re News Prime time in Canada

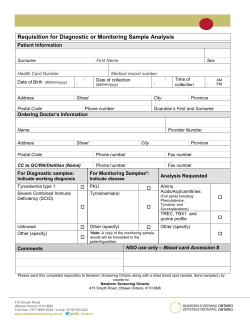

www.res-americas.com re News A Full Service Land Company serving North America www.elexco.com CANADA SPECIAL REPORT 2014 Trouble coming at the top League leader Ontario expects yearly growth volumes to plummet in the second half of the decade. Full table on planned installations to 2018 Wind farm construction in full bloom Manufacturers face up to a shrinking market New partner to help deliver 300MW Nigig • • • • PAGE 3 Quebec’s American dream Export potential keeps hopes alive as developers wait on policy reassurance from new regime. Pedals to metal as December deadline looms Lowdown on region’s project pipeline Utility delays starting pistol for 450MW call • • • PAGE Prime time in Canada 8 Alberta on comeback trail Province bounces off record low but wind sector faces increasingly challenging market conditions. Financing solutions getting more creative What’s shaping up out to 2018 Grid hurdles force developer rethink • • • PAGE 11 East coast engine sputtering Pace slows in Atlantic provinces as grid saturation and declining energy demand bite ambitions. New Brunswick leaves wind out in cold Tower manufacturer aiming for US expansion • • PAGE 13 Nova Scotia on high ground Utility-led charge on wind projects pushing region closer to realising renewable energy targets. Full run-through of projects in the mix Big appetite for bite-size sites • • PAGE 15 BC waits for wind to turn Developers banking on anticipated energy demand from new heavy industries to restore activity levels. Pattern to escape build-out paralysis Large projects shape up for future power calls • • PAGE 17 Central-west shutters down Saskatchewan and Manitoba halting wind energy procurements for the foreseeable future. Far north hunting expedition • PAGE 19 Scaling the heights: the Little River wind farm in Nova Scotia Photo: Scotian WindFields C anada is set for another record-breaker this year with at least 1.7GW of new capacity due online following the 1.6GW added in 2013, writes Patti Lane. The outlook beyond the next four years appears less rosy, however. Construction is set to drop off sharply for league leaders Ontario and Quebec while some regions face a full stop. Issues frustrating developers include policy uncertainty, grid queues, flat demand and financing. See page 2 CANADA’S GATEWAY TO THE WEST T » Best choice for project cargo » Liebherr LHM 320 mobile harbour crane » Minimize handling, time and cost » Extensive staging area and storage » Direct rail access by CN and CP to Western Canada » Intermodal Yard Thunder Bay Port Authority 100 Main Street Thunder Bay, ON P7B 6R9 T (807) 345-6400 F (807) 345-9058 www.portofthunderbay.ca 2 canada focus reNews 23 October 2014 The good times roll on Activity lifts nation to fifth in world wind rankings but uncertainty looms CANADA Across the line: Blackspring Ridge in Alberta Photo: Enbridge New wind installations to 2018 Due online 2014 Province T he Canadian wind energy sector is on pace for another strong year with at least 1.7GW of new installations following the record-breaking 1.6GW energised in 2013. Frantic activity has lifted the nation to fifth in global installed capacity rankings with a total 9.5GW to be online by year-end. “It’s an exceptionally busy time,” said Canadian Wind Energy Association president Robert Hornung. Annual installations will average between 1GW and 1.5GW over the next four years, driven by strong progress in Ontario and Quebec. The provinces accounted for 70% of growth this year and will add substantially more out to 2018. Developers, manufacturers and other stakeholders foresee continued expansion over the next four years but future opportunities have yet to emerge. Turbine manufacturers including Enercon, GE, Senvion, Siemens and Vestas continue to beef up local manufacturing capabilities and supply chains to meet domestic content requirements and demand. Ontario has introduced a competitive procurement regime after cancelling the feed-in tariff scheme that awarded 3GW of wind contracts. The province expects to sign 600MW of contracts in 2015 and 2016. Quebec is kicking off a 450MW call for wind projects that should come online in 2016 and 2017. However, Hornung asked: “Looking forward, once we get past the contracts that are already in place and being built, what does the future hold?” Electricity demand in much of Canada has yet to recover from the 2009 global recession. In Ontario, the government is mulling refurbishment of its nuclear power plants that could MW ALBERTA 352 BRITISH COLUMBIA 99 NOVA SCOTIA 55.57 ONTARIO 802.85 QUEBEC 438.5 PRINCE EDWARD ISLAND 30 TOTAL: 1778MW Slated for 2015 ALBERTA 318 NOVA SCOTIA 215.23 ONTARIO 1418.55 QUEBEC 493.6 SASKATCHEWAN 43 TOTAL: 2488MW Coming in 2016 ALBERTA 1160 BRITISH COLUMBIA 185 NOVA SCOTIA 24.19 ONTARIO 373.45 QUEBEC 150 SASKATCHEWAN 177 TOTAL: 2070MW Starting up in 2017 ALBERTA 518 ONTARIO 200 SASKATCHEWAN 10 TOTAL: 728MW On horizon for 2018 ALBERTA 328 ONTARIO 300 QUEBEC 200 TOTAL: 828MW create new opportunities for wind and other sources. Quebec is reshaping its long-term energy strategy and expects to unveil new policies in late 2015. Alberta’s deregulated market poses challenges for financing wind. Development has dwindled and is now driven by alternative off-take agreements and partnerships, such as Swedish furniture giant IKEA’s deal to buy Mainstream Renewable Power’s 46MW Oldman 2 project. Although Alberta is one of the only provinces experiencing strong growth in electricity demand, current arrangements will likely result in a build out of natural gas rather than renewables. Wind developers continue to stake out positions in British Columbia in anticipation of supplying power to dozens of planned liquefied natural gas plants, oil and gas extraction projects and mines. However, the provincial government has yet to outline a role for wind in the anticipated industrial expansion. “Political decisions need to be made now to ensure we have a continuous wind industry by the end of 2017,” said Senvion chief executive for North America Helmut Herold. The federal government under Conservative Prime Minister Stephen Harper has taken a hands-off approach, allowing each province to set www.reNews.biz its own energy policies. Canada is heading into an election year in 2015 and the parties have yet to adopt positions on climate change and clean energy. The Liberal and NDP opposition parties are likely to be more proactive on climate change and more interested in renewables. However, it remains to be seen if this will translate into action at the federal level. In the meantime, the wind industry is waiting for electricity markets to rebound. “We’re optimistic,” said Hornung. “We’re confident that when new opportunities emerge people will look to wind to help address those challenges and the sector will be well positioned to take advantage.” canada focus 3 23 October 2014 reNews Trouble at the top Installations leader Ontario braces for chill as demand for clean energy flags O ntario remains at the top of Canada’s leader board with total wind energy capacity of almost 3GW but yearly growth volumes are set to plummet in the second half of the decade. The industry expects to complete a pipeline of more than 2GW of contracted projects over the next two years and reach 5GW of total capacity by end-2016. The province accounted for a quarter of Canada’s new construction in 2013 with installations of some 440MW. This year, it is on track to build a record 800MW. Beyond the next two years, however, the market looks set On the rise: construction at Suncor’s Adelaide wind farm Photo: Suncor to drop off dramatically, said Senvion chief executive for North America Helmut Herold. “It’s clear it will be challenging,” he said. “The volumes were 1GW a year, now they will come down to 300MW a year.” Ontario has replaced the feed-in tariff regime that awarded more than 3GW of contracts with a competitive renewable procurement process to award 600MW by 2016. Clean energy remains a cornerstone of policy in the province, which shuttered its last coal-fired plant this year, but demand has flatlined. Ontario’s industrial base has also still not fully recovered from the 2009 recession and the Independent 4 Players set sights on 300MW prize Ontario is developing a request for proposals under the 540MW large renewable procurement scheme that will include 300MW of wind energy. Dozens of developers replied to a request for qualifications and Ontario Power Authority is set to reveal winners on 4 November. The utility is also consulting on an RFP framework ahead of a call expected in January 2015. “We’re optimistic we will see contracts awarded for 300MW by August next year,” said CanWEA Ontario regional director Brandy Giannetta. Under the draft, developers have four years to build projects after finalising power purchase agreements. Players advancing schemes include Samsung, GDF Suez, Mainstream, Innergex, Boralex, Capstone and NextEra. Wind covers 4% to 5% of Ontario’s power demand and the province is expected to update its long-term energy plan every three years. “Wind is well positioned to provide up to 15% by 2031,” said Giannetta. Seeing is believing Galion