Document 39070

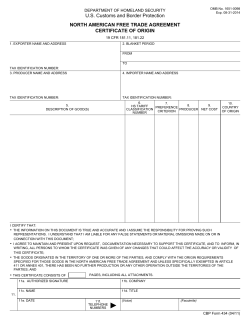

U.S. DEPARTMENT OF HOMELAND SECURITY OMB No. 1651-0098 See back of form for Paperwork Reduction Act Notice. Bureau of Customs and Border Protection NORTH AMERICAN FREE TRADE AGREEMENT CERTIFICATE OF ORIGIN Please Print or Type 19 CFR 181.11, 181.22 1.SUPPLIER NAME AND ADDRESS 2. BLANKET PERIOD: 2 FROM 1 TO TAX IDENTIFICATION NUMBER: 3. PRODUCER NAME AND ADDRESS: 4. BUYER NAME AND ADDRESS: 3 4 TAX IDENTIFICATION NUMBER: TAX IDENTIFICATION NUMBER: 5. DESCRIPTION OF GOOD(S) 6. HS TARIFF CLASSIFICATION NUMBER 5 6 7. PREFERENCE CRITERION 7 8. PRODUCER 9. NET COST 8 9 10. COUNTRY OF ORIGIN 10 I CERTIFY THAT: THE INFORMATION ON THIS DOCUMENT IS TRUE AND ACCURATE AND I ASSUME THE RESPONSIBILITY FOR PROVING SUCH REPRESENTATIONS. I UNDERSTAND THAT I AM LIABLE FOR ANY FALSE STATEMENTS OR MATERIAL OMISSIONS MADE ON OR IN CONNECTION WITH THIS DOCUMENT; I AGREE TO MAINTAIN AND PRESENT UPON REQUEST, DOCUMENTATION NECESSARY TO SUPPORT THIS CERTIFICATE, AND TO INFORM, IN WRITING, ALL PERSONS TO WHOM THE CERTIFICATE WAS GIVEN OF ANY CHANGES THAT COULD AFFECT THE ACCURACY OR VALIDITY OF THIS CERTIFICATE; THE GOODS ORIGINATED IN THE TERRITORY OF ONE OR MORE OF THE PARTIES, AND COMPLY WITH THE ORIGIN REQUIREMENTS SPECIFIED FOR THOSE GOODS IN THE NORTH AMERICAN FREE TRADE AGREEMENT AND UNLESS SPECIFICALLY EXEMPTED IN ARTICLE 411 OR ANNEX 401, THERE HAS BEEN NO FURTHER PRODUCTION OR ANY OTHER OPERATION OUTSIDE THE TERRITORIES OF THE PARTIES, AND THIS CERTIFICATE CONSISTS OF 1 PAGES, INCLUDING ALL ATTACHMENTS. 11a. AUTHORIZED SIGNATURE 11b. COMPANY: 11 11c. NAME (Print or Type) 11d. TITLE: 11. 11e. DATE (MM/DD/YYYY) 11f. (Voice) (Facsimile) TELEPHONE NUMBER CBP Form 434 (04/97) 1 1. Exporter Name & Address: State full legal name and address (including country) and legal tax identification number of the exporter. If the good(s) are being exported (shipped) from Mexico or Canada to Urban Outfitters, list the company or person responsible for exporting the good(s). 2. Blanket Period: Complete if the NAFTA certificate will cover multiple shipments of identical goods described in field 5 for a specified period of up to one (1) year. “From” is the date which the certificate becomes applicable to the good(s) covered. The “from” date may be prior to the date of signing the NAFTA certificate. 3. Producer Name & Address: State the full legal name, address (including country) and legal tax identification of the producer of the goods. The producer is the company or person who manufactured the finished good(s) listed in field # 5. If you wish to keep the producer confidential, it is acceptable to state “Available to Customs Upon Request”. If the exporter and producer are the same, list “Same” in field # 3. 4. Importer Name & Address: State full legal name and address (including country) and legal tax identification number of the importer. If the importer is not known, “various” or “available to customs upon request” can be entered in this field. 5. Description of Goods: Provide a full description of each good. The description should be sufficient to relate it to the invoice description, as well as the Harmonized Tariff System description of the good. 6. HTS Number: Identify the Harmonized Tariff Classification, to at least the first 6 digits, for each good listed in field # 5. http://www.usitc.gov/tata/hts/bychapter/index.htm 7. Preference Criterion: For each good listed in field # 5, state which preference criteria is applicable. Preference Criteria (A) – The good(s) are wholly obtained or produced entirely in one or more NAFTA territory (i.e. USA, Canada, Mexico). This means not one atom of material in the good(s) can be of origin outside of a NAFTA territory. (example: fruits and vegetables grown in USA, livestock