Skills for Success in Business Development Kauffman Campus Best Practices Workshop Purdue University

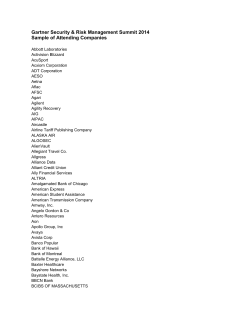

Skills for Success in Business Development Kauffman Campus Best Practices Workshop Purdue University Ted T. Ashburn, MD, PhD Senior Director Corporate Development Genzyme Corporation [email protected] November 9, 2007 Outline 1. 2. 3. 4. Current Trends Genzyme Business Development in Action Key Skills for Success Business Development General © 2007 Genzyme Corporation. All rights reserved. 1 Outline 1. 2. 3. 4. Current Trends Genzyme Business Development in Action Key Skills for Success Business Development General © 2007 Genzyme Corporation. All rights reserved. 2 1. The Pharmaceutical Value Chain Idea! Target Discovery • Expression analysis • In vitro function • In vivo validation • Bioinformatics Discovery & Screening • • • • • 2-3 yr In vitro Ex vivo In vivo In silico High throughput 0.5-1 yr Lead Optim. ADMET • Traditional Med. Chem. • Rational drug design • Bioavailability • Systemic exposure 1-3 yr 1-2 yr Clinical Develop. • Testing starts at Phase I (Phase I/II for cancer) Registration. • • • • Drug U.S (FDA) E.U. (EMEA) Japan (MHLW) Rest of World 5-6 yr 1-2 yr • 10-17 years, $1.7 billion+ process • > 75 different disciplines • < 10% overall probability of success once a candidate enters clinical trials!!! Ashburn & Thor, Nature Reviews Drug Discovery, Aug, 2004, pg 673-683 Gilbert, Henske & Singh, IN VIVO, Nov, 2003 © 2007 Genzyme Corporation. All rights reserved. 3 1. The Industry’s Productivity Gap Ashburn & Thor, Nature Reviews Drug Discovery, Aug, 2004, pg 673-683 © 2007 Genzyme Corporation. All rights reserved. 4 1. Possible Explanation for the Industry’s Productivity Gap 1940’s Disease 1960’s Bacterial Hypertension Infections 1990’s Today Arthritis Alzheimer’s Drug penicillin propranolol celecoxib N.A. Chemical Starting Point penicillin adrenaline Screening /RDD Screening /RDD Target Validation High Med Low Very Low Development Complexity Low Med High Very High © 2007 Genzyme Corporation. All rights reserved. The Fruit Is Getting Higher! 5 1. Why Innovation in HealthCare Is Important By Pass (Heart Surgeons) Complexity of treatment Stents (Cardiologists) Antihyperlipidemics (PCP’s & NP’s) OTC Antihyperlipidemics? (Patients) Time Adapted from: Christensen, Bohmer © 2007 Genzyme Corporation. All rights reserved. & Kenagy, Harvard Business Review, Sept-Oct, 2000 6 1. Where Does Innovation Come From? Gov./Acad./Non-Prof. Industry 300 > 90% of all new drugs are developed by the Pharma Industry 250 200 150 100 50 0 Sales >$500M in '01* Drugs Approved in the '90's** * NIH Response to the Conference Report Request for a Plan to Ensure Taxpayers' Interests are Protected. Department of HHS, NIH. July 2001. Available at: http://www.nih.gov/news/070101wyden.jsp. © Genzyme Corporation. All rights reserved. **2007 Tufts University 7 1. Dependency of revenues on externally sourced products 49% 47% ~½ of all innovation comes from small companies 45% 43% 41% Big Pharma 39% Mid Pharma 04 05 06f 07f Source: Datamonitor; company-reported information © 2007 Genzyme Corporation. All rights reserved. 08f 09f 10f 8 Outline 1. 2. 3. 4. Current Trends Genzyme Business Development in Action Key Skills for Success Business Development General © 2007 Genzyme Corporation. All rights reserved. 9 2. Our Global Corporation >9,500 employees worldwide Helping patients in nearly 90 countries 17 manufacturing sites 9 genetic testing lab sites 14 marketed products 2006 revenue of $3.2 billion >70 locations in >30 countries © 2007 Genzyme Corporation. All rights reserved. 10 2. Our Revenue Growth $ 4,000 3,500 3,000 $ In Millions 2,500 2,000 1,500 1,000 500 0 '91 '92 '93 '94 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 (E) © 2007 Genzyme Corporation. All rights reserved. 11 2. Awards and Recognition One of the “100 Best Companies to Work for” by FORTUNE Named a top employer by Science Rated one of the most generous in-kind givers by BusinessWeek Named to the Dow Jones Sustainability Genzyme Center recognized as one of the most environmentally responsible U.S. buildings © 2007 Genzyme Corporation. All rights reserved. 12 2. Our Major Marketed Products & Services Reproductive Cerezyme® Renagel® Synvisc® Campath® Oncology Fabrazyme® Hectorol® Carticel® Clolar® Infectious Disease Aldurazyme® MACI® Thyrogen® Cardiovascular Myozyme® SepraTM Products Genetic Testing Genetic Diseases © 2007 Genzyme Corporation. All rights reserved. Renal Orthopaedics/ Biosurgery Oncology/ Endocrinology Thymoglobulin® Cholestagel Transplant/ Immune Disease Cardiovascular 13 Outline 1. 