for which Stanford pays

the majority of the cost, and benefits for which you

pay the full cost. These include:

• Dependent coverage in the

lowest-cost plan

• Coverage in a medical plan that is

not the lowest-cost plan (You pay

the difference in the cost between

the lowest-cost plan and the plan

you select.)

• The Delta Dental Enhanced PPO dental

plan (You pay the difference in cost

between this plan and the Delta Dental

Basic PPO plan.)

• Accidental Death & Dismemberment

(AD&D) insurance for you and your

eligible dependents

• Flexible Spending Accounts (FSAs) for

health care and dependent day care

(unless you receive a Child Care

Subsidy Grant)

• Supplemental Life Insurance

• Dependent Life Insurance for your

spouse/registered domestic partner

and children

• Long-Term Care Insurance for you, your

spouse/registered domestic partner and

certain other family members

benefits.stanford.edu | 2015 Faculty Benefits Summary

7

When Does Coverage Start?

The date your coverage starts depends on the plan, when you enroll and, in

some cases, the amount of coverage you select.

If you are an existing employee, changes you make during

Open Enrollment take effect January 1, 2015.

If you are a new hire, coverage under most plans starts on

your date of hire, with the exception of the following:

• If you elect more than three-times salary for Supplemental

Life Insurance for yourself and more than $25,000 for

your spouse/ partner for Supplemental Dependent Life

Insurance, coverage starts after Evidence of Insurability

(EOI) is submitted to, reviewed and approved by the

insurance company. See page 18 for more information

on life insurance and an explanation of EOI.

• Long-Term Care Insurance begins the date your

application is approved by CNA.

• The medical, dental and vision plans have no pre-existing

condition exclusions. This means you are covered for any

eligible condition as soon as your coverage starts.

• Coverage for enrolled dependents begins on the date of

the qualified Life Event (job, family or personal change)

if you provide the appropriate Dependent Eligibility

Documentation within 30 days of the date you make

your benefits elections. Generally, the date of the event

is the date your coverage starts, with the exception of

the following:

»» Increases to your Flexible Spending Accounts

election are not retroactive. An increase will cover

claims you incur starting from the date of the change.

»» Any increase in Supplemental Life Insurance and

Supplemental Dependent Life Insurance will require

you to submit EOI, and coverage starts after it is

submitted to, and reviewed and approved by the

insurance company.

8

2015 Faculty Benefits Summary | benefits.stanford.edu

NEED MEDICAL SERVICES

BEFORE YOU RECEIVE

YOUR ID CARD?

If you made no changes to your medical

plan election for Open Enrollment, simply

use your current medical ID card.

If you changed elections for 2015 during

Open Enrollment, your ID card should be

sent to you by the end of the 2014 calendar

year. If you have not received it and need

medical care on or after January 1, 2015,

print a copy of your Confirmation Statement

as proof of coverage until you receive your

new ID card.

Your doctor’s office or pharmacy may also

verify coverage by calling us at 877-905-2985

or 650-736-2985 (Monday through Friday

from 7 a.m. to 5 p.m. PST), and pressing

option 9. If you need a prescription filled

while waiting for your ID card, you might have

to pay the full cost and then submit a claim

to your medical plan for reimbursement.

What Happens If I Don’t Enroll?

Initial Enrollment As a New Hire

As a new hire, if you do not elect benefits within the

31 days of your date of hire, you’ll receive default

coverage. Default coverage is assigned only to

you and does not include your spouse/registered

domestic partner or your dependents.

Full-Time Employees

If you work 75 to 100 percent time and do not

enroll within 31 days of your hire date, you receive

the following default coverage:

• Blue Shield High-Deductible

Health Plan (HDHP)

• Delta Dental Basic PPO

unless you have a Life Event change. Find more

information on Life Event changes on the Benefits

website at http://benefits.stanford.edu.

WAIVING MEDICAL COVERAGE

If you are a full-time employee and have medical

or dental coverage elsewhere, you must log on to

MyBenefits and actively waive coverage.

If you waive your medical coverage, you will

receive a $25 credit (if you work in a full-time,

benefits-eligible position) or a $12.50 credit (if

you work in a part-time, benefits eligible position)

provided as taxable income in each paycheck.

• Basic Life Insurance

• Long-Term Disability (LTD)

• Business Travel Accident (BTA) insurance

Part-Time Employees and

VA Doctors

If you are a part-time employee working between

50 and 74 percent time, or are a VA doctor, you will

be assigned:

• Basic Life Insurance

• Long-Term Disability (LTD)

• Business Travel Accident (BTA) insurance

You will not have medical or dental coverage.

However, you will receive a $12.50 credit for waived

medical in your paycheck. You will also not have

the opportunity to change your assigned default

coverage or enroll in any other health and life

benefits until the next Open Enrollment period,

Annual Open Enrollment for

Existing Employees

If you are an existing Stanford employee (not a new

hire) and you don’t make your benefits elections

by the end of the Open Enrollment period, your

benefits elections from the prior year will roll over

automatically, with the exception of the following:

• Health care and/or a dependent day

care Flexible Spending Account.

• Child Care Subsidy Grant if one had

been awarded to you.

• Health Savings Account (HSA). You must

re-enroll in the HSA to contribute money

and receive contributions from Stanford.

If you do not re-enroll, your election

will default to waive participation in the

HSA. (Note: You may enroll in the HSA

and elect $0.00 employee contributions

to receive the employer contribution

provided by the university.)

benefits.stanford.edu | 2015 Faculty Benefits Summary

9

Medical Plans

Stanford offers a variety of medical insurance plans, all of which

provide coverage for pre-existing conditions, prescription drugs, and mental

health and substance abuse. Choosing and personalizing your benefits

depends on your specific health care needs, doctor preferences, budget

and the type of plan you prefer.

Stanford HealthCare Alliance (SHCA)

Stanford HealthCare Alliance (SHCA) is a select

network health plan in which Stanford Health Care

physicians and affiliated providers in multiple

specialties take responsibility for working together

to carefully coordinate and deliver your care. SHCA

features an expanded network of primary and

specialty care physicians who are affiliated with

Stanford Health Care and Stanford Children’s Health

to allow for seamless coordination of the high-quality

care you expect from this world-class institution.

Your SHCA Member Care Services team provides

personalized assistance to you in scheduling

appointments, selecting physicians, navigating

your care experience and answering all claims and

billing issues. SHCA covers your expenses only if

you go to an SHCA network doctor and/or facility

except for an urgent or life-threatening emergency.

With Stanford HealthCare Alliance, you:

• Have no deductible

• Have no claims to file

• Pay a fixed copay for each office visit,

emergency room visit and hospital stay

10

2015 Faculty Benefits Summary | benefits.stanford.edu

You are encouraged to select a primary care

physician (PCP) to coordinate and provide all of

your primary care. If you need to see a specialist,

you should coordinate the referral with your

Stanford HealthCare Alliance PCP.

