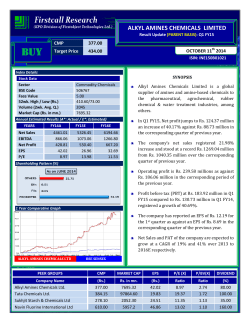

Market share gains continue; retain Buy

INDIA Hero MotoCorp Buy 17 October 2014 Strong brand franchise helps maintain market share gains QoQ: Dealer interaction revealed that brand franchise of Splendor and Passion models continued to be strong (driven by low maintenance and better resale value vs. peers) and Maestro in the scooter segment was also doing well. This was reflected in the company’s ability to raise HMCL’s market share in the domestic motorcycle segment to 52.1% compared to 51.8% in FY14 and 48.8% in 2QFY14. Valuation & Risks: We continue to like HMCL given its ability to retain market share and strong presence in the fast growing scooter segment and rural markets. We retain Buy with TP of Rs3,230 (based on 16x September 2016E EPS). Key downside risks are 1) Failure of new indigenous products launched by HMCL and 2) Higher than expected success of Discover models of Bajaj Auto. Y/E Mar (Rs mn) 2QFY15 2QFY14 YoY (%) 1QFY15 QoQ (%) 2QFY15E Var (%) 69,153 9,348 13.5 750 49 8,549 1,935 10,484 2,851 7,634 57,262 8,327 14.5 2,869 30 5,428 1,155 6,583 1,769 4,814 20.8 12.3 (102) bps 70,368 9,472 13.5 2,915 30 6,527 1,128 7,655 2,027 5,628 (1.7) (1.3) 6 bps 69,616 9,482 13.6 915 30 8,537 1,128 9,664 2,559 7,105 (0.7) (1.4) (10) bps (18.1) Net sales Operating profit OPM (%) Dep.& amortisation Interest EBT Other income PBT Provision for tax PAT (Adj.) 57.5 59.3 58.6 31.0 37.0 35.6 199.7 Previous Target Rs3,230 Diluted Shares O/S(mn) 199.7 Previous Rating Buy Mkt Cap (Rsbn/USDbn) Price Performance (%)* 558.9/9.1 52 Wk H / L (Rs) 3080/1907 3080/1187 1M 6M 1Yr 5 Year H / L (Rs) HMCL IN (1.1) 26.1 35.0 Daily Vol. (3M NSE Avg.) NIFTY (2.4) 14.8 28.8 481080 *as on 16 October 2014; Source: Bloomberg, Centrum Research Shareholding pattern (%)* Sept-14 Jun-14 Mar-14 Dec-13 Promoter 39.9 39.9 39.9 39.9 FIIs 34.3 34.3 30.8 30.6 8.4 7.7 8.0 8.5 17.3 18.1 21.3 21.0 Dom. Inst. Public & Others Source: BSE, *as on 16 October 2014 Trend in EBITDA and EBITDA margin 10.0 16 8.0 15 14 6.0 13 4.0 12 EBITDA ( RsBn) 2QFY15 1QFY15 4QFY14 3QFY14 2QFY14 1QFY14 10 4QFY13 11 - 3QFY13 2.0 EBITDA margin ( %, RHS) Source: Company, Centrum Research Centrum vs. Bloomberg Consensus* FY15E FY16E Particulars (Rs mn) Centrum BBG Var(%) Sales 290,144 285,369 1.7 332,864 324,739 2.5 EBITDA 40,942 39,446 3.8 48,340 47,587 1.6 PAT 30,017 27,741 8.2 37,430 34,204 9.4 BBG Var(%) Centrum *as on 19 October2 Bloomberg Consensus* BUY SELL HOLD Target Price (Rs) 33 6 20 2,857 Centrum Target Price (Rs) Variance (%) 3,230 13.1 *as on 16 October 2014; Source: Bloomberg, Centrum Research Estimates 0.1 71.6 8.5 7.4 Ajay Shethiya, [email protected]; 91 22 4215 9855 Source: Company, Centrum Research Y/E Mar (Rsmn) HMCL IN 16% Curr Shares O/S (mn) 2QFY13 HMCL’s cost saving plan continues: In 2QFY14, HMCL announced that it was looking at savings of Rs15bn by FY17-18E. This plan is on track with the company achieving savings of Rs600mn in 2QFY15. Further, it indicated that in FY15E, it can achieve savings of Rs3-3.25bn through this cost saving program. Cost saving initiatives covered logistics, raw material consolidation and e-bidding. Management target is to improve margins by 250-300bps by FY17-FY18E. Though this seems a tall order, it gives us confidence on the sustainability of current margins. Rs2,799 Bloomberg Code Upside 1QFY13 Results in-line: HMCL’s operating results were largely in line. Total income for the quarter was largely in line at Rs69.2bn (up 20.8% but down 1.7% QoQ) compared to our estimate of Rs69.6bn. EBITDA margin was also largely in line at 13.5% against estimate of 13.6%. It is encouraging to note that the company has been able to expand its gross margins on QoQ basis by 75bps despite slightly unfavourable product mix. Despite in-line operating performance, reported PAT stood at Rs7.6bn, higher by 7% vs. our estimate of Rs7.1bn due to higher than expected other income and lower depreciation