Alternative Trade Finance Options Massachusetts Export Expo December 11, 2012

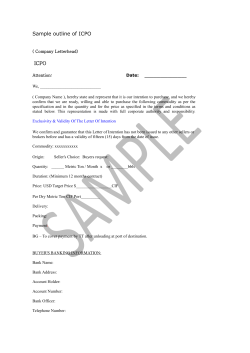

Alternative Trade Finance Options Massachusetts Export Expo December 11, 2012 International Risks Discounted Letters of Credit Why We’re Here Standby Letters of Credit Documentary Collections Forfaiting International Risk International Risks • Commercial risk (credit risk) Risk associated with the individual or institution responsible for payment (risk factors such as poor profitability, lack of sales, cash flow problems, insolvency, etc.) • Political risk (country risk) Inability of your customer to pay the receivable in full or on time due to government action (risk factors such as, war or military actions, revolution, changes in export- import laws, currency inconvertibility) • Foreign exchange risk Transaction, translation and economic exposure Questions to Ask Before Selecting Method of Payment • What’s our leverage with this buyer? • Can the business afford the loss if it is not paid? • Will extending credit and the possibility of waiting several months still make the sale profitable? • Can the sale only be made by extending credit? • If the shipment is made and not accepted can an alternative buyer be found? International Methods of Payment Intl Methods of Payment: Risk Assessment Seller Exporter High Risk Relies completely on buyer to pay as previously agreed Relies on buyer to pay draft on presentation or upon maturity Risk of his own nonperformance in adhering to all the requirements in the LC No risk Low Risk Open Account Buyer Importer No Risk Documentary Collections Relies on exporter to ship goods as described in documents Letter of Credit Relies on seller to ship goods as described in the documents Cash in Advance Relies completely on exporter to ship goods as ordered Low Risk High Risk Letter of Credit Usage Country/Continent L/C Usage Japan Rare Asia (not including Japan) Yes South America Yes Europe No, but may use Bankers Guarantee Eastern Europe Yes Middle East Yes Commercial Letters of Credit Commercial Letter of Credit • An Irrevocable commitment by a bank to pay a seller of merchandise when documents evidencing shipment are presented to the issuing bank. • The issuing bank substitutes its credit for that of the buyer, thus assuring the seller that payment will be made by the bank provided that the terms and conditions of the L/C are met. • If the L/C is “confirmed” by a U.S. bank, the U.S bank undertakes to pay seller, thus eliminating the foreign bank and country risk associated with an unconfirmed L/C. Benefits to Exporter • Issuing Bank’s credit replaces the buyer’s credit. • Eliminates foreign bank and country risk if confirmed a U.S Bank. • Protects seller against order cancellation. • Provides seller with the highest degree of protection, short of cash in advance. • Seller receives payment as quickly as possible. • Time LCs or usance credits offer a built-in financing mechanism. The Draft • Also know as “Bill of Exchange” • An unconditional obligation of the drawee to pay it at maturity • A draft is a demand for payment • Draw on and accepted by a bank • For payment at a future specific date Sample Draft: No. 12345 August 15, 2012 At 60 Days from Sight ORDER OF THE SUM OF OF THIS SOLE BILL OF EXCHANGE PAY TO THE XYC, Inc. $1,000,000.00 ------------------- U.S. DOLLARS One Hundred Thousand and 00/100 United States Dollars TO: Korea Bank ABC, Inc. Seoul, Korea AUTHORIZED SIGNATURE Acceptance and Deferred Payment • Acceptance: A time draft, or a bill of exchange, on which the drawee has written the word "Accepted" and affixed a signature. It is an unconditional obligation of the drawee to pay it at maturity. Banker's Acceptance: A draft drawn on and accepted by a bank (drawee). Trade Acceptance: A draft drawn on and accepted by a buyer (drawee). • Deferred Payment: Paid at some future date without requirement of bill of exchange or draft (high stamp duty in certain countries) Letter of Credit Financing Solutions What is L/C Discounting? • Bank purchases the draft under an L/C from the client at discount of the face value on a non-recourse basis, then SVB collects the proceeds of the L/C at maturity. • Utilize Commercial Letters of Credit to obtain extended payment terms from suppliers • Eliminate Country and Commercial Risk • Discounting allows access to cash tied up in Letters of Credit that have yet to pay • Source of Cash beyond Traditional Lines of Credit or Equity Letters of Credit Discounting - Calculation Discounting of $1,000,000 L/C for 180 days Formula: Amount of L/C X Discount Rate X No. of Days / 360 $1,000,000 X 4.11% (0.61% [6Mo Libor] + 3.5%) X 180 / 360 = $20,550.00 Net proceeds = $979,450 Pricing Considerations: • Credit worthiness of Issuing Bank of the L/C • Country Risk • Tenor of Draft • Party responsible for discount fee Potential Benefits Benefits to Seller • Accelerates Cash Flow and provides Non-recourse Financing • Mitigates Foreign Risk and Vendor Performance Risk • Competitive advantage – allows seller to offer financing to buyer • Reduces DSO • Finance AR that may be Ineligible under client’s Line Standby Letters of Credit Standby Letters of Credit • A Irrevocable