To enroll in the Stanford HealthCare Alliance you

must live within the service area (based on your

home zip code).

Kaiser Permanente (HMO)

Kaiser Permanente is a Health Maintenance

Organization (HMO) that provides patient services,

hospitalization, supplies and prescription drugs

through its own network of doctors, hospitals and

other Kaiser-affiliated health care facilities. Kaiser

covers your expenses only if you go to a Kaiser

provider or facility. You are also covered if you have

a life-threatening emergency when you are outside

a Kaiser service area.

When you enroll in Kaiser, you may select a primary

care physician (PCP) to manage your care using

Kaiser’s network of physicians and facilities. Most

likely, you’ll need approval from your PCP before

seeing a specialist.

MEDICAL PLANS

Kaiser offers cost-effective managed care and

places a strong emphasis on wellness and

preventive care. With Kaiser, you:

• Have no deductible

• Have no claims to file

• Pay a fixed copay for each office visit,

emergency room visit and hospital stay

To enroll in Kaiser, you must live within a Kaiser

service area (based on your home ZIP code).

Blue Shield Exclusive Provider

Organization (EPO)

The EPO is similar to an HMO because you must

use the physicians and facilities within the EPO

network, unless you have a life-threatening

emergency. When you see a provider in the EPO’s

network, there are no deductibles or claims to file.

You pay a fixed copayment for each office visit,

emergency room visit and hospital stay. If you go

to a doctor or hospital outside the EPO’s network,

you pay the full cost for the care you receive. With

the EPO, you do not need to select a primary care

physician. You may go to any doctor, specialist or

hospital within the network.

Blue Shield Preferred Provider

Organization (PPO)

A PPO provides you with the flexibility to go to the

provider or medical facility of your choice—even if

your provider or the facility is not in the Blue Shield

network. If you see providers and go to facilities

within the Blue Shield network, however, your outof-pocket costs are much lower than if you go out

of network for your care.

• In network: You pay a deductible,

and then, the plan pays 80 percent of

covered costs. You do not have to file

a claim—your provider will submit it to

Blue Shield for you. For routine office

visits, you pay $20 for each visit ($50 for

a specialist). Preventive care is provided

at no charge.

• Out of network: Your annual deductible is

larger. The plan pays 60 percent of covered

costs (based on Blue Shield’s allowed

amount), and you must file a claim to be

reimbursed for out-of-pocket costs. You

are also responsible for any remaining

amounts that Blue Shield does not pay.

Blue Shield High-Deductible

Health Plan (HDHP)

The Blue Shield High-Deductible Health Plan

(HDHP) works the same as the Blue Shield PPO

plan, but there are no fixed copays with this plan.

Instead, all benefits—including prescription

drugs—are covered after you meet your deductible.

(A family deductible applies to claims for all family

members until it is met. There is no individual

limit for each covered family member.) This is the

only plan available through Stanford that works in

conjunction with a Health Savings Account.

• In network: After you have paid the

deductible, the plan pays 80 percent of

covered costs (the amount Blue Shield

will pay for a specific service). You do not

have to file a claim, as your provider will

submit the claims to Blue Shield for you.

Preventive care is provided at no charge.

• Out of network: Your annual deductible

is the same as your in-network deductible.

The plan pays 60 percent of covered

costs (based on Blue Shield’s allowed

amount), and you must file a claim for

reimbursement of out-of-pocket costs.

You are also responsible for any remaining

amounts that Blue Shield does not pay.

Remember: Preventive care is not

covered if obtained out of network.

benefits.stanford.edu | 2015 Faculty Benefits Summary

11

Health Savings

Account (HSA)

If you are interested in setting aside tax-deductible

dollars for future health care expenses through

a Health Savings Account (HSA) you must be

enrolled in the Blue Shield High-Deductible Health

Plan (HDHP). Note: If you have an HSA, you cannot

also have a health care Flexible Spending Account.

In 2015, the HSA limit (the amount you contribute)

is $3,350 for employee only, and $6,650 for

employee + dependents.

Because of the tax savings and flexibility to

reimburse yourself for medical expenses, an HSA is

worth considering. You may even set up your HSA

with Blue Shield’s financial partner, HealthEquity,

at the same time you elect coverage in the HDHP.

If you have questions about how HSAs work with

your HDHP, visit http://www.healthequity.net/

stanford, or call HealthEquity at 877-857-6810.

If you are enrolled in the HDHP, you may set up

an HSA directly with HealthEquity or through a

financial institution of your choice. There are two

advantages in choosing HealthEquity:

• You may fund your HSA through

payroll deductions.

• Stanford contributes to your HSA

($300 for employee only and $600

for employee + family). Note: These

amounts are for employees who set up

their account(s) with HealthEquity after

electing the High-Deductible Health

Plan through MyBenefits. If you enroll

any time after January 1, the amount

Stanford contributes will be prorated

based on the number of pay periods

remaining in the calendar year after

you set up your account.

12

2015 Faculty Benefits Summary | benefits.stanford.edu

Prescription Drugs

Your medical plan provides prescription drug

coverage, so be sure to take your ID card when

you have a prescription filled. In 2015, all five

health plans will cover prescriptions at 100%

once the out-of-pocket maximum is met. The

High-Deductible Health Plan (HDHP) requires you

to pay 20 percent of the cost for all prescription

drugs after you have satisfied the deductible. If

you fill your prescriptions at a Blue Shield network

pharmacy, your costs are lower. You can find a list

of these pharmacies on the Blue Shield website at

https://www.blueshieldca.com.

For all other plans, the cost of your prescription

depends on whether or not it can be dispensed in

its generic form and if it is included in your plan’s

list of approved drugs (known as a formulary).

MEDICARE AND HSA

When you reach age 65, you must defer coverage

under Medicare Parts A and B to continue to

contribute to the HSA. If you have enrolled in

Medicare Parts A and B, you are no longer eligible

to contribute to the HSA. However, you will still

have access to any monies in your HSA account.

Once you become Medicare eligible, your HSA

contributions will automatically stop. If you

are not enrolled in the Medicare Parts A and B

and want to continue the HSA, you will need

to contact the Benefits Service Center to have

them re-enroll you.

Mental Health and Substance Abuse

Mental health and substance abuse treatment are covered

by your medical plan. For details, contact your plan or see

the comparison chart at the back of this booklet.

New Non-Network Mental Health Coverage for 2015

The allowed amount for non-network outpatient services (psychologists, therapists, counselors, etc.)

has changed for employees who elect a Blue Shield EPO, PPO, High-Deductible Health Plan (HDHP) or

Stanford HealthCare Alliance. Below are details on the non-network service changes:

PLAN

2014 NON-NETWORK

COVERAGE

2015 NON-NETWORK COVERAGE

Blue Shield EPO

Did not cover nonnetwork services.

