Module 1: PepsiCo

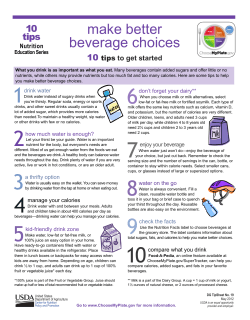

Module 1: PepsiCo Beverage Industry: Soft Drinks Consist of corporations that produce and sell soft drinks Some of these companies also sell food items Global soft drinks’ total revenue over $600 billion Major Soft Drink Corporations Coca-Cola PepsiCo Dr. Pepper Snapple Monster Beverage Co. Porter’s Five Forces These forces determine competitive intensity and profitability of firms in an industry Industry Competition, Buyer Power, Supplier Power, Product Substitutes, Threat of Entry Soft Drink Industry Competition Many competitive companies and varieties of soft drinks Endless areas for possible expansion, i.e. other products Large, established corporations in industry Soft Drink Buyer Power Demand for soft drinks is elastic Individual purchases are relatively insignificant Difficult for consumers to reproduce Buyers can be brand loyal Soft Drink Supplier Power Firms can easily switch between suppliers Entry to supplier market is easy, and a supplier can sway with lower price Many companies partly own their own suppliers Soft Drink Threat of Substitutes Consumers may prefer substitutes including, water, tea, and sports drinks Price does not make a difference in switching to substitutes Many companies have their own substitutes Soft Drink Threat of Entry Barriers to entry due to established brands Significant costs and qualifications to enter the market Industry leaders can force tough obstacles on new comers PepsiCo Food/beverage corporation headquartered in New York Product Pepsi-Cola and Frito-Lay merger in 1965 $65.49 billion in net revenue in 2012 PepsiCo Growth Strategy Research and development activities Drive innovation globally Develop new products Improve quality of existing products Enhance production processes Implement new, useful technologies PepsiCo Business Units PepsiCo Americas Foods PepsiCo Americas Beverages PepsiCo Europe PepsiCo Asia, Middle East and Africa PepsiCo Product Markets Carbonated drinks Non-carbonated drinks Snack foods PepsiCo Carbonated Drinks Pepsi Mountain Dew 7 Up Mirinda Pepsi Max Sierra Mist PepsiCo Non-Carbonated Drinks Tropicana Gatorade Lipton Teas Aquafina Snack Foods Lay’s Doritos Quaker Foods Cheetos Ruffles Tostitos Fritos Walkers PepsiCo Primary Competitors Coca-Cola Nestle S. A. Danone DPSG Kellogg Company General Mills Mondelez International Kraft PepsiCo Risk Factors Demand could be affected if no innovation Legal/regulatory environment limitations Bottom line contingent on ability to compete Need to grow business in emerging markets Unfavorable economic conditions Increasing costs or supply problems Failure to realize anticipated benefits Failure to complete successful acquisitions PepsiCo SWOT: Strengths Diverse products Successful M & A Strong distribution channel Great brand loyalty PepsiCo SWOT: Weaknesses Coca-Cola has large market share Heavy reliance on Wal-Mart as a customer Small profit margin PepsiCo SWOT: Opportunities Push for healthy food and drinks Emerging/developing foreign markets Many available companies for M & A activity PepsiCo SWOT: Threats Negative effects of legal issues Fluctuating tastes in food and beverage Many strong competitors in same industry

© Copyright 2026