Lidar, pioneering a change in wind energy. Real world measurements to protect your investment. We understand wind energy. galionlidar.com Rotor diameters -4 -2 0 2 4 6 8 10 12 14 16 18 Offshore array wake measurements www.reNews.biz 4 canada focus Electricity System Operator forecasts a decline in demand for gridsupplied energy. At the same time, the flip side of the FiT’s success has been community pushback at the prospect of hundreds of new wind turbines in some areas. Almost every FiT project has been appealed and the permitting process has dragged out timelines. Consumers also blame renewable energy for driving up electricity bills. Wind power has become highly politicised, pitching rural residents against urban neighbours and Liberal supporters against Conservatives. As a result, developers will likely need to demonstrate some level of community support in the upcoming request for proposals. Wind energy advocates welcomed the re-election this spring of the Liberal party and Premier Kathleen Wynne, said CanWEA Ontario regional director Brandy Giannetta. “There is more political stability with a majority government that supports our industry and has a commitment to renewables development 3 and capacity,” she said. The government remains committed to a 7.7GW target of wind capacity, although the deadline has shifted from 2018 to 2021. It intends to hold procurements for “leftover megawatts” not realised in previous contracts. Any future commitments to wind will depend on a number of factors. Ontario has postponed plans to build new nuclear plants and intends to refurbish its nuclear fleet over the next 16 years, presenting potential for additional renewable development to plug the gap. One of Ontario’s major goals is to further integrate wind, which is now included as a dispatchable generation source, into the electricity system. The province has also placed a new emphasis on stored energy capacity to help promote system reliability. Contracts for 34MW of storage were awarded this year and the Ontario Power Authority intends to award another 15MW. The new capacity is intended to help defer transmission investments and enhance renewable generation. SAFE, RELIABLE, ECONOMICAL STORAGE SYSTEMS 1$2iDMDQFXRSNQ@FDRXRSDLRB@MOQNUHCDFQHC NVMDQR@MCNODQ@SNQRVHSGTMHPTDRNKTSHNMRSN SNC@XiRBNLOKDWFQHCBG@KKDMFDR 䘟 Deferral of grid upgrade 䘟 Outage mitigation 䘟 5NKS@FD×TBST@SHNMRTOONQS 䘟 /D@JHMFB@O@BHSX 䘟 %QDPTDMBXQDFTK@SHNM ONTARIO reNews 23 October 2014 End-2013 total Installed capacity 2490.5MW Due online 2014 MW Developer Oxley Project 6 Verhoeven South Branch 30 EDP Renewables South Kent 270 Samsung/Pattern Bluewater 60 NextEra Energy Canada HAF Vineland 9 IPC Energy McLean’s Mountain 60 Northland/Mnidoo Mnising Power Skyway 8 10 Capstone Infrastructure Adelaide 60 NextEra Energy Canada Bornish 73.5 NextEra Energy Canada Jericho 150 NextEra Energy Canada Ernestown 10 Horizon Wind Wainfleet 10 IPC Energy Adelaide 40 Suncor Energy Products Springwood 8.2 wpd Canada Whittington 6.15 wpd Canada TOTAL: 802.85MW Coming in 2015 Dufferin 91.4 Longyuan Canada Renewables Grand 149 Samsung/Pattern K2 270 Samsung/Pattern/Capital Armow 180 Samsung/Pattern Sumac Ridge 10.25 wpd Canada Napier 4.1 wpd Canada Fairview 16.4 wpd Canada White Pines 59.45 wpd Canada Conestogo 69 Invenergy Ostrander Point 22.5 Gilead Power Goulais 25 Capstone/Batchewana First Nation St. Columban 33 Veresen Grand Valley 3 40 Veresen Bow Lake 60 BluEarth Renewables/Batchewana FN Quixote One 2.35 Leader Resources Services Majestic 2 Sierra Nevada Power/Leader Resources Meyer 4 Sierra Nevada Power/Leader Resources Clarington 8.1 Sierra Nevada Power/Leader Resources Trout Creek 9 Sierra Nevada Power/Leader Resources Gunn’s Hill 18 Prowind Canada Goshen 102 NextEra Energy Canada East Durham 23 NextEra Energy Canada Grand Bend 100 Northland Power Port Ryerse 10 Boralex Cedar Point 100 Suncor Energy Products Cloudy Ridge/Skyway 126 10 Wind Works Power TOTAL: 1418.55MW Slated for 2016 Snowy Ridge 10 Capstone Infrastructure Settlers Landing 10 Capstone Infrastructure Ganaraska ZEP 20 Capstone Infrastructure Grey Highlands ZEP 10 Capstone Infrastructure Grey Highlands Clean Energy 18.45 Capstone Infrastructure Niagara Region 230 Niagara Region Wind Corp Amherst Island 75 Algonquin Power TOTAL: 373.45M Going live 2017 Belle River 100 Samsung/Pattern www.res-americas.com/storage TBD 100 Samsung/Pattern A global company with a local presence 0#1MDjACQGL+MLRPÌ?J?LB-LR?PGM Scheduled for 2018 TOTAL: 200MW Nigig 300 Henvey Inlet First Nation TOTAL: 300MW www.reNews.biz 23 October 2014 reNews Construction piles on wind capacity with 600MW already going live this year D evelopers in Ontario have fired up almost 600MW of wind projects this year and expect to add another 200MW by year-end. Samsung Renewable Energy is especially active and along with joint venture partner Pattern Energy commissioned the 270MW South Kent project in March, the first wind farm completed under the Green Energy Investment Agreement with the provincial government. Samsung and Pattern recently unveiled their fifth wind project, the 100MW Belle River near the southern shore of Lake St Clair. Siemens 2.3MW and 3MW turbines are in the frame with construction slated to start in early to mid-2016. The Samsung-led South Korean consortium has also committed to build 1369MW of wind and solar projects, cut from 2500MW in the original deal, plus four manufacturing facilities. The 1069MW wind portfolio employs Siemens turbines with blades produced in Tillsonburg and towers from a CS Wind plant in Windsor. Samsung is acting as general contractor for the joint venture’s 150MW Grand project, where turbine installation has wrapped up and completion is expected this autumn. Crews also broke ground this year at the $850m, 270MW K2 scheme, where Samsung and Pattern are partnering with Capital Power and first power is expected in summer 2015. Elsewhere, Samsung and Pattern are wrapping up financing for the 180MW Armow, which holds provincial approval and is in line to power up in 2015. Hatch has been retained to provide owner’s engineer services. Engineering, procurement and construction joint venture AMEC Black & McDonald is building both K2 and Armow. Samsung expects to reveal its sixth and final GEIA wind project soon, said spokesman Tim Smitheman. A land package is being prepared for a 100MW canada focus 5 Ontario in full bloom Up and running: the 270MW South Kent was commissioned in March Photo: Pattern Energy facility that will complete its 1069MW commitment when powered up by end-2017. NextEra Energy Canada continues to develop its eightproject FiT wind portfolio with a sixth scheme, the 149MW Jericho, set to reach commercial operation within weeks. The Florida-based developer completed three wind farms this summer, the 60MW Bluewater, 60MW Adelaide and 73MW Bornish. General contractor Borea Construction recently broke ground at the company’s 102MW Goshen site, which is slated to power up in early 2015. NextEra is also wrapping up local permits for its final FiT project, the 22.4MW East Durham, where construction will begin “very soon”. Meanwhile, Suncor Energy Products has completed road construction and foundations at its 40MW Adelaide scheme and rotor assembly and turbine lifts are underway. AMEC is the general contractor and Graham Infrastructure is handling civil www.reNews.biz works, foundations and erection of 18 Siemens 2.3MW 113 turbines. Completion is slated in December. However, Suncor’s 100MW Cedar Point proposal, which will feature up to 46 Siemens 2.3MW 113 turbines, is going through an Environmental Review Tribunal appeal with a hearing scheduled on 10 November. Elsewhere, the first wind farm completed by Capstone Infrastructure from the 95MW portfolio it gained in its acquisition of Renewable 6 6 canada focus Energy Developers, the 10MW Skyway 8, has gone live. Construction is underway at the 25MW Goulais, where commissioning is expected in the second quarter of 2015, while another five FiT projects are going through environmental review and permitting. Capstone anticipates arranging some C$250m in financing for the projects over the next two years with operations in 2016. A year-end start-up is targeted at the 91.4MW Dufferin wind project by Longyuan Canada Renewables. General contractor Mortenson Construction has erected 49 GE turbines and is also in charge of building Veresen’s 33MW St Columban project, which features 15 Siemens 2.3MW 113 machines. Commercial operations at St Columban are expected in the first half of 2015. Veresen’s 40MW Grand Valley 3 development continues to advance through the regulatory process. Ontario-based developer Horizon Wind Inc wrapped up the C$30m, 10MW Ernestown wind farm this month and wpd Canada is commissioning its 8.2MW Springwood and 6.15MW Whittington wind farms. Wpd also plans to construct four further facilities in Ontario totalling more than 90MW through 2016. Gilead Power has hit a delay at the 22.5MW Ostrander Point after an Ontario judge ordered a stay of construction until an appeal of an earlier court decision is heard in December. Provincial environment regulators continue to review the 230MW Niagara Region Wind Corporation project in south-west