– Chapter 13 Support Capital Budgeting

Chapter 13 – Support Capital Budgeting Techniques 13b.1 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Remember? The Different Methods of Evaluation? • • • • Payback Period (PBP) Internal Rate of Return (IRR) Net Present Value (NPV) Profitability Index (PI) Let us use the ‘New Asset’ project from Chapter 12 (VW13E-13b.xlsx) 13b.2 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Project Evaluation: Alternative Methods We will start with the cash flows of the project and also calculate the cumulative cash flow values. We can use Excel functions / approaches to calculate each of the following methods from the above cash flows. 13b.3 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Remember to refer to Excel spreadsheet ‘VW13E-13b.xlsx’ and the ‘New Asset’ tab. IRR: Project Evaluation The Internal Rate of Return function is built into Excel! Simply use the formula above: • $L$24:$L$28: represents the cash flows from period 0 through the last period (4 in our example) • K31: represents a “guess” as to the answer, but you do not need to put this in the formula 13b.4 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Remember to refer to Excel spreadsheet ‘VW13E-13b.xlsx’ and the ‘New Asset’ tab. NPV: Project Evaluation •The Net Present Value (NPV) function is built into •Excel and we used it in the TVM chapter! • K31: represents the rate of return investors expect to earn for the given amount of risk (discount rate) • $L$25:$L$28: represents the cash flows from period 1 through the last period (we do NOT use period 0) • $L$24: We subtract the ICO (or add if we already assigned it a negative sign as we did in slide 3). • This is an important “quirk” with the Excel function 13b.5 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Remember to refer to Excel spreadsheet ‘VW13E-13b.xlsx’ and the ‘New Asset’ tab. PI: Project Evaluation The Profitability Index (PI) function does not exist in Excel, but we can use a simple calculation using the NPV answer or a second method directly using the NPV function. • We can simply use the NPV earlier ($K$34) and divide by the ICO (-$L$24) and add this to 1.00 – [Method #1] • Second, we use the NPV formula and calculate the present value of cash flows in periods 1 through 4 discounted at the $K$31 discount rate. This value we simply divide by the ICO of -$L$24 – [Method #2] 13b.6 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Remember to refer to Excel spreadsheet ‘VW13E-13b.xlsx’ and the ‘New Asset’ tab. PBP: Project Evaluation The Payback Period (PBP) function does not exist in Excel either, but this complicated formula is one way to write a set of if functions to determine PBP. • The IF statements attempt to find when the cumulative cash flows change from a negative sign to a positive sign. • Once that occurs, we know the core number of years and we can then calculate the portion of the next year to get payback • To make this work for a longer project life, you need to add additional imbedded if statements 13b.7 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Asset Replacement? • Now go back to Chapter 12 and the cash flows we developed for the ‘Asset Replacement’ project and calculate the PBP, IRR, NPV and PI. • Hint: The answers are shown in ‘VW13E13b.xlsx’ file on the ‘Asset Replacement’ tab. • Given are assumptions, would you want to replace the project? Why or why not? 13b.8 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Remember? Potential Problems Under Mutual Exclusivity Ranking of project proposals may create contradictory results. A. Scale of Investment B. Cash-flow Pattern C. Project Life 13b.9 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Remember? A. Scale Differences Compare a small (S) and a large (L) project. END OF YEAR 13b.10 NET CASH FLOWS Project S Project L 0 –$100 –$100,000 1 0 0 2 $400 $156,250 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Remember to refer to Excel spreadsheet ‘VW13E-13b.xlsx’ and the ‘Scale’ tab. A. Scale Differences Refer to VW13E-13b.xlsx on the ‘Scale’ tab. 13b.11 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. A. Scale Differences • Remember that we evaluate the projects based on maximizing shareholder wealth • So we choose the ‘Large’ project even though the other evaluation methods seem better! • In Excel, we can use the functions or alternatively ‘Data Tables’ to create the chart on the previous slide which allows us to easily graph the NPV Profiles. 13b.12 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Remember? B. Cash Flow Pattern Let us compare a decreasing cash-flow (D) project and an increasing cash-flow (I) project. END OF YEAR 13b.13 NET CASH FLOWS Project D Project I 0 1 –$1,200 1,000 –$1,200 100 2 500 600 3 100 1,080 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Remember to refer to Excel spreadsheet ‘VW13E-13b.xlsx’ and the ‘Pattern’ tab. B. Cash Flow Pattern Refer to VW13E-13b.xlsx on the ‘Pattern’ tab. 13b.14 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. B. Cash Flow Pattern • • • • 13b.15 Remember that we evaluate the projects based on maximizing shareholder wealth, but in this case they have essentially the SAME NPVs. So we evaluate the uncertainty … to the left of the intersection the increasing CF pattern is best and to the right it is decreasing Both are acceptable projects, but if we must choose only one, the “decreasing” pattern might be better • It generates cash quicker which has less risk • It has a positive NPV as long as the discount rate is less than about 23% Again, we can use the functions or ‘Data Tables’ to create the chart on the previous slide. Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Remember? C. Project Life Differences Let us compare a long life (X) project and a short life (Y) project. END OF YEAR 13b.16 NET CASH FLOWS Project X Project Y 0 1 –$1,000 0 –$1,000 2,000 2 0 0 3 3,375 0 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Remember to refer to Excel spreadsheet ‘VW13E-13b.xlsx’ and the ‘Life’ tab. C. Project Life Differences 13b.17 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. B. Cash Flow Pattern (NOT renewing project) • Remember that we evaluate the projects based on maximizing shareholder wealth, but in this case we have an overriding question – what happens at the end of the first year if we choose project “Y”? • We do indeed choose Project “X” (see previous slide) because the NPV is greatest if, and only if, this is a project that won’t be repeated or renewed. With the discount rates we used, X is superior to Y in every scenario shown. • If this project is repeated, then we need to re-evaluate the cash flows as follows. • Again, we can use the functions or ‘Data Tables’ to create the chart on the previous slide. 13b.18 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Remember to refer to Excel spreadsheet ‘VW13E-13b.xlsx’ and the ‘Life2’ tab. C. Project Life Differences 13b.19 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. B. Cash Flow Pattern (NOT renewing project) • Notice on the previous slide that we created the repeated cash flows for the project assuming no change in cash flows. • We are still evaluating projects based on maximizing shareholder wealth. • We now choose Project “Y” (see previous slide) because the NPV is greatest! • In fact, Y is greatly superior to X in all of the scenarios shown. • Again, we can use the functions or ‘Data Tables’ to create the chart on the previous slide. 13b.20 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Remember? Capital Rationing Capital Rationing occurs when a constraint (or budget ceiling) is placed on the total size of capital expenditures during a particular period. Example: Julie Miller must determine what investment opportunities to undertake for Basket Wonders (BW). She is limited to a maximum expenditure of $32,500 only for this capital budgeting period. 13b.21 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Remember? Capital Rationing We can use the “Solver” Add-in for Excel to find the optimal mix EASILY!!! First make sure you have it available on your computer by: • Click the round Microsoft Office button (upper left corner of screen) when Excel is open, click “Excel Options” at the bottom, and then click the “Add-ins” category on the left side. • In the “Manage” box at the bottom, choose “Excel Add-ins”, and then click the “Go” button. • In the pop-up box of Add-ins available, check the “Solver Add-in” box, and then click OK. 13b.22 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Remember? Available Projects for BW Project A B C D E F G H 13b.23 ICO $ 500 5,000 5,000 7,500 12,500 15,000 17,500 25,000 IRR 18% 25 37 20 26 28 19 15 $ NPV PI 50 6,500 5,500 5,000 500 21,000 7,500 6,000 1.10 2.30 2.10 1.67 1.04 2.40 1.43 1.24 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Capital Rationing • We are going to use this data that can be found in VW13E-13b.xlsx or you can enter the data yourself. • Your data should look something like below in the yellow section. • The “Yes/No” box is a binary variable that determines if we want to keep that project as being optimal. 13b.24 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Capital Rationing • Let us open Solver. Click on the ‘Data’ tab and then in the ‘Analysis’ ribbon choose ‘Solver’. • The box should open like the following example: 13b.25 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Capital Rationing • “Set Target Cell” equal to the box that sums the NPVs and click on the “Max” option • In the “By Changing Cells” area, set it to the binary ‘Yes / No’ values (F3:F10 in this case) 13b.26 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Capital Rationing • Now we need to add our constraints. • We want the values of F3:F10 to be ONLY a “0” or a “1” value • We want G11, sum of the ICOs to be $32,500 or less 13b.27 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer. Capital Rationing Now we solve by clicking the ‘SOLVE’ button! Look, only projects B, C, D and F are chosen!! If you look at the Excel formulas for columns ‘G’ and ‘H’ you will see that the values are set to the “Yes/No” variable value (either 0 or 1) multiplied by the original value in columns ‘C’ and ‘E’. This is a nifty way to find the optimal decision! 13b.28 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

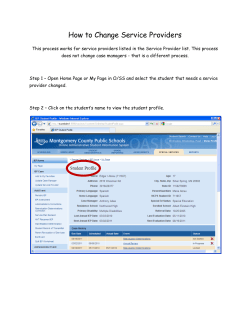

© Copyright 2026