80% of up to $300 in allowed charges for professional services

will be covered per visit, for a maximum benefit of $240.*

Blue Shield PPO

60% of non-network

services were covered

after deductible.

80% of up to $300 in allowed charges for professional services

will be covered per visit, for a maximum benefit of $240*.

Blue Shield High

Deductible Health

Plan (HDHP)

60% of non-network

services were covered

after deductible.

80% of up to $300 in allowed charges for professional services

will be covered per visit, for a maximum benefit of $240*.

Stanford HealthCare

Alliance (SHCA)

Did not cover nonnetwork services.

80% of up to $300 in allowed charges for professional services

will be covered per visit, for a maximum benefit of $240*.

For all other services, 60% of allowed charges will be covered.

For all other services, 60% of allowed charges will be covered.

* Example, if bill charge is $350, 80% of $300 will be covered. 80% x $300 = $240.

Faculty Staff Help Center

Stanford’s Faculty Staff Help Center provides up to

10 sessions of professional, confidential, short-term

counseling and consultation services free of charge to

Stanford employees, retirees and their dependents.

You can learn more about the service at

http://helpcenter.stanford.edu.

FACULTY STAFF HELP

CENTER HAS MOVED!

The Faculty Staff Help Center’s main office

has relocated from the Mariposa House to

the Keck Science Building (380 Roth Way).

benefits.stanford.edu | 2015 Faculty Benefits Summary

13

Dental Plans

Dr. Kari C. Nadeau

Associate Professor of Pediatrics,

Allergy & Immunology,

School of Medicine

Good dental care can affect your overall health and wellness. In addition

to coverage for basic and major services, Stanford’s coverage includes

diagnostic and preventive checkups and cleanings.

Stanford offers comprehensive dental benefits through Delta Dental’s network of dentists with two plans:

Delta Dental Basic PPO

Delta Dental Enhanced PPO

Stanford covers the entire cost of this plan for

full-time employees. The Basic PPO plan does

not include orthodontic treatment and coverage

for implants.

This plan requires an employee contribution

but provides a higher level of coverage for some

services when you use Delta Dental PPO providers.

The Enhanced PPO plan includes orthodontic

treatment and coverage for implants.

Note: If you waive dental coverage at any time, you will not be able to enroll in a dental plan for two years

unless you have a Life Event change.

You may view more details about Stanford’s dental coverage in the comparison chart located at the back

of this Faculty Benefits Summary or visit the Benefits website at http://benefits.stanford.edu.

14

2015 Faculty Benefits Summary | benefits.stanford.edu

Vision Care

Abbas Milani

Hoover Institute Research Fellow and

The Hamid and Christina Moghadam

Director of Iranian Studies Department

Vision Service Provider (VSP) is an employee-based benefit that provides

vision care through its Signature Choice network of providers. For a

provider in your area, call VSP or go to the VSP website at http://vsp.com.

You can find VSP contact information in the Contacts section of the

Stanford Benefits website at http://benefits.stanford.edu.

VISION CARE

COVERAGE

COST WHEN USING

A VSP PROVIDER

Eye Exam

Once every calendar year

$25 copay

Lenses

Once every calendar year*

(includes basic and bifocals)

Plan pays 100%

Frames

Once every calendar year

Plan pays 100%

up to $150 retail value

Once every calendar year in lieu of

frames and lenses

Contact Lenses

Extras

• Medically necessary

Plan pays 100%

• Elective (fitting and materials)

Plan pays 100% up to $150

Including scratch-resistant lenses,

anti-reflective lenses, additional

prescription glasses or sunglasses

Discount through your

VSP provider

* $40 copay for progressive lenses

benefits.stanford.edu | 2015 Faculty Benefits Summary

15

Christian Linder

Assistant Professor of

Civil and Environmental

Engineering

Flexible Spending Accounts

Flexible Spending Accounts (FSA) allow you to set aside before-tax money to

pay for certain health care expenses including deductibles, copayments, certain

services not covered by your health plan and dependent day care expenses.

Here’s how they work: you authorize contributions

to be taken out of your paycheck before taxes are

calculated. You pay your provider and file a claim

for reimbursement. You then get reimbursed with

the before-tax dollars in your spending account.

Note: Whether you are newly electing an FSA or if

you had an FSA in 2014, Stanford’s vendor, Benesyst

(a TASC Company), will send you a debit MasterCard

for the 2015 year. The debit Visa card distributed

in 2014 will not be accepted effective January 1, 2015.

The debit MasterCard will have your 2015 FSA

election loaded on it and may only be used in the

plan year the expenses were incurred.

Two Types of Flexible

Spending Accounts

Health Care FSA

You may use this account to pay for medical and

dental copayments, deductibles, prescription

16

2015 Faculty Benefits Summary | benefits.stanford.edu

eyeglasses or contact lens expenses not covered by

VSP or your medical plan, orthodontia, and certain

over-the counter medications. The IRS limit for

the amount of pre-tax money that employees may

contribute to their health care FSA in 2015 is $2,500.

This spending account includes a debit card for

your convenience.

When you use your FSA debit card for eligible

expenses at a participating pharmacy or doctor,

the provider is immediately reimbursed the full

amount from your account. Please note that the

IRS requires proof of payment on some claims. Be

sure to save all itemized receipts when using your

FSA debit card.

You may be asked for a copy of your receipts to

prove your purchase (called substantiation).

You may also submit claims electronically, or by

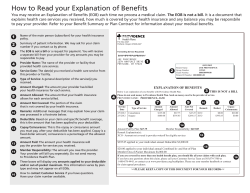

mail or fax. Please include an itemized receipt or

Explanation of Benefits with the claim form. Some

FLEXIBLE SPENDING ACCOUNTS

services may require a letter of medical necessity

to certify that the expense is necessary to treat a

medical condition.

When you elect a health care FSA, you may submit

expenses for yourself and your eligible dependents,

even if you are not covering your dependents under

your medical, dental or vision plans. If you increase

the amount of your health care spending account

during the calendar year due to a Life Event change,

the amount of the increase is effective as of the

date of the increase. The increased amount is not

retroactive and will not cover claims incurred prior

to the effective date of your increase.

Note: The debit card may only be used in the plan

year the expenses were incurred.

Dependent Day Care FSA

You may use this account to pay non-medical

day care expenses for your eligible dependent

children up to age 13, elder dependents and

disabled dependents. (You may only pay for your

dependents’ health care expenses through a health

care FSA.) The IRS limit for pre-tax contributions

to your dependent care FSA in 2015 is $5,000

per household. If you received a CCSG grant, the

amount will be included in your total dependent

care FSA annual amount. The combined total

cannot exceed the $5,000 annual limit. When

you file a claim for reimbursement, you can only

be reimbursed up to the amount that is in your

account at the time you submit a claim.