Ontario, which will feature 77 Enercon 2.3MW to 3MW machines. NRWC has been unable to reach road use agreements with some local municipalities and has applied to the Ontario Energy Board for leave to construct distribution facilities to connect to the provincial electricity grid. Haldimand County officials said the earliest construction could start is January 2015. reNews 23 October 2014 5 Cutting edge: blade production at Senvion’s Welland facility Photo: Senvion That shrinking feeling Manufacturers looking to new markets following axing of FiT T urbine manufacturers are facing up to a shrinking market in Ontario, where the feed-in tariff has been cancelled and domestic content requirements eliminated. Siemens, Vestas, GE, Senvion and Enercon set up factories and supply chains to service projects supported under the FiT, which established a 50% local content rule. Despite the expected slowdown, manufacturers and supply chain companies are now well positioned to ship products to other parts of Canada, the US and overseas, according to CanWEA’s Brandy Giannetta. “I don’t see anybody closing up shop,” she said. The FiT regime “was a fundamental reason for us to invest in the province”, added Senvion chief executive for North America Helmut Herold. Senvion has secured a 200MW to 300MW pipeline in Ontario, enough to keep its Welland blade plant busy for the next two years. It is also looking to supply North American markets. “We are quoting projects in the north-east US,” said Herold, “but we need both elements. We need a domestic market that allows us to amortise certain fixed costs and then we can also be competitive for markets abroad.” The company’s Ontario plant manufactures 45-metre blades for the MM92 2MW platform. It also plans to make 55-metre blades for its 3MW turbine, which will be available for projects bidding in the upcoming 300MW calls for wind power. Senvion captured 30% of the Canadian market in 2013, second to Enercon, which supplied 36% of the country’s new installations, according to MAKE Consulting. Vestas supplied 25% and Siemens 8%. Ontario projects featuring Senvion hardware include Prowind Canada’s 25MW Gunn’s www.reNews.biz Hill, wpd’s 110MW portfolio and Capstone’s 68MW pipeline. Siemens was selected to supply Samsung’s 1000MW wind farm portfolio and opened a blade plant in Tillsonburg. In addition, the German giant is to supply turbines for Invenergy’s 69MW Conestogo, Northland’s 100MW Grand Bend, Suncor’s 40MW Adelaide and 100MW Cedar Point, and Veresen’s 33MW St Columban and 40MW Grand Valley 3. Siemens also established a service and distribution centre in Chatham. General Electric is building almost 300 turbines for six NextEra wind farms expected to produce more than 460MW. It is also supplying China Longyuan Power’s underconstruction 91.4MW Dufferin project, Gilead Power’s 22.5MW Ostrander Point and BluEarth’s 60MW Bow Lake schemes. Five GE manufacturing plants in the province are producing turbine 7 canada focus 7 23 October 2014 reNews New blood to drive Nigig O Local content: the 150MW Grand wind farm in Ontario features steel towers from CS Wind and blades from Siemens that are manufactured in the province Photo: Surespan components. German turbine manufacturer Enercon built a new plant in Beamsville to produce power converters, control electronics and up to 60 different types of electrical cabinetry. It also plans to build a $20m concrete tower batch facility near its primary Ontario customer, the 230MW Niagara Region Wind project. Vestas has supplied some 370MW of turbines to FiT projects in Ontario while Samsung partner CS Wind established a tower 6 manufacturing plant in Windsor to supply the Korean consortium’s projects and other Ontario wind farms. It has also shipped towers to US customers. Elsewhere, China-based Shanghai Taisheng Wind Power Equipment outfitted a C$25m tower factory in Thorold. TSP Canada Towers’ first orders were exported offshore and the company has also supplied Ontario projects, including wpd Canada’s 6.9MW Whittington and 9.2MW Springwood schemes. ntario’s largest onshore feed-in tariff project, the 300MW Nigig wind farm, has a new development partner. Henvey Inlet First Nation has formed a 50-50 partnership with an undisclosed large US developer that will see the project through development and construction, said Nigig Power president Ken Noble. BluEarth Renewables started working with Nigig but the two have parted ways. The project on reserve land on the north shore of Georgian Bay has also negotiated a fouryear extension. The Ontario Power Authority has agreed to a February 2018 commercial operation date, said Noble. The amended power purchase agreement maintains a 15 cents/ kWh FiT price that includes a 1.5 cent/kWh aboriginal adder. The project has been delayed while the Henvey Inlet irons out the permitting process. “We’re the first First Nation in Canada to implement our own environmental assessment regime,” said Noble. The project will follow the same framework as the province’s renewable energy approval regime. “The big difference is we have the authority to issue the permit so we can fast-track that process,” added Noble. Nigig expects the band to approve the project in midsummer 2015. The proponent has also lined up financing for the $1bn scheme, including funds from the aboriginal loan guarantee scheme. “The financing was a huge challenge but we’ve been able to overcome it,” said Noble. The next step is to select a turbine supplier. GE was roped as part of the earlier arrangement with BluEarth but the agreement expired. Bids from manufacturers including GE are under consideration. Nigig continues to work on environmental assessments for two possible transmission routes, a 90km wire into Parry Sound or an 18km cable to a 500kV line east of the site. The developer aims to break ground in autumn 2015. TRUSTED LEADER IN PROJECT DEVELOPMENT 1,370+ MW DEVELOPED IN CANADA EDF EN Canada Ontario: 416.363.8380 Québec: 514.397.9997 www.edf-en.ca EXPE EX PERT PE RTIS RT ISE IS E | CO COMM MMIT MM ITME IT MENT ME NT | INN NNOV OVAT OV ATIO AT ION IO N www.reNews.biz 8 canada focus Eyes on America as export offers hope for future reNews 23 October 2014 Out of the blocks: the first turbines went up at the Temiscouata project last month Photo: Boralex 1GW wire attracting interest while Quebec sector waits for new Liberal regime to set out updated energy policy in 2015 C anada’s second largest wind market, Quebec, boasts 2.4GW of wind capacity, a 1.7GW pipeline and a firmly established manufacturing base. Wind players have invested $10bn in the province, created 5000 jobs and developed the largest supply chain in the nation. After installing a record 1GW in 2013, additions will hover around 500MW per annum for a few years. Quebec now looks set to reach its 4GW installed capacity goal by 2018, having initially set a 2015 target. By year-end the province will close in on 3GW if more than half a dozen projects hit their December in-service deadlines. Wind energy enjoys strong bipartisan political support in Quebec and the Liberal party took power this year from the Parti-Québécois, which launched the industry more than 10 years ago. Quebec’s current energy policy expires in 2015 and new Premier Philippe Couillard is crafting an updated strategy via a consultation exercise. The recommendations of a wind energy task force composed of government representatives and industry stakeholders on sector development are expected in early 2015 and a formal energy policy is to be unveiled by the end of next year. New energy minister Pierre Arcand has said the government is willing to support the industry but only if it becomes more self-sufficient. An Electricity Commission report earlier this year said a supply surplus negates www.reNews.biz the need for new energy procurements. However, the new administration has distanced itself from the study and is working to develop new markets. CanWEA Quebec regional director Jean-Frédérick Legendre said the sector can benefit from “strong demand in the north-east United States for clean energy”. The US Department of Energy recently approved the $2bn, 1GW Champlain Hudson Power Express transmission line, which will deliver Quebec generation to New York. Other cross-border transmission lines are in the works. Internal demand is also expected to recover as the Quebec economy gets back on its feet and the province is jumping on board the electrification of transportation. Hydro-Quebec is expanding its Electric Circuit public charging network throughout the province to support the adoption of plug-in electric vehicles. “Wind energy is part of the solution for the Quebec economy and the government realises that,” said Legendre. Quebec’s economic development strategy North Plan could also present opportunities. This year, start-up Tugliq Energy is building a C$22.6m single-turbine wind-dieselstorage pilot project at Nunavik, in the northernmost tip of the province. German manufacturer Enercon supplied a 3MW E-82 turbine and 86-metre steel tower at the scheme at Glencore’s Raglan 9 23 October 2014 reNews C onstruction crews are working flat out as developers race to meet Hydro Quebec’s 1 December energisation target. The utility set