Commentary

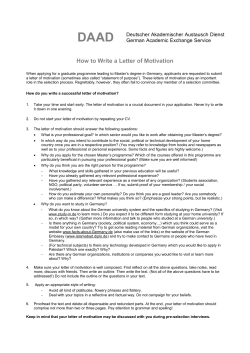

Environment and Planning D: Society and Space 2011, volume 29, pages 571 ^ 583 doi:10.1068/d2904com Commentary Turmoil in Euroland: The geopolitics of a suboptimal currency area ? How far we have come since an early 1950s project seeking to ameliorate FrancoGerman competition (Loriaux, 2008) under the permissive gaze of the USA (Lundestad, 1998). Four more states are now official candidates seeking to join the European Union (EU). Whether Turkey can join, and the EU enlarges as far as the borders of Iran and the Kurdistan Regional Government, is an open question. But it is expected that more countries, amongst them the former Stalinist, majority Muslim Albania, will seek membership. Seventeen EU members (plus some microstates like Andorra and Monaco) use the euro as their official currency. So does another state that is not an EU member and that was not an official candidate until 2010: for Montenegro had already unilaterally adopted the euro whilst still in uneasy union with Serbia. And Serbia's breakaway territory of Kosovo (whose independence has been recognised now by seventy-six states, including twenty-two of the twenty-seven member states of the EU) also uses the euro. The value of euro notes and coins in circulation exceeds that of United States dollars. Whilst the latter remains the global reserve currency, there is no doubt that authorities in Beijing carefully watch the yuan ^ euro exchange rate as well as the dollar ^ euro and yuan ^ dollar ones that more often make the headlines. Moreover, there is a large de facto Eurozone in West Africa, where fourteen postcolonial states use a common currency pegged to the Euro guaranteed by the French treasury. It may have few pretences to be anything other than a `civilian power' (Bachmann and Sidaway, 2009), but the geopolitical and geoeconomic orbit of the EU is tangible. Yet there is also a widespread sense that things have gone awry. In part, this is a fall-out from a financial crisis that has convulsed the west. The mixture of disquiet merging into downright hostility towards the EU project also seems to reflect the speed, depth, and breadth of integrationöa sense that things have run out of control that is read through other social, cultural, demographic, and economic shifts (from neoliberalism to migration flows). The series of shocks, adjustments, crises, bailouts (striking language, indeed) in the headlines bears witness to this, as shows The Economist's front cover playing on Hollywood's representation of other tricky entanglements (see figure 1). Attention to media visualisations has more often been a theme in critical work on geopolitics, along with other material from popular culture, such as films and comics (Dittmer, 2011). There have been many cartoons depicting the challenges and contests that the financial crisis unleashed for the euro. For example, the British cartoonist Steve Bell parodied the German reticence to `bail out' Greece in a cartoon that appeared in the British left-of-centre daily Guardian newspaper (see figure 2). A few days later another Steve Bell cartoon depicted EU President Herman van Rompuy as a Smurf, the blue creatures created by the Belgian cartoonist Peyo known in French as Schtroumpfs, in Dutch as Smurfen, and in German as Schlu«mpfe.(1) In these the Smurf sings to the Greeks (symbolically a line of riot police in between), uttering abusive language and stereotypes that were heard all too commonly during recent debates. Whilst Bell's work has previously been examined for its geopolitical resonances (Dodds, 2007), arguably in these particular cartoons it is the geoeconomic that is foregrounded. (1) For this and other cartoons by Steve Bell see http://www.belltoons.co.uk/. 572 Commentary Figure 1. [In colour online.] Encore troublesome entanglements (source: The Economist 2010). The relationship between these geopolitical and geoeconomic dimensions is at the heart of European integration. Indeed, from the beginning the political project of European integration used economic means (witness the `common market') to articulate and achieve its aims. This is acknowledged in most accounts of the European integration project (Gillingham, 2003; Wiener and Diez, 2004), and its class dynamics are foregrounded in more critical approaches (van Apeldoorn et al, 2003). The articulation of nation, class, region, and other scales in the crisis that has developed since 2008 constitutes an urgent scholarly and