RETAIL BANKING Are banks prepared for a new turning point

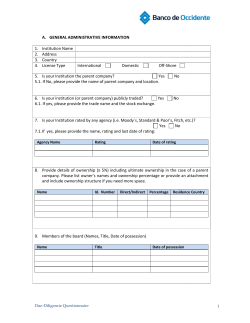

POINT OF VIEW BEHAVIOR CLIENT GY Are banks prepared for a new turning point in the retail banking landscape? OCTOBER 2014 RA P HI CS MY ONO MA C OG LO RETAIL BANKING EC TIT O R S EM L ESS MO RO ME NO NT PE DE BUS CO M RN T EC H GOVE IN MARKE T ROLE OF ING REGUL ATIO K N N BA SECTOR E TH LEGACY D RETAIL BANKING ARE BANKS PREPARED FOR A NEW TURNING POINT IN THE RETAIL BANKING LANDSCAPE? 2 ROL AND BERGER STRATEGY CONSULTANTS RETAIL BANKING ARE BANKS PREPARED FOR A NEW TURNING POINT IN THE RETAIL BANKING LANDSCAPE? Leveraging the Roland Berger Retail Banking Wheel®, our analyses point to the start of a new era in the retail banking landscape, driven by client behaviour and business model changes. Banks are continuously faced with the challenge of interpreting the reality in which they operate and envisioning an appropriate strategy and new positioning. In a vast universe of drivers and influences, this is a particularly complex exercise in which prioritization and focus turn out to be key. The Roland Berger Retail Banking Wheel®, a new and innovative methodology and tool, has been developed to facilitate this kind of exercise. The strategic focus of retail banks must continuously adjust over time Looking back on the past 25 years, many different factors and events have shaped the evolution of the retail banking landscape. Main examples are the repeal of the US Glass Steagall Act and the implementation of the EU Financial Services Action Plan in 1999, which spurred banks to focus on growth through new business models and geographical expansion. With the financial crisis in 2008, the focus shifted to compliance and management of legacy assets. Banks encounter difficulties to anticipate these key turning points, because at any point in time a large set of influencing factors are at work. Banks should hence be able to first identify all landscape-shaping factors and next assess them on their relevance and focus correctly on the most influencing and disruptive ones towards the future A . ROL AND BERGER STRATEGY CONSULTANTS 3 RETAIL BANKING ARE BANKS PREPARED FOR A NEW TURNING POINT IN THE RETAIL BANKING LANDSCAPE? A INFLUENCING FACTORS AND KEY EVENTS IN THE FINANCIAL SECTOR OVER THE LAST 25 YEARS 2015 ? What will be next Degree of influence 5 4 3 Regulation & legacy 2 1 2008 0 Financial crisis 5 4 Business model & market 3 2 1 1999 1. Glass Steagall act repealed 2. Financial services action plan 0 5 4 Technology 3 2 1 4 ROL AND BERGER STRATEGY CONSULTANTS Business model Legacy Role of the sector Competitors Market Government Macroeconomy Technology Banking regulation 0 = Low - 5 = High Demographics Launch www Client Behavior 1990 0 RETAIL BANKING ARE BANKS PREPARED FOR A NEW TURNING POINT IN THE RETAIL BANKING LANDSCAPE? The key question for banks today is whether we are approaching a new turning point, i.e. the start of a new phase in retail banking. If the answer to that question is yes, banks should ponder whether they are well prepared for this new environment. So, what is next on the horizon? Our intuition is that 2015 – 2016 will be looked back upon as a turning point in the retail banking history, which will have been driven by the factors client behavior and business model. We highlight two evolutions which can cause a fundamental change. First, there is an ongoing gradual and by many underestimated trend of disintermediation of banks in their core business: lending. There is a general belief that European corporate funding relies on an overall funding mix of 80% bank funding and 20% capital market funding. Indeed, this general principle did apply in Belgium before the crisis and it had been relatively stable for many years. However, our analysis showed that in a time frame of merely three years, the debt funding mix of Belgian corporates has shifted from 