the deadline in contracts awarded following requests for proposals and the next batch will target 1 December 2015 completion. EDF EN Canada commissioned the 24.6MW La Mitis community wind farm this month and is now wrapping up the first 150MW phase of the 350MW Rivière du Moulin. By the end of 2015, the France-based company will have placed into service 1GW featuring more than 500 Senvion turbines. EDF sold partial stakes in several Quebec wind farms this year, reducing its ownership to 20% in the Saint-RobertBellarmin, Lac Alfred and Massif du Sud facilities. Quebec-based Boralex commissioned the 272MW Seigneurie de Beaupré wind farm last year and will add a 68MW extension this year, plus a 25MW community scheme in 2015. When completed, the 365MW complex will be the largest in Canada. Hamel Construction is handling Boralex’s Témiscouta wind farm and erected the first turbines last month. A 25MW community project is canada focus 9 Pedals to the metal as deadline looms due online in December and a 50MW second phase by the end of 2015. The 440MW Boralex portfolio uses Enercon turbines. Meanwhile, Eolectric hopes to power up 43 Enercon 2.35MW E92 machines at its 101MW Vents du Kempt wind firm in December. Enercon also supplied Invenergy’s 21.15MW des Moulins 2 and le Plateau 2 expansion schemes, which will power up by year-end. Construction is ongoing at Algonquin Power’s 24MW St Damase community project. The C$65m scheme is slated to start operations in early 2015 and could qualify for a refundable Quebec tax credit worth approximately C$16.4m. Algonquin is awaiting provincial approval for the C$70m, 24MW Val-Éo community wind farm near Lac Saint-Jean, where 10 Enercon E-92 2.35MW or eight E-101 3MW turbines are in the frame. Construction is Quebec on move nickel-copper mine. The company’s cold climate version includes oversized components and heated blades as well as a unique steel-base foundation mounted on piles drilled 13 metres into the ground. The model is intended to be rolled out to remote offgrid Inuit communities and industrial operations. In the meantime, the province has committed to adding another 650MW of wind. A 450MW competitive call is underway and Hydro-Quebec Production was allocated a 200MW block to develop inhouse. The utility is evaluating projects but is not ready to divulge plans, said spokesman Louis-Olivier Batty. 8 www.reNews.biz slated to kick off in the spring and wrap up by end-2015. Capstone Infrastructure will power up Enercon hardware at its 24MW Saint-Philémon community wind farm in Bellechasse County in early 2015, slightly behind the 1 December deadline. Elsewhere, environmental permitting is underway for Northland Power’s 24MW Frampton proposal, which is 33% owned by 10 canada focus 10 QUEBEC Due online 2014 Project End-2013 total installed capacity 2398.3MW MW Developer Raglan 3 Tugliq Energy Seigneurie de Beaupre 2 68 Boralex/Gaz Metro Temiscouata 1 25 Boralex Vents du Kempt 101 Eolectric/Fiera Axium Infrastructure Riviere du Moulin 1 150 EDF EN Canada Le Plateau 2 21.15 Invenergy Des Moulins 2 21.15 Invenergy Le Granit 24.6 EDF EN Canada La Mitis 24.6 EDF EN Canada Expected in 2015 Riviere du Moulin 2 200 EDF EN Canada Mont Rothery 74 EDF EN Canada Temiscouata 2 50 Boralex St-Damase 24 Aglonquin Power Val-Eo 24 Aglonquin Power Saint Philémon 24 Capstone Infrastructure Cote de Beaupre 25 Boralex Frampton 24 Northland Pierre de Saurel 24.6 MRC Pierre de Saurel St-Cyprien 24 Kahnawake Sustainable Energies TOTAL: 493.6MW Slated for 2016 Mesgi’g Ugju’s’n 150 Innergex/Mi’gmaq communities TOTAL: 150MW Crossing the line by 2018 TBD 200 False start for contenders in 450MW power call race P TOTAL: 438.5MW Hydro Quebec Production TOTAL: 200MW TRUSTED EXPERT IN OPERATIONS & MAINTENANCE reNews 23 October 2014 rovincial utility Hydro-Quebec has postponed the timetable for a hotly anticipated 450MW call for wind energy to give regulators more time to review project evaluation criteria. Bids were due by 3 September but the new submission date will be at least 10 days after the Energy Board issues a decision, said Hydro-Quebec spokesman Louis-Olivier Batty. In-service deadlines of 1 December 2016 and 2017 are not expected to be affected, he added. CanWEA Quebec regional director Jean-Frédérick Legendre said the RFP must go ahead as soon as possible. “It’s a very tight deadline,” he said. The call is divided into two tranches with a 300MW block reserved for projects in the Lower St Lawrence-Gaspé region while 150MW is for projects throughout Quebec. There is also a 60% Quebec content requirement with at least 35% spent in the Matane and Gaspésie-Iles-de-laMadeleine regions. Municipalities, counties, First Nations and community groups must have at least 50% ownership in the projects. Community groups are not required to provide equity, unlike previous calls. Dozens of developers are courting local partners and competition is expected to be tough. The municipal governments and First Nations in the Lower St Lawrence and Gaspésie-Îlesde-la-Madeleine have formed joint venture East Wind Alliance to invest in 300MW of projects with 26 potential schemes in the two regions alone. Boralex is working on a 225MW, 75 to 113-turbine wind farm in the lower St Lawrence region. The Quebec-based developer is also mulling bids of 50MW, 100MW and 150MW for a site near its Seigneurie de Beaupré wind farm. EDF EN Canada is studying 150MW to 300MW in Lower St Lawrence as well as a boost at the Rivière-du-Moulin site. Hydromega is developing 25MW in Matapedia in a project slashed from 21 to eight turbines following local opposition. Meanwhile, Innergex has a 983MW development portfolio in its home province and said it is “very active in preparing submissions”. Algonquin Power is developing 101MW expansion projects at its Saint-Damase and Val-Éo community wind sites. Other developers considering bids include Capstone, Enerfín, Eolectric, Invenergy, NextEra, Northland Power, RES Canada and Air Energy TCI. Winners will be named in early 2015. Race to hit December deadline the Municipality of Frampton. The C$75m project will feature 12 Enercon E-82 2MW turbines. Provincial regulators held a public hearing this summer into the 24.6MW Pierre de Saurel wind farm, Quebec’s only 100% municipally owned project. The C$67m scheme will employ 12 Senvion MM92 2.05MW turbines on 100-metre towers and Montreal-based engineering and construction company Dessau is project manager. Quebec’s only aboriginalowned project, the 24MW Saint-Cyprien, proposes eight Enercon E101 3MW turbines. The Mohawk First Nation’s Kahnawake Economic 9 8,000+ MW O&M in North America MAXIMIZE PROFITABILITY OPTIMIZE AVAILABILITY ANALYZE PERFORMANCE EDF Renewable Services 858.521.3575 www.edf-renewable-services.com www.reNews.biz Development Commission has submitted an environmental impact assessment to regulators. If approved, commissioning could happen in December 2015. Air Energy TCI assisted with initial development. Canadian developer Innergex received a government decree in September authorising the 150MW Mesgi’g Ugju’s’n wind farm, developed in a 50-50 partnership with three Mi’gmaq communities. The proponent has finalised micro-siting and started preconstruction activity at the Gaspé Peninsula site. Construction is expected to start next year ahead of commercial operations in late 2016. canada focus 11 23 October 2014 reNews Alberta on comeback trail Job done: Alberta’s operational wind farms include Blackspring Ridge Photo: Enbridge W ind farm construction in Alberta picked up from a record low to add 352MW this year but future growth will hinge on projects navigating a maze of challenging market conditions. Alberta’s long grid queue lists more than 2.3GW of wind but many sites have suffered repeat delays due to difficulties in securing finance in Canada’s sole pure merchant power market. “Wind is continuing to grow but at a significantly slower pace,” said CanWEA Alberta regional director Tim Weis. The turnaround in Canada’s third-largest market follows a slowing of activity in recent years. For the first time in more than a decade, no new wind generation was added last year. Alberta has Canada’s only deregulated electricity market, where suppliers sell directly into the provincial pool. Independent producers face low power prices and difficulty financing projects. The industry is looking for provincial action to boost development. New Alberta Premier Jim Prentice, who won a Conservative party leadership contest in September to replace Alison Redford, said one of his five campaign priorities was to establish Alberta as an environmental leader. However, he also insisted “we will not damage the competitiveness of our oil and gas industry by unilaterally imposing added costs and But the political and financial complexities of country’s only deregulated power market make for slow wind progress regulations”. It is therefore not clear what role wind will play in the new premier’s vision. The government is working on a 20-year comprehensive energy strategy, including a plan to phase out coal-fired plants. Coal facilities make up some 43% of the province’s total installed generating capacity while natural gas accounts for 41% and wind 7%. As the province