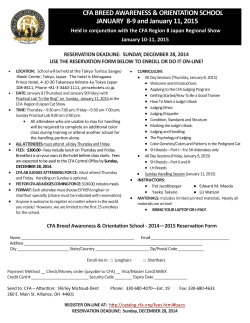

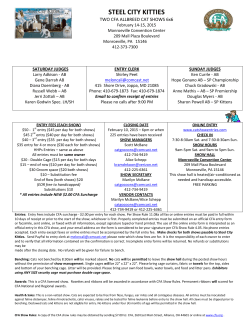

CHAPTER 4 FINANCIAL REPORTING STANDARDS Presenter’s name Presenter’s title

CHAPTER 4 FINANCIAL REPORTING STANDARDS Presenter’s name Presenter’s title dd Month yyyy OVERVIEW • Income statement components and format • Accounting issues - Revenue recognition - Expense recognition - Inventory - Depreciation - Nonrecurring items • Earnings per share • Income statement analysis • Comprehensive income Copyright © 2013 CFA Institute 2 INCOME STATEMENT COMPONENTS • Also called the “statement of earnings,” “statement of operations,” and “profit and loss statement (P&L)” • Presents results of operations for the accounting period Revenues – Expenses = Net income Revenue + Other Income + Gains – Expenses – Losses = Net income Copyright © 2013 CFA Institute 3 INCOME STATEMENT FORMAT • Subtotals - Gross profit (i.e., revenue less cost of sales) - Multistep format: Income statement shows gross profit subtotal - Single-step format: Income statement excludes gross profit subtotal - Operating profit (i.e., revenue less all operating expenses) - Profits before deducting taxes and interest expense and before any other nonoperating items - Operating profit and EBIT (earnings before interest and taxes) are not necessarily the same • Expense Grouping Copyright © 2013 CFA Institute 4 INCOME STATEMENT FORMAT: EXAMPLE 1 COLGATE-PALMOLIVE COMPANY Colgate Annual Report Copyright © 2013 CFA Institute 5 INCOME STATEMENT FORMAT: EXAMPLE 2 L’OREAL GROUP L'Oreal's Annual Report Copyright © 2013 CFA Institute 6 INCOME STATEMENT FORMAT: EXAMPLE 3 PROCTER & GAMBLE Proctor & Gamble Report Copyright © 2013 CFA Institute 7 GENERAL PRINCIPLES OF REVENUE RECOGNITION AND ACCRUAL ACCOUNTING • Revenue recognition can occur independently of cash movements—for example, in the case of the - sale of goods and services on credit or - receipt of cash in advance of providing goods and services • A fundamental principle of accrual accounting is that revenue is recognized (reported on the income statement) in the period in which it is earned. Copyright © 2013 CFA Institute 8 WHEN TO RECOGNIZE REVENUE • IFRS specify that revenue from the sale of goods is to be recognized when the following conditions are satisfied: - Entity has transferred to the buyer the significant risks and rewards of ownership of the goods; - Entity retains neither continuing managerial involvement with nor effective control over the goods sold; - Amount of revenue can be measured reliably; - It is probable that the economic benefits associated with the transaction will flow to the entity; and - Costs incurred with respect to the transaction can be measured reliably. Copyright © 2013 CFA Institute 9 WHEN TO RECOGNIZE REVENUE U.S. GAAP specify that revenue should be recognized when it is “realized or realizable and earned.” The U.S. Securities and Exchange Commission (SEC) provides guidance on how to apply the accounting principles. This guidance lists four criteria to determine when revenue is realized or realizable and earned: 1. There is evidence of an arrangement between buyer and seller. 2. The product has been delivered, or the service has been rendered. 3. The price is determined or determinable. 4. The seller is reasonably sure of collecting money. Copyright © 2013 CFA Institute 10 SPECIFIC REVENUE RECOGNITION APPLICATIONS: LONG-TERM CONTRACTS • Long-term contract: contract that spans a number of accounting periods. • Percentage-of-completion method - Use when the outcome of a contract can be measured reliably. - In each accounting period, the company estimates what percentage of the contract is complete and then reports that percentage of the total contract revenue in its income statement. - Contract costs for the period are expensed against the revenue. - Net income or profit is reported each year as work is performed. Copyright © 2013 CFA Institute 11 SPECIFIC REVENUE RECOGNITION APPLICATIONS: LONG-TERM CONTRACTS EXAMPLE Example that uses the percentage-of-completion method of revenue recognition: • Network Construction project: bid was $5,000,000 and estimated costs