2. 3. 4. Current Trends Genzyme Business Development in Action Key Skills for Success BD General © 2007 Genzyme Corporation. All rights reserved. 14 3. Summary: What is Business Development? In larger companies – Licensing/Acquisitions Department – “Buying” In smaller companies – “BD is the Marketing & Sales before there are any products” – “Selling” (and sometimes buying) Source: Jack Anthony, SVP, Business Development, Saegis Pharmaceuticals © 2007 Genzyme Corporation. All rights reserved. 15 3. Genzyme Strategy: Growth By Building Value Organic growth / status quo Optimize capital structure Maximize Shareholder value Improve investor understanding Streamline portfolio Goal: To Remain A Growth Stock Licensing arrangements joint ventures Strategic transactions CD is Here © 2007 Genzyme Corporation. All rights reserved. Add-on acquisitions Objective: 20%-25% E.P.S. Growth Large scale transaction/ merger/ sale 16 3. An Integrated/Cross-Functional Approach Corporate Development Finance Business Unit Legal © 2007 Genzyme Corporation. All rights reserved. 17 3. Genzyme Deal Criteria Significant Unmet Medical Need – Rare diseases – New Standard of Care Risk-reduced Opportunities – Human POC or later – Clear Regulatory pathways Focused Call Point(s) – Not PCP’s Partnerships – Desire to work together to create value – Both Regional and worldwide © 2007 Genzyme Corporation. All rights reserved. 18 3. The “Kissing Lots Of Frogs” Problem It takes 10-17 yrs & over $1.7 bn to develop a drug < 1 in 10 that begin human trials reach the market Late stage clinical trials are often delayed/stopped We Can’t Be Too Hundreds of ongoing clinical trials targeting “Picky” About Where hundreds of diseases We Find Good > 1,500 private & public biotech companies (US) Opportunities < 35% of approved products justify the cost of development & launch 20% earnings growth promised to Wall Street © 2007 Genzyme Corporation. All rights reserved. 19 3. A Transformation (One Step at a Time) Genzyme pre-2000 LSDs Cerezyme - 1999 Revenues: $750M - Market Cap: $3.5B Genetics Diagnostics Orthopaedics Biomaterials Pre-natal Carticel Sepra Gabi/Epicel IMPATH Biomatrix GelTex 12/00 12/00 9/03 4/04 WYE/Synvisc Bone Care AnorMED 1/05 7/05 11/06 Genzyme 2007 LSDs Cerezyme® Fabrazyme® Aldurazyme® Myozyme® I2S (Asia) Niemann Pick Genetics Diagnostics Cancer Reproductive © 2007 Genzyme Corporation. All rights reserved. SangStat Orthopaedics/ Biomaterials Synvisc ® Carticel ® Sepra Synvisc II Hylastan Renal Renagel ® Hectorol ® Renvela Renal fibrosis Tolevamer Ilex/BioIlex envision 12/04 12/04 10/07 - 2006 Revenues: ~$3.2B - Market Cap: $18B Transplant & Immune Disease ® Thymoglobulin / ® Lymphoglobulin Mozobil TGFb antibodies FC gamma receptor Oncology/ Endocrinology Thyrogen® CAMPATH® CLOLAR® ILX-651 DENSPM liver 20 Who are Business Development People? “Top Notch Business Development People are People who have an irresistible urge to Make Things Happen” Source: Jack Anthony, SVP, Business Development, Saegis Pharmaceuticals © 2007 Genzyme Corporation. All rights reserved. 21 3. BD Backgrounds at Genzyme 10 MBA’s (Wharton, Harvard, Kellogg) 4 PhD’s – Harvard PhD (Biomedical engineering) with small cap biotech & start-up experience – xScientist from Integrated Genetics – MIT trained chemist 3 xSales Reps (Lilly & BMS) 3 JD’s (Georgetown & Harvard) 2 xConsultants (Bain & McKinsey) 1 MPH (BU) & 1 MD (Missouri) 1 overly-trained individual Anyone can do this as long as they are exceptionally strong at… – Harvard/MIT trained MD/PhD with Big Rx, VC & start-up experience © 2007 Genzyme Corporation. All rights reserved. 22 4. Key Skills for Success: Business Development Selling Ability Listener Organized/ Organizer Planner Presenter Cold Caller Articulate Enthusiastic People Person Lucky Manager Science Friendly Reality Based Common Sense Source: Jack Anthony, SVP, Business Development, Saegis Pharmaceuticals © 2007 Genzyme Corporation. All rights reserved. 23 4. Key Skills for Success: General 1. Find a Cause 2. Think BIG! 3. READ VORACIOUSLY! 4. Take care of yourself 5. Have a platform… © 2007 Genzyme Corporation. All rights reserved. 24 Skills for Success in Business Development Kauffman Campus Best Practices Workshop Purdue University Ted T. Ashburn, MD, PhD Senior Director Corporate Development Genzyme Corporation [email protected] November 9, 2007

© Copyright 2026