fights to develop export markets for oil and gas it is also trying to polish its image abroad. In a mandate letter to environment minister Kyle Fawcett, the premier directed him to maximise reductions in greenhouse gas emissions but failed to mention renewable energy. “The litmus test for social licence is action on climate change,” said Weis. The province has been developing an alternative and renewable energy framework for the past few years and the new government is thought to be continuing that work. Wind energy can compete on price even though electricity rates have been low for several years, Weis noted. The challenge is financing D Money men get creative evelopers have sought alternative ways of financing wind farms in recent years. The 300MW Blackspring Ridge by EDF EN Canada and Enbridge, the largest wind facility in western Canada, started full commercial operation in May and features 166 Vestas V100 1.8MW turbines. Renewable energy credits generated at the project are contracted to Pacific Gas and Electric under a 20-year purchase agreement while electricity is sold into the Alberta power pool. Meanwhile, Irish developer Mainstream Renewable Power accepted an offer from Swedish furniture giant IKEA for its 46MW Oldman 2 project. The Irish developer will continue to operate and maintain the site. Mainstream development manager Lee Anderson said: “Oldman 2 is in the final stages of reaching full commercial operation, which should wrap up in the coming weeks.” Elsewhere, the Alberta Schools Commodities Purchasing Consortium has a power www.reNews.biz projects with power purchase agreements rare and some support schemes axed. Continued growth in the oil and gas sector is driving the Alberta economy and peak electricity demand is expected to grow from 11GW to around 18.5GW by 2034. New policies that improve the economics of renewables are needed to increase the amount of wind capacity that develops, said Weis. “It’s going to be a struggling and challenging market without some sort of policy change,” he said. “At the same time, we’re not asking for subsidies or to impose a burden on ratepayers because wind is as cheap as anything to build and helps stabilise and hedge the system over the long term.” purchase agreement for output from BluEarth Renewables’ Bull Creek wind farm near Provost. “The industry has found some pretty creative ways of making projects work,” said CanWEA Alberta regional director Tim Weis. “Unfortunately, a lot of those creative solutions are getting harder to find or don’t exist anymore.” Wind projects have also benefited from Alberta’s carbon offset programme. Under the specified gas emitters regulation, credits are priced at C$15 a tonne. Oil and gas giant Suncor, which 12 12 canada focus is planning the 80MW Hand Hills scheme near Delia, has an internal appetite for such credits as they will offset its own emissions. A regulatory hearing is due on 4 November into the project featuring up to 54 GE 1.6MW 100 turbines. Local developer WindRiver Power has secured a 20-year off-take deal with the City of Medicine Hat for its 6MW Box Springs wind farm. The deal includes carbon credits the city can use to offset emissions from its natural gas-fired units. Box Springs features three Gamesa G90 2MW turbines and went live in September. The carbon tax scheme was to expire last month but the Alberta government renewed it to the year-end for evaluation. While it is unlikely to raise the carbon levy other changes could facilitate project financing. “I’ll be shocked if they let it expire,” said Weis. 11 ALBERTA Furnishing power: IKEA bought the Oldman 2 wind farm from Mainstream Renewable Power Photo: Mainstream End-2013 total installed capacity 1119.1MW Due online 2014 Project reNews 23 October 2014 MW Developer Blackspring Ridge 300 EDF EN/Enbridge Box Springs 6 WindRiver Power Oldman 2 46 Mainstream Renewable Power/IKEA TOTAL: 352MW Breaking the tape in 2015 Hand Hills 80 Suncor Bull Creek 115 BluEarth Renewables Windy Point 63 Mainstream/Alberta Wind Energy Mclaughlin 60 Renewable Energy Service Ltd TOTAL: 318MW Wrapping up in 2016 Irma 150 Mainstream Old Elm and Pothole Creek 300 Mainstream/Alberta Wind Energy Peace Butte 120 Renovalia Energy/Pteragen Wild Rose 1 210 Naturener Wild Rose 2 189 Naturener Grizzly Bear 120 Eon Welsch 69 Eolectric Box Springs 2 2 WindRiver Power TOTAL: 1160MW Arriving in 2017 Riverview 115 Enel Green Power Canada Castle Rock Ridge 2 33 Enel Green Power Canada Jenner 120 Joss Wind Schuler 150 Invenergy Heritage 1 100 Heritage Wind TOTAL: 518MW Expected in 2018 Heritage 2 250 Heritage Wind Hand Hills 78 BluEarth Renewables TOTAL: 328MW Transmission hurdles force project rethink D ifficult market conditions and transmission delays have prompted several developers to apply for construction permit extensions. Affected projects include Renovalia’s 120MW Peace Butte, BluEarth’s 78MW Hand Hills, Enel’s 33MW Castle Rock Ridge 2, Eoloectric’s 69MW Welsch, Mainstream’s 63MW Windy Point and the 291MW Heritage project. Calgary-based BluEarth is considering a rejig of its approved 46-turbine, 115MW Bull Creek scheme under which just 17 turbines would be installed and link to the distribution system, eliminating the need for a dedicated substation. The company is also considering changing the GE 2.5MW machine initially proposed. In June, the Alberta Electric System Operator put a 75km transmission project on hold after interest dwindled for development in the area southeast of Lethbridge. The agency said it does not know when the 240kV Etzikom Coulee to Whitla line will proceed. “Wind development in the www.reNews.biz area has not progressed at the pace originally anticipated,” said AESO. The proposed line is part of the multi-stage Southern Alberta Transmission Reinforcement project approved in 2009. SATR was designed to alleviate existing system constraints and integrate about 3GW of southern Alberta wind generation. ECW is a stage two project and two additional schemes are proceeding under the phase. AESO and transmission facility owner AltaLink are conducting technical and engineering studies for the 70km Picture Butte to Etzikom Coulee and 170km to 220km Goose Lake to Etzikom Coulee wires. AESO has also cancelled a SATR stage three transmission project because it is no longer needed. A new double-circuit 240kV line was to connect two substations east of Calgary, Ware Junction and Langdon. AESO still has 18 active wind projects totalling some 2.4GW in the connection queue. The agency forecasts wind capacity will double over the next 20 years to 2.7GW. canada focus 13 23 October 2014 reNews Wind development in Atlantic provinces battles against grid and demand hurdles C anada’s Atlantic provinces account for 11% of the country’s wind capacity but additional growth prospects are unclear in the face of flat or declining energy demand and grid saturation in some areas. Slowing or static development activity is not expected to pick up without a change of policy direction in Nova Scotia, Prince Edward Island, New Brunswick and Newfoundland and Labrador. Nova Scotia is Canada’s fourth-largest wind energy market with 338MW in operation and this is set to almost double by 2016. However, what happens thereafter is not clear. The province is well on its way to meeting a target of 25% of generation from renewable sources by 2015 and 40% by 2020 with some 300MW of contracted wind projects due online in the next two years. Construction is nearing completion on 120MW of grid-connected wind farms while 200MW of distributionlinked community feed-in tariff projects are in various stages of construction and development (see page 15). However, no new procurements are anticipated once these are complete. Plans for a 100MW wind farm by utility Nova Scotia Power were scrapped because of loss of load from the province’s declining pulp and paper sector. Blade runner: a rotor heads for the South Canoe wind farm project site Photo: Sean Brennan/South Canoe Stalling sector waits on policy jump leads PEI End-2013 total installed capacity 173.6MW Online 2014 Project Hermanville-Clearspring MW Developer 30 PEI Energy Corp TOTAL: 30MW Hydropower from Labrador transmitted through the Maritime Link subsea cable will help Nova Scotia meet the 2020 renewables target. The Liberal government has been in power for a year and Premier Stephen McNeil has kept mum about additional wind development. “We’re not sure what their appetite is for more wind power,” said Brad Murray, director of tower manufacturer DSTN, which runs its principal operations from Trenton. A 12-month electricity system review wraps up in December and the government is expected to unveil a new energy policy in spring 2015. The province has also directed NS Power to develop a renewable electricity market to promote competition. It would allow independent power producers and electricity suppliers to sell directly to the utility’s retail customers. NS Power said the draft framework will be filed with the Nova Scotia Utility and Review Board for approval in late 2015 with the goal of opening the market in mid-2016. Several dormant wind projects could be dusted off if such a market proves viable. BluEarth filed for environmental approval for