political agenda. In such contexts our commentary comprises four dispatches from EU member states (including one key member that is outside the Eurozone). These four states are less the focus than those whose political and economic actors have framed dominant Commentary 573 Figure 2. [In colour online.] Giving the finger (source: Steven Bell, 2011). narratives about the crisis. Inevitably, our critical accounts of the turmoil in Euroland will date fast, reflecting dynamism and current uncertainty. But the four short dispatches that follow take stock and historicise the headlines. They also reflect personal connections and affiliations. We all live and work in Amsterdam, but one of us is French, another English. And of the two Dutch authors, one has previously worked in Germany and currently researches state-finance relations there. We are acutely aware that from say, Tallinn, Rome, or Athens, the dynamics and experiences will carry different messages. And these are everywhere contested. For as so often in Europe's past, be careful what you wish for. The Oxford-based writer Timothy Garton Ash recently expressed something of this in the following terms: ``For much of its history, what has become the European Union pursued political ends by economic means. For Kohl and Mitterrand, the euro was mainly a political project, not an economic one. Now the boot is on the other foot. In order to save a poorly designed and over-extended monetary union, we need an exceptional political commitment. The political must ride to the rescue of the economic'' (Garton Ash, 2011, page 33). Although much more work will be needed to specify the scaled geopolitics and geoeconomics at work, our dispatches consider some forms that these are taking in four states as of mid-2011, underlining their unevenness. Dispatch from the Netherlands, Ewald Engelen These are not happy times for the pudgy Dutch Minister of Finance Jan-Kees de Jager. The euro crisis has forced de Jageröoperating with a political license that is relying upon Geert Wilders's wildly eurosceptic and nationalistic Freedom Party öto shift whimsically between populist euroscepticism at home and Eurocratic pragmatism when in Brussels. An oratory of `no Dutch taxpayer money for Southern Europe' prior to ever-more frequent EU meetings sits uneasily with a discourse of `the benefits of the euro' and `saving the European dream' afterward. The roots of de Jager's schizophrenia 574 Commentary go deeper than simply saving banks by other means, since the exposure of Dutch banks to European `peripherals' is negligible compared with French and German banks. It smells more like desperationöde Jager arriving in Brussels with a set jaw and a eurosceptic mandate, leaving again with an embarrassed smile, a sweaty back and a compromise that saves the banksöand speaks of the growing confusion of a founding member of the EU that has increasingly found itself at the margins of the European power game. It is evident that politicians in the EU have always played `two-level' bargaining games (Putnam, 1988). But until the early 1990s, negotiating these levels was easy. Permissive consensus allowed politicians to pursue policies of gradual Europeanisation without much consideration of voter preferences. The Treaty of Maastricht, which formalised the goal of economic and political integration through monetary means, changed all that. As if politicians had unknowingly broken implicit electoral promises, 1992 then saw the unexpected rejection of the treaty in Denmark and its near rejection in France, setting in motion a groundswell of electoral disaffection, as is indicated in the public opinion data in figure 3, which shows a marked drop in support for the European project after 1991. Figure 3. European public opinion (source: European Union, 2011). According to Hooghe and Marks (2008), the treaty of Maastricht heralded in a new age of constraining dissensus. Everything that has happened sinceöfrom the rejection of the Constitutional Treaty in 2005 to the euro crisis in 2010, and even the initially feeble response to the popular revolts on the southern shores of the Mediterranean in 2011öis the unintended outcome of European elites desperately trying to come to terms with the new rules imposed by an increasingly eurosceptic electorate. The biggest challenge European politicians now face is to realign the integrationist logic of the European bargaining game with the eurosceptic logic of national games. Commentary 575 Figure 