2800

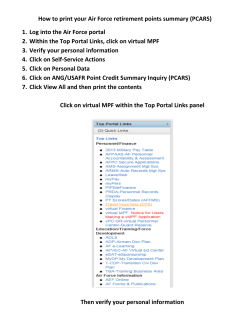

2800 Risk Disclosure Statements •The Tracker Fund of Hong Kong (“TraHK”) is an exchange-traded fund designed to provide investment results that closely correspond to the performance of the Hang Seng Index (“Index”) but its return may deviate from that of the Index. •Investment involves risk, including risks of concentration of investments in a single market and the constituent stocks of the Index, performance of the Index, economic, political and social developments, and risks relating to investment in Hong Kong-listed stocks. Investors may lose part or all of their investments. •The trading price of TraHK may differ from the underlying net asset value (“NAV”) per unit. •TraHK may not be suitable for all investors. Investors should not invest based on this advertisement only. Investors should read TraHK’s prospectus including all risk factors, consider the product features, their own investment objectives, risk tolerance level and other factors, and seek independent financial and professional advice as appropriate prior to making any investment. •The performance of TraHK, the NAV per unit and the performance by the manager and the trustee of their respective obligations are not guaranteed by the HKSAR Government. The HKSAR Government has given no guarantee or assurance that the investment objective of TraHK will be met. USING TraHK TO INVEST FOR RETIREMENT It is never too early to start planning for your retirement. Your first stage with retirement planning is to decide how much you will need to save. As a guideline, you are likely to need at least two-thirds of your working income to live well in retirement. And as a useful rule of thumb, to get a pension of two-thirds of your income by 65, you should put away a percentage of income that is equal to half your age. That means if you begin saving at 30, you should put away 15%, while if you don’t begin until 40 you should put away 20%. Obviously, even if you cannot afford that, starting with a lower amount is still useful. But it is important to keep contributing and to increase them as soon as you are able. 2800 USING TraHK TO INVEST FOR RETIREMENT / 02 Start investing early As money accumulates, it may grow faster and faster — a powerful phenomenon known as “compound growth”. Therefore, start investing early to enjoy the benefits of compounding. Benefits of compounding Savings (HK$) Investor A HK$ 7,871,759 $7,500,000 Investor B HK$ 3,646,147 $5,000,000 The difference between 1% and 0.5% annual charge may not seem much. But over time, it can make a big difference to your returns over time. $4,000,000 Investor C HK$ 1,688,872 $2,000,000 Investor D HK$ 782,274 $0 AGE 253035404550556065 Source: The Motley Fool Personal Finance Workbook: A Foolproof Guide to Organizing Your Cash and Building Wealth, by David Gardner and Tom Gardner and SSgA. It is important to remember that past performance is no guarantee of future results. This hypothetical example is based on four investors of different ages, from 25 to 55 years old. Each contributes HK$50,000 to a tax-deferred retirement plan every year for 10 years. An 8% rate of return compounded monthly is assumed. Income tax will be due when funds are withdrawn from the account. An investor’s account may earn more or less than this example. Investing in this manner does not ensure a profit or guarantee against loss in declining markets. This chart is for illustrative purposes only and not meant to represent the performance of any State Street Fund. When your money earns more money, it is natural to want to take that profit and use it. But when it comes to retirement saving, it is better to keep your hands off as the more your money accumulates, the faster your earnings may accelerate. Keep an eye on costs The difference between 1% and 0.5% annual charge may not seem much. But over time, it can make a big difference to your returns. If a more expensive fund allows you to invest in an asset class that you believe has higher potential returns or has a manager that you believe can significantly outperform the market, it may be worth paying. However, in general, keeping costs as low as possible is likely to improve your returns. Exchange-traded funds (ETFs) usually have much lower costs than mutual funds. Most ETFs are passive. They do not try to outperform the market, but simply aim to match it as closely as possible. If you are not confident that you can find a mutual fund where the manager is likely to outperform the market, an ETF may be a more cost effective investment. ETFs are traded on the stock market like a normal share and can be bought and sold throughout the trading day via a stockbroker. They can be an extremely useful tool for building a diversified portfolio at relatively low cost and switching between different assets cheaply and easily. 