charge. Rs3,230 Key Data CMP* 4QFY12 We retain Buy with a TP of Rs3,230. Operating results were largely in line with EBITDA margins at 13.5% vs. est. 13.6%. Despite weaker product mix, the company managed to expand gross margins by 75bps QoQ. Other positives were market share gains and grant of interim dividend. HMCL’s market share in the domestic motorcycle segment stood at 52.1% compared to 51.8% in FY14 and 48.8% in 2QFY14. The company also announced an interim dividend of Rs 30/share. Dealer interaction reveals that brand franchise of Splendor and Passion models continued to remain strong. Further, HMCL indicated that its ongoing margin transformation program can improve margins by 250-300bps by FY17-18E. Target Price 3QFY12 Market share gains continue; retain Buy 2QFY12 Result Update 1QFY12 Automobiles Revenue YoY (%) EBITDA EBITDA (%) Adj. PAT RoE (%) RoCE (%) PE (x) EV/EBITDA (x) FY13 237,681 0.8 32,845 13.8 21,182 YoY (%) Fully DEPS (Rs) (10.9) 106.1 45.6 45.8 26.4 15.9 FY14 252,755 6.3 35,401 14.0 21,091 (0.4) 105.6 39.8 39.8 26.5 14.6 FY15E 290,144 14.8 40,942 14.1 30,017 42.3 150.3 49.6 49.6 18.6 12.4 FY16E 332,864 14.7 48,340 14.5 37,430 24.7 187.4 53.1 53.0 14.9 10.3 FY17E 381,402 14.6 55,809 14.6 43,201 15.4 216.3 52.3 52.3 12.9 8.8 Source: Company, Centrum Research Estimates Centrum Equity Research is available on Bloomberg, Thomson Reuters and FactSet Valuation and Recommendations Exhibit 1: Sensitivity Analysis: FY15E % impact on EBITDA margin +20bps +70bps % change Sensitivity to key variables Sales Volumes Realization +1 +1 % impact on EPS +2.0 +7.0 Source: Company, Centrum Research Estimates Exhibit 2: Rolling forward EV/EBITDA chart Exhibit 3: Rolling forward P/E chart 13 12 11 10 9 8 7 6 20 16 12 EV/EBITDA Mean P/E Mean Mean + Std Dev Mean - Std Dev Mean + Std Dev Mean - Std Dev Source: Bloomberg, Company, Centrum Research Estimates Oct-14 Apr-14 Oct-13 Apr-13 Oct-12 Apr-12 Oct-11 Apr-11 Oct-10 Apr-10 Oct-14 Apr-14 Oct-13 Apr-13 Oct-12 Apr-12 Oct-11 Apr-11 Oct-10 Apr-10 8 Source: Bloomberg, Company, Centrum Research Estimates Exhibit 4: Comparative Valuations CAGR FY14-FY16E (%) EBITDA Margin (%) PE (x) EV/EBITDA (x) RoE (%) Div Yield (%) Mkt Cap (Rs bn) Rev. EBITDA PAT FY14 FY15E FY16E FY14 Hero MotoCorp 558.9 14.8 16.9 33.2 14.0 14.1 14.5 26.5 18.6 14.9 14.6 12.4 10.3 39.8 49.6 53.1 2.3 3.2 4.0 Bajaj Auto 683.9 13.5 7.8 11.4 21.8 20.2 19.6 20.5 18.9 16.8 13.6 12.6 11.0 38.1 34.4 32.8 2.1 2.3 2.6 Company FY15E FY16E FY14 FY15E FY16E FY14 FY15E FY16E FY14 FY15E FY16E Source: Companies, Centrum Research Estimates 2 Hero MotoCorp Quarterly financials, Operating Metrics and Key Performance Indicators Exhibit 5: Quarterly Financials Y/E March (Rs mn) 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 4QFY14 1QFY15 2QFY15 Net Sales 61,876 61,458 61,595 57,262 68,768 65,130 70,368 69,153 Raw Materials 45,854 44,395 44,556 40,955 49,989 46,798 51,112 49,708 Employee Costs 1,982 2,259 2,215 2,290 2,439 2,357 2,678 2,850 Other Expenditure 6,253 6,306 5,672 5,690 7,360 7,033 7,107 7,248 EBITDA 7,787 8,498 9,152 8,327 8,980 8,942 9,472 9,348 Depreciation 2,832 2,655 2,744 2,869 2,732 2,728 2,915 750 30 31 30 30 30 29 30 49 Interest Other Income 901 1,045 1,123 1,155 957 1,230 1,128 1,935 5,826 6,857 7,502 6,583 7,174 7,414 7,655 10,484 Tax 947 1,115 2,016 1,769 1,928 1,870 2,027 2,851 Tax rate (%) 16.3 16.3 26.9 26.9 26.9 25.2 26.5 27.2 4,879 5,742 5,486 4,814 5,247 5,544 5,628 7,634 PBT Reported PAT YoY Growth (%) Revenue 2.6 1.8 (1.4) 10.4 11.1 6.0 14.2 20.8 EBITDA (17.4) (8.2) (2.3) 15.8 15.3 5.2 3.5 12.3 PAT (20.4) (4.9) (10.9) 9.3 7.5 (3.4) 2.6 58.6 12.6 13.8 14.9 14.5 13.1 13.7 13.5 13.5 7.9 9.3 8.9 8.4 7.6 8.5 8.0 11.0 15,73,135 15,27,351 15,59,282 14,16,211 1,680,940 15,89,462 17,15,254 16,92,523 Average Realizations (Rs/Vehicle) 39,333 40,238 39,502 40,433 40,910 40,976 41,025 40,858 Raw material costs (Rs/Vehicle) 29,148 29,067 28,575 28,919 29,739 29,443 29,798 29,369 Other