4. Dutch public opinion (source: European Union, 2011). While this is a challenge for politicians everywhere, it is starkly felt in the Netherlands. As figure 4 shows, the age of permissive consensus took much longer to unravel here than elsewhere. It was only after the introduction of the cash euro in January 2002 that the share of Dutch europhiles neared European averages. And it was only during the referendum on the Constitutional Treaty in 2005ö which according to a prominent Dutch daily was a ``belated popularity vote on the euro'' (NRC Handelsblad 2005) ö that Dutch euroscepticism came out of the closet. Linking treaty and euro and feeding Dutch disaffection for the European project was a high ranking official from the Dutch central bank who divulged a month before the referendum that the Dutch guilder had been converted to the euro against a depreciated exchange rate, effectively wiping out more than 5% of Dutch spending power while boosting Dutch exports through what in effect was a onetime devaluation (Het Parool 2005). The introduction of the euro initiated three years of lacklustre economic performance due to weak domestic consumption, while the politically important Dutch export sector booked bumper profits. The failure to keep rank entailed big political costs: it corroborated a deep-seated suspicion on the side of Dutch citizens that at root the political elite were unreliable and that there was indeed something fishy about the euro. This conjuncture was not helped by changing European rules of the game. Before 1985 French ^ German tensions ensured the Netherlands substantial influence over European decision making. As a result, Dutch electoral preferences hardly mattered, since there were always European subsidies to throw around. This changed after the 1980s, when Germany and France reached a grand bargain over German reunification and the future direction of the European project and no longer had to `bribe' Dutch politicians to shore up their deals. Combined with EU enlargement, this severely weakened Dutch influence, while the subsidies from European integration disappeared, feeding electoral disaffection for the European project. In fact, in 1995 the Netherlands for the first time became a net budget contributor, while the late 1990s saw a number 576 Commentary of Dutch claims to high-profile European functions blocked [such as Ruud Lubbers's candidature for the presidency of the European Commission in 1994 while Wim Duisenberg's presidential term at the European Central Bank (ECB) was shortened to accommodate French candidate Trichet] by Franco-German manipulation, as it was said. The Dutch response was to work itself up as the staunchest defender of monetarist orthodoxy against Mediterranean leniency. However, when in 2003 Germany itself was one of the first to breach the criteria of the Growth and Stability Pact, this strategy came unstuck. And since in the Eurozone the classic Dutch stratagem of negotiating the power balances of the UK against France and Germany does not work, the Netherlands has increasingly found itself in the back seat of a fickle Merkel, who herself has to negotiate between unruly lawyers, precarious banks, eurosceptic media, populist D-mark nostalgia, and good European citizenship. Playing two-level games in an age of constraining dissensus was never easy, but it is especially hard if you are a politician from a member state of middling size that is increasingly confused about its European role as a result of the return of big state diplomacy and an enlarged Europe that was never reckoned with. That, more than anything, is what is truly behind the resentment most bluntly voiced by Geert Wilders of the Freedom Party over the fact that the Netherlands was not invited for a crucial meeting on the fate of Greece: ``It is a humiliation and an insult that the Netherlands is being bypassed for talks about Greece'' (Wilders as quoted by Torchia and Crimmins, 2011). Who cares about money if your prestige is at stake? Dispatch from Germany, Reijer Hendrikse Ever since the collapse of Lehman Brothers in 2008, Germany has been riding a dazzling politico-economic rollercoaster. Where its economy fell off a cliff in 2009, a remarkable, albeit uneven, revival followed in 2010. The political flipside of this upturn has been equally noteworthy, as by the time financial unrest spiralled into sovereign-debt crisis, Germany found itself enjoying a ``unipolar moment'' within Europe (Guërot and Leonard, 2011, page 