80/20 in 2010 towards 70/30 in 2013. If such trend continues, banks will need to redefine not only their credit activities, but more fundamentally their business model as a whole. Second, digitization has become the new normal. Internet penetration is over 80% and 70% of Belgians with an internet connection use it for online banking. Approximately 10% of Belgian banking clients are client at a direct bank without branch network. If we take the year 1995 as the introduction of mainstream internet, 50% of the population has witnessed the digital evolution from before the age of 21. The first generation to be in touch with internet before adulthood is now increasingly occupying influencing positions, both in the corporate world and beyond. Banks will feel the impact of massive digitization through all aspects of their business model. The most visible today is on the bank's distribution channel strategy. An important impact of massive digitization towards the future is that it stimulates more and more people to adapt their shopping behavior and compare prices as a natural reflex, also outside the financial world. This significantly reduces the traditional value of advice and relationship in the banking sales process. The bank-client relationship will also be put under further stress in the payments domain, where the increasing interconnection between telecom, credit card companies and banks will rephrase the question on the physical presence of money and the role of banks in the payments value chain. ROL AND BERGER STRATEGY CONSULTANTS 5 RETAIL BANKING ARE BANKS PREPARED FOR A NEW TURNING POINT IN THE RETAIL BANKING LANDSCAPE? THE ROLAND BERGER RETAIL BANKING WHEEL® HELPS NAVIGATE CHANGES IN STRATEGIC PRIORITIES The Retail Banking Wheel® is a methodology and a tool to stimulate strategic assent at executive level about the key drivers of the financial sector. It is linked to a two-day board-level workshop and backed up with extensive analysis and industry insights. A similar development is ongoing for the insurance industry. The added value of the Roland Berger Retail Banking Wheel® is twofold: 1. Providing a universe of strategy drivers 2. Incentivizing strategic focus The Retail Banking Wheel® aims at providing a structured and exhaustive view on the external and internal drivers to be taken into account in a strategy exercise. Due to its coherent structure, it's also a powerful way to standardize strategy making across countries or entities. The second added value of the Retail Banking Wheel® lies in its ability to create consensus on the strategic focus. Through its structure, CxO's are encouraged to reflect and prioritize factors with the highest relevance to their own, specific context. This is a crucial step in the strategy workshop. In order to accomplish this prioritization, two steps need to be taken. First, criteria to identify the relevance of influencing factors need to be determined. Next, the assessment of these criteria needs to be performed through discussion and the support of underlying analysis. The Retail Banking Wheel® is composed of four layers which influence a bank's strategy: SOCIETY: macro evolutions relevant to the financial sector, including client behavior, technological and demographical trends OPERATING ENVIRONMENT: factors shaping the world in which banks operate, including government, regulatory framework and the macro-economic trends BANKING SECTOR: sector-specific evolutions, including role of the sector in society, market dynamics and competitive trends INDIVIDUAL BANK: an internal bank-specific layer, including business model and legacy The figure below displays the full Roland Berger Retail Banking Wheel®, including its subcategories. The Wheel is accompanied with a document outlining what is meant with each factor mentioned on the wheel and examples of how these factors have influenced the direction of the financial sector in the past and analysis for the future. 