Expenditure (Rs/Vehicle) 3,975 4,128 3,638 4,018 4,379 4,425 4,143 4,282 Employee costs (Rs/vehicle) 1,260 1,479 1,421 1,617 1,451 1,483 1,561 1,684 EBITDA (Rs/Vehicle) 4,950 5,564 5,869 5,880 5,342 5,626 5,522 5,523 Margin (%) EBITDA PAT Key Drivers Total volumes ( in units) Per Vehicles basis (Rs.) Source: Company, Centrum Research Exhibit 6: Key Assumptions Volumes ( in Units) Motorcycle Scooters Total YoY Change (%) Motorcycle Scooters Total FY13 FY14 FY15E FY16E FY17E 5,501,247 574,336 6,075,583 5,538,291 707,604 6,245,895 6,185,201 854,382 7,039,583 6,888,924 1,025,259 7,914,183 7,675,678 1,230,311 8,905,989 (4.3) 18.3 (2.6) 0.7 23.2 2.8 11.7 20.7 12.7 11.4 20.0 12.4 11.4 20.0 12.5 Source: Company, Centrum Research 3 Hero MotoCorp Financials Exhibit 7: Income Statement Y/E March (Rs mn) Sales Volume % Growth Net Sales Raw Materials % of sales Personnel % of sales Manufact. & Other Exp. % of sales EBITDA EBITDA Margin (%) Depreciation and Amortisation EBIT Interest Expenses PBT from operations Other Income PBT Tax-Total Tax Rate (%) - Total Reported PAT Adjusted PAT Exhibit 9: Balance Sheet FY13 FY14 FY15E FY16E FY17E 6,075,583 6,245,895 7,039,583 7,914,183 8,905,989 (2.6) 2.8 12.7 12.4 12.5 237,681 252,755 290,144 332,864 381,402 175,035 183,288 209,678 240,443 275,987 73.6 72.5 72.3 72.2 72.4 8,209 9,300 10,416 11,666 13,066 3.5 3.7 3.6 3.5 3.4 21,592 24,766 29,107 32,415 36,541 9.1 9.8 10.0 9.7 9.6 32,845 35,401 40,942 48,340 55,809 13.8 14.0 14.1 14.5 14.6 11,418 11,074 5,008 3,308 3,808 21,427 119 21,308 3,984 25,292 4,110 16.3 21,182 21,182 24,327 118 24,209 4,464 28,673 7,582 26.4 21,091 21,091 35,934 94 35,840 4,999 40,840 10,823 26.5 30,017 30,017 45,032 107 44,925 5,999 50,925 13,495 26.5 37,430 37,430 52,001 123 51,878 6,899 58,777 15,576 26.5 43,201 43,201 Source: Company, Centrum Research Estimates Exhibit 8: Key Ratios Y/E March Growth ratios (%) Net sales & operating other income EBITDA Adjusted Nt Profit Profitability Metrics (%) EBITDA Margin EBIT Margin PAT Margin Return Ratio (%) ROE ROcE ROIC Turnover Ratio days (days) Inventory Period Debtors Period Net working capital Solvency Ratio Debt-equity (x) Net Debt-equity (x) Liquidity ratio (x) Interest coverage ratio (%) Dividend Dividend per share Dividend Payout (%) Dividend Yield (%) Per share (Rs) Basic ( end point) EPS - reported Basic ( end point) EPS - adjusted FDEPS - Reported FDEPS - Adjusted CEPS Book value Valuation (x) P/E P/BV EV/EBITDA EV/Sales Market Cap / Sales FY13 FY14 FY15E FY16E FY17E 0.8 (9.2) (10.9) 6.3 7.8 (0.4) 14.8 15.7 42.3 14.7 18.1 24.7 14.6 15.4 15.4 13.8 9.1 9.0 14.0 9.7 8.4 14.1 12.5 10.4 14.5 13.6 11.3 14.6 13.7 11.4 45.6 45.8 126.6 39.8 39.8 130.5 49.6 49.6 169.3 53.1 53.0 154.2 52.3 52.3 138.2 9.1 9.5 (21.5) 9.0 12.4 (24.1) 8.0 8.0 (28.5) 8.0 8.0 (30.3) 8.0 8.0 (30.6) 0.0 (76) 0.5 179.9 0.4 (75) 0.5 205.8 0.4 (81) 0.6 383.2 0.3 (80) 0.6 420.5 0.3 (79) 0.6 423.5 60.0 56.6 2.1 65.0 61.5 2.3 90.2 60.0 3.2 112.5 60.0 4.0 129.8 60.0 4.6 106 106 106 106 163 251 106 106 106 106 161 280 150 150 150 150 175 325 187 187 187 187 204 381 216 216 216 216 235 446 26.4 11.2 15.9 2.2 2.4 26.5 10.0 14.6 2.1 2.2 18.6 8.6 12.4 1.8 1.9 14.9 7.3 10.3 1.5 1.7 12.9 6.3 8.8 1.3 1.5 Y/E March (Rs mn) Sources of Funds Capital Reserves & Surplus Shareholders’ Funds Def. pay creditsTax Liab. Secured Loans Unsecured Loans Total Loan Funds Deferred Tax Liabi. - Net Total Application of Funds Gross Block Accumulated Dep. Capital WIP Net Fixed Assets Investments Inventories Sundry Debtors Cash & Bank Balances Loans and Advances Tot. Curr. Assets, Loans & Adv. Current Liab. Provisions Total Current Liab. & Prov. Net Current Assets Total assets FY13 FY14 FY15E FY16E FY17E 399 49,663 50,062 3,022 3,022 1,324 54,408 399 55,599 55,999 245 245 (1,060) 55,183 399 64,545 64,945 245 245 (1,060) 64,129 399 75,701 76,100 245 245 (1,060) 75,285 399 88,576 88,975 245 245 (1,060) 88,160 66,851 (36,141) 621 31,331 36,238 6,368 6,650 1,810 14,020 