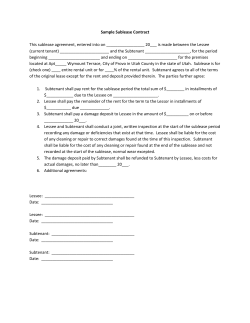

Master Lease Agreement – Guidance for Municipalities