to complete were $4,000,000 - Year 1: Costs incurred of $3,000,000 (assume this mirrors the percentage complete) - Revenue? - Cost of revenue? - Year 2: Job is completed with costs of $1,000,000 - Revenue? - Cost of revenue? Copyright © 2013 CFA Institute 12 SPECIFIC REVENUE RECOGNITION APPLICATIONS: LONG-TERM CONTRACTS EXAMPLE Example that uses the percentage-of-completion method of revenue recognition (continued): • Network Construction project: bid was $5,000,000 and estimated costs to complete were $4,000,000. - Year 1: Costs incurred $3,000,000 (assume this mirrors the percentage complete) - Revenue? - Cost of revenue? - Year 2: Job is completed with costs of $1,250,000 (a cost overrun) - Revenue? - Cost of revenue? Copyright © 2013 CFA Institute 13 SPECIFIC REVENUE RECOGNITION APPLICATIONS: LONG-TERM CONTRACTS • Percentage-of-completion is the preferred method under both IFRS and U.S. GAAP • When the outcome of a contract cannot be measured reliably, there are alternatives to the percentage-of-completion method - Assuming it is probable that costs will be recovered, IFRS permit recognition of revenue up to the amount of costs incurred. - U.S. GAAP (but not IFRS) permit the completed contract method. • Company does not report any income until the contract is substantially finished. • Completed contract method is also acceptable when the entity has primarily short-term contracts. Copyright © 2013 CFA Institute 14 SPECIFIC REVENUE RECOGNITION APPLICATIONS: LONG-TERM CONTRACTS EXAMPLE • Assume the following: - A company has a contract to build a network for a customer for a total sales price of $10 million. - Network will take an estimated three years to build. - Considerable uncertainty surrounds total building costs because new technologies are involved. - The outcome cannot be reliably measured, but it is probable that the costs up to the agreed-upon price will be recovered. - Expenditures total $3 million, $5.4 million, and $6 million as of the end of Year 1,2, and 3, respectively. • Question: How much revenue, expense (cost of construction), and income would the company recognize each year under IFRS and, using the completed contract method, under U.S. GAAP? Copyright © 2013 CFA Institute 15 SPECIFIC REVENUE RECOGNITION APPLICATIONS: LONG-TERM CONTRACTS EXAMPLE • Question: How much revenue, expense (cost of construction), and income would the company recognize each year under IFRS and using the completed contract method under U.S. GAAP? • Answer: Under IFRS, recognize revenue to the extent of contract costs incurred. Company would recognize - Year 1, $3 million construction cost, $3 million revenue, and thus, $0 income - Year 2, $2.4 million construction cost, $2.4 million revenue, and thus, $0 income - Year 3, $0.6 million construction cost, remaining $4.6 million revenue (because the contract has been completed and the outcome is now measurable), and thus, $4 million income. • Answer: With the completed contract method under U.S. GAAP, no revenue will be recognized until the contract is complete. - Year 1, $0 million construction cost, $0 million revenue, and thus, $0 income - Year 2, $0 million construction cost, $0 million revenue, and thus, $0 income - Year 3, $6 million construction cost, $10 million revenue (because the contract has been completed), and thus, $4 million income Copyright © 2013 CFA Institute 16 SPECIFIC REVENUE RECOGNITION APPLICATIONS: INSTALLMENT SALES • Installment sales: Sales in which proceeds are to be paid in installments over an extended period. • IFRS separate the installments into the sale price (present value of the installment payments) and an interest component. • Revenue attributable to the sale price is recognized at the date of sale • Revenue attributable to the interest component is recognized over time. • International standards note, however, that the guidance for revenue recognition must be considered in light of local laws regarding the sale of goods in a particular country. Copyright © 2013 CFA Institute 17 SPECIFIC REVENUE RECOGNITION APPLICATIONS: INSTALLMENT SALES • Sale of real estate under U.S. GAAP • A sale of real