born in Mexico, or mineral goods extracted in Canada) Preference Criteria (B) – The good(s) are produced entirely in one or more NAFTA territory (i.e. USA, Canada, Mexico) and satisfies the specific rule of origin outlined in Annex 401. http://www.nafta-secalena.org/DefaultSite/index_e.aspx?DetailID=188 Preference criteria B would apply to goods produced in USA, Canada or Mexico from foreign material, which after production the good(s) will undergo a tariff classification change (.example: A men’s cotton tank top manufactured in USA (heading 6109 in the U.S. HTS) from cotton fibers (heading 5203 in the U.S. HTS) imported from Singapore would qualify as originating). Regional Value Content (RVC) may also be a requirement to determine if the good(s) are originating. (Reference Net Cost – Field # 9) Preference Criteria (C) – The good(s) are produced entirely in one or more NAFTA territory (i.e. USA, Canada, Mexico) exclusively from originating materials. Under this criterion one or more of the materials in the good may not fall within “wholly produced or obtained”. (example: Bovine skins imported into Mexico from Argentina are processed into finished leather. A company in Mexico purchases the finished leather to manufacture leather eyeglass cases. The eyeglass cases would qualify as originating, as the finished leather would originate in Mexico due to a tariff classification change from 4101 to 4104) Preference Criteria (D) – The good(s) are produced entirely in one or more NAFTA territory (i.e. USA, Canada, Mexico) but does not satisfy the specific rule of origin outlined in Annex 401, due to certain non originating materials that do not undergo the required tariff classification change. The good(s) do however meet the Regional Value Content (RVC) requirements. (Reference Net Cost – Field # 9) Note- this preference criteria will never apply to apparel and textiles in chapters 61 through 63 of the harmonized tariff schedule. Note – Preference criteria E (automatic data processing goods) and preference criteria F (originating agricultural goods) will not apply to goods purchased by Urban Outfitters. 2 8. Producer: State “YES” if you are the producer of the good(s) described in field # 5. If you are not the producer of the good(s), state “NO” followed by (1), (2) or (3). NO(1) - Your personal knowledge that the good(s) qualify as originating. NO (2) – You posses written documentation from the producer of the good(s) (other than a certificate of origin), that the goods qualify as originating. NO(3) – The producer of the good(s) has supplied a completed and signed certificate of origin stating the good(s) qualify as originating. 9. Net Cost: If the good(s) described in field # 5 qualify as originating under Regional Value Content (RVC), indicate “NC” in field # 9 if the RVC is calculated according to the Net Cost method. If RVC does not apply, indicate “NO” in field # 9. Net Cost method calculates the RVC as a percentage of the net cost to produce the good (minus expenses of sales promotion, royalties, shipping and packing costs). 50% or more of the good must be determined to be originating to qualify under the Net Cost method) RVC = NC – VNM NC X 100 Example: ($3.65 - $1.80) ($3.65 X 100) = 50.1% RVC = Regional Value Content, expressed as a percentage NC = Net Cost of good VNM = Value of non-originating materials used by the producer in the production of the good. (*Note – goods classified under chapters 61-63 of the USHTS are excluded from qualifying as originating under RVC) 10. Country of Origin: Indicate country of origin of good(s). USA (shown as US), Mexico (shown as MX), Canada (shown as CA). 11. Signature: Fields A through F must be completed, and the NAFTA certificate of origin must be singed to be valid. 3

© Copyright 2026