the New Brunswick leaves wind out in cold New Brunswick has committed to increasing the provincial renewable portfolio standard but the move is unlikely to bring an end to several years of paralysis for the industry. Some 30% of the electricity consumed is from renewables including hydro, wind and biomass, and the province this year boosted the RPS target to 40% by 2020. The renewed ambition promises little for New Brunswick’s wind industry, which has been on pause since 2011 after the province’s most recent project came online. The government will focus on non-intermittent sources such as biomass and has pledged to work with First Nations on small-scale renewable projects. The idea of a procurement programme for proposals up to 15MW was floated but has yet to be rolled out. www.reNews.biz 50MW East Bay Hills wind farm in Cape Breton in the summer. The Calgary-based outfit proposes to build up to 30 GE 1.68MW 82.5 turbines on Crown land and acquired the project from a subsidiary of Cape Breton Explorations. Heading northwards, Prince Edward Island is now generating more than 30% of its electricity from wind but growth prospects look dim. The 30MW HermanvilleClearspring wind farm was plugged into the grid in January, bringing total on-island capacity to 204MW. Spanish manufacturer Acciona supplied, constructed and commissioned 10 AW3000/ 116 3MW turbines and will cover operations and maintenance. The C$60m scheme could be the last to appear on the island for some time as Canada’s smallest province has maxed out its ability to integrate new capacity and has no plans for expansion. Canada’s easternmost province, Newfoundland and Labrador, is in a similar position. The government there does not plan to increase wind power beyond two operational farms with a combined capacity of 54MW. Instead, the province will focus 14 14 canada focus on hydroelectric development and once the 824MW Muskrat Falls dam is complete will get more than 98% of its power from renewable sources. Construction of two dams and three transmission lines, including a 480km, 500MW subsea link to Nova Scotia, is scheduled for completion in 2017. Opportunities for wind growth in Newfoundland and Labrador are reserved for the micro end of the capacity spectrum. Energy company Nalcor is starting phase two of the 0.3MW Ramea wind-hydrogendiesel project. Three turbines installed in 2010 help to displace diesel consumption and the company is now fine-tuning the hydrogen storage system. If the hybrid project is successful Nalcor hopes to use the model in other remote Newfoundland communities, as well as in Canada’s north and in small island nations with a high reliance on diesel generators. 13 reNews 23 October 2014 Ahead of the curve: DSTN hopes to expand into the US market Photo: DSTN Tower manufacturer aiming for US market N ova Scotia turbine tower manufacturer DSTN has covered a sizeable chunk of recent installations in Canada’s Atlantic provinces but is now casting its net further afield in search of new orders. The company, a joint venture between the province and Korea’s Daewoo Shipbuilding and Marine Engineering, has provided steel towers for turbines by DeWind, Suzlon and Acciona. However, it sees very little room for additional growth in its home territory, director Brad Murray told reNews. “It looks like the COMFIT scheme in Nova Scotia is coming to a close, PEI is pretty saturated and in New Brunswick there’s no demand,” he said. The manufacturer is therefore turning its attention south of the border. “We’re looking at opportunities in Maine and New England,” he added. The north-east US has a www.reNews.biz strong appetite for clean energy and high electricity rates but uncertainty over federal tax policy and difficulty siting wind farms has hampered growth. DSTN’s Trenton plant now employs some 180 workers, including employees involved in pressure vessel fabrication. The manufacturer started deliveries this month at the 102MW South Canoe project, Nova Scotia’s largest wind farm. The 34-turbine scheme features Acciona 3MW machines mounted on 90.2-metre towers that are fabricated in five sections. The factory completed a 10-tower order for a Prince Edward Island project last year and is finalising a deal with some community feed-in tariff projects in Nova Scotia. That order would cover about eight turbines slated for delivery in 2015. 23 October 2014 reNews canada focus 15 Nova Scotia Due online 2014 Project Firm footing: work at the South Canoe wind farm project site Photo: Bob Hutt/South Canoe Utility helping to cement ambitions for Nova Scotia Drive on wind projects will push province closer to its renewable energy targets N ova Scotia Power is backing two under-construction wind projects that will help propel the province towards a renewable energy target of 25% by 2015. The utility holds a 49% stake in the 102MW South Canoe and 13.8MW Sable wind farms and will buy output from the duo under 20year power purchase agreements. The C$196m South Canoe is majority owned by Minas Basin Pulp and Power and Oxford Frozen Foods. Acciona is to supply 34 AW3000/116 turbines and handle construction, internal electrical infrastructures and assembly. It will also cover operation and maintenance. Subcontractor Van Zutphen has completed 30km of roads and foundation pours are wrapping up. Acciona has shipped some blades, hubs and nacelles to the port of Liverpool from Spain and will deliver another eight sets of blades from its plant in China. Commercial operation is expected in early 2015 although the project is involved in a legal appeal involving Cape Breton Exploration with a court hearing scheduled in December. Meanwhile, crews are pouring foundations at the C$27m Sable wind farm in eastern Nova Scotia, which is majority-owned by the Municipality of Guysborough. Enercon is delivering six E82 2.3MW turbines with 78-metre towers from Germany. The manufacturer will install and commission the machines and commercial operations are targeted in December. Local outfit Zutphen Contractors is handling road construction and land clearing while CBCL Ltd is supplying engineering services, Shihlin Electric & Engineering will provide the substation transformer and Mitsubishi Electric Power Products has scooped the circuit breakers contract. Elsewhere, Minas Energy is developing the 16.1MW Ellershouse project on behalf of Alternative Resource Energy Authority, a partnership between the Towns of Berwick, Mahone Bay and Antigonish. The member municipalities will buy output and Canadian green energy provider Bullfrog Power will purchase surplus renewable certificates. The C$23.6m project will feature seven Enercon E92 2.3MW turbines atop 98-metre towers. Clearing and road construction works are to begin this autumn. End-2013 installed capacity 329.85MW MW Developer Kaizer Meadow 2.3 Chester Municipality St. Rose 1.99 Scotian Windfields/WEB Wind Energy Parker Mountain 1.99 Scotian Windfields/WEB Wind Energy Little River 1.99 Scotian Windfields/WEB Wind Energy Sable Island 13.8 Municipality of Guysborough/NS Power Hillside Boularderie 4 Natural Forces/Wind4All Gaetz Brook 2.3 Natural Forces/Wind4All Millbrook 6 Firelight Infrastructure Partners/Millbrook FN Truro Heights 4 Firelight Infrastructure Partners/Eskasoni FN Chebucto-Pockwock 10 Firelight Infrastructure Partners-Chebucto Pockwock Lake Wind Field Whynotts 4 Firelight Infrastructure Partners/Mi’kmaq FN Cheticamp 0.9 Celtic Current Mulgrave 2.3 Celtic Current TOTAL: 55.57MW Crossing the line in 2015 South Canoe 102 Minas Basin/Oxford Foods/NS Power Ellershouse 16.1 AREA/Minas Basin Bateson 2.3 Celtic Current North Beaver Bank 8 Scotian Windfields/WEB Wind Energy Isle Madame 1.99 Scotian Windfields/WEB Wind Energy Black Pond 1.99 Scotian Windfields/WEB Wind Energy Martock Ridge 6 Scotian Windfields/WEB Wind Energy Nine Mile River 4 Scotian Windfields/WEB Wind Energy Aulds Mountain 4.6 Natural Forces/Wind4All Amherst Community 6 Natural Forces/Mi’kmaq FN Barrachois 4 Natural Forces/Wind4All New Glasgow 6.4 Watts Wind Energy, Katalyst Wind, Elemental Energy Barrington 3.2 Watts Wind Energy, Katalyst Wind, Elemental Energy Wedgeport 1.8 Watts Wind Energy, Katalyst Wind, Elemental Energy Limerock 5 Firelight, Affinity SPCA, RMS Energy Kemptown 5 Firelight, Affinity SPCA, RMS Energy Greenfield 3.2 Firelight, Affinity SPCA, RMS Energy Dean Back Road 1.85 Firelight, Affinity SPCA, RMS Energy Fitzpatrick’s Mountain 1.4 RMS Energy/Wind Power Charity Cape Breton U 5.4 Cape Breton University/Cape Breton Explorations Avondale 1.7 Northumberland Wind Field CEDIF/RESL Lake Major 11.5 Halifax Regional Water Commission North Preston 4.6 Halifax Regional Water Commission Terence Bay 7.2 RESL/Chebucto Wind Field TOTAL: 215.23MW Wrapping up in 2016 Point Aconi 1.9 Celtic Current Goldboro 1.5 Celtic Current Baddeck 1.99 Scotian Windfields/WEB Wind Energy Porters Lake 3.8 Watts Wind Energy, Katalyst Wind, Elemental Energy Bayswater 2 Watts Wind Energy, Katalyst Wind, Elemental Energy Bear Cove-Ketch Harbour 4.6 Watts Wind Energy, Katalyst Wind, Elemental Energy New Minas 4 Watts Wind Energy, Katalyst Wind, Elemental Energy Lingan 0.8 Watts Wind Energy, Katalyst Wind, Elemental Energy Liverpool wind/storage 3.6 Watts/Lightsail Energy