estate is reported at time of sale using normal revenue recognition conditions when seller has completed the significant activities in the earnings process and is either 1) assured of collecting the selling price or 2) able to estimate amounts that will not be collected. • Otherwise, defer some of the profit using - the installment method, in which the portion of the total profit recognized in each period is determined by the percentage of the total sales price for which the seller has received cash, or - the cost recovery method, in which the seller does not report any profit until the cash amounts paid by the buyer—including principal and interest on any financing from the seller—are greater than all the seller’s costs of the property. Copyright © 2013 CFA Institute 18 SPECIFIC REVENUE RECOGNITION APPLICATIONS: EXAMPLE • Assume the following: - Sales price and cost of a property are $2,000,000 and $1,100,000, respectively, so that the total profit to be recognized is $900,000. - Seller received a down payment of $300,000 cash, with the remainder of the sales price to be received over a 10-year period. - There is significant doubt about the ability and commitment of the buyer to complete all payments. - How much profit will be recognized attributable to the down payment if 1) the installment method is used? 2) the cost recovery method is used? Copyright © 2013 CFA Institute 19 SPECIFIC REVENUE RECOGNITION APPLICATIONS: EXAMPLE How much profit will be recognized attributable to the down payment if the installment method is used? - Installment method apportions the cash receipt between cost recovered and profit using the ratio of profit to sales value. - Here, the ratio of profit to sales value equals $900,000/$2,000,000 = 45%. - Seller will recognize the following profit attributable to the down payment: 45% of $300,000 = $135,000. How much profit will be recognized attributable to the down payment if the cost recovery method is used? - Under the cost recovery method, do not recognize any profit until cash received from buyer exceeds all costs. - Here, $300,000 cash paid by the buyer is less than the seller’s cost of $1,100,000. - Seller will recognize $0 profit attributable to the down payment. Copyright © 2013 CFA Institute 20 SPECIFIC REVENUE RECOGNITION APPLICATIONS: GROSS VS. NET REPORTING • Merchandising companies typically sell products that they purchase from a supplier. To account for the sales, they - record the amount of the sale proceeds as sales revenue and - record the cost of the products as the cost of goods sold. • Some internet-based merchandising companies sell products that they never hold in inventory; they simply arrange for the supplier to ship the products directly to the end customer. Should they record revenues of - the gross amount of sales proceeds received from their customers? - the net difference between sales proceeds and their cost? • U.S. GAAP guidance - Report revenues gross if the company is the primary obligor under the contract, bears inventory risk and credit risk, can choose its supplier, and has reasonable latitude to establish price. - Otherwise, report revenues net. Copyright © 2013 CFA Institute 21 SPECIFIC REVENUE RECOGNITION APPLICATIONS: EXAMPLE Company OLR, an online retailer, buys tickets (airline, concert, etc.), resells them for $100, and earns a 10% fee. What is the correct accounting? Alternative A: Gross - Revenue $100 - Cost of goods sold $90 - Gross Profit $10 Alternative B: Net - Revenue Copyright © 2013 CFA Institute $10 22 SPECIFIC REVENUE RECOGNITION APPLICATIONS: EXAMPLE “We evaluate whether it is appropriate to record the gross amount of product sales and related costs or the net amount earned as commissions. Generally, when we are primarily obligated in a transaction, are subject to inventory risk, have latitude in establishing prices and selecting suppliers, or have several but not all of these indicators, revenue is recorded at the gross sales price. We generally record the net amounts as commissions earned if we are not primarily obligated and do not have latitude in establishing prices.” Amazon Inc. (2011), 10-K