1). Amongst others, Germany's dominance over Eurozone/EU governance is expressed through the debt crisis-management machinery chiefly erected outside Europe's formal institutions thereby assuming political leverage proportional to its large financial pledges. Theoretically, these actions accentuate Merkel's new `union method' allegedly bridging community and intergovernmental approaches. In reality, it is intergovernmental by another name ösidelining the commission, converting Europe's periphery into mere dominions, and rescaling Europe's balance of power along the way. This, it is often claimed, represents Germany's `return to normality', whereby its interests and European integration can no longer be assumed to be ``two sides of the same coin'' (Kohl as quoted by Bulmer and Paterson, 2010, page 1072). Instead, others note Germany's ``solipsistic and normatively depleted mindset ... can no longer even guarantee that the unstable status quo in the EU will be preserved'' (Habermas, 2010). In many respects, Germany is a microcosm of Europe: a multiscalar landscape composed of cultural, political, and economic unevenness stretching north to south, east to west. Crucially, reunification provided Germany ample experience with the costly complexities of integration troubling today's Eurozone. Where the Bonn Republic culminated into a larger `transfer union' known as the Berlin Republic, today's politicians öcaptained by the richer regional La«nder comprising the federationöare vigilant not to see this process replicated on a larger scale. As a result, Germany and Europe are markedly uncomfortable with one another. Truth be told, both do not have the slightest idea where the rollercoaster fuelled by volatile finance will take them. Commentary 577 Figure 5. [In colour online.] All that is solid melts into air (source: Der Spiegel 2010). The ongoing debt crisis merely amplified a longer-term process. For decades the model of Rheinischer Kapitalismus witnessed incremental yet profound change to shoulder the costs of reunification and reap the rewards of EU integration. Today, German firms dominate Europe's single market, and its huge export surpluses equally elevate its financial sector beyond national borders. As a result, these changes irreversibly integrated Germany into a larger financial space wherein traditional divisions delineating `state and market' have steadily diffused into a novel order that has today become contested. For example, over the years indebted localities, or Kommunen, increasingly solicited the services of Deutsche Bank and others who öhaving shifted from bank-based to finance-based business models öhappily accepted their newfound consultancy role by pushing complex interest-rate swaps in their backyard. 578 Commentary Today, hundreds of German cities and towns are entangled in what are typically nonpaying if not painfully loss-making contracts. In turn, these Kommunen own the local savings institutions, known as Sparkassen, who together with various La«nder own Germany's regional Landesbanken. As of writing, four Landesbanken are in financial dire straits as they haplessly accumulated US subprime securities, including undecipherable synthetic collateralised debt obligations as well as massive volumes of peripheral Eurozone debt. Although both La«nder and Sparkassen increasingly want to disinvest their way out of the Landesbanken, it is hard to fathom how German taxpayers could walk away from this toxic cocktail without getting hurt. Mind you, this merely represents the traditional public arm of Finanzplatz Deutschland. Add bailed-out institutions like Hypo Real Estate to the equation and Germany's risk exposure is quickly multiplied. Contemporary Germany lacks vision for itself and Europe and is best characterised by Merkel's unpredictable chancellorship. Concerning Europe's pecuniary troubles, Germany's reluctance to initiate domestic banking reform stands in stark contrast with the structural adjustments brought upon the periphery. The connection is clear: that is to say, Merkel's `wait-and-see' strategy at home does not hold without Europe's fringes servicing the hundreds of billions in foreign claims held by German financial institutions. Although debt restructuring inevitably hangs in the air, the general status quo indeed reveals an abiding `solipsistic' reluctance to grasp the link between its export surpluses and peripheral deficits wedded in monetary union. Today, like the popular media, a large section of the