22,480 27,610 14,399 42,008 (19,529) 54,408 69,089 (46,657) 8,541 30,974 40,888 6,696 9,206 1,175 10,976 21,356 28,787 15,943 44,730 (23,373) 55,183 86,089 (51,665) 500 34,925 42,888 6,725 6,725 10,255 12,470 29,450 28,787 21,071 49,858 (20,408) 64,129 98,089 (54,972) 500 43,617 47,888 7,715 7,715 13,025 14,306 35,046 32,706 26,275 58,981 (23,935) 75,285 110,089 (58,780) 500 51,809 52,888 8,840 8,840 17,239 16,392 42,471 37,521 30,326 67,847 (25,377) 88,160 FY13 FY14 FY15E FY16E FY17E 25,292 (4,869) 11,418 (3,927) 388 (3,263) (4,198) 3,498 (1,086) (8,588) 28,673 (9,966) 11,074 (2,556) (328) 3,044 1,243 1,545 (66) 2,882 40,840 (10,823) 5,008 2,481 (29) (1,494) 2,720 5,128 (2,720) 6,085 50,925 (13,495) 3,308 (990) (990) (1,836) 3,341 5,203 578 5,307 58,777 (15,576) 3,808 (1,125) (1,125) (2,086) 3,796 4,052 1,019 4,531 16,160 29,641 41,110 46,044 51,541 (4,505) 3,404 (10,717) (4,649) (8,959) (2,000) (12,000) (5,000) (12,000) (5,000) (17,000) Source: Company, Centrum Research Estimates Exhibit 10: Cash Flow Y/E March (Rs mn) Pre-tax profit Total tax paid Depreciation Chg in debtors Chg in inventory Chg in loans & advances Chg in creditors Chg in provisions Chg in other current liabilities Net chg in working capital Cash flow from operating activities (a) Capital expenditure Chg in marketable securities Cash flow from investing activities (b) Dividend (incl. tax) Cash flow from financing activities (c) Net chg in cash (a+b+c) (1,100) (15,366) (10,959) (17,000) (14,018) (15,186) (21,071) (26,275) (30,326) (14,018) (14,941) (21,071) (26,275) (30,326) 1,042 (667) 9,080 2,770 4,214 Source: Company, Centrum Research Estimates Source: Company, Centrum Research Estimates 4 Hero MotoCorp Appendix A Disclaimer Centrum Broking Limited (“Centrum”) is a full-service, Stock Broking Company and a member of The Stock Exchange, Mumbai (BSE) and National Stock Exchange of India Ltd. (NSE). Our holding company, Centrum Capital Ltd, is an investment banker and an underwriter of securities. As a group Centrum has Investment Banking, Advisory and other business relationships with a significant percentage of the companies covered by our Research Group. Our research professionals provide important inputs into the Group's Investment Banking and other business selection processes. Recipients of this report should assume that our Group is seeking or may seek or will seek Investment Banking, advisory, project finance or other businesses and may receive commission, brokerage, fees or other compensation from the company or companies that are the subject of this material/report. Our Company and Group companies and their officers, directors and employees, including the analysts and others involved in the preparation or issuance of this material and their dependants, may on the date of this report or from, time to time have "long" or "short" positions in, act as principal in, and buy or sell the securities or derivatives thereof of companies mentioned herein. Centrum or its affiliates do not own 1% or more in the equity of this company Our sales people, dealers, traders and other professionals may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary to the opinions expressed herein, and our proprietary trading and investing businesses may make investment decisions that are inconsistent with the recommendations expressed herein. We may have earlier issued or may issue in future reports on the companies covered herein with recommendations/ information inconsistent or different those made in this report. In reviewing this document, you should be aware that any or all of the foregoing, among other things, may give rise to or potential conflicts of interest. We and our Group may rely on information barriers, such as "Chinese Walls" to control the flow of information contained in one or more areas within us, or other areas, units, groups or affiliates of Centrum. Centrum or its affiliates do not make a market in the security of the company