Copyright © 2013 CFA Institute 23 GENERAL PRINCIPLES OF EXPENSE RECOGNITION • Fundamental principle: A company recognizes expenses in the period in which it consumes (i.e., uses up) the economic benefits associated with the expenditure. • Matching principle: Costs are matched with revenues. • As with revenue recognition, expense recognition can occur independently of cash movements. - Inventory and cost of goods sold - Plant, property, and equipment and depreciation Copyright © 2013 CFA Institute 24 SPECIFIC EXPENSE RECOGNITION APPLICATIONS: INVENTORY Inventory Cost Flow Beginning Inventory Goods Purchased Balance Sheet Copyright © 2013 CFA Institute Goods Available for Sale Ending Inventory Cost of Goods Sold Income Statement 25 SPECIFIC EXPENSE RECOGNITION APPLICATIONS: EXAMPLE Inventory Purchases First quarter 2,000 units at $40 per unit Second quarter 1,500 units at $41 per unit Third quarter 2,200 units at $43 per unit Fourth quarter 1,900 units at $45 per unit Total 7,600 units at a total cost of $321,600 Inventory sales during the year: 5,600 units at $50 per unit What are the revenue and expense for these transactions during the year? Assume the company specifically identifies that - the 5,600 units sold were those purchased in the 1st and 2nd quarter plus 2,100 of the units purchased in the 3rd quarter and - the 2,000 remaining units were 100 of those purchased in the 3rd quarter plus the 1,900 purchased in the 4th quarter. Copyright © 2013 CFA Institute 26 SPECIFIC EXPENSE RECOGNITION APPLICATIONS: EXAMPLE SOLUTION • Revenue = $280,000 (5,600 units times $50 per unit) Total available for sale • Cost of Goods Sold The 5,600 units that were sold were specifically identified as follows: From 1st quarter: 2,000 units at $40 per unit $80,000 From 2nd quarter: 1,500 units at $41 per unit $61,500 From 3rd quarter: 2,100 units at $43 per unit $90,300 Total cost of goods sold $231,800 • Ending inventory From the 3rd quarter: 100 units at $43 per unit $4,300 From the 4th quarter: 1,900 units at $45 per unit $85,500 Total remaining (or ending) inventory cost $89,800 Copyright © 2013 CFA Institute 27 SPECIFIC EXPENSE RECOGNITION APPLICATIONS: EXAMPLE Inventory Purchases First quarter 2,000 Second quarter 1,500 Third quarter 2,200 Fourth quarter 1,900 Total 7,600 units at $40 per unit units at $41 per unit units at $43 per unit units at $45 per unit units at a total cost of $321,600 Inventory sales during the year 5,600 units at $50 per unit. Revenue and expense for these transactions during the year? Assume the company does not specifically identify the units, but instead uses the weighted average cost method of inventory costing. Copyright © 2013 CFA Institute 28 SPECIFIC EXPENSE RECOGNITION APPLICATIONS: EXAMPLE SOLUTION • Revenue = $280,000 (5,600 units times $50 per unit) Total available for sale • Average cost per unit = Total cost of goods available divided by total units available = $321,600/7,600 units = $42.3158 per unit • Cost of goods sold = 5,600 units at $42.3158 per unit $236,968 • Ending inventory = 2,000 units at $42.3158 per unit $84,632 Copyright © 2013 CFA Institute 29 SPECIFIC EXPENSE RECOGNITION APPLICATIONS: EXAMPLE Inventory Purchases First quarter 2,000 Second quarter 1,500 Third quarter 2,200 Fourth quarter 1,900 Total 7,600 units at $40 per unit units at $41 per unit units at $43 per unit units at $45 per unit units at a total cost of $321,600 Inventory sales during the year: 5,600 units at $50 per unit. What are the revenue and expense for these transactions during the year? Assume the company does not specifically identify the units, but instead uses the FIFO (first in, first out) method of inventory costing. Copyright © 2013 CFA Institute 30 SPECIFIC EXPENSE RECOGNITION APPLICATIONS: EXAMPLE SOLUTION Inventory Purchases First quarter 2,000 Second quarter 1,500 Third quarter 2,200 Fourth quarter 1,900 Total 7,600 units at $40 per unit units at $41 per unit units at $43 per unit units at $45 per unit units at a total cost of $321,600 Using the FIFO method of inventory costing: FIFO to determine COGS: 2,000 from 1st quarter at $40 per unit + 1,500 from 