German elite is dismayed about the resolutions enacted to curtail Europe's debt woes. If anything, its policy makers appear guided by the fear of further dissolution of Germany's traditional institutional penchants. Last year German pundits cried foul over policy changes enacted by the ECB, which saw its Bundesbank DNA supplemented with `Anglo' monetisation jeopardising `sound money' values and political independence öthe holy grail of German monetary policy. These events amplified Germany's conviction to play the intergovernmental card. However, the ultimately transient nature of its actions is obvious. In this respect, the retreat of Bundesbank chief and ECB crown prince Axel Weber is telling. In his words, Europe's enduring `firefighter politics' meant to tame the rollercoaster creates ``the impression that one is being driven by markets and is not in control of markets'' (Weber as quoted in Vits et al, 2010). The ECB policy U-turn leading to Weber's exit reveals that when crisis hits and `all that is solid melts into air', Germany typically comes to represent a minority opinion on issues of Eurozone/EU governance. Although Germany is the major shareholder of the ECB, it has trouble translating its financial might into political control over Euroland's last-standing, increasingly troubled sovereign. And much to Germany's dismay, whereas Europe's monetary marriage originally came with a set of national prenuptial agreements, the contemporary route towards a union in common debts progressively appears irrevocable. Such reflections reveal the confines of Germany's alleged unipolar moment: it is fragile, uncomfortable, and limited. As a result, Merkel appears as fickle as volatile finance leaving Europe hanging in the balance awaiting the next rollercoaster loop. Dispatch from France, Virginie Mamadouh The French, including influential factions of its political and economic elites, never fully embraced the globalisation project. As a result, debates about the US crisis and the subsequent financial, economic, and sovereign-debt crises and their consequences were often framed in terms of systemic change. France has been a stronghold of the struggle against neoliberal economic theory targeted as la pensëe unique Commentary 579 Figure 6. [In colour online.] An explosive cocktail (source: Alternatives Economiques 2010). (literally, `the single thought', but a better translation would be `the blinkered thought'). Indeed, Alternatives Eèconomiques (see figure 6) was established as a direct answer to Tina (ie, `There is no alternative') put forward by Mrs Thatcher, the British Prime Minister. French intellectuals and social movements were important contributors of the altermondialist movement with ATTAC, Le Monde Diplomatique, and the creation of the World Social Forum. Similarly, bashing the Garlic Belt or PIIGS (Portugal, Ireland, Italy, Greece and Spain) ö the Club Med countries as they are called in France ö for their financial 580 Commentary problems is less widespread than in say Germany or the Netherlands. There is also more criticism of the German model of export-led growth and austerity policies and even more of the German attitude of suggesting that every member state should follow the same policy, even though Germany's success depended directly on the trade deficit of other member states (Riols, 2010). Although German monetary orthodoxy has gained currency in France since the 1992/1993 crisis of the European Monetary System (EMS) and the establishment of the ECB led by a French banker Jean-Claude Trichet, the French do not forget the primacy of politics over the economic and the financial. It was a political decision to agree on a Stability and Growth Pact; it was always possible to make other political agreements in different circumstances. The recent crises have been seized as an opportunity to strengthen France's position in the Eurozone, the EU, and global politics, as well as the personal image of the French President Nicolas Sarkozy. Therefore, the debate is focused not so much on the performance of the national economy and its public finances (for a comparison see Mamadouh and Van der Wusten, 2011), but more on the French position as Germany's key partner in the Eurozone. President Sarkozy and Chancellor Merkel were the main players of the creation of new mechanisms to `save' the countries with difficulties and possibly the euro (Barluet, 2010). The role of Franco-German leadership at different crucial steps was key. It is a clear