or does it? The Valuation of Over-rented Properties

What Goes Round Comes Round: or does it? The Valuation of Over-rented Properties ERES 2011 Sarah Sayce Judy Smith Fiona Quinn Philip Parnell presented by Sarah Sayce 1 Agenda • • • • An introduction: the Scenario of the 1990s The Current Market Scenario Exploring Current Practice: a pilot study Implications for valuation techniques: A discussion of the Issues • Conclusions 2 Why This is Timely Property Total Returns •2 property collapses 30 •20 years apart 20 10 •This swifter – deeper %0 •But superficially similar -10 -20 -30 1981 1984 1987 1990 1993 1996 1999 2002 2005 2008 Years Income Capital value Source: adapted from IPD 2010 annual indices 3 Why This is Timely •2 property collapses •20 years apart •This swifter – deeper •But superficially similar Do they raise the same valuation issues? Did we learn nothing last time round? 4 What Happened in the early 1990s • The Market: • Rental values collapsed in the wake of over-supply and economic downturn and high interest rates • Capital values collapsed • Commercial property rents secured on covenant not value • Estimated 85% City of London Offices over-rented • Yields moved sharply up • Property priced as no growth investment • Tenants trapped in long leases: • Mainly 25 year terms • Upward only rent reviews – no get outs • Ongoing liability (privity of contract) Valuations called in to question.... 5 What Happened in the early 1990s • Valuers and their methods were called into question as: • Secured loans failed and valuations exposed • Market assumptions of implied growth questioned • Institutions questioned the medium of property as an appropriate investment vehicle.. • Failure to recognise real estate as part of the investment spectrum Worse still • Valuers were found to have been negligent through a string of high profile negligence cases 6 What Happened in the 1990s- the Response in Practice • Yields were adjusted and a simple initial yield approach adopted to place risk within the cap rate • The Term and Reversion approach exposed as inappropriate and inaccurate 7 Problem- Double counting Rent passing Over-rent Over-rent MR Reversion- all risks yield implies growth at each future rent review into perpetuity End of lease What Happened in the 1990s- the Academic Response “more explicit techniques highlight a number of areas which are either overlooked or over-simplified in traditional techniques, particularly regarding the timing and level of the projected cashflows” (Adams and Booth, 1996) • • • • Comparability was viewed as inappropriate Risk lay in cash flow rather than physical asset Call for greater sophistication Encouragement to adopt ‘short-cut’ DCF which could accommodate risks to the cash flow as explicit assumptions made about future rental growth 9 What Happened in the 1990s- the Academic Response • Tiered top slice • Required specific assumptions about the future movement of rental growth • Required market yield and money-based rate • Placed risk where is really lay – more logically • 2 versions proposed Adapted from Crosby and Goodchild, 1992 10 Tiered Top Slice-vertical split of top slice Rent passing Tier 1 top slice at e% Tier 2 top slice at e% x PV at e% Tier 3 top slice at e% x PV at e% Over-rent Over-rent MR MR capped for 3 years at e% 3 years RR Market rent x capitalised at market yield x PV £1 at equated yield 8 years RR 13 years RR Layered Top Slice-horizontal split of top slice Rent passing Layer 3 top slice at e% Layer 2 top slice at e% Over-rent Layer 1 top slice at e% Over-rent MR MR x cap 3 years at e% 3 years RR Market rent x capitalised at market yield x PV £1 at equated yield 8 years RR 13 years RR Aftermath: call for Change • Complex • Issues around assessing rental growth prospect • Knowledge issue Challenges around level of rental growth Connected to lease length 13 Structures in place to improve Valuations • Valuer Guidance • Increased scope of ‘Red Book’ • Guidance of differentiation MV and Worth • Tightening of reporting requirements • Requirements to rotate valuers • Valuing under conditions of Uncertainty (GN5) issued 2003; reviewed 2008; • Valuing certainty (GN1, 2011) – call to be explicit and transparent; use of Sensitivity Analysis where high volatility • Wider use of DCF use advocated (RICS, 2010; IVSC, 2011) 14 Structures in place to improve Valuations • Discussions regarding ‘Mark to Market v Mark to Model’ (RICS 2008) • Tracking valuation accuracy reveals greater consistency • Valuers “quick to grasp the nettle” (French 2010) 15 Same but different • • • • Same Collapse in confidence Rental and capital values fall Financial market issues Significant number of over-rented properties Different • Low interest rates • Shorter leases (average 6 years) • Break clauses • Risk adverse investors • Privity of Contract abolished • Easier assignments • Greater understanding of worth Therefore market issues are different- but still need for explicit exploration of rental growth and understanding of required returns and risk profiling There is a clear case for explicit valuations 16 A Pilot Study Leading Valuation firms + 2 smaller firms All members of RICS Valuer Registration Scheme Scenario presented of over-rented London City Office • In relation to scenario: – How you would deal with the over-rent? – growth implicit or growth explicit approach- and specifically what method? – How would you establish the nature and quantum of risk and factor it in? 17 A Pilot Study • More generally, what is Impact on valuations of: –Historically low interest rate –Finance cost and availability –Changed Lease structure 18 Findings: General Approach Very consistent answers • • • • • • An implicit approach still prevails One valuer – Term and Reversion Core and top-slice – very much like 20 years ago 2 simply take 1 cap rate (initial yield) But build in for voids at lease end (majority view); Adjust yield for risk of voids (minority view) 19 Findings: Use of Explicit Approach • DCF still a minority game • But – some using DCF as a ‘check’ against traditional – Where they did the period ranged from 5 – 9 years to build in for voids • DCF more likely “Where purchaser likely to be a fund as recognition that fund managers use explicit methods” 20 Findings: Approach to Risk • • • • • • Tenant covenant viewed as the chief risk Build in for Voids Build in for voids + rent free period Analyse against covenant strength (majority) Take a view on market at lease expiry No indication of application of sensitivity analysis 21 Findings: Placing the Valuation in the Wider Context • The changed interest rate environment is not perceived as relevant – simply rely on market comparable evidence • only one valuer commented that there would be need to look at wider money market if few comparables • Another interest rates are only one factor in market pricing” • No account of lending market or availability of finance – assumption now that market is equity driven 22 Findings: Placing the Valuation in the Lease Context • The issue of changes to privity etc not raised • Lease length and void risk – majority would build in voids explicitly as assume tenant would leave – minority simply build in as part of risk profile • No valuer assumed that tenant would re-negotiate back to Market Rent – or considered the early surrender scenario 23 Conclusion • Very little changed in market practice over 20 years • Hardcore (core and top-slice) is growth implicit – this was difficult to justify before – arguably still the case – despite different market conditions • Taking voids into account explicitly is not compatible with hardcore - so implies a move back to Term and Reversion.. • Using DCF as a back up check - progress? • The changes to leases structure reduces the issue in valuation terms as over-rents will not persist 24 Conclusion • The lack of relating of valuations to the wider financial markets is perhaps concerning given that the property is compared to other asset classes • The lack of change of methodology does present risks • Transparency and rigour are key • Initial yield and traditional simply too doesn’t work in times of economic uncertainty • Time to dust off those textbooks –or extend the survey? 25

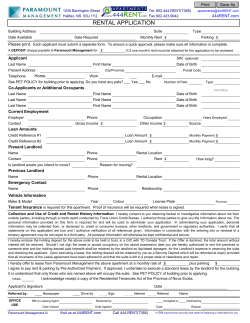

© Copyright 2026