THE PATENT BOX - TIPS & PREDICTIONS New Seminar

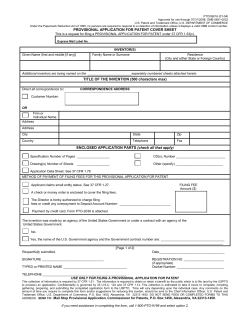

Organised by Management Forum UK – experts in the field since 1983 New Seminar THE PATENT BOX TIPS & PREDICTIONS We have deferred this seminar from the original date in early September due to the impending publication of a number of reports by the OECD on the BEPS action plan which are due to be released in late September,including an update on discussions around 'substance' requirements for IP regimes. This seminar will provide you with the most recent information, which will be ‘hot off the press’. Issues to be addressed during this meeting will include: 5.5 CPD HOURS n n n n Practical tips Experiences so far Accessing the Regime Future prospects Chairman: Gwilym Roberts - Partner, Kilburn & Strode Speakers: JOIN US ON David Harris - Senior Policy Adviser Patent Box, HMRC Philip Leyshon - Senior Associate, Taylor Wessing LLP Laura Mair - Executive Director, International Tax Services, EY Victoria Pickering - Senior Tax Manager, International Tax Services, EY Chris Thornham - Partner, Taylor Wessing LLP Tim Worden - Partner, Taylor Wessing LLP Register online at www.management-forum.co.uk or by phone on +44 (0)1483 730071, fax 730008 22 October 2014 The Rembrandt Hotel, London WHY YOU SHOULD ATTEND • • • • • The Patent Box regime has bedded in – is it working? Big companies are obtaining major savings on tax through the regime – are you? The EU has asked questions about the legal validity of the regime – where might this end? Ensure you’re adopting the best practice Ensure you’re future proofing your IP tax measures WHO SHOULD ATTEND • • • • • • • • Chief Financial Officers Finance Directors Financial Controllers Accountants IP Solicitors IP Managers In house legal officers Patent Attorneys ATTENDANCE LIMITED - EARLY REGISTRATION RECOMMENDED This limitation, a unique feature of all MANAGEMENT FORUM seminars, will give participants the opportunity for a thorough discussion of the complex issues to be covered by the programme. DOCUMENTATION Delegates will receive a course material folder containing comprehensive documentation provided by the speakers, which will be a valuable source of reference for the future. ACCREDITATION This course merits 5.5 hours under the UK Solicitors Regulation Authority self-accreditation scheme. Ref. CJA/MAFO Reserve your place at the seminar by registering online now at www.management-forum.co.uk or by fax +44 (0)1483 730008 Any questions? e-mail [email protected] A Certificate of Attendance for Professional Development will be given to each participant who completes the course CHAIRMAN Gwilym Roberts is a European patent attorney and a partner at Kilburn & Strode in London. He is involved in patent drafting, prosecution and contentious work principally in the field of IT and communications technology and has experience of working with a number of multinational bulk filing companies. He is a member of the CIPA Patents Committee and author of “A Practical Guide to Drafting Patents” published by Sweet & Maxwell. SPEAKERS David Harris is a Senior Policy Adviser at HMRC with responsibility for the patent box regime. David joined HMRC (then IR) in 1994 after completing a PhD in physics, and has held a number of posts, mainly in tax policy - most recently, Departmental Growth Champion. Before that, David had responsibility for film tax relief, R&D relief and the venture capital schemes, including introducing film tax relief in 2006 and large company R&D relief in 2002. Philip Leyshon is an Associate in the Corporate Technology group of Taylor Wessing LLP in the London Office. He advises technology-rich companies on a wide range of corporate issues, including mergers and acquisitions, corporate finance and investment transactions, corporate restructurings and advising on the corporate aspects of the implementation of tax structuring projects, inward investments and UK set-up. Laura Mair is an Executive Director in the International Tax Services group of EY in London, providing tax consultancy services to a wide range of UK and foreign-based multinational companies. She joined EY in 2000 and has been advising on international tax matters for more than 12 years. Laura has built up a wide range of experience advising UK listed companies and UK inbound groups in many industries including consumer products, pharmaceuticals and technology. Laura provides advice to clients in relation to their IP strategies including advice related to optimal holding locations, key people functions and managing interaction with tax authorities. Victoria Pickering is a Director in EY’s International Tax Services team and is a member of the firm’s core patent box team. Victoria joined EY in 2005 and has been involved in advising organisations from a wide range of sectors on how the Patent Box could apply to them and fit in with their wider IP strategy, with a specialism in the lifesciences and biotech industries. Victoria has experience of agreeing the practical application of the patent box to clients’ facts with HMRC. Chris Thornham is a Partner at Taylor Wessing LLP and is based in their London office. Chris acts for clients on patent matters across the full range of technologies. Chris has acted in over twenty English patent trials and appeals. Chris also works with patent attorneys and overseas lawyers on coordinated multi-jurisdictional disputes in Europe, the US and elsewhere. Chris is a regular invited speaker on patent issues at international conferences and he writes regularly for intellectual property publications. Tim Worden is a Partner in Taylor Wessing LLP’s intellectual property department, and is based in the firm’s Cambridge office. He specialises in transactional, non-contentious and regulatory intellectual property in the life sciences and technology sectors. Tim was previously Legal Counsel and Company Secretary at Eli Lilly and Company Limited, the UK subsidiary of the US pharmaceutical company. 