reinforcement of the role of national governments in EU politics, although it also recentres the Franco-German motor of the European project. It should be stressed, however, that the cooperation is not particularly easy, as with earlier Franco-German couples, like Adenauer (CDU) and De Gaulle (Gaullist party), who founded the FrancoGerman Friendship with the 1963 Elysëe treaty; Giscard d'Estaing (Liberal) and Schmidt (SPD) in the late 1970s; or Mitterrand (PS) and Kohl (CDU), who negotiated German reunification. The partnership between the two countries is framed as one of equals, downplaying obvious differences in terms of economic weight, export structures, and monetary and financial policy. It is easy to portray France in this context as a mouse walking on a bridge with an elephant telling him `we really shook that bridge'. Yet this would be a misconception of their deep commitment to Franco-German collaboration. It is not only about being the motor of the European integration project; the two countries have common ministerial councils and shared diplomatic representations in certain locations. Moreover, in other domains (military power and geopolitical influence) the roles are reversed. Another contingency added to the weight of the French in global financial matters in 2011: the presidencies of the G8 and the G20. President Sarkozy's stated ambitions reach further than the Eurozone and include a reform of the international monetary system. In February 2011 at the G8-G20 summit in Paris he announced that the French presidency would lobby for the implementation of the Tobin Tax (a forty-year-old idea of Nobel Prize winner James Tobin to tax international financial transactions) with the support of Germany and other EU member states and the Organisation for Economic Co-operation and Development (OECD), but facing opposition from the International Monetary Fund (IMF), the UK, the US, and China (De Fillippis, 2011). He also set out to echo the Americans and convince China to allow the yuan to appreciate faster. For that financial agenda Sarkozy counted on the help of two Frenchmen in international finance: Jean-Claude Trichet at the ECB and Dominique Strauss-Kahn (known as DSK) at the IMF. The IMF has played an important role in the European rescue plans for Greece and Ireland (Rampini, 2010). However, DSK was also one of the main socialist politicians and had been their most likely candidate for the 2012 presidential election, credited with the potential to beat the incumbent (Piquard, 2011). Commentary 581 That more than half the French public believe DSK's recent arrest on sexual assault charges in New York reflect a political conspiracy (Le Monde.fr 2011)öeither by domestic competitors or by international parties like the US or Russiaömight reflect their alienation from what they regard as elite games, amongst which are counted the financial reforms. Dispatch from the United Kingdom, James D Sidaway Schadenfreude is one of those German words that have become popular amongst the British. And perhaps it is because the postwar era more often yielded envy than pleasure when they came to compare themselves with their European neighbours that today large sections of the British political class, media, and public express something near to delight that the UK chose not to join the euro. But as well as the sense of relief that the Bank of England retains the old strategy of devaluation (see figure 7) as a means of restoring competiveness and growth, the geopolitics of euroscepticism are in evidence. In these discourses British sovereignty has mythical status. A realm of social science has pointed to the limits of nation-states as useful units of analysis whilst at the same time social scientists have learnt to be mindful of the endurance and mobilising functions of what some of them term `the imagined community' of the nation. However, sovereignty is invoked amongst eurosceptic arguments, constructed as a thing threatened by European integration. That sovereignty is social relation and construct entangled with all manner of flows (and alliances such as NATO) is lost in these narratives, which tend to see it as more or less black and white. But British eurosceptic Schadenfreude knows no such nuance. Below the surface there is an element of celebration. The Irish can no longer so decidedly cock their snout about their republic having a higher GDP per capita than the UK, and Italian claims of sorpasso are mocked, along with the sorry figure of