for which this report or any report was written. Further, Centrum or its affiliates did not make a market in the subject company’s securities at the time that the research report was published. This report is for information purposes only and this document/material should not be construed as an offer to sell or the solicitation of an offer to buy, purchase or subscribe to any securities, and neither this document nor anything contained herein shall form the basis of or be relied upon in connection with any contract or commitment whatsoever. This document does not solicit any action based on the material contained herein. It is for the general information of the clients of Centrum. Though disseminated to clients simultaneously, not all clients may receive this report at the same time. Centrum will not treat recipients as clients by virtue of their receiving this report. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Similarly, this document does not have regard to the specific investment objectives, financial situation/circumstances and the particular needs of any specific person who may receive this document. The securities discussed in this report may not be suitable for all investors. The securities described herein may not be eligible for sale in all jurisdictions or to all categories of investors. The countries in which the companies mentioned in this report are organized may have restrictions on investments, voting rights or dealings in securities by nationals of other countries. The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives. Persons who may receive this document should consider and independently evaluate whether it is suitable for his/ her/their particular circumstances and, if necessary, seek professional/financial advice. Any such person shall be responsible for conducting his/her/their own investigation and analysis of the information contained or referred to in this document and of evaluating the merits and risks involved in the securities forming the subject matter of this document. The projections and forecasts described in this report were based upon a number of estimates and assumptions and are inherently subject to significant uncertainties and contingencies. Projections and forecasts are necessarily speculative in nature, and it can be expected that one or more of the estimates on which the projections and forecasts were based will not materialize or will vary significantly from actual results, and such variances will likely increase over time. All projections and forecasts described in this report have been prepared solely by the authors of this report independently of the Company. These projections and forecasts were not prepared with a view toward compliance with published guidelines or generally accepted accounting principles. No independent accountants have expressed an opinion or any other form of assurance on these projections or forecasts. You should not regard the inclusion of the projections and forecasts described herein as a representation or warranty by or on behalf of the Company, Centrum, the authors of this report or any other person that these projections or forecasts or their underlying assumptions will be achieved. For these reasons, you should only consider the projections and forecasts described in this report after carefully evaluating all of the information in this report, including the assumptions underlying such projections and forecasts. The price and value of the investments referred to in this document/material and the income from them may go down as well as up, and investors may realize losses on any investments. Past performance is not a guide for future performance. Future returns are not guaranteed and a loss of original capital may occur. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice. Centrum does not provide tax advice to its clients, and all investors are strongly advised to consult regarding any potential investment. Centrum and its affiliates accept no liabilities for any loss or damage of any kind arising out of the use of this report. Foreign currencies denominated securities are subject to fluctuations in exchange rates that could have an adverse effect on the value or price of or income derived from the investment. In addition, investors in securities such as ADRs, the value of which are influenced by foreign currencies effectively assume currency risk. Certain transactions including those involving futures, options, and other derivatives as well as non-investment-grade securities give rise to substantial risk and are not suitable for all investors. Please ensure that you have read and understood the current risk disclosure documents before entering into any derivative transactions. This report/document has been prepared by Centrum, based upon information available to the public and sources, believed to be reliable. No representation or warranty, express or implied is made that it is accurate or complete. Centrum has reviewed the report and, in so far as it includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed. The opinions expressed in this document/material are subject to change without notice and have no obligation to tell you when opinions or information in this report change. This report or recommendations or information contained herein do/does not constitute or purport to constitute investment advice in publicly accessible media and should not be reproduced, transmitted or published by the recipient. The report is for the use and consumption of the recipient only. This publication may not be distributed to the public used by the public media without the express written consent of Centrum. This report or any portion hereof may not be printed, sold or distributed without the written consent of Centrum. The distribution of this document in other jurisdictions may be restricted by law, and persons into whose possession this document comes should inform themselves about, and observe, any such restrictions. Neither Centrum nor its directors, employees, agents or representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. This document does not constitute an offer or invitation to subscribe for or purchase or deal in any securities and neither this document nor anything contained herein shall form the basis of any contract or commitment whatsoever. This document is strictly confidential and is being furnished to you solely for your information, may not be distributed to the press or other media and may not be reproduced or redistributed to any other person. The distribution of this report in other jurisdictions may be restricted by law and persons into whose possession this report comes should inform themselves 5 Hero MotoCorp about, and observe any such restrictions. By accepting this report, you agree to be bound by the fore going limitations. No representation is made that this report is accurate or complete. The opinions and projections expressed herein are entirely those of the author and are given as part of the normal research activity of Centrum Broking and are given as of this date and are subject to change without notice. Any opinion estimate or projection herein constitutes a view as of the date of this report and there can be no assurance that future results or events will be consistent with any such opinions, estimate or projection. This document has not been prepared by or in conjunction with or on behalf of or at the instigation of, or by arrangement with the company or any of its directors or any other person. Information in this document must not be relied upon as having been authorized or approved by the company or its directors or any other person. Any opinions and projections contained herein are entirely those of the authors. None of the company or its directors or any other person accepts any liability whatsoever for any loss arising from any use of this document or its contents