2nd quarter at $41 per unit + 2,100 from 3rd quarter at $43 per unit COGS = $231,800 Copyright © 2013 CFA Institute 31 SPECIFIC EXPENSE RECOGNITION APPLICATIONS: EXAMPLE Inventory Purchases First quarter 2,000 Second quarter 1,500 Third quarter 2,200 Fourth quarter 1,900 Total 7,600 units at $40 per unit units at $41 per unit units at $43 per unit units at $45 per unit units at a total cost of $321,600 Inventory sales during the year: 5,600 units at $50 per unit. What are the revenue and expense for these transactions during the year? Assume the company reports under under U.S. GAAP LIFO is not allowed IFRS.and uses the LIFO Assume company does notofspecifically identify the units, but instead (last the in, first out) method inventory costing. uses the LIFO method of inventory costing. Copyright © 2013 CFA Institute 32 SPECIFIC EXPENSE RECOGNITION APPLICATIONS: EXAMPLE SOLUTION Inventory Purchases First quarter 2,000 Second quarter 1,500 Third quarter 2,200 Fourth quarter 1,900 Total 7,600 units at $40 per unit units at $41 per unit units at $43 per unit units at $45 per unit units at a total cost of $321,600 Using the LIFO method of inventory costing: LIFO to determine COGS: 1,900 from 4th quarter at $45 per unit + 2,200 units at $43 per unit + 1,500 units at $41 per unit COGS = $241,600 Copyright © 2013 CFA Institute 33 SUMMARY TABLE ON INVENTORY COSTING METHODS COGS when prices are rising relative to the other two methods Method Description FIFO Assumes that earliest items purchased were Lowest sold first Assumes most recent items purchased were Highest* sold first Averages total costs Middle over total units available LIFO Average Cost Ending Inventory when prices are rising relative to the other two methods Highest Lowest* Middle *Assumes no LIFO layer liquidation. LIFO layer liquidation occurs when the volume of sales exceeds the volume of other purchases in the period so that some sales are assumed to be from existing, relatively low-priced inventory rather than from more recent purchases. Copyright © 2013 CFA Institute 34 INVENTORY METHOD: EXAMPLE DISCLOSURE “Inventory Valuation Inventories are valued at the lower of cost or market value. Product related inventories are primarily maintained on the first-in, first-out method. Minor amounts of product inventories, including certain cosmetics and commodities, are maintained on the last-in, first-out method. The cost of spare part inventories is maintained using the average cost method. Procter & Gamble (2011), Annual Report “Inventories are valued at the lower of cost or net realizable value. Cost is calculated using the weighted average cost method.” L’Oreal Group (2011), Registration Document Copyright © 2013 CFA Institute 35 INVENTORY METHOD: EXAMPLE DISCLOSURE “Inventories. Inventories are stated at the lower of cost or market. The cost of approximately 80% of inventories is determined using the firstin, first-out (FIFO) method. The cost of all other inventories, predominantly in the U.S. and Mexico, is determined using the last-in, first-out (LIFO) method.” Colgate-Palmolive (2011), Annual Report (Note 2) “Inventories valued under LIFO amounted to $271 and $263 at December 31, 2011 and 2010, respectively. The excess of current cost over LIFO cost at the end of each year was $30 and $52, respectively. The liquidations of LIFO inventory quantities had no material effect on income in 2011, 2010 and 2009.” Colgate-Palmolive (2011), Annual Report (Note 16) Copyright © 2013 CFA Institute 36 SPECIFIC EXPENSE RECOGNITION APPLICATIONS: DEPRECIATION • Depreciation: Process of systematically allocating costs of long-lived assets over the period during which the assets are expected to provide economic benefits. - Depreciation: term commonly applied for physical long-lived assets, such as plant and equipment (NOT land) - Amortization: Term commonly applied to this process for intangible long-lived assets with a finite useful life • Depreciation Methods: - Straight line - Accelerated (i.e., diminishing balance) - Units of production Copyright © 2013 CFA Institute 37 SPECIFIC EXPENSE RECOGNITION APPLICATIONS: DEPRECIATION EXAMPLE • Equipment cost = $9,000. Estimated residual = $0. Useful life = 3 years. • Annual depreciation expense = (Cost – Residual value)/Useful life. Cost of equipment $9,000 Less Year 1 depreciation expense – 3,000 Book value at end of Year 1 $6,000 Less Year 2 depreciation expense – 3,000 Book value at end of Year 2 $3,000 Less Year 3 depreciation expense – 3,000 Book value at end of Year 3 Copyright © 2013 CFA Institute $0 38 SPECIFIC EXPENSE RECOGNITION APPLICATIONS: DEPRECIATION EXAMPLE • Judgments and estimates needed in depreciation: - estimated salvage value - estimated useful life • For example, given a purchase price of $10,000, what is the annual straight-line depreciation expense - if estimated salvage value = $5,000 and useful life = 10 years? - if estimated salvage value = $0 and useful life = 2 years? Copyright © 2013 CFA Institute 39 SPECIFIC EXPENSE RECOGNITION APPLICATIONS: DEPRECIATION EXAMPLE Diminishing Balance Depreciation • Determine straight-line rate (100%/Useful life) • Determine acceleration factor (e.g., 1.5× or 2×) • Depreciation rate = (Straight-line rate x acceleration factor) • Depreciation expense = Net book value (NBV) x Depreciation rate • Discontinue depreciation when net book value = Salvage value Example: What is the annual depreciation expense each year? Asset cost: $11,000 Estimated salvage value: $1,000 Estimated useful life: 5 years Acceleration factor: 2× Copyright © 2013 CFA Institute 40 SPECIFIC EXPENSE RECOGNITION APPLICATIONS: DEPRECIATION EXAMPLE SOLUTION Year NBV Beginning of Year Depreciation Expense Accumulated Depreciation NBV End of Year 1 11,000 4,400 4,400 6,600 2 6,600 2,640 7,040 3,960 3 3,960 1,584 8,624 2,376 4 2,376 950 9,574 1,426 5 1,426 426 10,000 1,000 Copyright © 2013 CFA Institute 41 NONRECURRING ITEMS AND CHANGES IN ACCOUNTING STANDARDS • Separating nonrecurring from recurring items of income and expense can help an analyst assess a company’s future earnings. • Nonrecurring items: - discontinued operations - extraordinary items (not permitted under IFRS) - unusual or infrequent items • Changes in accounting standards Copyright © 2013 CFA Institute 42 EARNINGS PER SHARE • Earnings per share (EPS) is the net earnings available to common stockholders for the period divided by the weighted average number of common stock shares outstanding • If firm has a “complex” capital structure, it will report basic and diluted EPS. • EPS is extensively used by analysts in evaluating a firm. Colgate's Annual Report L'Oreal's Annual Report Copyright © 2013 CFA Institute 43 EPS: EXAMPLE 1 • Basic EPS - Earnings available to common shareholders divided by weighted average number of shares outstanding Basic EPS = (Net income – Preferred dividends) Weighted average number of shares outstanding Assume the following: - Company had net income of $2,431 million for the year, - 488.3 million weighted average number of common shares outstanding - No preferred stock, no convertible securities, no options What was the company’s basic EPS? Colgate's Annual Report Copyright © 2013 CFA Institute 44 EPS: EXAMPLE 1 SOLUTION Assume the following: - Company had net income of $2,431 million for the year - 488.3 million weighted average number of common shares outstanding - No preferred stock, no convertible securities, no options What was the company’s Basic EPS? Basic EPS = (Net income – Preferred dividends)/Weighted average number of shares outstanding = ($2,431 – $0)/488.3 = $4.98 Colgate's Annual Report Copyright © 2013 CFA Institute 45 EPS: EXAMPLE 2 WEIGHTED AVERAGE NUMBER OF SHARES Calculate (1) the weighted average number of shares outstanding (2) the company’s basic EPS Assume the following: Company had net income of $2,500,000 for the year and paid $200,000 of preferred dividends. 