Berlusconi. Barely disguised rows between Merkel, Sarkozy, and the rest over the terms of intra-Eurozone loans and transfers are represented as the latest incarnations of an old continental balance-of-power, which offshore-Albion should play to its advantage. Other sober-minded commentators (such as the influential Institute for Fiscal Studies) point out, however, that the Bank of England and Treasury strategy of austerity combined with loose money is both feeding inflation and may strangle investment in ways that once again bode ill for the UK's longer-term competitive position. And it is in such longer historical horizons that the peculiar mixture of hubris, Schadenfreude, and doubt that run deeply through postwar British political and social consciousness is cast into useful perspective. There are lessons from the ways that economic challenges facing Britain in the postwar period were conceptualised in particular frameworks (Tomlinson, 2009). Thus political discourse long coded the UK's economic challenges as a balance of payments problem, rather than a combination of imperial overstretch, wartime debts, and a growing shift to the City that would become the commanding height of British capitalism by the 1980s. That this might have contemporary resonances and lessons is left to those few voicesöin the media and outside the Cabinet and Her Majesty's oppositionölargely on the political margins. Economics lends a hand. The most vehement eurosceptics (and indeed others from the economic and political mainstream) frequently invoke the literature on optimum currency areas, starting with a classic paper (Mundell, 1961) that helped to earn its author a Nobel Prize. Mundell's authority is invoked with arguments about the consequences of structural macroeconomic diversity, asymmetric shocks, and mechanisms for fiscal transfers to compensate for these. In other words, does the euro make sense given the diversity of member economies and the limited will to move around money that might ameliorate 582 Commentary Figure 7. The sliding pound (source: ECB, 2011). the consequences of this? In this context the UK isöit is arguedöbetter off out, especially given that it is a highly financialised and globalised economy. What is rarely noted is that Mundell suggests that the logic of his theory means that an optimal currency area could be a city or a region rather than a state. As he notes, political factors determine that this does not happen. For the euro is (no less than prior `national currencies') a geopolitical project: the determination of whose founders (a reluctant Bundesbank amongst them) to preserve it should not be understated. What of the UK? It is evident that British Eurozone membership, should it ever come, would provide a significant and deeper global role for the euro, via the City of London. Of course, it seems that only a series of political, constitutional, and economic shifts (and most probably a few crises) in the UK could lay that path: just as they underpinned Britain's 1960s application to belatedly join the European Economic community (EEC), when its elite had finally realised that the Empire was gone after the debacle at Suez, and the continentals were busy forging ahead.(2) But given the UK's deep internal disequilibria and its economic geography, whereby the City might logically form one optimum currency area and what remains of British industry in the lands beyond southeast England another (Pollard and Sidaway, 2002), such crises may not be so far away. Acknowledgements. We are grateful to the editors of Society and Space, Olivier Kramsch, and the weekly lunchtime financial geographies discussion group at the University of Amsterdam for their helpful comments on an earlier draft. Ewald Engelen, Reijer Hendrikse, Virginie Mamadouh, James D Sidaway University of Amsterdam References Bachmann V, Sidaway J D, 2009, ``Zivilmacht Europa: a critical geopolitics of the European Union as a global power'' Transactions of the Institute of British Geographers, New Series 34 94 ^ 109 Barluet A, 2010, ``Nicolas Sarkozy et Angela Merkel veulent marquer de leur empreinte le plan de sauvetage europëen'' Le Figaro 11 February, page 18 Bulmer S, Paterson W E, 2010, ``Germany and the European Union: from `tamed power' to normalized power'' International Affairs 86 1051 ^ 1073 Dittmer J, 2011 Popular Culture, Geopolitics and Identity (Rowman & Littlefield, Lanham, MD) (2) It is instructive to compare the British, French, and Dutch experiences of