KPMG Business Traveller Foreign Earnings Deduction (FED) module

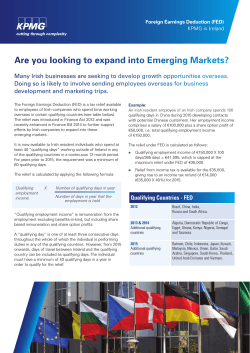

KPMG Business Traveller Foreign Earnings Deduction (FED) module Automated tracking and reporting of travel for FED Tax Relief for Business Travellers Claiming Tax Relief Foreign Earnings Deduction (FED) provides income tax relief to employees of Irish companies who spend time working abroad on business trips in certain countries. The relief was introduced in 2012 to support efforts by Irish companies to expand into emerging markets, originally the BRICS countries. The list of qualifying countries was expanded last year and from 1 January 2015 will extend further to cover 28 countries in total including: Singapore, Japan, the United Arab Emirates and Malaysia (see table overleaf). Where the conditions are met, an employee can get an annual income tax deduction of up to €35,000. Employees can claim the relief through their tax return and such claims must be supported by a statement from their employer indicating the dates of departure and return to Ireland and the location at which work duties were performed while abroad. From 1 January 2015, the qualifying conditions are less onerous so that more business travellers should be able to avail of the relief. These include: n The minimum number of days spent working overseas in qualifying countries will reduce to 40 days; n The consecutive number of days for a relevant trip will reduce to 3 days; and n Days of travel, between Ireland and the qualifying country, can be included as qualifying days. KPMG Link Mobile App & FED The KPMG Link Mobile App provides automated location tracking by using state of the art GPS functionality. The KPMG software provides employers and employees with a tailored FED report to capture travel between Ireland and FED countries only so that Irish companies can produce a report of employees who may be eligible to claim relief under FED. In addition, a report can be produced by employers as an automated and validated statement of travel to assist employees with their FED claims for their tax returns. It reduces the compliance risk and operational HR time spent validating travel to and from these locations. HR Dashboard Key Benefits for Employers: n Tailored report for FED purposes n Real-time reporting of employee whereabouts reduces compliance risk in the host locations n Better employee engagement n Reduced risk for HR providing FED statements n Can be integrated into your overall business traveller programme KPMG Link Mobile App Key Benefits for Business Travellers: n Supports claim for tax relief n Enables quicker refund of tax n User friendly mobile app n Automated GPS tracking means no manual intervention required Qualifying Countries - FED 2012 Additional qualifying countries Additional qualifying countries in 2015 in 2013 & 2014 Brazil, China, India, Russia and South Africa. Algeria, Democratic Republic of Bahrain, Chile, Indonesia, Japan, Congo, Egypt, Ghana, Kenya, Kuwait, Malaysia, Mexico, Oman, Qatar, Nigeria, Senegal and Tanzania. Saudi Arabia, Singapore, South Korea, Thailand, United Arab Emirates and Vietnam. Contacts Michael Rooney Head of Global Mobility Services Gearoidín Burke Director Laura McTiernan Associate Director t: +353 1 700 4061 e: [email protected] t: +353 1 410 1497 e: [email protected] t: +353 1 700 4113 e: [email protected] kpmg.ie © 2014 KPMG, an Irish partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Ireland. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation. The KPMG name, logo and “cutting through complexity” are registered trademarks of KPMG International Cooperative (“KPMG International”), a Swiss entity. If you’ve received this publication directly from KPMG, it is because we hold your name and company details for the purpose of keeping you informed on a range of business issues and the services we provide. If you would like us to delete this information from our records and would prefer not to receive any further updates from us please contact us at (01) 410 2665 or e-mail [email protected] Produced by: KPMG’s Creative Services. Publication Date: October 2014. (414)

© Copyright 2026