2800 USING TraHK TO INVEST FOR RETIREMENT / 03 One investment approach that investors may wish to consider is core/satellite investing, an idea that institutional managers have used for years. A core/satellite strategy combines index funds or ETFs at the core with satellite investments in actively managed or direct investments such as individual stocks and bonds, or mutual funds. The passive core component, which aims simply to match — neither beat nor lag — the performance of a certain group of assets (such as the Hang Seng Index) is a way to minimize the risk of underperforming the market. At the same time the complimentary, actively managed satellite securities or funds — carefully chosen to match an investor’s risk tolerance and time horizon — offer an opportunity to achieve outperformance. How TraHK can help your retirement • COST EFFICENCY: Low management fees, compared to many other investments. •INCOME POTENTIAL: The fund aims to pay dividends on a semi-annual basis. (Note: Dividends are not guaranteed.) •MITIGATED RISK THROUGH DIVERSIFICATION: A wide spread of Hong Kong’s largest, most established listed companies. One investment approach that investors may wish to consider is core/satellite investing. Ways of including TraHK in your retirement portfolio 1.Directly through your securities account The Tracker Fund of Hong Kong is flexible and easy to trade. Investors can buy and sell them like shares during Hong Kong trading hours, typically through a stock broker or a bank. The board lots size for TraHK is 500. Investors can also employ traditional share trading techniques including stop orders, limit orders and margin purchases (if available). 2.Through monthly stock investment programme For those who do not wish to risk timing the market, you may consider investing regularly (usually monthly) through a stock investment programme if your bank or broker offers such an option. This strategy, called dollar cost averaging, means that you purchase the stock at different prices over a period of time which averages out the costs. There are two advantages of this strategy; firstly, it removes the guesswork and is relatively inexpensive as many banks or brokers offer this type of plan from as little as HKD1,000 per month. It also encourages discipline and regular saving. To begin investing in TraHK through the stock investment programme, please contact your bank or broker. 3.Through contributions to an MPF fund investing in TraHK For MPF scheme members who would like to allocate part of their portfolios to Hong Kong equity, you might want to consider index-tracking MPF funds that invest in TraHK. Currently, there are six MPF providers that offer MPF funds with TraHK. Provider (By alphabetical order) Bank of Communications Trustee Limited* Bank of East Asia (Trustees) Limited* BCT Financial Limited BOCI-Prudential Trustee Limited# FIL Investment Management (Hong Kong) Limited Principal Trust Company (Asia) Limited* * These are MPF Trustees. The remaining names quoted are MPF Sponsors. # BOCI-Prudential Trustee Limited represents both MPF Sponsor and Trustee. 2800 USING TraHK TO INVEST FOR RETIREMENT / 04 This list of MPF Providers is not exhaustive and is provided for information purposes only. It is subject to change from time to time. This list of MPF Providers is not intended to be and shall not be construed as a solicitation, recommendation or invitation of an offer to buy or invest in, an offer or an advertisement of, any products provided by the above list of MPF Providers. The products as offered or provided by these MPF Providers are separate to and are not endorsed by State Street Global Advisors Asia Limited (道富環球投資管理亞洲有限公司) or TraHK. This brochure is issued by State Street Global Advisors Asia Limited (“Manager”) and has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). It may not be reproduced, distributed or transmitted to any person without express prior written permission. This brochure and the information contained herein may not be distributed and published in jurisdictions in which such distribution and publication is not permitted. Nothing contained here constitutes investment advice or should be relied on as such. The NAV per unit, the price of units, and the income from units, if any, may fall or rise. Past performance of TraHK is not necessarily indicative of its future performance. The prospectus for TraHK is available and may be obtained from the Manager and downloaded from TraHK’s dedicated website: www.trahk.com.hk. The semi-annual distributions are dependent on TraHK’s performance and are not guaranteed. Investors may only redeem units with the Manager under certain specified conditions and the listing of TraHK on the Stock Exchange of Hong Kong (“Stock Exchange”) does not guarantee a liquid market for the units. TraHK may be delisted from the Stock Exchange. TraHK’s website is not authorised by SFC and it may contain information relating to investment funds which are not authorised by the SFC. Tracking number : IBGAP-2328 Expiration date : 10/31/2015

© Copyright 2026