For more information on how these plans work and which expenses are eligible, visit the

Stanford Benefits website at http://benefits.stanford.edu, and click on the “Medical &

Life” section and then the “Flexible Spending Accounts” section.

NEW IN 2015: $500 CARRYOVER FOR HEALTH CARE FSA

An Internal Revenue Service (IRS) change to the health care Flexible Spending

Account (FSA) modifies the “use it or lose it” rule and allows participating active

employees to carry over up to $500 in unused funds from one year to the next.

Stanford University will be implementing the new carryover provision for 2015, which

means you will be able to defer up to $500 of unused funds from your 2014 health care

FSA into your 2015 health care FSA. (The $500 carryover is in addition to the $2,500

annual contribution limit for the 2015 year.) Any 2014 FSA monies over $500 will be

forfeited. The carryover funds may be accessed starting May 1, 2015, once all 2014 FSA

expenses have been reimbursed. For more information on the FSA carryover or for a

list of FAQs, visit the Stanford Benefits website at http://benefits.stanford.edu.

benefits.stanford.edu | 2015 Faculty Benefits Summary

17

Life and Accident Insurance

Basic Life Insurance

Stanford automatically provides insurance

coverage in an amount equal to your annual

appointment salary (up to a $50,000 maximum).

Supplemental Life Insurance

for Yourself

You may purchase additional coverage from one to

eight times your salary, up to a $1.5 million maximum.

Newly hired employees must complete an online

Evidence of Insurability (EOI) form for coverage

levels above three-times salary. For existing

employees, any increase in your coverage amount

requires EOI. You must be actively at work to apply

for or increase coverage.

Supplemental Life Insurance

for Your Spouse/Registered

Domestic Partner

You may purchase coverage up to 50 percent

of your total coverage (combined Basic and

Supplemental) or $250,000, whichever is less.

For newly hired employees, coverage more

than $25,000 requires your spouse or partner to

complete EOI. For existing employees, any increase

in this benefit requires EOI.

Supplemental Life Insurance for

Your Dependent Child(ren)

You may purchase coverage for your dependent

children in amounts of $5,000, $10,000 or $25,000

(up to 50 percent of your total coverage). One

policy covers each of your dependent children for

the same amount.

18

2015 Faculty Benefits Summary | benefits.stanford.edu

Accidental Death &

Dismemberment Insurance

(AD&D)

AD&D insurance provides protection to you or your

beneficiaries if you die or are seriously injured in an

accident. It does not cover a death resulting from

illness or natural causes. See the AD&D Insurance

Summary on the Stanford Benefits website at

http://benefits.stanford.edu for information on

how this plan works.

You may purchase AD&D insurance from one to

eight times your salary, up to $1.5 million. You

may also purchase AD&D insurance for your

spouse/registered domestic partner and/or

your dependent child(ren). The coverage levels

are similar to the Supplemental Dependent Life

Insurance plan. To enroll your dependents, you

must have coverage for yourself equal to or greater

than their coverage. You must be actively at work to

apply for or increase coverage.

Business Travel Accident Insurance

Stanford provides you with Business Travel

Accident Insurance in case you are accidentally

injured or die during an official university business

trip. Enrollment is automatic, and Stanford pays

the full cost of coverage.

EVIDENCE OF INSURABILITY

Depending on the amount of supplemental life

insurance you purchase, you may be required to

provide Evidence of Insurability (EOI), also known

as “proof of good health.” If the amount you request

requires EOI, you will be prompted to complete an

online EOI short form as part of the enrollment process.

Disability (Wage Replacement)

Voluntary Short-Term

(Non-Work Related)

Disability Insurance

Stanford automatically enrolls you in a shortterm disability plan, called Voluntary Disability

Insurance (VDI). The plan pays 60 percent of your

appointment salary, up to a certain maximum.

Generally, coverage begins on the eighth day of

your disability or on the first day of hospitalization.

You pay the cost of this coverage. You may choose

to reject automatic enrollment in Stanford’s VDI

plan and instead enroll in California State Disability

Insurance (SDI). You must complete a VDI Rejection

Notice and submit it to the Payroll Department.

You may always return to the VDI plan as long as

you complete an SDI Rejection Notice and submit

it to the Payroll Department. For more information

on SDI, visit California’s Employment Development

Department website.

Long-Term Disability (LTD)

As part of your benefits, Stanford provides LongTerm Disability (LTD) coverage that pays you a

monthly benefit if you meet the plan guidelines.

Enrollment is automatic, and Stanford pays the full

cost of coverage.

Once you qualify, the plan provides a benefit of

66 2/3 percent of your monthly appointment salary.

This amount may be reduced by payments you receive

from other sources, such as Workers’ Compensation or

Voluntary Short-Term Disability Insurance.

Long-Term Care (LTC) Insurance

LTC insurance is an optional, after-tax benefit that helps

pay many of the day-to-day expenses for nursing home

and in-home care not generally covered by medical or

disability plans. LTC insurance is provided through CNA.

NEW in 2015

In addition to enrollment and customer service, CNA

will take over direct billing for all long-term care

insurance coverage, starting in 2015. Those that were

enrolled in LTC insurance in 2014 will receive direct

billing information from CNA in late October. Please note

that Stanford’s last payroll deduction will be December

22; employees enrolled in LTC insurance coverage will

receive a direct bill from CNA in late January.

LTC insurance is available to you, your spouse/

registered domestic partner, parents, grandparents,

and the parents and grandparents of your spouse/

registered domestic partner. You must be actively

at work to apply for or increase coverage.

You can apply for coverage at any time, but if you apply

for yourself within the 31-day new hire enrollment

period, you do not have to complete Evidence of

Insurability (EOI) and coverage is guaranteed. If you apply

at a later time, you are required to complete EOI and

coverage is not guaranteed.

Your eligible dependents or family members may

also apply at any time, but must complete EOI and

coverage is not guaranteed.

You may find more information about disability

insurance and long-term care insurance on the

Stanford Benefits website at http://benefits.

stanford.edu under the “Medical & Life” section.

benefits.stanford.edu | 2015 Faculty Benefits Summary

19

Dr. Laurence C. Baker

Professor of Health Research and Policy;

Stanford Health Policy Fellow

Retirement Savings Plan

Participating in a retirement savings plan is one of the best things you can do

to save for your future.

• Start immediately: Start saving for

retirement after your first paycheck.

You decide how much you want

to contribute to the plan, and the

deduction is automatically taken out

of your paycheck.

• Maximize your dollars: Your contributions

come out of your paycheck before

federal and state taxes are taken out.

This reduces your taxable income, and

you pay less in taxes.

