Commercial Bank Treasury & Financial Markets Daily Update 2014

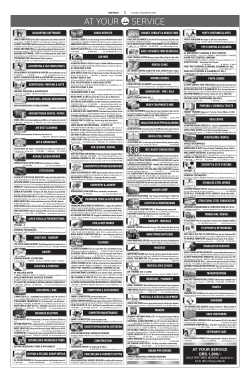

FX FX Rates (Mid) USD QAR USD - 3.64 EUR 1.282 4.669 JPY 106.14 0.034 GBP 1.598 5.819 CHF 0.941 3.868 AUD 0.879 3.200 INR 61.60 0.059 TRY 2.269 1.605 ZAR 11.07 0.329 BRL 2.458 1.482 QIBOR RATES Duration QIBOR Duration QIBOR Overnight 0.80 3 Months 1.10 1 Week 0.86 6 Months 1.27 1 Month 0.92 9 Months 1.40 2 Months 1.03 1 Year 1.52 US RATES US Rates Treasuries Libor Swaps 3M 0.01 0.23 - 6M 0.04 0.32 - 5Y 1.28 - 1.48 10Y 2.08 - 2.24 Index Level 1 Day % QE Index 13329 -1.35% Saudi Arabia (TASI) 9903 -2.69% UAE (ADX) 4880 -0.24% UAE (DFM) 4493 -1.73% Kuwait (KSE) 7542 -0.52% Oman (MSM) 7104 -0.88% Bahrain (BAX) 1461 0.13% Dow Jones 16142 -1.06% S&P 500 1862 -0.81% Nasdaq 4215 -0.28% FTSE 6212 -2.83% Euro Stoxx 50 2893 -3.61% Nikkei 14783 -1.93% Hang Seng 23016 -0.54% Nifty India 7858 -0.08% Borsa Istanbul 74856 0.23% Crude Oil 80.76 -1.25% Natural Gas 3.82 0.47% 1240 -0.13% GLOBAL MARKETS Indices GCC GLOBAL COMMODITIES Gold US ECONOMIC DATA Time 15:30 15:30 16:15 16:15 16:15 Event Initial Jobless Claims Continuing Claims Industrial Production MoM Capacity Utilization Manufacturing (SIC) Production Period Survey Prior Oct-11 290K 287K Oct-04 2380K 2381K Sep 0.40% -0.10% Sep 79.00% 78.80% Sep 0.30% -0.40% TOP NEWS US Treasuries surged, with benchmark 10-year yields falling the most since March 2009, as a decline in retail sales prompted traders to reduce wagers the Federal Reserve will raise interest rates in 2015. Rates on federal fund futures show the probability of a September rate increase fell to 30%, down from 46% yesterday and 67% two months ago, a Bloomberg News article reported. The benchmark 10-year yield traded below 2% at one point yesterday, for the first time since June 2013 even as the Fed is forecast to end its quantitative easing this month, before closing at 2.14% in New York close. Federal Reserve Chair Janet Yellen told a closed-door meeting over the weekend that the US economy was poised to grow about 3% going forward, with inflation set to rise toward the US central bank's target, Bloomberg News reported on Wednesday. Citing two people familiar with Yellen's comments, Bloomberg News said Yellen made the comments to the Group of 30. The United States on Wednesday renewed a warning that Europe risks falling into a downward spiral of falling wages and prices, saying recent actions by the European Central Bank may not be enough to ward off deflation. A second Texas nurse infected with Ebola alerted U.S. health officials to her elevated temperature before flying from Cleveland to Dallas on a commercial airline. The nurse’s movements after helping care for the first Ebola patient to die in the U.S. at Texas Health Presbyterian Hospital in Dallas increased the number of people potentially exposed to the virus in the country. Most stock markets in the Middle East continued to decline on Wednesday as global equities remained under pressure and disappointing quarterly earnings and forecasts weighed on bourses in Oman and Kuwait. While selling of Gulf stocks in previous days was fairly indiscriminate, many oil-related shares suffered most on Wednesday as the price of Brent crude slipped to a fresh 47-month low, before recovering slightly to around $85 a barrel. Lower oil prices are not a disaster for Gulf economies, which have little debt and large fiscal reserves that they can use to maintain government spending. But the prospect of smaller state oil revenues is having some impact on investor sentiment in the region, and pulling down stocks such as petrochemical producers - which benefit from a cost advantage over foreign rivals when global oil prices are high - and companies serving the drilling industry. The United Arab Emirates market regulator implemented measures in June to help ignite domestic debt sales. Since then not a single borrower has issued the bonds. To spur sales, the country needs to increase sovereign issuance to provide a benchmark for other borrowers and ensure institutional demand for the debt by reforming pension and insurance funds, according to Abdul Kadir Hussain, who oversees about $1.2 billion as chief executive officer of Mashreq Capital DIFC Ltd. Barwa Real Estate Company is planning to liquidate four of its local subsidiaries. The subsidiaries - Okaz Media, Barwa Technology, Lucair Real Estate and Knowledge Group - “have been dormant and not generating any revenue”, a company spokesman said. The decision to liquidate these entities was taken, following the board of directors’ resolution. Doha: Mannai Corporation disclosed the interim financial statements for the period ending September 30, 2014. The interim financial statements revealed a net profit of QR 377.8 million for the nine months period ended September 30, 2014 in comparison to a net profit of QR 290.2 million for the corresponding period last year. FX COMMENTARY The Dollar was sharply lower, its appeal deeply dented after poor U.S. data added to growth concerns