rejuvenating their empires after the Second World War (White, 2011). Recognition that this could go only so far to enable reconstruction and that it came with growing costs and resistance then fed into European integration. For Germany, of course, until Ostpolitik opened other paths, European integration was the only permissible outlet. These postimperial and postwar moments are now passing into memory and histories of the founding of the EU. The future appears, therefore, more open. Commentary 583 Dodds K, 2007,``Steve Bell's Eye: cartoons, geopolitics and the visualization of the `War on Terror' '' Security Dialogue 28 157 ^ 187 De Filippis V, 2011, ``La taxe Tobin sur l'agenda sarkozyste; la taxation des transactions financie©res est une ûprioritëý de l'Elysëe pour le G20'' Libëration 18 February, page 5 Garton Ash T, 2011, ``Everywhere, the European project is stalling. It needs a new German engine'' The Guardian 16 June, page 33 Gillingham J, 2003 European Integration 1950 ^ 2003. Superstate or Market Economy? (Cambridge University Press, Cambridge) Guërot U, Leonard M, 2011,``The new German question: how Europe can get the Germany it needs'' European Council on Foreign Relations, http://www.ecfr.eu/page/-/Germany%20in%20Europe %20text.pdf Habermas J, 2010, ``Germany and the Euro-Crisis'' The Nation 28 June, http://www.thenation.com/ article/germany-and-euro-crisis Het Parool 2005, ``Het laatste wat DNB wilde, was onrust; Directeur Brouwer: de gulden was ondergewaardeerd'', 30 April, page 35 Hooghe L, Marks G, 2008, ``A postfunctionalist theory of European integration: from permissive consensus to constraining dissensus'' British Journal of Political Science 39 1 ^ 23 Le Monde.fr 2011, ``Une majoritë de Franc°ais pense DSK victime d'un complot'', 18 May, http://www.lemonde.fr/dsk/article/2011/05/18/une-majorite-de-francais-pense-dsk-victime-d-uncomplot 1523603 1522571.html Loriaux, M, 2008 European Union and the Deconstruction of the Rhineland Frontier (Cambridge University Press, Cambridge) Lundestad G, 1998 `Empire' by Integration. The United States and European Integration, 1945 ^ 1997 (Oxford University Press, Oxford) Mamadouh V, Van der Wusten H, 2011, ``Financial, monetary and governance crisis: an outlook on the Euro(zone)'' Tijdschrift voor Economische en Sociale Geografie 102 111 ^ 118 Mundell R A, 1961, ``A theory of optimum currency areas'' American Economic Review 51 657 ^ 665 NRC Handelsblad 2005, ``Burger gaat alsnog stemmen over de euro; bij referendum speelt `eurokwestie' hoofdrol'', 19 May, page 2 Piquard A, 2011, ``Sondages: les retraits de Borloo et Villepin profiteraient peu a© Sarkozy'' Le Monde.fr 27 April, http://www.lemonde.fr/politique/article/2011/04/26/sondages-les-retraitsde-borloo-et-villepin-profiteraient-peu-a-sarkozy 1512856 823448.html Pollard J S, Sidaway J D, 2002, ``Nostalgia for the future: the geoeconomics and geopolitics of the Euro'' Transactions Institute of British Geographers, New Series 27 518 ^ 521 Putnam R, 1988, ``Diplomacy and domestic politics: the logic of two-level games'' International Organization 42 427 ^ 460 Rampini F, 2010, ``La Gre©ce, cheval de Troie des Etats-Unis'' La Tribune 27 April, page 13 Riols Y M, 2010, ``Allemagne solidaire ou suicidaire?'' L'Expansion 1 September, page 56, http://lexpansion.lexpress.fr/economie/allemagne-solidaire-ou-suicidaire 237781.html Tomlinson J, 2009, ``Balanced accounts? Constructing the balance of payments problem in post-war Britain'' English Historical Review CXXIV(509) 863 ^ 884 Torchia A, Crimmins C, 2011, ``Europe pressured to revise Irish and Greek bailouts'' Reuters 8 May, http://www.reuters.com/article/2011/05/08/us-eurozone-crisis-idUSTRE7471WV20110508 van Apeldoorn B, Overbeek H, Ryner M, 2003, ``Theories of European Integration: a critique'', in A Ruined Fortress? Neoliberal Hegemony and Transformation in Europe Eds A W Cafruny, M Ryner (Rowman and Littlefield, Lanham MD) pp 17 ^ 45 Vits C, Randow J, Tomlinson R, 2010, ``Weber defies Trichet over Europe bond bailout as ECB succession approaches'' Bloomberg 18 June, http://www.bloomberg.com/news/2010-06-17/ weber-defies-trichet-over-europe-bond-bailout-as-ecb-succession-approaches.html Weiner A, Diez T (Eds), 2004 European Integration Theory (Oxford University Press, Oxford) White N J, 2011, ``Reconstructing Europe through rejuvenating Empire: the British, French, and Dutch experiences compared'' Past and Present 210 211 ^ 236 ß 2011 Pion Ltd and its Licensors

© Copyright 2026