6 ROL AND BERGER STRATEGY CONSULTANTS RETAIL BANKING ARE BANKS PREPARED FOR A NEW TURNING POINT IN THE RETAIL BANKING LANDSCAPE? CLIENT BEHAVIOR n Princin & Fee g parenc Transy tio Tax a Mobile M De arke fin t itio n A NI B R N U ATION Z POPULATIO H T W O R G G ERG EN BEH ERATIONAL AP H I AVIOR CS OMY ON GR MI IN GR MO AC M E AG INT RO EC Cu Ac r ren Ba coun t lan t ce DE y N s Bran che s Assets Revenue Streams Niche Banks Sh Ba adow nki ng Large Bank s F in Rep ancial ress ion vit Sav Quo ings te AT IO Consumer Protection n Reputatio Key Res our ces RO LE Fi Sta scal bil ity Proc Pow essing er Tax Bala Labor/ nce Capital DI R SEL EC F TI O N rag e cti INTERNATIONALIZATION AA I ON Sto IZAT MARKET Sector RE S TO R S M& nt Operating environment ETI ULE Unemployement Dispo Incom sable e Nu of P mber laye rs me Society E XIS TIN G L Inflation Competi Intensity tive Rate rest nt Inte ironme Env CTU ESS M xchange Stock E . Bear) (Bull vs TRU PropositValue ions Ch an ne ls E OD ta Solvency & Liquidity est Inv T Y AS MP LR SIN Profi GDP th Grow bility bt ion De osit P EN OG FR re Tier-2 Banks NM OL IN CA BU T ct Direnks Ba ER HN ty CO FIS ) ity tur th Ma Grow & mer Custo ents Segm er tom p Cusionshi at Rel G OV TEC Se ri cu ub (S w ds e N ran B IC ers W Nonnking Ba yers Pla on ol l ntr ncia o C na s F i sset A tructu Key hips Partners s itie tiv c yA Ke NE n Foreig Players Cost S old STST E M S Weight the Sec of tor ic Systemrt Suppo tedConnec ness E & mpl Rig oy hts ees n ve tio uti ensa c e Ex omp C M ATO Inte Local rnat vs. iona l reh APPLIC ATIONS Sovereign Strength LEGACY Sha cs Fi Ec nan o c & nom ing SM y E n utio trib Con Analyti R ECTO S HE FT Oof PE COL ER-T LAB O-P OR E E AT R IO N K R I S TUD E TI AT y nc ty lve idi So Liqu & In Co ter n op ati era on tio al n T REGULATIO A NK I NG N y lator Reguup Set- B T RU S Employer Attractiven es Y OG L NO N C H OPT IO E T D A Poli Syst tical em PR IC E N E S S IT I VI T Y R TOME CUS ALTY LOY Bank ROL AND BERGER STRATEGY CONSULTANTS 7 Conclusion Continuous change and adaptation is inherent to the financial sector. In a world with a vast universe of trends and influencing factors, successful retail banks correctly anticipate key turning points in the banking landscape and identify, prioritize and focus on the most important trends in society, the operating environment, the sector and the bank itself. In order to facilitate this complex task, Roland Berger developed the Retail Banking Wheel®, aimed at stimulating strategic assent at executive level about the key drivers of the financial sector. We believe that a new turning point is ahead of us for which many banks are ill prepared: the era of client behavior and business model changes. Publisher The authors welcome your questions, comments and suggestions ROLAND BERGER STRATEGY CONSULTANTS SA/NV Vorstlaan 100 boulevard du Souverain 100 B-1170 Brussels | Belgium +32 2 661 03 00 www.rolandberger.be Links & likes ORDER AND DOWNLOAD www.think-act.com STAY TUNED www.twitter.com/BergerNews LIKE AND SHARE www.facebook.com/RolandBergerStrategyConsultants Tablet version DOWNLOAD OUR KIOSK APP To read our latest editions on your tablet, search for "Roland Berger" in the iTunes App Store or at Google Play. Download the Kiosk App for free. BRUNO COLMANT Partner [email protected] GRÉGOIRE TONDREAU Partner [email protected] KASPER PETERS Principal [email protected] JOERI GUSSE Consultant [email protected] This publication has been prepared for general guidance only. The reader should not act according to any information provided in this publication without receiving specific professional advice. Roland Berger Strategy Consultants SA/NV shall not be liable for any damages resulting from any use of the information contained in the publication. © 2014 ROLAND BERGER STRATEGY CONSULTANTS NV/SA. ALL RIGHTS RESERVED.

© Copyright 2026