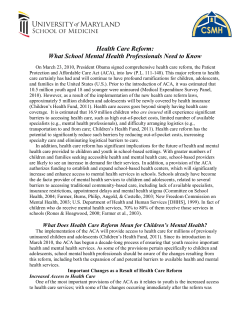

The Waterfall Effect: Transformative Impacts of Medicaid Expansion on States