undertaking of the issuing bank to honor, by payment, the beneficiary’s draft/documents when properly presented under the terms of the standby letter of credit • Supports applicant’s obligation under a contract or agreement by adding bank’s undertaking • In the event that the applicant fails to comply with the terms of the underlying agreement, the bank is obligated to pay the beneficiary upon presentation of documents in compliance with the terms and conditions of the letter of credit. • Secondary mechanism of payment – because the letter of credit should be drawn on only if the applicant fails to fulfill his obligation covered in the underlying contract. • In merchandise trade transactions, they are commonly used for invoice support, advance payments, performance bonds or to guarantee payment to a supplier Standby Letters of Credit Standby Letters of Credit are often used to support a variety of transactions. Frequent uses include: Invoice Support Standby can be used in conjunction with Open Account payment terms. As supplier may be willing to ship on Open Account terms but only if it has received a separate assurance from a bank, that the buyer will pay those invoices. The Invoice Support Standby serves the purpose, and provides the buyer with a bank undertaking that the invoice will be promptly paid. Standby Letters of Credit Standby Letters of Credit are often used to support a variety of transactions. Frequent uses include: Performance Standby can be used when a supplier is required to provide a Performance Standby to a buyer. The performance Standby serves to assure the buyer that the supplier will perform in accordance with the terms of the contract and in fact supply the goods, etc. Advance Payment Standby can be used when a buyer is required to make an up-front payment to the supplier, in advance of the actual supply of goods. In such circumstances, the buyer may require a separate assurance, issued by the supplier’s bank, that the advance payment will be refunded in the event that the supplier fails to perform under the contract. Standby Letters of Credit Standby Letters of Credit are often used to support a variety of transactions. Frequent uses include: Guarantee – Federal Reserve Regulations prevent nationally chartered banks in the United States from issuing Guarantees. That is the reason why U.S. banks generally issue Standby Letters of Credit in lieu of Guarantees. Counter Standby Guarantees – Some international contracts require that a Standby Letter of Credit or Guarantee be issued in a specific foreign country and under the laws or in the language of, that foreign country. When a U.S. bank cannot issue its own Standby Letter of Credit or Guarantee under the required term, they will instead issue a Counter Standby to a correspondent bank in the foreign country. The correspondent bank will then use the U.S. bank’s counter Standby Guarantee as security for its issuance of the local Guarantee in the required format. Documentary Collections Documentary Collections • Documents controlling merchandise forwarded through banking channels • Documents surrendered when buyer: o o Pays, or Accepts seller’s draft • Not a guarantee of payment • A seller will usually agree to receive payment on a documentary collection basis when the buyer’s creditworthiness and country of domicile represent acceptable risks Documentary Collections - Tenor • Sight or Documents Against Payment: The payment is made when the documents are received by the buyer’s bank and the buyer agrees to pay. • Tenor or Documents Against Acceptance (30, 60, 90 etc. days): The documents are received by the buyer’s bank, the buyer signs draft or bill of exchange and agrees to pay at a specific future date. o Risk: The seller is counting on the buyer’s ability to pay on the maturity date. Remember, the buyer has possession of the merchandise before payment is due. If the buyer’s bank adds their Aval, which is their unconditional obligation to pay at maturity, the draft can be discounted for immediate funds. Documentary Collections – Benefits to Exporter • More competitive sales terms - gives exporter advantage over other sellers that are offering Cash in Advance or LC terms • Banks monitor the collection and automatically send out periodic tracers • Slightly more secure for the seller than an open account. Documents are controlled by agent banks until payment is obtained or the draft is accepted by buyer. • Less costly than an LC. International Credit Products - Forfaiting Alternative Financing Solutions What is Forfaiting? • It’s an international trade finance practice, where a bank purchases, at a discount, larger dollar amount, longer-term receivables from exporters. It could be a one-off deal or a series of on-going transactions. • Forfaiting is a non-recourse transaction • Ideally, amount is $500,000 or more and the term is 6 months or longer, up to 5-8 years. 27 Potential Benefits Benefits to Seller • Accelerates Cash Flow and provides Non-recourse Financing • Mitigates against all Foreign Risk of non-payment. • Competitive advantage – allows seller to offer financing to buyer under open account payment terms. • Reduces DSO 28 Questions?

© Copyright 2026