www.reNews.biz TOTAL: 24.19MW 16 canada focus reNews 23 October 2014 Big appetite for bite-size sites People power: Parker Mountain developer Scotian WindFields is tapping COMFIT supports Photo: Scotian WindFields A handful of medium wind projects have come online and dozens more are in development under Nova Scotia’s community feed-in tariff (COMFIT) regime. The province has approved 200MW of renewables capacity, double the scheme’s 100MW target. The vast majority of contracts were awarded to wind proposals, although not all are expected to reach construction. The province expects distribution-level technical constraints and financing issues will lead to project attrition. COMFIT projects get C$131/ MWh for wind farms larger than 50kW and C$499/MWh for small wind. Other technologies get between C$140/MWh (run-ofriver hydro) and C$652/MWh (tidal stream) under 20-year power purchase agreements with Nova Scotia Power. The energy department is revising the regime and is no longer accepting applications larger than 500kW. Most wind proponents are using community economic development investment funds to enable local cash injection and ownership. Natural Forces, formerly the Canadian arm of UK-based Wind Prospect Group, has completed Medium wind sector vibrant as developers tap NS community feed-in tariff regime construction of the 4MW Hillside Boularderie and 2.3MW Gaetz Brook. Another three COMFIT wind farms are due to enter service next year. Enercon is responsible for turbine supply, erection and commissioning and has a 12 to 15-year service deal. Elsewhere, Scotianweb is progressing a 28MW COMFIT portfolio. Three projects came online in early 2014 and another five will be completed in the first quarter of 2015. Foundation construction has kicked off at 8MW North Beaver Bank and next in line are the 1.99MW Black Pond, 1.99MW Isle Madame, 4MW Nine Mile River and 6MW Martock Ridge. Vestas is scheduled to deliver V100 2MW turbines in late November. Scotianweb, a partnership between Scotian Wind, Scotian WindFields and WEB Wind Energy North America, lined up C$61.4m in project financing arranged by British Columbiabased Travelers Capital Corporation. The package was funded by Industrial Alliance Insurance and Financial Services Inc and Siemens Financial Ltd. Construction is also underway at four wind farms totalling 24MW developed by Juwi Wind Canada. Engineering, procurement and construction contractor HB White Canada is building the C$75m portfolio. Vestas is supplying 12 V100 2MW turbines to the 10MW Chebucto Pockwock, 6MW Millbrook, 4MW Truro Heights and 4MW Whynotts schemes. Commercial operations are slated by year-end Juwi, which sold its interests in the projects to Firelight Infrastructure Partners and several First Nations, continues to oversee construction and will remain as asset manager. Vancouver-based Elemental Energy has teamed up with Nova Scotia outfits Watts Wind Energy and Katalyst Wind on a 35MW COMFIT portfolio. A C$30m financing closed in July for the first projects, the 6.4MW New Glasgow, 3.2MW Barrington and 1.8MW Wedgeport. “The three projects are having foundations installed with the expectation of turbine delivery in early 2015,” said Elemental director of project investments Graeme Millen. US manufacturer GE will www.reNews.biz supply 1.68MW 82.5 turbines. Commercial operation is expected in March 2015. Watts has an additional 25MW of COMFIT-approved projects at various stages of development. The three schemes most likely to proceed to construction in the next 18 to 24 months are Porters Lake, Ketch Harbour and Bayswater, which total about 10MW of capacity, said Millen. Nova Scotia developer RMS Energy has lined up GE 1.6MW series turbines for a COMFIT pipeline owned by Firelight Infrastructure Partners and Affinity Renewables, which includes the Nova Scotia Society for the Prevention of Cruelty to Animals. Commercial operations are targeted in August 2015 at the 5MW Limerock, 5MW Kemptown, 3.2MW Greenfield, 1.85MW Dean Back Road and 1.4MW Fitzpatrick Mountain. Meanwhile, Celtic Current has tapped Enercon to supply hardware at five COMFIT sites. Construction is underway at the 2.3MW Mulgrave, 2.3MW Bateston and 0.9MW Cheticamp. The German manufacturer is also lined up to supply three E92 2.35MW turbines to Renewable Energy Services’ 7.2MW Terence Bay near Halifax. canada focus 17 23 October 2014 reNews Pattern to escape build-out paralysis Plain sailing: Cape Scott went live earlier this year Photo: GDF Suez North America C British Columbia crews wait for weather to turn Fresh demand from new heavy industries could fill sector sails W ind farm construction slowed in British Columbia this year but developers continue to mark out territory in the hope of surging energy demand if new heavy industries take off. The province racked up 490MW of installed capacity when the 99MW Cape Scott wind farm was commissioned at the start of the year. Progress on the ground has been quiet since then but the promise of future energy demand growth in BC, a rare commodity in Canada, is keeping the industry waiting in the wings. However, Finavera Wind Energy chief executive Jason Bak BC warned that developers need patience. “It’s a slow, difficult environment to do any development in this province,” he said. Vancouver-based Finavera, which won contracts for 300MW in the 2008 Clean Power Call, has bowed out of the BC wind market to focus on residential solar development in the US. BC may be challenging for smaller players but it offers huge potential, said Bak. “For companies that have a large capitalisation and patience End-2013 total installed capacity 389.7MW Online 2014 Project Cape Scott MW Developer 99 GDF Suez/Mitsui/Axiom TOTAL: 99MW Planned for 2016 Meikle 185 Pattern Energy TOTAL: 185MW to deal with the environment assessment office and the First Nations, there’s a reward.” The government has yet to voice support for additional wind energy, though. “We need a clear, significant signal that there is a market for the wind sector in BC,” said CanWEA vice president for policy and government affairs Jean-François Nolet. In its latest energy plan, unveiled in December 2013, utility BC Hydro said electricity needs will grow by around 40% over the next 20 years. For now, however, there is an oversupply of power and it will not buy more from independent producers in the next five years. “The integrated resource plan released last year had nothing in it for us,” said Nolet. “That was a big disappointment.” Premier Christy Clark’s government did confirm plans to review its long-term energy strategy and a new integrated resource plan is to be developed in 2015, mainly www.reNews.biz 18 onstruction has been at a standstill since the commissioning of the 99MW Cape Scott wind farm at the northern tip of Vancouver Island in January. The 55-turbine project by joint venture partners GDF Suez Canada, Mitsui and Fiera Axium Infrastructure features Vestas V100 1.8MW machines. 3 Nations Construction Ltd, a joint venture of three First Nations and Lemare Group, constructed a large part of the project’s roads and earthworks. Amec Black & McDonald oversaw construction. GDF also built a 40km transmission line to connect to the provincial electrical grid. The C$325m project generates some 290GWh/year for BC Hydro under a 20-year power purchase agreement. Pattern Energy will build the next wind farm in BC, the 185MW Meikle. The company expects to start logging this month with full mobilisation scheduled for May 2015. The developer has yet to finalise a turbine supplier and general contractor although hardware delivery is slated to start in June 2016 with commercial operation following later that year. Pattern acquired the C$400m Meikle from Vancouver-based Finavera along with a 25-year BC Hydro PPA. Finavera won four contracts totalling around 300MW following the 2008 Clean Power Call but cancelled 116MW as part of the transfer to Pattern. Finavera retains licences and permits for the Wildmare and Bullmoose projects and continues to collect data from met masts at the sites. Chief executive Jason Bak said the plan is “to hibernate those in the short to medium term”. canada focus Fields of dreams for developers 18 reNews 23 October 2014 M ore than a dozen developers are pushing on with larger projects in anticipation of future calls for wind energy in British Columbia. EDF EN is advancing three schemes in the Peace River region. The 250MW Sundance, 250MW to 400MW Taylor and 70.5MW Wartenbe wind farms were initiated by Avro Wind Energy, which retains an interest and is helping with development. Taylor and Sundance are undergoing environmental assessment and could deliver power as early as 2017, subject to power off-take agreements with BC Hydro. Wartenbe has received its BC environmental assessment certificate, which expires in 2016. Meanwhile, EDP Renewables Canada has partnered with TimberWest Forest Corp to develop, build and operate 300MW of wind farms on southern Vancouver Island. Canadian developer Innergex Renewable Energy has proposed the 210MW Nulki Hills scheme in north-west BC, part of a 475MW development portfolio in the province. Environmental assessment work is underway for the up to 70-turbine project, to be located