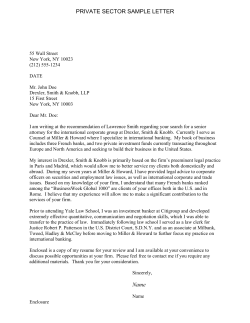

B P S F