that sent equities tumbling and Treasury yields plunging. Already on shaky ground after being buffeted by growth concerns over the past few sessions, a string of downbeat economic data including weak retail sales and manufacturing activity numbers dealt Wall Street a fresh blow overnight, sending the S&P 500 down by as much as 4.4 percent at one point. Safe-haven U.S. Treasuries rallied in response, with the poor data further diminishing prospects for an early rate hike by the Federal Reserve. The benchmark 10-year yield momentarily sliced below the 2 percent threshold to a 17-month trough. The Dollar fell to a five-week trough against the Yen and a threeweek low versus the Euro as yields slid. The greenback came off lows as Treasury yields partially retraced their decline, although bargain hunters were half-hearted in their bids. Against the Yen, which tends to benefit from risk aversion, the Dollar had inched up 0.1 percent to 106.04 after hitting the five-week low of 105.195. A slide in Tokyo stocks to a 4-1/2 month low boosted demand for safe-haven Yen and firmly capped the Dollar. The greenback has come hurtling down from a six-year high of 110.09 hit at the start of the month, when expectations of an early rate hike by the Federal Reserve were significantly stronger amid a rosier outlook for the U.S. economy. Factors including poor data, seemingly dovish views expressed at September's Fed policy meetings and worries of a slowing Euro Zone recovery weighing on the global economy have since curtailed such expectations. The Euro was little changed at $1.2827, staying within reach of a three-week high of $1.2835 hit overnight. The common currency, battered by prospects of the European Central Bank easing monetary policy further to stave off deflation in the Euro Zone, had stooped to a two-year low of $1.2500 earlier this month before the Dollar's fortunes took a turn for the worse. The Dollar index was down 0.3 percent at 84.88 after slipping to a three-week low of 84.472 overnight. The currency market will once again brace for U.S. data, such as September industrial output and weekly jobless claims due later in the session, and their impact on equities and Treasuries. Thursday, October 16, 2014 REGIONAL STOCK MARKETS % CHG Year to Date Yesterday 0.50 DUBAI EGYPT - DOHA (0.50) BAHRAIN SAUDI (1.00) ABU DHABI (1.50) MUSCAT JORDAN (2.00) LEBANON KUWAIT (2.50) (10.00) (3.00) - 10.00 20.00 30.00 40.00 6.0 5.0 4.0 3.0 2.0 1.0 0.0 -1.0 Spread to Bench QATAR 4 01/20/15 QATAR 3 1/8 01/20/17 QATAR 2.099 01/18/18 Sukuk QATAR 6.55 04/09/19 Today QATAR 5 QATDIA 5 QATAR 4 1/4 07/21/20 1/2 01/20/20 01/20/22 01/01/2014 QATAR 3.241 01/18/23 Sukuk QATAR 9 QATAR 6.4 QATAR 5 3/4 01/20/40 3/4 06/15/30 01/20/42 200 150 100 50 (50) (100) (150) Spread bps Yield % QSOV. USD YIELD CURVE CHART OF THE DAY Surging U.S. stock volatility has carried into the bond market -- a sequence that’s at odds with history, according to Pierre Lapointe, Pavilion Global Markets Ltd.’s head of global strategy and research. The CHART OF THE DAY tracks three indicators that Lapointe and a colleague, Alex Bellefleur, used to draw their conclusion in a report yesterday. Their gauge of stock-market swings was the Chicago Board Options Exchange Volatility Index, derived from prices paid for Standard & Poor’s 500 Index options. Pavilion’s strategists compared the VIX with bond and currency volatility gauges compiled by Bank of America Corp.’s Merrill Lynch unit and JPMorgan Chase & Co., respectively. The JPMorgan index tracks the Group of Seven industrial countries. Only the Merrill index, called the MOVE, had any kind of follow-through effect on the other two indicators since 2000, according to the report. The finding was based on statistical analysis of monthly data. “Bond volatility tends to react swiftly in uncertain times,” wrote Lapointe and Bellefleur, based in Montreal. Yet the MOVE was left behind this month by the VIX, which increased 74 percent from Oct. 8 through yesterday. The five-day jump was the biggest since August 2011. Yesterday, the MOVE played catch-up. The bond indicator, derived from prices of options on Treasury securities, climbed 36 percent to 101.28. The advance was the steepest in a single day since December 1989. Disclaimer: It is understood that any opinions expressed by CBQ or its affiliates as to the commentary, market information, and future direction of prices of specific securities reflects the views of the individual analyst who issued them, and not necessarily represent the views of CBQ or its affiliates in any way. In no event shall CBQ or its affiliates have any liability for any direct or indirect losses incurred in connection with any decision made, action or inaction taken by any party in reliance upon the information provided in this materials or for any delays, inaccuracies, errors in, or omissions of the said information Contact Cb Dealing Room: Telephone: +974 - 44202253, 44202259, 44202261 Email: [email protected] Thursday, October 16, 2014

© Copyright 2026