09.30 u Programme INTRODUCTION Since the inception of the Patent Box tax regime, major companies have been using it to obtain significant tax savings in relation to innovation-related profits. We’ve now had some time to see how the system has settled in and can assess its effectiveness. Is the system just for the big players or are SME’s missing a trick? And what does the future hold in light of the review of IP regimes undertaken by the EU code of conduct group and the wider BEPS project. Gwilym Roberts - Kilburn & Strode 09.45 u ACCESSING THE REGIME AND UNDERSTANDING THE TAX EFFECTS We provide a review of the current regime, qualifying criteria and potential impact on the tax payable by qualifying companies, plus a comparison with systems in other countries. • Overview of the qualifying criteria for the UK regime • Worked examples of tax benefits • Compare and contrast with other regimes Laura Mair and Victoria Pickering – EY 11.15 u Coffee 11.30 u USING THE REGIME – LEGAL ISSUES AND EXAMPLES 13.00 u Lunch We discuss, with examples, Patent Box legal issues that can arise: • Transfers & Licences: terms/requirements to comply with Patent Box • What is meant by an “exclusive licence” for Patent Box purposes? • Regularising corporate IP arrangements to benefit from Patent Box • Corporate restructuring • Resolution of disputes: possible “win-win” outcomes for licensors and licensees Tim Worden, Philip Leyshon & Chris Thornham – Taylor Wessing LLP 14.00 u THE UK PATENT BOX AS PART OF THE IP STRATEGY OF MULTINATIONALS • Trends in global IP strategy and migration opportunities • Interaction of the UK Patent Box with other UK IP legislation and incentives Laura Mair and Victoria Pickering – EY 15.00 Tea u 15.15 u INTERNATIONAL DEVELOPMENTS RELATING TO BEPS AND FUTURE PROSPECTS OF THE UK PATENT BOX REGIME The team are joined by David Harris from HMRC who will provide the government perspective on recent developments, followed by a Q&A session. • HMRC view on the Patent Box and sustainability • Overview of BEPS project and interaction with EU code of conduct review • Government/HMRC perspectives on BEPS and Harmful Tax Practices • Future prospects of the Patent Box regime Panel Discussion 17.00 End of Meeting u THE PATENT BOX - TIPS & PREDICTIONS W 22 October 2014, Conf. No H10-7014 tion to Applicaister Reg Please PRINT your details: Title .................. First Name........................................... (Dr, Mr, Mrs, etc) Family name ................................................................... Position ........................................................................... Department..................................................................... Company ........................................................................ Company VAT No. .......................................................... Address .......................................................................... ........................................................................................ City ................................ Post Code ............................. Country........................................................................... Dates 22 October 2014 Start: 09.30 – Finish: 17.00 Registra tion Informati on Registration & Coffee 22 October 2014 09.00 Venue and Accommodation The Rembrandt Hotel, 11 Thurloe Place, London SW7 2RS Hotel Tel: +44(0)20 7589 8100. Hotel Fax:+44(0)20 7225 3476. Email: [email protected] Subject to availability, a limited number of bedrooms have been reserved at the hotel at a special rate. All bookings should be made directly with the hotel or online at www.sarova.com/rembrandt, quoting promo code ‘manforum’. Directions Fax No............................................................................. Opposite V&A Museum. Nearest underground station: South Kensington. www.sarova-rembrandthotel.com/location-local-attractions E-mail ............................................................................. Fee Tel No. ............................................................................. Secretary’s Name ........................................................... Payment by either: VISA MASTERCARD AMEX Card No. £598 + VAT if applicable. The fee includes course documentation as well as mid-session refreshments and lunch. Invoice and confirmation will be forwarded to you. Conference No. H10-7014 Discounted Rates Card Security No. Available on application for personnel from non-profit making organisations and registered charities. Group discount available on request AMEX Cancellation Policy: Expiry date........../......... Cheque enclosed payable to Management Forum Limited Bank transfer on receipt of invoice ß +44 (0) 1483 730008 Management Forum Ltd To Reg i ster www.management-forum.co.uk E-mail: [email protected] If you have NOT received confirmation seven days after registering, please contact Registration Department. Over 14 days prior to the Seminar: Cancellation fee of £75. 7/14 days prior to the Seminar: 50% of the fee. Fewer than 7 days or if no notification received: Registrant liable to pay FULL seminar fee. NB: Cancellations must be received in writing by [email protected] Management Forum reserves the right to cancel/ alter the programme, the speakers, the date or venue. If an event is cancelled Management Forum is not responsible for airfare, hotel or other costs incurred by registered delegates. For Promotional Opportunities email: [email protected] If you do not want to receive future mailings from Management Forum please contact [email protected] If you do not wish to receive selected third party mailings please contact [email protected] MANAGEMENT FORUM LTD, 98-100 Maybury Road, Woking, Surrey GU21 5JL, UK Tel: +44 (0)1483 730071 Fax: +44 (0)1483 730008 Website: www.management-forum.co.uk

© Copyright 2026