The Stanford Contributory Retirement Plan

(SCRP) offers a variety of investment options and

allows you to make before-tax contributions from

your paycheck directly to a savings account. At the

end of your first year of service, Stanford rewards

you with a Basic Contribution to a retirement

account based on your salary and years of service.

You receive this money from Stanford even if you

do not make contributions to the plan out of your

own paycheck. If you do decide to contribute

money toward your retirement out of your

20

2015 Faculty Benefits Summary | benefits.stanford.edu

paycheck, you become eligible for Stanford’s

Match Contribution—up to an additional five

percent of your earnings each pay period. Over

time, your contributions and Stanford’s Basic and

Match Contributions, may add up to significant

retirement savings.

You are always fully vested in both the contributions

you make and those you receive from Stanford.

Visit the Stanford Benefits website at

http://benefits.stanford.edu to learn more

about Stanford’s retirement savings plan and to:

• See the plan details in the Summary

Plan Description (SPD).

• Use the Before-Tax Calculator

to help you determine your

maximum contribution.

• Schedule a free financial counseling

appointment with a representative from

Fidelity, Vanguard or TIAA-CREF.

Commit to Your Health with BeWell@Stanford

The BeWell@Stanford employee incentive program encourages benefitseligible employees and their spouses/registered domestic partners to

adopt (or maintain) healthy lifestyle behaviors. By committing to health and

wellness, employees not only feel better, but also earn rewards!

In 2015, benefits-eligible employees can earn up

to $580 in a taxable incentive for completing The

Stanford Health and Lifestyle Assessment (SHALA)

and the following activities by November 30:

1. Wellness Profile ($480)*

This includes health screenings,

advising session, online plan and

advisor-endorsed action.

2. Six BeWell Berries ($100)

Berries are health-related activities that help

employees put wellness goals into action.

Choose from a variety of Berry options,

including exercise classes, fitness assessments,

stress workshops and self-reported activity.

* In addition to completing the steps above, BeWell

participants must also be enrolled in a Stanfordsponsored medical plan in 2015 and agree to share

their SHALA and health screening information in

order to receive the maximum employee incentive.

Participants who choose not to share information

nor enroll in a Stanford-sponsored medical plan are

still eligible to receive a $200 taxable incentive. Your Spouse or Partner Can

Benefit, Too!

A spouse or registered domestic partner of a BeWell

participant may earn a $240 taxable incentive if he or

she completes the SHALA and Wellness Profile, agrees

to share the results of these screenings and is enrolled

in a Stanford-sponsored medical plan. A spouse/

registered domestic partner is only eligible to receive

the incentive if the employee earns the incentive.

Other Rewards

In addition to monetary incentives, BeWell

participants also receive other rewards, including

access to free Stanford athletic and arts events

throughout the year.

Learn how to get healthy and earn rewards with

BeWell at http://bewell.stanford.edu.

WHY SHARE YOUR

INFORMATION?

Your SHALA and health screening information

is used to help you identify ways to improve

your health and/or manage any chronic

conditions you may have.

BeWell advisors will review the information

with you and may use your results to suggest

appropriate health promotion resources, both

on campus or with your medical plan. Your

medical plan also may use your information

for the purpose of health promotion and/or

disease management outreach.

Rest assured that BeWell and Stanford are

committed to protecting the privacy and

security of your health information.

benefits.stanford.edu | 2015 Faculty Benefits Summary

21

Tara Bryant

Hospital Technician,

Clinical Decision Unit

Fitness and Healthy Living Classes with

Health Improvement Program (HIP)

Did you know you have more than 250 fitness and health education classes

available to you each quarter through the Health Improvement Program

(HIP), part of the School of Medicine?

If you are a BeWell participant and have completed

your SHALA, you are eligible for two discounted $30

group fitness classes per quarter. Some of the group

fitness classes include cross-training, indoor cycling,

yoga, Pilates, tai chi, swimming, dance and more.

To find a class, register for a class or listen to a prerecorded webinar, visit http://hip.stanford.edu.

In addition, many of the Healthy Living classes are

eligible for STAP funds. You may find STAP-eligible

HIP programs on the searchable HIP schedule.

Examples include:

Through the Department of Athletics, Physical

Education and Recreation, you have access to a

variety of athletic, recreation and wellness facilities,

including two 75,000-square-foot sports and

recreation centers; a recreational pool; a driving

range; tennis courts; indoor climbing walls; playing

fields and a world-class aquatic center.

• Healthy Living: Nutrition and weight

management, stress management,

disease prevention and management,

and more.

• Behavior Change: Coaching and

counseling, weight management,

smoking cessation and more.

22

2015 Faculty Benefits Summary | benefits.stanford.edu

Physical Education, Recreation

and Wellness

With all of these facilities at your disposal, you have

lots of opportunity to find an activity that fits your

needs and interests and to get fit.

Find a class or activity that interests you at

http://recreation.stanford.edu.

Tuition Grant Program (TGP)

Stanford will assist with up to four years of undergraduate college tuition

costs at approved colleges and universities for eligible dependent children.

Faculty in a university appointment for six months or longer are eligible for

this benefit as soon as their appointment begins.

For the 2014–15 fiscal year, the maximum available

amount is $22,092 depending on employment

status, the amount of time worked (prorated if you

work less than 100 percent time) and tuition cost.

For more information on the TGP, call 877-905-2985

or 650-736-2985 (press option 5) or visit TGP at

http://hreap.stanford.edu.

Dan Elison Azagury

Assistant Professor of Surgery

(General Surgery), Stanford University

Medical Center, wife Tatiana Maratchi

along with son Leo and daughter Olivia

benefits.stanford.edu | 2015 Faculty Benefits Summary

23

Stanford WorkLife Office

Stanford provides an array of programs and services to assist you with child

care, elder care and living-well resources. Information about on-site child

care and community resources is available. Financial assistance is available

to eligible employees for child care expenses, adoption, and emergency and

back-up child or elder care. Elder care resources are offered for both local and

long-distance care giving.

Child Care Subsidy Grant

Program (CCSG)

Stanford provides up to $5,000 per year in taxfree grants for eligible child care expenses. Grant

amounts are based on the applicant’s (and their

spouse/registered domestic partner’s) adjusted

gross income and the number of eligible children

age nine or younger.

Faculty Child Care Assistance

Program (FCCAP)

Stanford provides a salary supplement to eligible

faculty to offset qualified child care expenses.

Award levels are based on an applicant’s (and their

spouse/registered domestic partner’s) household

adjusted gross family income. Awards range from

$5,000 to $20,000.

Junior Faculty Dependent Care

Travel Grant Program

Junior faculty can receive a taxable grant of up

to $1,000 for qualified dependent care expenses

incurred when traveling to attend professional

meetings, conferences, workshops and professional

development opportunities, or to conduct approved

research or scholarship.