1,000,000 200,000 Shares outstanding on 1 January 20XX Shares issued on 1 April 20XX (100,000) Shares repurchased on 1 October 20XX 1,100,000 Shares outstanding on 31 December 20XX Copyright © 2013 CFA Institute 46 EPS: EXAMPLE 2 SOLUTION WEIGHTED AVERAGE NUMBER OF SHARES Weighted average number of shares outstanding 1,000,000 × (3 months/12 months) Jan, Feb, Mar + 1,200,000 × (6 months/12 months) April–Oct + 1,100,000 × (3 months/12 months) Oct, Nov, Dec = 1,125,000 Weighted average number of shares outstanding Basic EPS = (Net income – Preferred dividends)/Weighted average number of shares outstanding = ($2,500,000 – $200,000)/1,125,000 = $2.04 Copyright © 2013 CFA Institute 47 EPS: EXAMPLE 3 IF-CONVERTED METHOD FOR CONVERTIBLE PREFERRED STOCK Assume a company has the following: - net income of $1,750,000 - an average of 500,000 shares of common stock outstanding - 20,000 shares of convertible preferred outstanding - no other potentially dilutive securities Each share of preferred pays a dividend of $10 per share, and each is convertible into five shares of the company’s common stock. Calculate the company’s basic and diluted EPS. Diluted EPS = Net income/(Weighted average number of shares outstanding + New shares issued at conversion) Copyright © 2013 CFA Institute 48 EPS: EXAMPLE 3 IF-CONVERTED METHOD FOR CONVERTIBLE PREFERRED STOCK SOLUTION Basic EPS Diluted EPS Using If-Converted Method Net income Preferred dividend $1,750,000 – 200,000 $1,750,000 0 Numerator $1,550,000 $1,750,000 500,000 0 500,000 500,000 100,000 600,000 $3.10 $2.92 Weighted average number of shares outstanding If converted Denominator EPS Copyright © 2013 CFA Institute 49 EPS: EXAMPLE 4 IF-CONVERTED METHOD FOR CONVERTIBLE DEBT Assume a company has the following: - net income of $750,000 - an average of 690,000 shares of common stock outstanding - $50,000 of 6% convertible bonds outstanding that are convertible into a total of 10,000 shares - no other potentially dilutive securities - An effective tax rate is 30% Calculate the company’s basic and diluted EPS. Diluted EPS = (Net income + After-tax interest on convertible debt – Preferred dividends)/(Weighted average number of shares outstanding + Additional common shares that would have been issued at conversion) Copyright © 2013 CFA Institute 50 EPS: EXAMPLE 4 IF-CONVERTED METHOD FOR CONVERTIBLE DEBT SOLUTION Diluted EPS Using Basic EPS If-Converted Method Net income After-tax cost of interest Preferred dividend $750,000 0 –0 $750,000 2,100 0 Numerator $750,000 $752,100 690,000 0 690,000 690,000 10,000 700,000 $1.09 $1.07 Weighted average number of shares outstanding If converted Denominator Earnings per share (EPS) Copyright © 2013 CFA Institute 51 EPS: EXAMPLE 5 TREASURY STOCK METHOD FOR STOCK OPTIONS Assume a company reported net income of $2.3 million for the year ended 30 June 2005 and has the following: - an average of 800,000 common shares outstanding - 30,000 options with an exercise price of $35 outstanding - no other potentially dilutive securities Over the year, its market price averaged $55 per share. Calculate the company’s basic and diluted EPS. Diluted EPS = (Net Income – Preferred dividends)/(Weighted average number of shares outstanding + New shares issued at option exercise – Shares that could have been purchased with cash received upon exercise) Copyright © 2013 CFA Institute 52 EPS: EXAMPLE 5 TREASURY STOCK METHOD FOR STOCK OPTIONS SOLUTION Calculate Denominator 800,000 Weighted average number of shares outstanding + 30,000 New shares issued at option exercise Shares that could be purchased with cash received upon exercise, calculated as $1,050,000 ($35 for – 19,091 each of the 30,000 options exercised) divided by average market price of $55 per share = 19,091 shares = 810,909 Shares 30,000 – 19,091 = 10,909 Copyright © 2013 CFA Institute 53 EPS: EXAMPLE 5 TREASURY STOCK METHOD FOR STOCK OPTIONS SOLUTION Diluted EPS Using Treasury Stock Basic EPS Method Net income $2,300,000 $2,300,000 Numerator $ 2,300,000 $2,300,000 Weighted average number of shares outstanding If exercised and treasury shares purchased Denominator EPS Copyright © 2013 CFA Institute 800,000 800,000 0 800,000 10,909 810,909 $2.88 $2.84 54 DILUTIVE VS. ANTIDILUTIVE SECURITIES • Dilutive securities: securities that, if included in a diluted EPS calculation, result in an EPS lower than the company’s basic EPS • Antidilutive securities: securities that, if included in a diluted EPS calculation, would result in an EPS higher than the