or otherwise arising in connection therewith. Centrum and its affiliates have not managed or co-managed a public offering for the subject company in the preceding twelve months. Centrum and affiliates have not received compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for service in respect of public offerings, corporate finance, debt restructuring, investment banking or other advisory services in a merger/acquisition or some other sort of specific transaction. As per the declarations given by them, Mr. Ajay Shethiya, research analyst and and/or any of his family members do not serve as an officer, director or any way connected to the company/companies mentioned in this report. Further, as declared by him, he has not received any compensation from the above companies in the preceding twelve months. He does not hold any shares by him or through his relatives or in case if holds the shares then will not to do any transactions in the said scrip for 30 days from the date of release such report. Our entire research professionals are our employees and are paid a salary. They do not have any other material conflict of interest of the research analyst or member of which the research analyst knows of has reason to know at the time of publication of the research report or at the time of the public appearance. While we would endeavour to update the information herein on a reasonable basis, Centrum, its associated companies, their directors and employees are under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent Centrum from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or Centrum policies, in circumstances where Centrum is acting in an advisory capacity to this company, or any certain other circumstances. This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject Centrum Broking Limited or its group companies to any registration or licensing requirement within such jurisdiction. Specifically, this document does not constitute an offer to or solicitation to any U.S. person for the purchase or sale of any financial instrument or as an official confirmation of any transaction to any U.S. person unless otherwise stated, this message should not be construed as official confirmation of any transaction. No part of this document may be distributed in Canada or used by private customers in United Kingdom. The information contained herein is not intended for publication or distribution or circulation in any manner whatsoever and any unauthorized reading, dissemination, distribution or copying of this communication is prohibited unless otherwise expressly authorized. Please ensure that you have read “Risk Disclosure Document for Capital Market and Derivatives Segments” as prescribed by Securities and Exchange Board of India before investing in Indian Securities Market. Rating Criteria Rating Buy Hold Sell Market cap < Rs20bn Upside > 25% Upside between -25% to +25% Downside > 25% Market cap > Rs20bn but < 100bn Upside > 20% Upside between -20% to +20% Downside > 20% Market cap > Rs100bn Upside > 15% Upside between -15% to +15% Downside > 15% Member (NSE, BSE, MCX-SX), Depository Participant (CDSL) and SEBI registered Portfolio Manager Registration Nos. CAPITAL MARKET SEBI REGN. NO.: BSE: INB011454239, NSE: INB231454233 DERIVATIVES SEBI REGN. NO.: NSE: INF231454233 (TRADING & SELF CLEARING MEMBER) CDSL DP ID: 12200. SEBI REGISTRATION NO.: IN-DP-CDSL-661-2012 PMS REGISTRATION NO.: INP000004383 MCX – SX (Currency Derivative segment) REGN. NO.: INE261454230 Website: www.centrum.co.in Investor Grievance Email ID: [email protected] Compliance Officer Details: Tel: (022) 4215 9413; Email ID: [email protected] Centrum Broking Limited Registered Office Address Bombay Mutual Building , Correspondence Address Centrum House 2nd Floor, Dr. D. N. Road, Fort, Mumbai - 400 001 6th Floor, CST Road, Near Vidya Nagari Marg, Kalina, Santacruz (E), Mumbai 400 098. 6 Tel: (022) 4215 9000 Hero MotoCorp

© Copyright 2026