Adoption Assistance

Stanford reimburses eligible adoption expenses up

to $10,000 per adoption, with a maximum lifetime

benefit of $20,000 per family.

Emergency and Back-Up

Dependent Care

Stanford offers help with child/elder care if a

regular caregiver is ill or on vacation, or if a child/

elder is mildly ill and is in need of temporary care.

The Back-Up Care Advantage (BUCA) Program is

for faculty and provides both in-home dependent

care from credentialed in-home care agencies and

trained caregivers as well as in-center care for a

small copay.

Eldercare

The WorkLife Office supports family caregiving

through a partnership with Avenidas to provide

resources, referrals and monthly Caregivers’

Seminars. For Stanford faculty, Avenidas offers free

and discounted consultations with a social worker.

Additional information on these programs and others is available on the WorkLife website

at http://worklife.stanford.edu, or by calling 650-723-2660.

24

2015 Faculty Benefits Summary | benefits.stanford.edu

Unemployment Insurance

All employees have unemployment insurance coverage for qualifying periods

of unemployment. Stanford pays the full cost of coverage.

Workers’ Compensation

Workers’ Compensation provides benefits for a work-related illness or injury.

Stanford continues to pay your base salary for the first five working days after

a work-related accident, and then Workers’ Compensation payments start.

Pre-Designation of Personal Physician

In the event you sustain an injury or illness related

to your employment, you may be treated for such

injury or illness by your personal medical doctor

(M.D.), doctor of osteopathic medicine (D.O.) or

medical group if:

• Your employer offers group

health coverage;

• The doctor is your regular physician,

who shall be either a physician who has

limited his or her practice of medicine

to general practice or who is a boardcertified or board-eligible internist,

pediatrician, obstetrician-gynecologist

or family practitioner, or has previously

directed your medical treatment, and

retains your medical records;

• Your “personal physician” may be a

medical group if it is a single corporation

or partnership composed of licensed

doctors of medicine or osteopathy, which

operated an integrated multispecialty

medical group providing comprehensive

medical services predominately for nonoccupational illnesses and injuries;

• Prior to the injury, your doctor agrees to

treat you for work injuries or illnesses;

• Prior to the injury, you provided your

employer the following in writing:

1. Notice that you want your personal

doctor to treat you for a workrelated injury or illness, and

2. Your personal doctor’s name and

business address.

Visit the Risk Management website at http://stanford.edu/dept/risk-management

for more information.

benefits.stanford.edu | 2015 Faculty Benefits Summary

25

Other Resources and Services

Stanford Coordinated Care

Stanford Coordinated Care (SCC) is a team of

medical professionals and care coordinators who

help people with chronic illnesses lead a healthy

life and smoothly navigate their health care

experiences. SCC can help you manage chronic

health conditions, coordinate your medical care—

no matter how many specialists you see—

and provide you with care at our clinic or

collaborate with your primary care provider. Visit

http://stanfordhealthcare.org/medical-clinics/

coordinated-care.html, or call 650-724-1800.

Direct Deposit/

Withholding Information

Learn how to sign up for direct deposit of your

Stanford paycheck at the Axess website at

http://axess.stanford.edu.

News and Information

The Stanford Report includes daily news and

events at Stanford and is sent to all employees

electronically. View past issues of The Stanford

Report, at http://news.stanford.edu/sr/. Stanford

employees also receive The Stanford Employee

Insider, a quarterly digital newsletter featuring

employment-related news and updates produced

by University Human Resources. View past issues

and subscribe to the newsletter at http://uhr.

stanford.edu/stanford-insider. SLAC employees

also receive SLAC Today via email.

Stanford Events

For information on lectures, concerts, athletic events,

exhibits and much more, sign up for Stanford for You,

a free monthly e-newsletter about fun, affordable

events on campus. Register for Stanford for You at

http://foryou.stanford.edu.

26

2015 Faculty Benefits Summary | benefits.stanford.edu

Parking &

Transportation Services

Stanford supports many commuter programs

including free transit on CalTrain and VTA. For

information about the programs, mass transit,

ride-sharing incentives and parking at Stanford,

visit the Parking & Transportation Services website

at http://transportation.stanford.edu, or call

650-723-9362.

Note: SLAC employees are not eligible for the

commuter program.

Housing Program

The University has several financial programs

designed to assist eligible faculty with the purchase

of a home. The University also provides to eligible

faculty long-term residential ground leases for oncampus housing, as well as rental housing on and

off the campus.

For information about housing programs and

eligibility, visit the Faculty Staff Housing website at

http://fsh.stanford.edu, or call 650-725-6893.

Faculty Information Resources

The University Faculty Handbook provides an overview of policies,

procedures and other information related to faculty appointments

at Stanford. To review the information or print a copy, go to

http://facultyhandbook.stanford.edu.

• For faculty policies, procedures,

forms and helpful links, go to

http://facultyaffairs.stanford.edu.

For questions, email facultyaffairs@

stanford.edu or call 650-723-3622.

• For policies specific to your school, go

to your school’s website or contact your

dean’s office at http://facultyaffairs.

stanford.edu/other_contacts.

• View the Research Policy Handbook at

http://rph.stanford.edu to learn about

the conduct of research at Stanford,

including the Faculty Policy on Conflict

of Commitment and Interest.

• The Global Operations Guide provides

practical and logistical information for

faculty and staff of regulatory issues that

are likely to be encountered by those

working internationally. To view the

guide, visit the Global Business Services

website at http://stanford.edu/group/

fms/globalops/guide.

• The Office of the Vice Provost for Faculty

Development & Diversity supports the

faculty through a variety of programs

and resources for new and pre-tenured

faculty in professional development,

and for department chairs and deans

in recruitment, retention and diversity.

For more information, visit

http://facultydevelopment.stanford.edu.

• The Office of Diversity & Access at

http://stanford.edu/dept/diversityaccess

may provide additional information.

benefits.stanford.edu | 2015 Faculty Benefits Summary

27

$20 copay primary/$50 copay

specialist

PENALTY for not pre-authorizing:

the services will be considered

not covered by the plan and the

member is responsible for the full

amount of the service.

Pre-authorization from your

primary care provider is required

for the following services:

Advanced Imaging (CT, MRI,

MRA and PET); all electively

scheduled inpatient admissions;

all elective outpatient procedures

(example- endoscopic procedures,

arthroscopic procedures,

epidural steroid injections, etc.);

physical therapy; durable medical

equipment; speech therapy.

There is no benefit if you see a

non-network provider, except for

emergency care or when clinically

appropriate and prior authorized

by Stanford HealthCare Alliance.

The Stanford HealthCare Alliance

ACO plan requires you designate

a primary care provider to

coordinate all of your care. You

may visit any Stanford HealthCare

Alliance network doctor or

hospital. Some services require

prior authorization from your

primary care physician.

