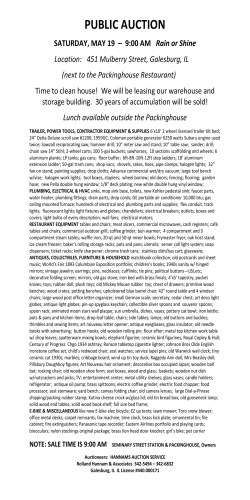

Document 350211