company’s basic EPS - Antidilutive securities are not included in the calculation of diluted EPS. - Diluted EPS should reflect the maximum potential dilution from conversion or exercise of potentially dilutive financial instruments. - By definition, diluted EPS will always be less than or equal to basic EPS. Copyright © 2013 CFA Institute 55 COMMON-SIZE INCOME STATEMENTS Panel A: Partial Income Statements for Companies A, B, and C ($) A B Sales C $10,000,000 $10,000,000 $2,000,000 Cost of sales 3,000,000 7,500,000 600,000 Gross profit 7,000,000 2,500,000 1,400,000 Selling, general, and administrative expenses 1,000,000 1,000,000 200,000 Research and development 2,000,000 — 400,000 Advertising 2,000,000 — 400,000 Operating profit 2,000,000 1,500,000 400,000 Copyright © 2013 CFA Institute 56 COMMON-SIZE INCOME STATEMENTS Panel B: Common-Size Income Statements for Companies A, B, and C A B C Sales Cost of sales Gross profit Selling, general, and administrative expenses Research and development Advertising Operating profit 100% 30 70 100% 75 25 100% 30 70 10 20 20 20 10 0 0 15 10 20 20 20 Each line item is expressed as a percentage of the company’s sales. Copyright © 2013 CFA Institute 57 INCOME STATEMENT RATIOS • Net profit margin = Net income/Revenue - Net profit margin measures the amount of income that a company was able to generate for each dollar of revenue. - Higher level of net profit margin indicates higher profitability (generally more desirable). - Net profit margin can also be found directly on the common-size income statements. - Also referred to as “return on sales.” • Profitability ratios found directly on the common-size income statement. - Gross profit margin = Gross profit/Revenue. - Operating profit margin = Operating profit/Revenue - Pretax profit margin = Pretax profit/Revenue - Net profit margin Colgate and L'Oreal Income Statements Copyright © 2013 CFA Institute 58 COMPREHENSIVE INCOME Beginning Equity + or – Change = Ending Equity Retained earnings + Net income – Dividends Retained earnings Accumulated other comprehensive income + Other comprehensive income – Other comprehensive loss Accumulated other comprehensive income Stock + Issuances – Repurchases Stock 1. Foreign currency translation adjustments 2. Unrealized gains or losses on derivatives contracts accounted for as hedges 3. Unrealized holding gains and losses on available-for-sale securities 4. Certain costs of a company’s defined benefit post-retirement plans that are not recognized in the current period Copyright © 2013 CFA Institute 59 COMPREHENSIVE INCOME: EXAMPLE Assume the following about a company: - beginning shareholders’ equity is €200 million - net income for the year is €20 million - cash dividends for the year are €3 million - no issuance or repurchase of common stock. - actual ending shareholders’ equity is €227 million. What amount has bypassed the net income calculation by being classified as other comprehensive income? What is the company’s comprehensive income? Copyright © 2013 CFA Institute 60 COMPREHENSIVE INCOME: EXAMPLE SOLUTION Assume the following about a company: - beginning shareholders’ equity is €200 million - net income for the year is €20 million - cash dividends for the year are €3 million - no issuance or repurchase of common stock - actual ending shareholders’ equity is €227 million What amount has bypassed the net income calculation by being classified as Other comprehensive income? Answer: €10 million. What is the company’s total comprehensive income? Answer: €30 million Copyright © 2013 CFA Institute 61 SUMMARY • Income statement shows how much revenue the company generated during a period and what costs it incurred in connection with generating that revenue. • Accounting issues relate primarily to timing (revenue recognition, expense recognition, nonrecurring items). • The income statement also presents EPS (earnings per share), an important metric. • Tools for income statement analysis include common-size analysis and profitability ratios. • Comprehensive income includes net income and other comprehensive income. Copyright © 2013 CFA Institute 62

© Copyright 2026