Stanford HealthCare Alliance

ACO Plan - Group #976248

Benefits Plan Comparison Charts

Office copay

Pre-Authorization

Requirement

Overview

Benefit

Description

Network: $20 copay primary/$50

copay specialist

Non-Network: 60% after deductible

PENALTY for not pre-authorizing:

benefit reduced to 50% of Blue

Shield Allowed Amount. Maximum

reduction of $1,000. You pay

balance of all charges not covered

by Blue Shield. Out-of-Pocket

Maximum does not apply. Certain

benefits may be denied in full for

failure to pre-authorize.

PENALTY for not pre-authorizing:

benefit reduced to 50% of Blue

Shield Allowed Amount. You pay

balance of all charges not covered

by Blue Shield. Out-of-Pocket

Maximum does not apply.

$20 copay primary/$50 copay

specialist

Pre-authorization required for

all hospital stays and certain

outpatient procedures.

When you see a non-network

provider you are responsible for

the balance of your bill that is not

covered by Blue Shield. The Out-ofPocket Maximum does not apply to

the balance of the bill not covered

by Blue Shield.

When you see a non-network

provider you are responsible for

the balance of your bill that is not

covered by Blue Shield. The Out-ofPocket Maximum does not apply to

the balance of the bill not covered

by Blue Shield.

benefits.stanford.edu | 2015 Faculty Benefits Summary

$20 copay primary/$50 copay

specialist

PENALTY for not pre-authorizing:

not covered.

PENALTY for not pre-authorizing:

benefit reduced to 50% of Blue

Shield Allowed Amount. Maximum

reduction of $1,000. You pay

balance of all charges not covered

by Blue Shield. Out-of-Pocket

Maximum does not apply. Certain

may be denied in full for failure to

pre-authorize.

Network: 80% after deductible

Non-Network: 60% after deductible

Pre-authorization required for all

elective inpatient and outpatient

procedures.

28

You may use only Kaiser

Permanente doctors and facilities

except in emergencies.

Kaiser Permanente HMO (CA)

Group #7145 (Northern CA)

Group #230178 (Southern CA)

Pre-authorization required for

all hospital stays and certain

outpatient procedures.

This plan is compatible with an

individual Health Savings Account

(HSA), that you establish at a

financial institution of your choice.

You may visit any doctor or

hospital. You receive a higher

level of benefits when you use

Blue Shield PPO providers. You

are responsible for ensuring all

providers are in the network.

Blue Shield High Deductible

PPO Plan - Group #170293

You may visit any doctor or

hospital. You receive a higher

level of benefits when you use

Blue Shield PPO providers. You

are responsible for ensuring all

providers are in the network.

Blue Shield PPO Plan

Group #170292

Pre-authorization required for all

elective inpatient and outpatient

procedures.

There is no benefit if you see a

non-network provider, except for

emergency or urgent care.

For certain services or procedures

Blue Shield may require use of

certain providers within their

network.

You may visit any Blue Shield PPO

network doctor or hospital.

Blue Shield EPO Plan

Group #976109

2015 Benefits Plan Comparison Charts

Benefits Plan Comparison Charts

Prenatal Visits

100%

A single out-of-pocket maximum

applies to all coverage under

the plan, including medical and

prescription drugs. (This will

cover prescriptions and medical

expenses at 100% once the out-ofpocket maximum is met.)

A single out-of-pocket maximum

applies to all coverage under

the plan, including medical and

prescription drugs. (This will

cover prescriptions and medical

expenses at 100% once the out-ofpocket maximum is met.)

Maternity

$3,000 per individual

$6,000 per family

$3,000 per individual

$6,000 per family

Out-of-Pocket

Maximum

100%

100% after applicable copays

100% after applicable copays

Coinsurance

No deductible

Blue Shield EPO Plan

Group #976109

No deductible

Stanford HealthCare Alliance

ACO Plan - Group #976248

Deductible

Benefit

Description

Network: $20 copay (first visit)

Non-Network: 60% after deductible

A single out-of-pocket maximum

applies to all coverage under

the plan, including medical and

prescription drugs. (This will

cover prescriptions and medical

expenses at 100% once the out-ofpocket maximum is met.)

Non-Network:

$7,500 per individual

$15,000 per family

100%

29

A single out-of-pocket maximum

applies to all coverage under

the plan, including medical and

prescription drugs. (This will

cover prescriptions and medical

expenses at 100% once the out-ofpocket maximum is met.)

$1,500 per individual

$3,000 per family

100% after applicable copays

No deductible

Kaiser Permanente HMO (CA)

Group #7145 (Northern CA)

Group #230178 (Southern CA)

benefits.stanford.edu | 2015 Faculty Benefits Summary

Network: 80% after deductible

Non-Network: 60% after deductible

A single out-of-pocket maximum

applies to all coverage under

the plan, including medical and

prescription drugs. (This will

cover prescriptions and medical

expenses at 100% once the out-ofpocket maximum is met.)

Combined Network or

Non-Network

$3,500 per individual

$7,000 per family

Non-Network: 60% of allowed

charges after deductible, including

prescriptions

Non-Network: 60% of allowed

amount after deductible

Network:

$3,500 per individual

$7,000 per family

Network: 100% for preventive care;

80% after deductible for all other

services, including prescriptions

Network: 100% for preventive care

after applicable copays; 80% after

deductible for other services

The family deductible applies to

claims for all family members until

the deductible is met. There is no

individual limit for each covered

family member.

Combined network or non-network

Non-network: $1,000 per

individual/$3,000 family

The family deductible applies to

claims for all family members until

the deductible is met. There is no

individual limit for each covered

family member.

$1,500 per individual/$3,000 per

family

Blue Shield High Deductible

PPO Plan - Group #170293

Network: $500 per

individual/$1,500 per family

Blue Shield PPO Plan

Group #170292

Stanford HealthCare Alliance

ACO Plan - Group #976248

OUTPATIENT CARE

[no visit limit]

Network: $20 copay per visit

Non-Network: 80% of billed

charges (up to $300 maximum

allowed charges) for professional

services only.

* The maximum allowed amount

will not exceed $300 for each office

visit. For example, if the billed

charge is $350, the plan will pay

80% of {the lesser of $300 or the

billed charge} = 80% x $300 = $240.

OUTPATIENT CARE

[no visit limit]

Network: $20 copay per visit

Non-Network: 80% of billed

charges (up to $300 maximum

allowed charges) for professional

services only.

* The maximum allowed amount

will not exceed $300 for each office

visit. For example, if the billed

charge is $350, the plan will pay

80% of {the lesser of $300 or the

billed charge} = 80% x $300 = $240.

Network: $20 copay per visit

Non-Network: 80% of billed

charges (up to $300 maximum

allowed charges) for professional

services only.