some 30km south of Vanderhoof. Elsewhere, Ontario-based Northland Power is collecting wind data at the Mount George site near Prince George and BC outfit Sea Breeze Power, which initiated Cape Scott, is investigating more than a dozen Gold in them thar hills: Capital Power’s 142MW Quality wind farm near Tumbler Ridge in BC Photo: Jimmy Jeonge sites throughout the province. Capital Power has two prospects in BC, including the 100MW Klo project where it has collected four years of wind data. Alterra Power and GE Energy Financial Services continue to own the rights to the fully permitted 156MW Dokie 2 expansion scheme while Alterra holds a 1GW portfolio at several coastal locations including Banks Island, Porcher Island, McCauley Island and Knob Hill. Other outfits investigating the market include RES Canada, Spain’s Enerfin, Brookfield, Elemental Energy and Natural Forces. German turbine manufacturer Senvion is also jockeying for position. “British Columbia has great potential,” said Senvion chief executive for North America Helmut Herold. “Now it’s just a question of political will to have a new request for proposals.” BC crews waiting for weather to turn to reassess the load forecast. New liquefied natural gas plants on the west coast, natural gas and mining projects in the interior and vehicle electrification are expected to boost energy demand. The province has committed to developing the greenest LNG sector in the world and the wind industry stands ready to help it deliver, said Nolet. LNG proponents are awaiting a new tax regime to be implemented by end-November 17 before making commitments. “Then we’ll see concrete progress on the LNG projects and get clarity on timelines,” said Nolet. The proposed C$8bn, 1100MW Site C Dam hydro project in north-east BC is another piece of the energy puzzle. It received full environmental approval this month and a final investment decision by the province is expected in November. Wind-generated electricity is cost-competitive with Site C and should, along with other low-impact renewables, be considered as an alternative, according to advocates. Regardless of the decision, wind proponents will be seeking a declaration that the sector will be backed alongside hydro. • BC will keep its carbon tax and maintain the current rate of C$30/tonne following a review. The government said it may consider changes if other North American jurisdictions bring in similar carbon taxes or pricing. www.reNews.biz Wind stands to make inroads D evelopers are hopeful British Columbia’s standing offer regime for energy projects up to 15MW will soon lead to its first wind contract award. The price and size cap are challenging but several wind developers have projects in the works. Zero Emission Energy Developments has proposed five 14.3MW schemes using Senvion hardware and BC Hydro is reviewing applications for the Septimus Creek, Pennask and Shinish Creek sites. Quebec-based Boralex and partner Aeolis Wind Power have applied for two 15MW seventurbine wind projects, Babcock Ridge and Moose Lake, near Tumbler Ridge. Meanwhile, wpd Canada has initiated the 15MW Vanderhoof scheme, which could be expanded to an 80MW project. BC Hydro expects to unveil a revised system this autumn. canada focus 19 23 October 2014 reNews Shutters slam in Saskatchewan C anada’s central-west provinces Saskatchewan and Manitoba have closed the door to additional wind energy procurements for the foreseeable future. Saskatchewan’s current capacity of 200MW will more than double when 230MW now in development comes online by 2017 but opportunities thereafter appear muted. Although the province offers ideal conditions with capacity factors greater than 40%, utility SaskPower believes it is well positioned to meet provincial needs through 2020. The utility has no plans to reduce its heavy reliance on coal, which provides around half the province’s Coal-addicted province to put faith in carbon capture and storage SASKATCHEWAN Due online 2015 MW Developer Morse Project 23 Algonquin Power Western Lily 20 Gaia Power TOTAL: 43MW Coming up in 2016 Chaplin 177 Algonquin Power TOTAL: 177MW Slated for 2017 Riverhurst 10 Capstone Infrastructure TOTAL: 10MW demand, and is looking into carbon capture and storage technologies. A large coal station with CCS was recently unveiled in the potash-rich region. For now, developers are working to complete a handful Far north hunting expedition R esearchers in Canada’s far north continue to study opportunities for wind development in isolated, sparsely populated communities that rely on expensive imported fossil fuels. Resource assessments are underway in various locations in the Yukon, Northwest Territories and Nunavut. Quilliq Energy is collecting data for a potential project in Cape Dorset while the Wind Energy Institute of Canada is to carry out a one-year resource assessment in Cambridge Bay. Elsewhere, Yukon Energy is studying the feasibility of 20MW projects at Tehcho-Ferry Hill End-2013 total capacity 198.4MW Cool running: a blade delivery to the Diavik wind farmPhoto: Rio Tinto near Steward and Mt Sumanik near Whitehorse. In the Northwest Territories a 9.2MW wind farm has been in operation at the Diavik diamond mine for more than two years. Last year, it reduced the mine’s annual diesel fuel requirement by 3.8 million litres and provided 8.5% of its power needs. Enercon erected four 2.3MW turbines at the site, which is on an island in Lac de Gras accessible by road for only eight or nine weeks a year. of projects that won contracts in earlier calls for power. Algonquin Power is currently wrapping up design, engineering and a provincial environmental assessment for the C$355m, 177MW Chaplin development 200km west of capital Regina. SaskPower has entered into a 25-year power purchase agreement for output and is conducting an interconnection system impact study. The utility proposes to build a new 9km 138kV transmission line. Wind farm construction is tentatively scheduled to begin mid to late 2015 with commercial operations in late 2016. Meanwhile, three projects totalling 53MW are in development under the Green Options lottery scheme. Algonquin started construction at the 23MW Morse wind farm some 180km west of Regina in August. Siemens will supply and commission 10 direct-drive SWT 2.3MW 113 turbines and the C$81m project is expected to start operations in the first half of 2015. SaskPower is building a new 25kV/138kV substation and 138kV transmission tap line to connect the facility with energisation slated in February 2015. Morse will attract a C$104.02/MWh contract rate for the first full year of operations with an annual escalation provision of 2% over the expected 20-year term. Annual output is estimated at 104GWh/year and additional land under lease could lead to a future expansion. Capstone Infrastructure expects to commission five Enercon E82 turbines at its 10MW Riverhurst wind farm 130km east of Regina in 2017 and Gaia Power proposes to build the 20MW Western Lily project 70 miles east of the capital. Gaia has secured an exemption from requirement for an environmental impact assessment. The GO programme is under review and lotteries were not held in 2013 and 2014. SaskPower expects to release a revised scheme later this year. N eighbouring Manitoba built its last wind farm in 2011 and has no plans for further development. Provincial utility Manitoba Hydro generates nearly all its electricity from 15 hydro stations. It also purchases power from two independently owned wind farms totalling 260MW. The province plans to meet growing energy demand through hydro expansion. Publisher Renews Limited, First Floor, St George’s House, St George’s Street, Winchester, Hampshire, SO23 8BG, UK. Editor Deputy editor UK offshore UK offshore Germany offshore France offshore North America offshore Ireland Solar Technology Production Todd Westbrook +44 (0)1479 873 167 [email protected] Seb Kennedy +44 (0)208 981 8151 [email protected] Peter Baber +44 (0)1706 810 506 [email protected] Martin Halfpenny +44 (0)1962 890 479 [email protected] Hans-Dieter Sohn +49 177 288 9015 [email protected] Lisa Louis +33 627 933 453 [email protected] Patti Lane +1 416 481 9795 [email protected] Stephen Dunne +353 87 760 9207 [email protected] Sian Crampsie +44 (0)7711 007277 [email protected] Eize de Vries +31 6133 18104 [email protected] Richard Crockett, Phil Dixon [email protected] © All articles appearing in reNews are protected by copyright. Any unauthorised reproduction is strictly prohibited. Publisher Sales manager Sales executive Sales executive Dan Rigden Cassi Davison Vicky Mant Tom Allerston re News www.reNews.biz +44 +44 +44 +44 (0)1962 (0)1962 (0)1962 (0)1962 890 890 890 849 449 440 468 302 [email protected] [email protected] [email protected] [email protected] Coming soon in our series of in-depth market reports: OFFSHORE To advertise contact: [email protected] ISSN 1478-307X reNews costs £440 + VAT for a 12-month subscription. A Multiple User Subscription (10 users) costs £1490 + VAT; a Corporate Subscription (unlimited) costs £2565 + VAT.

© Copyright 2026

![Mid Western Ontario District Event [Oakville]](http://cdn1.abcdocz.com/store/data/000192548_1-753105a447977030eda8c92bf1e983c6-250x500.png)