* The maximum allowed amount

will not exceed $300 for each office

visit. For example, if the billed

charge is $350, the plan will pay

80% of {the lesser of $300 or the

billed charge} = 80% x $300 = $240.

Network: $20 copay per visit

Non-Network: 80% of billed

charges (up to $300 maximum

allowed charges) for professional

services only.

* The maximum allowed amount

will not exceed $300 for each office

visit. For example, if the billed

charge is $350, the plan will pay

80% of {the lesser of $300 or the

billed charge} = 80% x $300 = $240.

Pre-certification is required by you

or your provider.

INPATIENT CARE

$100 copay per admission

OUTPATIENT CARE

[no visit limit]

Network: $20 copay per visit

Non-Network: 80% of billed

charges (up to $300 maximum

allowed charges) for professional

services only.

The maximum allowed amount

will not exceed $300 for each office

visit. For example, if the billed

charge is $350, the plan will pay

80% of {the lesser of $300 or the

billed charge} = 80% x $300 = $240.

Pre-certification is required by you

or your provider.

INPATIENT CARE

$100 copay per admission

OUTPATIENT CARE

[no visit limit]

Network: $20 copay per visit

Non-Network: 80% of billed

charges (up to $300 maximum

allowed charges) for professional

services only.

The maximum allowed amount

will not exceed $300 for each office

visit. For example, if the billed

charge is $350, the plan will pay

80% of {the lesser of $300 or the

billed charge} = 80% x $300 = $240.

OUTPATIENT CARE

[no visit limit]

Network: $20 copay per visit

Non-Network: 80% of billed

charges (up to $300 maximum

allowed charges) for professional

services only.

The maximum allowed amount

will not exceed $300 for each office

visit. For example, if the billed

charge is $350, the plan will pay

80% of {the lesser of $300 or the

billed charge} = 80% x $300 = $240.

OUTPATIENT CARE

[no visit limit]

Network: $20 copay per visit

Non-Network: 80% of billed

charges (up to $300 maximum

allowed charges) for professional

services only.

The maximum allowed amount

will not exceed $300 for each office

visit. For example, if the billed

charge is $350, the plan will pay

80% of {the lesser of $300 or the

billed charge} = 80% x $300 = $240.

30

Transitional Residential Recovery

Services

$100 copay per admission

OUTPATIENT CARE

[no visit limit]

$20 copay per visit, individual

$5 copay per visit, group

INPATIENT DETOXIFICATION

$100 copay per admission

OUTPATIENT CARE

[no visit limit]

$20 copay per visit, individual

$10 copay per visit, group

INPATIENT CARE

$100 copay per admission

Kaiser Permanente must approve

mental health care.

Kaiser Permanente HMO (CA)

Group #7145 (Northern CA)

Group #230178 (Southern CA)

benefits.stanford.edu | 2015 Faculty Benefits Summary

INPATIENT CARE

Network: 80% after deductible

Non-Network: 60% after deductible

INPATIENT CARE

Network: 100% after deductible

Non-Network: 60% after deductible

Pre-certification is required by you

or your provider.

Non-Network: 80% of billed

charges

Non-Network: 60% of allowed

charges

OUTPATIENT CARE

[no visit limit]

OUTPATIENT CARE

[no visit limit]

Pre-certification is required by you

or your provider.

Network: 80% after deductible

INPATIENT CARE

$100 copay per admission

Network: 100% after deductible

Blue Shield must approve mental

health care.

INPATIENT CARE

$100 copay per admission

Blue Shield High Deductible

PPO Plan - Group #170293

INPATIENT CARE

Pre-Certification is required by you

or your provider.

Blue Shield PPO Plan

Group #170292

INPATIENT CARE

Pre-Certification is required by you

or your provider.

Blue Shield EPO Plan

Group #976109

Stanford HealthCare Alliance must

approve mental health care.

Benefits Plan Comparison Charts

Substance Abuse

Mental Health

Mental Health/Autism/Substance Abuse

Benefit

Description

100%

Home Health Care

Benefits Plan Comparison Charts

Office visit copayment, or

Emergency Room copayment,

depending on the facility.

Urgent Care

100%

Office visit copayment, or

Emergency Room copayment,

depending on the facility.

$100 copay (waived if admitted)

In-network providers only

In-network providers only

$100 copay (waived if admitted)

Up to 20 visits per year

Up to 20 visits per year

Emergency Room

$20 copay

$20 copay

Chiropractors

100% after $50 copay

100% after $50 copay

Office copay may apply.

Office copay may apply.

In-network providers only

In-network providers only

100%

Up to 20 visits per year

Up to 20 visits per year

100%

$20 copay

Blue Shield EPO Plan

Group #976109

$20 copay

Stanford HealthCare Alliance

ACO Plan - Group #976248

Ambulance

Charges

Allergy Tests

Acupuncture

Other Services

Benefit

Description

Lab/ancillary/professional charges

paid at 80% after deductible,

network or non-network

(copay waived if admitted)

Non-Network: 60% after deductible

Non-Network: 60% after deductible

[3 visits per day max]

31

Up to 100 two-hour visits/calendar

year

100%

$20 copay at Kaiser Permanente

facility

$100 copay (waived if admitted)

American Specialty Health (ASH)

Plans Participating Chiropractors

Up to 40 combined chiropractic

and acupuncture visits per year

$15 copay

100% after $50 copay

$20 copay

American Specialty Health (ASH)

Plans Participating Acupuncturists

Up to 40 combined chiropractic

and acupuncture visits per year

$15 copay

Kaiser Permanente HMO (CA)

Group #7145 (Northern CA)

Group #230178 (Southern CA)

benefits.stanford.edu | 2015 Faculty Benefits Summary

Network: 80% after deductible

Network: 80% after deductible

$50 copay; lab/other services 80%

after deductible, network or nonnetwork

Network or Non-Network: 80%

after deductible

Non-Network: 80% after deductible

Non-Network: $100 copay per visit

Lab/ancillary/professional charges

paid at 80% after deductible for

Network or Non-Network

Network: 80% after deductible

Up to 20 combined network and

non-network visits per year

Non-Network: 60% after deductible

Network: 80% after deductible

Network or Non-Network: 80%

after deductible (if medically

approved)

Non-Network: 60% after deductible

Network: 80% after deductible

Up to 20 combined Network and

Non-Network visits per year

Non-Network: 60% after deductible

Network: 80% after deductible

Blue Shield High Deductible

PPO Plan - Group #170293

Network: $100 copay per visit

Up to 20 combined network and

non-network visits per year

Non-Network: 60% after deductible

Network: 80% after deductible

Network or Non-Network: 80%

after deductible (if medically

approved)

Non-Network: 60% after deductible

Network: $50 copay